- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3044

3 Dividend Stocks To Consider With Yields Starting At 3%

Reviewed by Simply Wall St

In the current global market, geopolitical tensions and concerns over consumer spending have led to volatility in major indices, with U.S. stocks experiencing sharp losses despite early-week gains. Amidst this uncertain economic landscape, dividend stocks can offer a measure of stability and income potential for investors seeking to navigate these turbulent times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.93% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.69% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.05% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.40% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.29% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.90% | ★★★★★★ |

Click here to see the full list of 1998 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

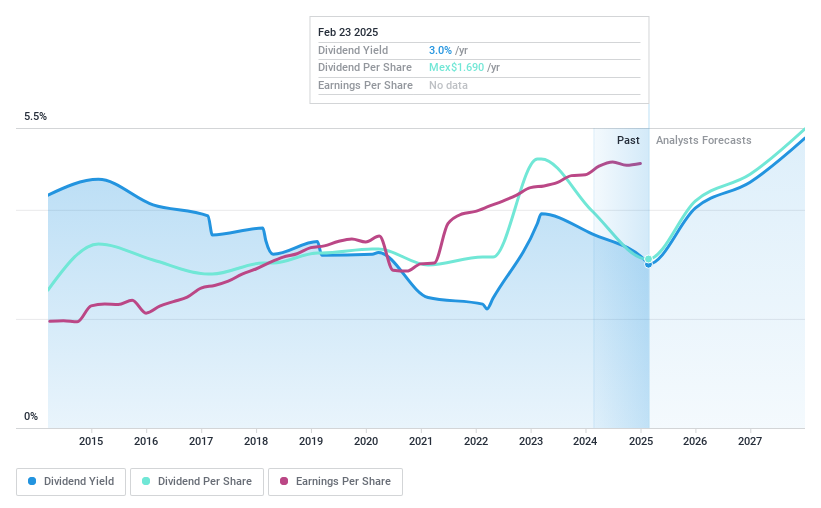

Wal-Mart de México. de (BMV:WALMEX *)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wal-Mart de México, S.A.B. de C.V. operates self-service stores across Mexico and Central America, with a market cap of MX$985.19 billion.

Operations: Wal-Mart de México generates its revenue primarily from operations in Mexico, contributing MX$797.60 billion, and Central America, adding MX$160.91 billion.

Dividend Yield: 3%

Wal-Mart de México's dividend yield is modest at 3%, below the top quartile in the MX market. Despite a volatile dividend history, recent earnings growth of 4.3% and a payout ratio of 38.5% suggest dividends are well-covered by earnings and cash flows (77.9%). The company plans to propose a combination of ordinary and extraordinary dividends totaling MXN 1.69 per share for 2025, payable in two installments later this year.

- Take a closer look at Wal-Mart de México. de's potential here in our dividend report.

- The analysis detailed in our Wal-Mart de México. de valuation report hints at an inflated share price compared to its estimated value.

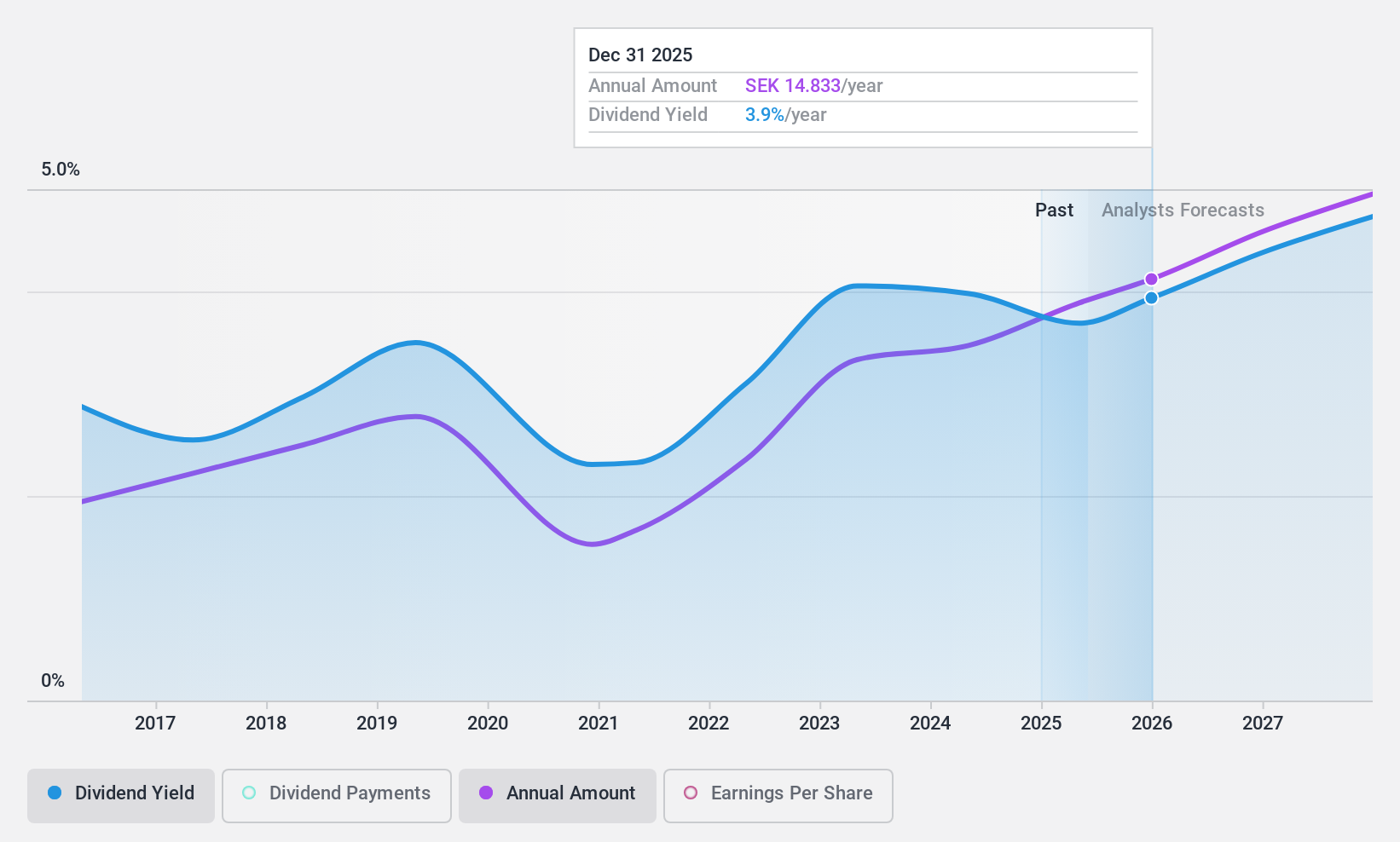

Loomis (OM:LOOMIS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Loomis AB (publ) offers solutions for the distribution, payments, handling, storage, and recycling of cash and other valuables with a market cap of SEK28.02 billion.

Operations: Loomis AB's revenue segments consist of SEK0.11 billion from Loomis Pay, SEK14.79 billion from Europe and Latin America, and SEK15.70 billion from the United States of America (USA).

Dividend Yield: 3.4%

Loomis's dividend yield of 3.42% is below the top tier in Sweden, and while dividends have grown over the past decade, they have been volatile with drops over 20%. The payout ratio of 59.5% indicates dividends are covered by earnings, and a low cash payout ratio of 23.5% suggests strong cash flow support. Recent earnings growth of 9.8% enhances dividend sustainability amid ongoing share buybacks and potential M&A activities as part of their capital allocation strategy.

- Click here to discover the nuances of Loomis with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Loomis' share price might be too pessimistic.

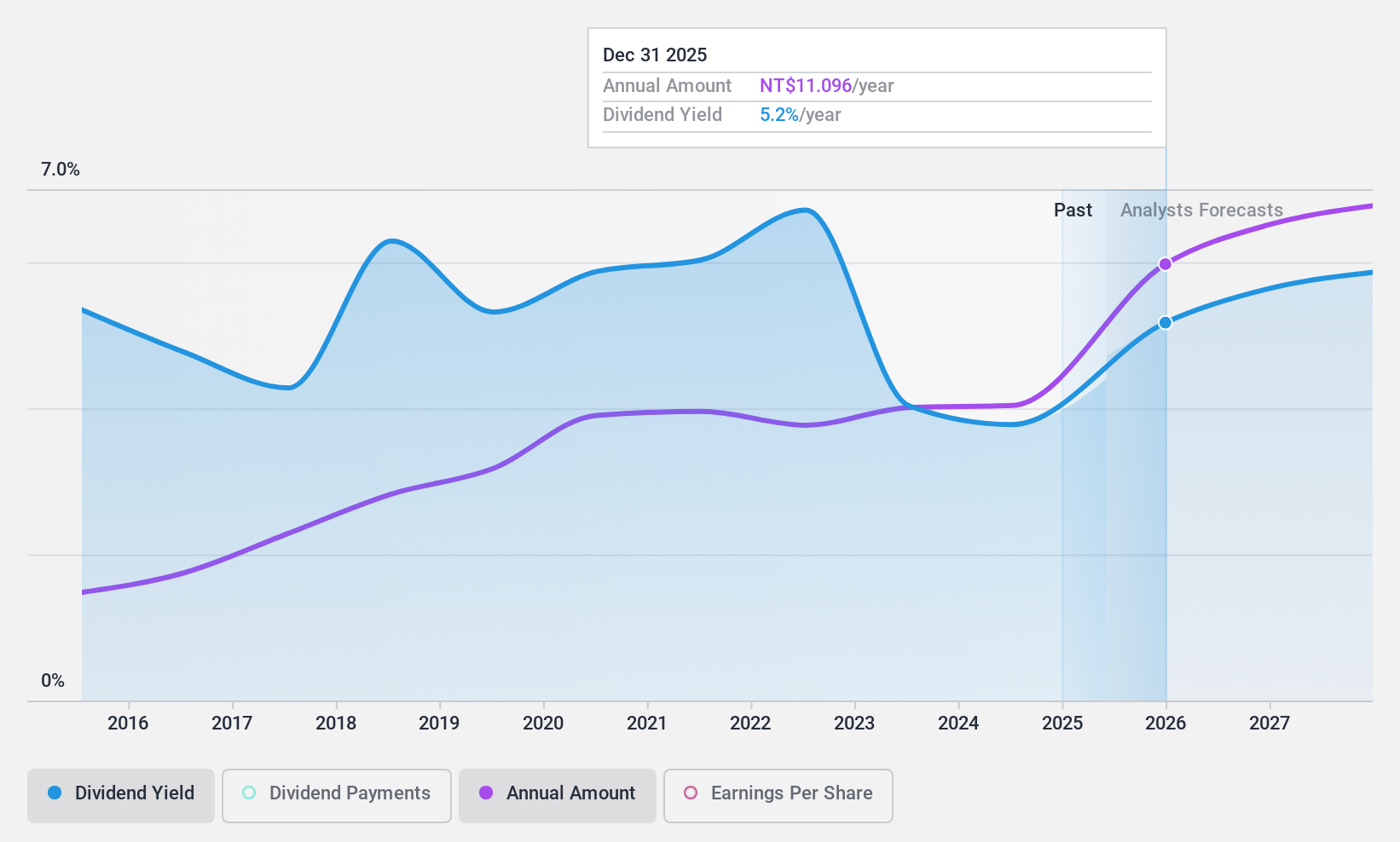

Tripod Technology (TWSE:3044)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tripod Technology Corporation processes, manufactures, and sells printed circuit boards and related components across Taiwan, China, Vietnam, Thailand, South Korea, Malaysia, and internationally with a market cap of NT$105.65 billion.

Operations: Tripod Technology Corporation generates revenue primarily from its Printed Circuit Board segment, which accounts for NT$63.31 billion.

Dividend Yield: 3.7%

Tripod Technology offers a stable dividend yield of 3.73%, slightly below Taiwan's top tier, with dividends reliably growing over the past decade. The payout ratios—49.4% for earnings and 40.6% for cash flows—suggest dividends are well covered, enhancing sustainability amid expected earnings growth of 14.47% annually. Trading at good value relative to peers and industry, its stock is also priced below fair value estimates, with analysts anticipating a price increase of 23.5%.

- Click here and access our complete dividend analysis report to understand the dynamics of Tripod Technology.

- According our valuation report, there's an indication that Tripod Technology's share price might be on the cheaper side.

Summing It All Up

- Take a closer look at our Top Dividend Stocks list of 1998 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Tripod Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tripod Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3044

Tripod Technology

Processes, manufactures, and sells printed circuit boards and other related components in Taiwan, China, Vietnam, Thailand, South Korea, Malaysia, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives