- Sweden

- /

- Capital Markets

- /

- OM:CS

Should You Steer Clear Of CoinShares International With One Superior Dividend Stock Option?

Reviewed by Sasha Jovanovic

Investing in dividend stocks can be a prudent way to generate steady income from your portfolio. However, it's essential to scrutinize the sustainability of these dividends. A high payout ratio, for instance, might indicate that a company is paying more to its shareholders than it can afford, potentially jeopardizing future payouts.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Zinzino (OM:ZZ B) | 4.48% | ★★★★★★ |

| Betsson (OM:BETS B) | 5.91% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 4.53% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.39% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.05% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.92% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.28% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.43% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.47% | ★★★★★☆ |

| Bilia (OM:BILI A) | 4.66% | ★★★★☆☆ |

Click here to see the full list of 24 stocks from our Top Dividend Stocks screener.

Let's review one of the notable picks from our screened stocks and one not so great.

Top Pick

Betsson (OM:BETS B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Betsson AB operates an online gaming business across the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally with a market capitalization of approximately SEK 17.01 billion.

Operations: The company's revenue from its Casinos & Resorts segment amounts to approximately €0.97 billion.

Dividend Yield: 5.9%

Betsson's 5.91% dividend yield ranks well above the Swedish market average, supported by a sustainable payout ratio of 48.9%. Despite a volatile dividend history over the past decade, recent earnings growth of 32.9% and strategic expansions into new markets like Peru suggest potential for stability and growth. Trading at significant undervaluation, Betsson also shows promise with analyst projections indicating a potential price increase of 22.4%. However, investors should note the historical instability in its dividend payments.

- Navigate through the intricacies of Betsson with our comprehensive dividend report here.

- Our valuation report unveils the possibility Betsson's shares may be trading at a discount.

One For The Future

CoinShares International (OM:CS)

Simply Wall St Dividend Rating: ★☆☆☆☆☆

Overview: CoinShares International Limited operates in the digital assets and blockchain technology sector based in Jersey, with a market capitalization of approximately SEK 3.73 billion.

Operations: The company generates revenue primarily through asset management, contributing £19.5m to the company's top line. The capital market segment, through gains and other income generated £17.3m, and principal investment gains added a further £7.1m.

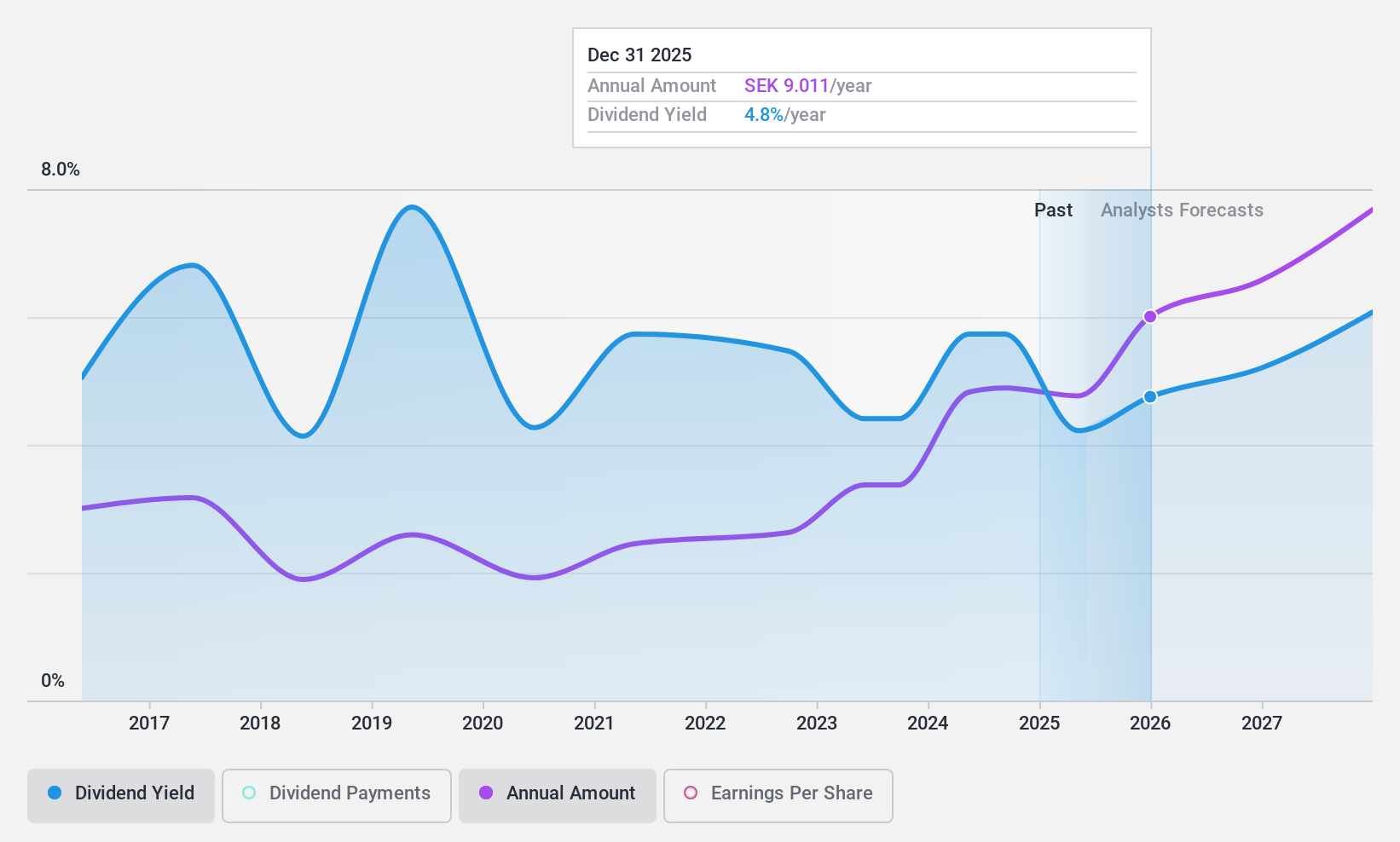

Dividend Yield: 3%

CoinShares International has implemented a recent policy aiming to distribute 20-40% of annual comprehensive income as dividends. On paper, the company reported a substantial net loss of £1.32 billion in Q1 2024, reversing from a net profit last year, but readers should be aware that this result is not representative of the true performance of the business. Due to the accounting treatment of companies with significant digital assets, CoinShares' net loss is somewhat misleading. In periods that have experienced an increase in digital asset prices and therefore rises in the ETP related obligations, this can manifest as a significant loss after tax. The increase in digital asset prices, however, is more important to the business and so the fair value gain on digital assets of £1.35 billion as detailed in the Other Comprehensive Income section offsets the loss. When analyzing businesses like CoinShares, net income must be considered in conjunction with any movement in digital assets.

As such, the company actually improved adjusted EBITDA for the quarter, reporting an EBITDA of £34.2 million, up significantly compared to £7.0 million Q1 2023. The first quarter of 2024 saw the company get off to its strongest financial start in its history and has helped support the introduction of the company's new dividend policy.

While we appreciate that the new dividend policy means the company does not pass some of our long-term stability checks for dividends, which generally looks at a 10-year period, we're comfortable with the fact that the company is able to sustainably meet its dividend obligations.

Although CoinShares International is not raising concerns about the sustainability of its dividend payments, its dividend yield of 3.05% is below the top quartile in the Swedish market, making it less attractive compared to peers with higher and longer dividend history. Given how recently the dividend policy was introduced, we're optimistic that we could see CoinShares make the list of top dividend stocks in years to come.

Where To Now?

- Click through to start exploring the rest of the 22 Top Dividend Stocks now.

- Got skin in the game with some of these stocks? Elevate how you manage them by using Simply Wall St's portfolio , where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CS

CoinShares International

Engages in the digital assets and blockchain technology business in Jersey and the United States.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives