- Sweden

- /

- Capital Markets

- /

- OM:EQT

Does JPMorgan’s Upgrade And Portfolio Moves Change The Bull Case For EQT (OM:EQT)?

Reviewed by Sasha Jovanovic

- In recent days, JPMorgan upgraded EQT AB from Neutral to Overweight, highlighting past Q3 2025 results and a pipeline of fundraising milestones through 2026 that it believes could support higher carried interest and investment income forecasts.

- Alongside this shift in analyst sentiment, EQT has been actively reshaping its portfolio through real estate acquisitions, a partial exit from Galderma to L’Oréal, and a lender-led exit from elderly care operator Colisée.

- We’ll now examine how JPMorgan’s upgrade, anchored in anticipated fundraising activity and higher income forecasts, could influence EQT’s investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

EQT Investment Narrative Recap

To own EQT, you need to believe in its ability to keep scaling private markets platforms, grow fee-based revenue and convert fundraising into realization-driven earnings. In the near term, the key catalyst is successful execution of upcoming flagship fundraises, while the biggest risk remains any slowdown or “glass ceiling” in fundraising that could constrain fee and carry growth. JPMorgan’s upgrade, tied to specific fundraising milestones, directly reinforces that central short term catalyst.

Within the recent news, JPMorgan’s focus on BPEA IX, EQT XI and Infrastructure VII fundraising timelines is the most relevant for investors tracking near term drivers. Higher carried interest and investment income forecasts underline how dependent EQT’s earnings profile is on sustained capital raising momentum, especially as the firm pushes further into Asia, the U.S. and private wealth offerings that are central to its growth story.

Yet investors also need to weigh the risk that fundraising growth could stall just as EQT leans harder into larger flagship funds and new regions...

Read the full narrative on EQT (it's free!)

EQT's narrative projects €4.0 billion revenue and €1.9 billion earnings by 2028.

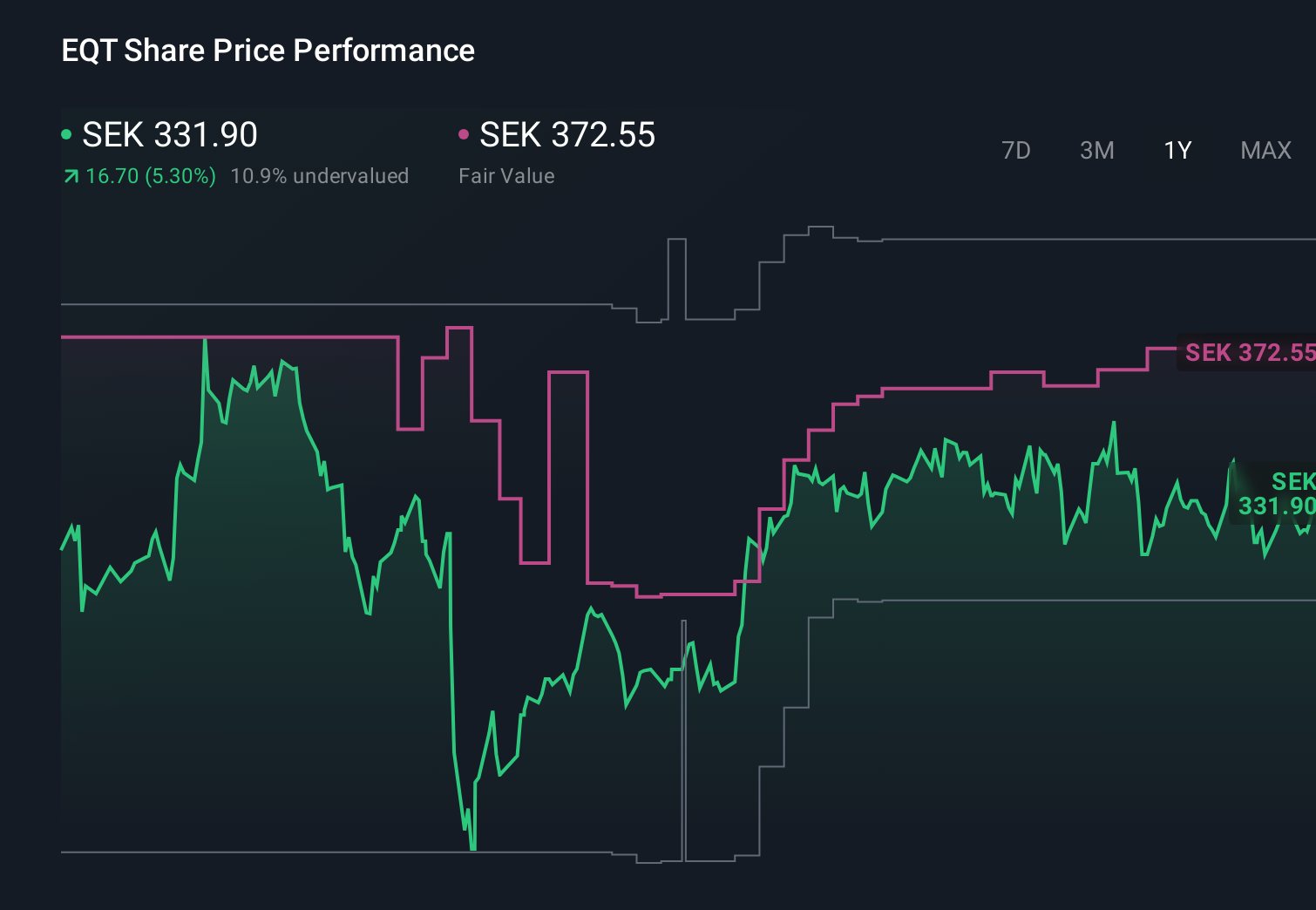

Uncover how EQT's forecasts yield a SEK372.55 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community span roughly SEK 40.55 to SEK 405.52 per share, highlighting sharply different expectations. Before you decide where you sit in that range, consider how heavily EQT’s next fundraising cycle could influence its ability to grow fees and carried interest over time.

Explore 7 other fair value estimates on EQT - why the stock might be worth as much as 24% more than the current price!

Build Your Own EQT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EQT research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free EQT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EQT's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EQT

EQT

A global private equity & venture capital firm specializing in private capital and real asset segments.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion