3 European Stocks Estimated To Be Up To 47% Below Intrinsic Value

Reviewed by Simply Wall St

As European markets navigate mixed returns with the STOXX Europe 600 Index inching higher amid hopes for interest rate cuts, investors are keenly observing economic indicators like the uptick in eurozone inflation and steady GDP growth. In this context, identifying stocks that are trading below their intrinsic value can be particularly appealing, as they offer potential opportunities for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Stellantis (BIT:STLAM) | €10.17 | €20.10 | 49.4% |

| Sanoma Oyj (HLSE:SANOMA) | €9.19 | €18.32 | 49.8% |

| PVA TePla (XTRA:TPE) | €22.52 | €44.13 | 49% |

| Mo-BRUK (WSE:MBR) | PLN308.50 | PLN601.98 | 48.8% |

| Gentili Mosconi (BIT:GM) | €3.30 | €6.54 | 49.5% |

| Figeac Aero Société Anonyme (ENXTPA:FGA) | €10.90 | €21.62 | 49.6% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.393 | €0.78 | 49.4% |

| Digital Workforce Services Oyj (HLSE:DWF) | €2.57 | €5.09 | 49.5% |

| Allcore (BIT:CORE) | €1.355 | €2.66 | 49% |

| Aker BioMarine (OB:AKBM) | NOK90.00 | NOK177.13 | 49.2% |

We'll examine a selection from our screener results.

Electrolux Professional (OM:EPRO B)

Overview: Electrolux Professional AB (publ) offers food service, beverage, and laundry products and solutions to various service sectors such as restaurants, hotels, and healthcare facilities with a market cap of approximately SEK18.71 billion.

Operations: The company's revenue is derived from two primary segments: Laundry, contributing SEK4.96 billion, and Food & Beverage, accounting for SEK7.46 billion.

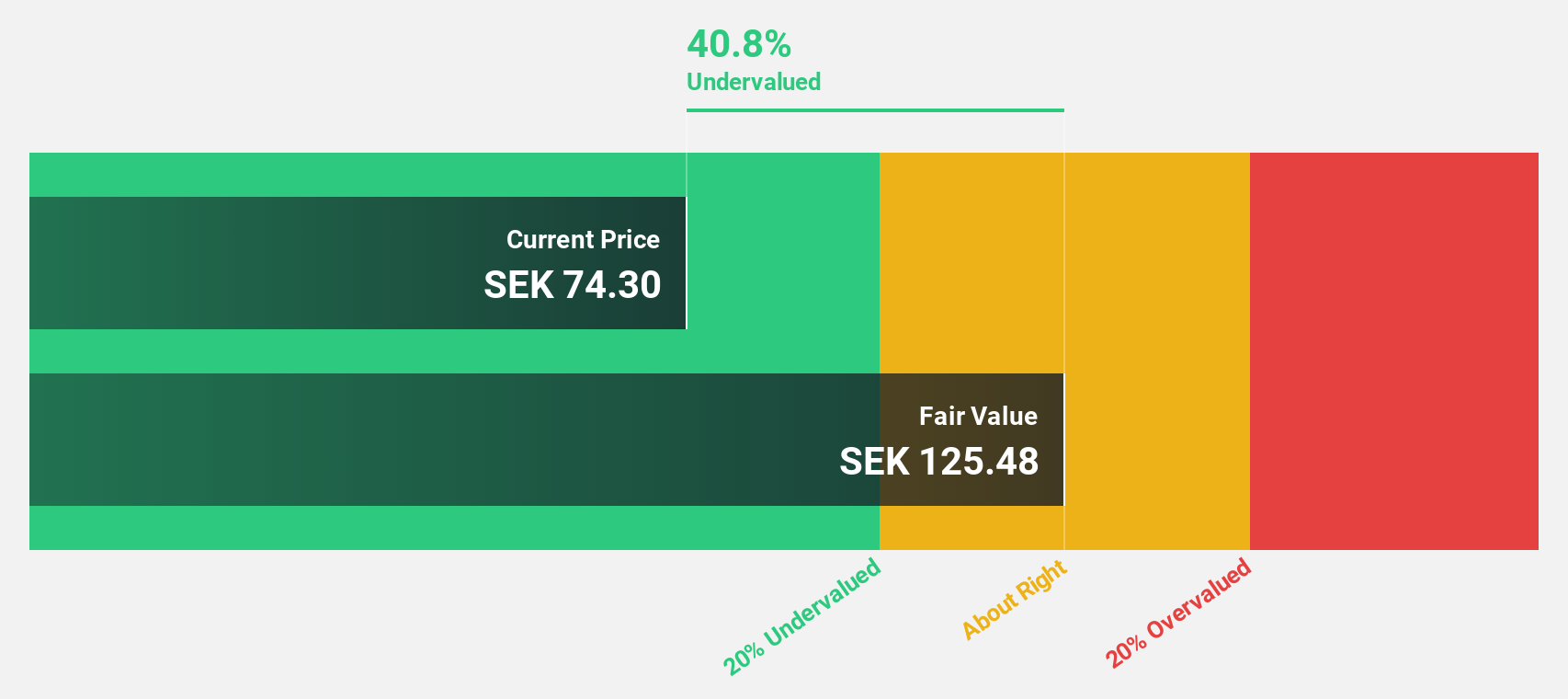

Estimated Discount To Fair Value: 40.2%

Electrolux Professional is trading at SEK65.1, significantly below its estimated fair value of SEK108.92, suggesting it may be undervalued based on cash flows. Earnings are expected to grow significantly, outpacing the Swedish market's growth rate. Recent strategic alliances and business reorganizations aim to enhance operational efficiency and sustainability, while a new EUR 240 million credit facility strengthens financial flexibility. However, recent earnings show a decline in net income compared to the previous year, indicating potential challenges ahead.

- Insights from our recent growth report point to a promising forecast for Electrolux Professional's business outlook.

- Take a closer look at Electrolux Professional's balance sheet health here in our report.

Mips (OM:MIPS)

Overview: Mips AB (publ) develops, manufactures, and sells helmet-based safety systems across North America, Europe, Sweden, Asia, and Australia with a market cap of SEK8.24 billion.

Operations: The company generates revenue from its helmet-based safety systems primarily through the Sporting Goods segment, which accounts for SEK530 million.

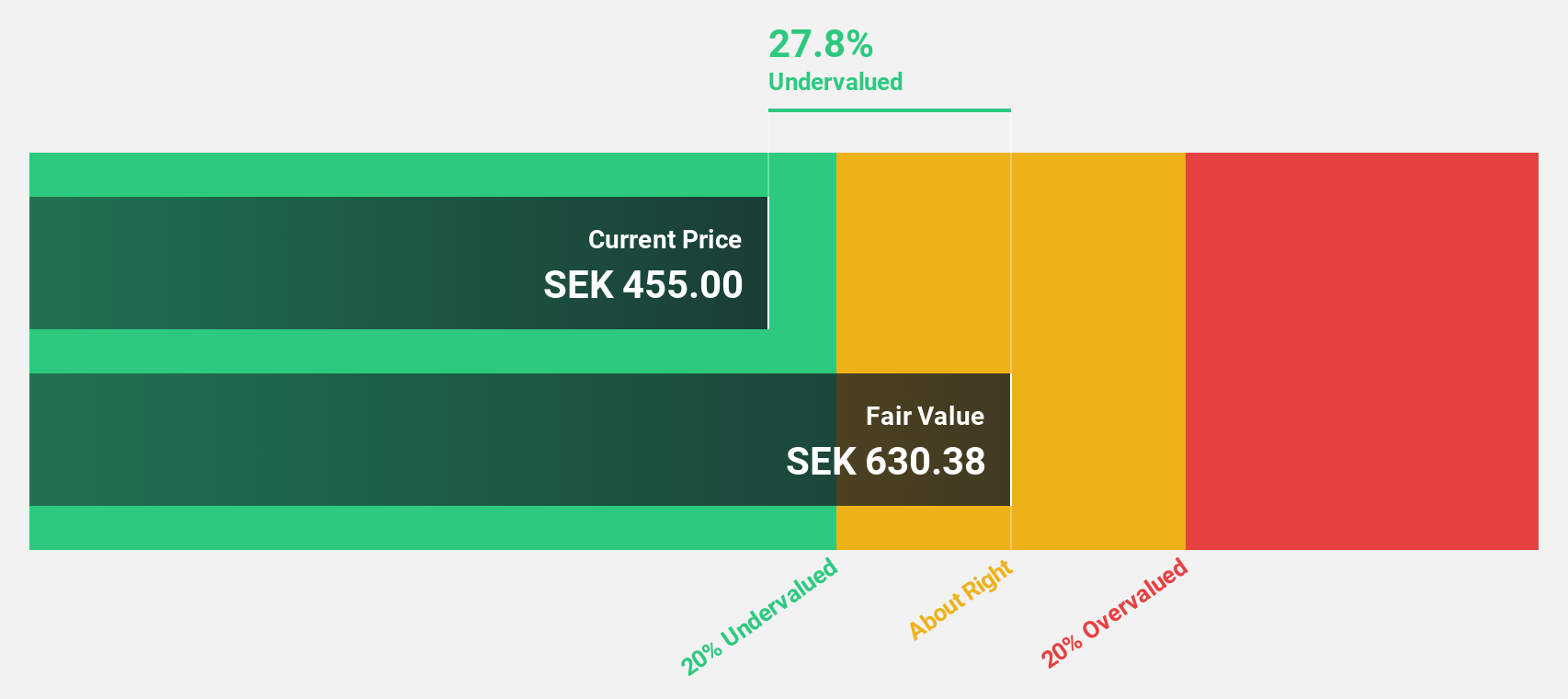

Estimated Discount To Fair Value: 37.4%

Mips is trading at SEK311, below its fair value estimate of SEK497.2, highlighting potential undervaluation based on cash flows. Analysts project robust earnings growth of 45.4% annually over the next three years, outpacing the Swedish market. Revenue is also expected to grow significantly at 25.7% per year. However, recent quarterly results showed a slight decline in net income and earnings per share compared to last year, which could pose challenges despite strong future growth forecasts.

- Our earnings growth report unveils the potential for significant increases in Mips' future results.

- Dive into the specifics of Mips here with our thorough financial health report.

Rusta (OM:RUSTA)

Overview: Rusta AB (publ) operates as a retailer offering home decoration, consumables, seasonal products, leisure items, and DIY goods across Sweden, Norway, Finland, and Germany with a market capitalization of approximately SEK12.50 billion.

Operations: Rusta AB generates revenue through its retail operations in home decoration, consumables, seasonal products, leisure items, and DIY goods across Sweden, Norway, Finland, and Germany.

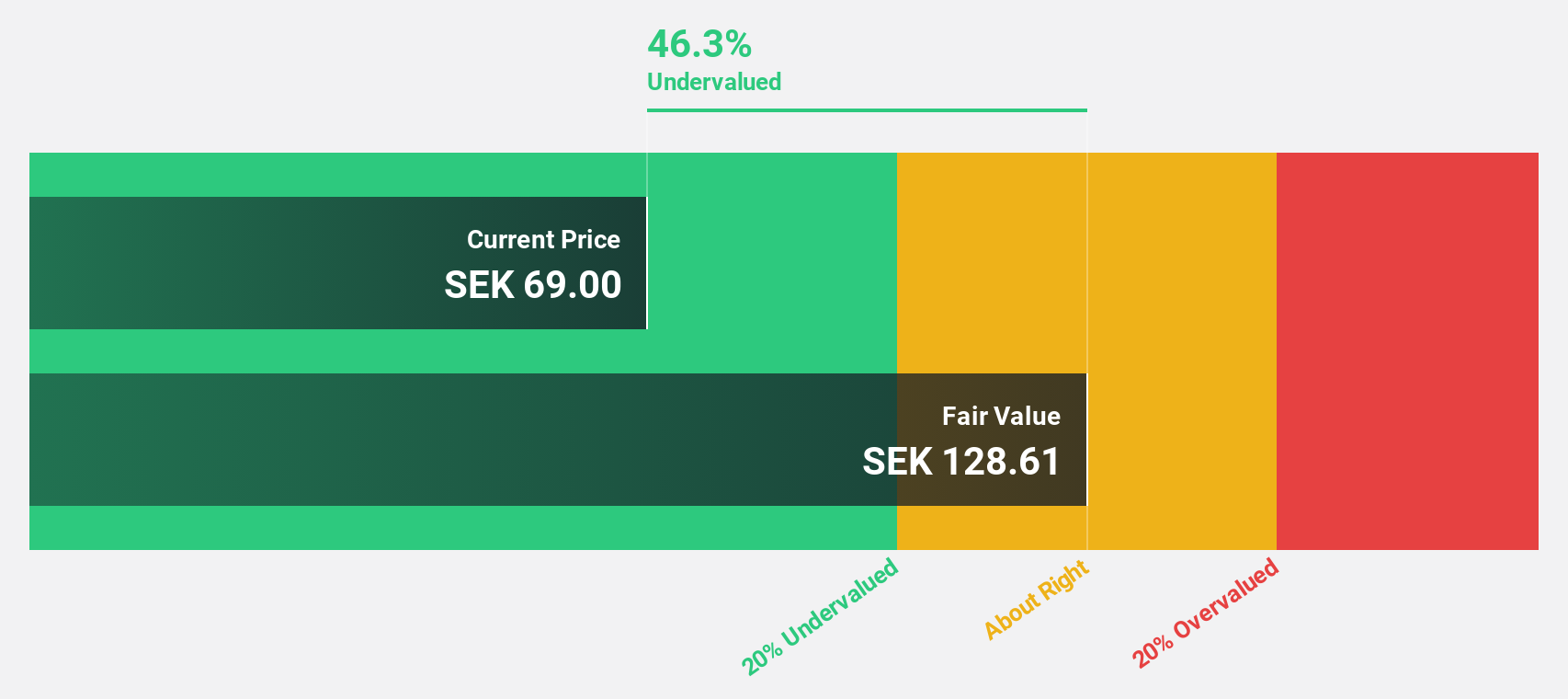

Estimated Discount To Fair Value: 47%

Rusta is trading at SEK81.75, significantly below its fair value estimate of SEK154.29, suggesting undervaluation based on cash flows. With projected annual earnings growth of 21%, Rusta is expected to outpace the Swedish market's growth rate of 13.5%. Recent earnings showed a mixed performance with increased quarterly net income but a slight decrease in six-month figures compared to last year, while revenue forecasts indicate an annual growth rate of 8.6%.

- Our growth report here indicates Rusta may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Rusta stock in this financial health report.

Taking Advantage

- Explore the 193 names from our Undervalued European Stocks Based On Cash Flows screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electrolux Professional might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EPRO B

Electrolux Professional

Provides food service, beverage, and laundry products and solutions to restaurants, hotels, healthcare, educational, and other service facilities.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026