- Sweden

- /

- Commercial Services

- /

- OM:BRAV

We Ran A Stock Scan For Earnings Growth And Bravida Holding (STO:BRAV) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Bravida Holding (STO:BRAV). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Bravida Holding

How Fast Is Bravida Holding Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, Bravida Holding has grown EPS by 9.2% per year. That's a good rate of growth, if it can be sustained.

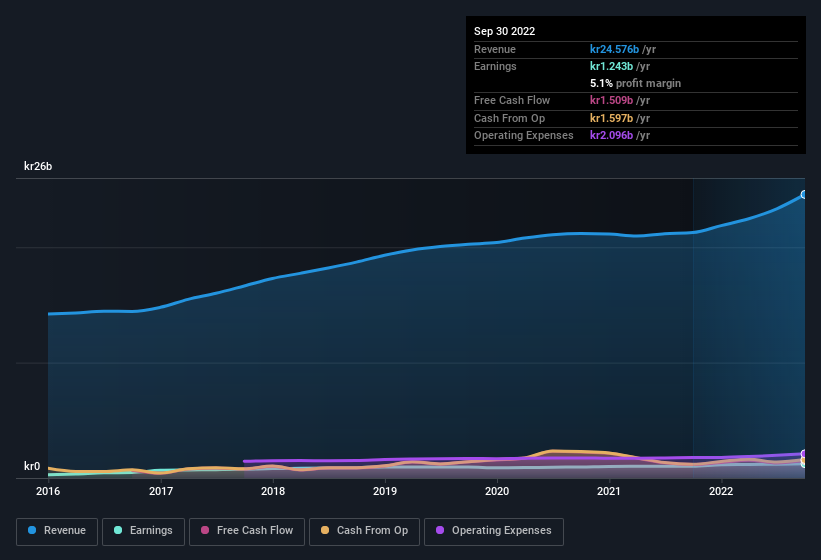

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Bravida Holding achieved similar EBIT margins to last year, revenue grew by a solid 16% to kr25b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Bravida Holding's future profits.

Are Bravida Holding Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

While Bravida Holding insiders did net kr1.5m selling stock over the last year, they invested kr8.8m, a much higher figure. An optimistic sign for those with Bravida Holding in their watchlist. We also note that it was the CEO & Group President, Mattias Johansson, who made the biggest single acquisition, paying kr1.3m for shares at about kr92.90 each.

On top of the insider buying, it's good to see that Bravida Holding insiders have a valuable investment in the business. Indeed, they hold kr325m worth of its stock. This considerable investment should help drive long-term value in the business. Despite being just 1.4% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Bravida Holding To Your Watchlist?

As previously touched on, Bravida Holding is a growing business, which is encouraging. In addition, insiders have been busy adding to their sizeable holdings in the company. That makes the company a prime candidate for your watchlist - and arguably a research priority. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Bravida Holding , and understanding it should be part of your investment process.

The good news is that Bravida Holding is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Bravida Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BRAV

Bravida Holding

Provides technical services and installations for buildings and industrial facilities in Sweden, Norway, Denmark, and Finland.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives