- Sweden

- /

- Capital Markets

- /

- OM:CAT B

Catella AB (publ) (STO:CAT B) Analysts Just Trimmed Their Revenue Forecasts By 17%

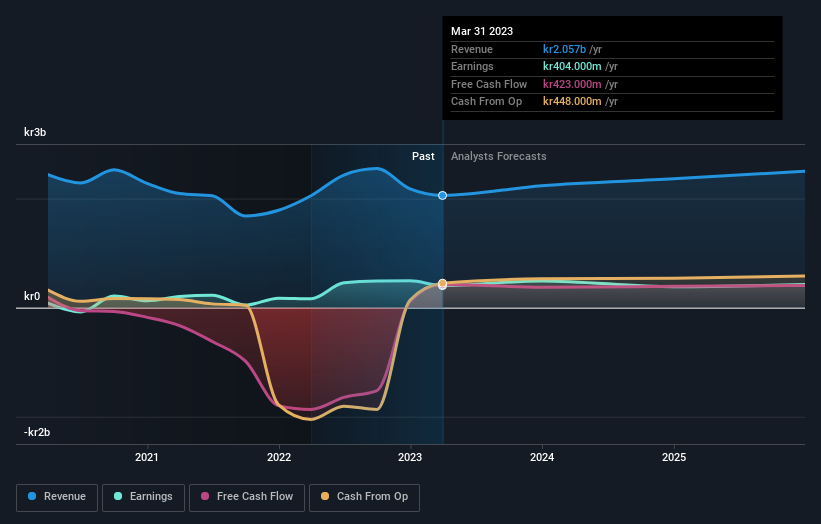

The analysts covering Catella AB (publ) (STO:CAT B) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Revenue estimates were cut sharply as the analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

Following the latest downgrade, the current consensus, from the two analysts covering Catella, is for revenues of kr1.9b in 2023, which would reflect an uneasy 9.1% reduction in Catella's sales over the past 12 months. Before the latest update, the analysts were foreseeing kr2.2b of revenue in 2023. It looks like forecasts have become a fair bit less optimistic on Catella, given the measurable cut to revenue estimates.

See our latest analysis for Catella

Notably, the analysts have cut their price target 14% to kr60.00, suggesting concerns around Catella's valuation.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. Over the past five years, revenues have declined around 0.2% annually. Worse, forecasts are essentially predicting the decline to accelerate, with the estimate for an annualised 12% decline in revenue until the end of 2023. Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 15% annually. So it's pretty clear that, while it does have declining revenues, the analysts also expect Catella to suffer worse than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for this year. They also expect company revenue to perform worse than the wider market. Furthermore, there was a cut to the price target, suggesting that the latest news has led to more pessimism about the intrinsic value of the business. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Catella after today.

In light of the downgrade, our automated discounted cash flow valuation tool suggests that Catella could now be moderately overvalued. Find out why, and see how we estimate the valuation for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you're looking to trade Catella, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CAT B

Reasonable growth potential second-rate dividend payer.