- Italy

- /

- Industrials

- /

- BIT:ITM

Uncovering Three European Small Cap Gems with Strong Fundamentals

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating economic indicators and shifting trade dynamics, European markets have shown resilience, with the pan-European STOXX Europe 600 Index recently ending higher despite tariff concerns. In this environment, identifying small-cap stocks with strong fundamentals can offer unique opportunities for investors seeking to navigate these complex market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Italmobiliare (BIT:ITM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Italmobiliare S.p.A. is an investment holding company that manages a diverse portfolio of equity and investments across financial and industrial sectors both in Italy and internationally, with a market capitalization of approximately €1.17 billion.

Operations: The company's primary revenue streams include Caffè Borbone (€334.53 million), Italmobiliare (€140.15 million), and Italgen (€66.80 million). Other significant contributors are Officina Profumo-Farmaceutica Di Santa Maria Novella and Casa Della Salute, generating €69.97 million and €63.23 million, respectively.

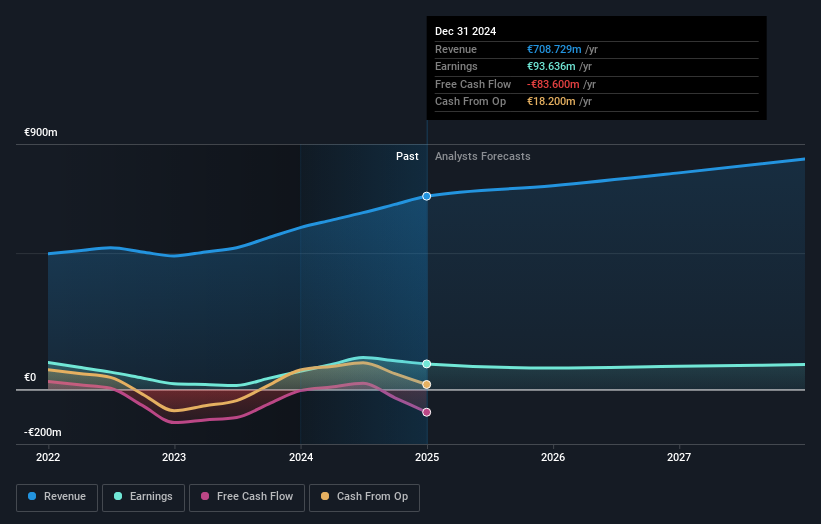

Italmobiliare, a smaller player in the investment landscape, has shown impressive earnings growth of 40.6% over the past year, outpacing the Industrials industry average of 9%. Trading at a P/E ratio of 12.5x, it offers good value compared to Italy's market average of 16.5x. Despite not being free cash flow positive recently, its debt situation seems manageable with a net debt to equity ratio at a satisfactory 4.6%. The company's interest payments are well covered by EBIT at 5.6x coverage, indicating strong financial health and potential for future growth with forecasted earnings increases of nearly 16% annually.

- Click to explore a detailed breakdown of our findings in Italmobiliare's health report.

Gain insights into Italmobiliare's historical performance by reviewing our past performance report.

Caisse régionale de Crédit Agricole Mutuel d'Ille-et-Vilaine Société coopérative (ENXTPA:CIV)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse régionale de Crédit Agricole Mutuel d'Ille-et-Vilaine Société coopérative operates as a banking service provider in France, with a market capitalization of €500.50 million.

Operations: The primary revenue stream for Crédit Agricole Mutuel d'Ille-et-Vilaine comes from its retail banking segment, generating €264.58 million.

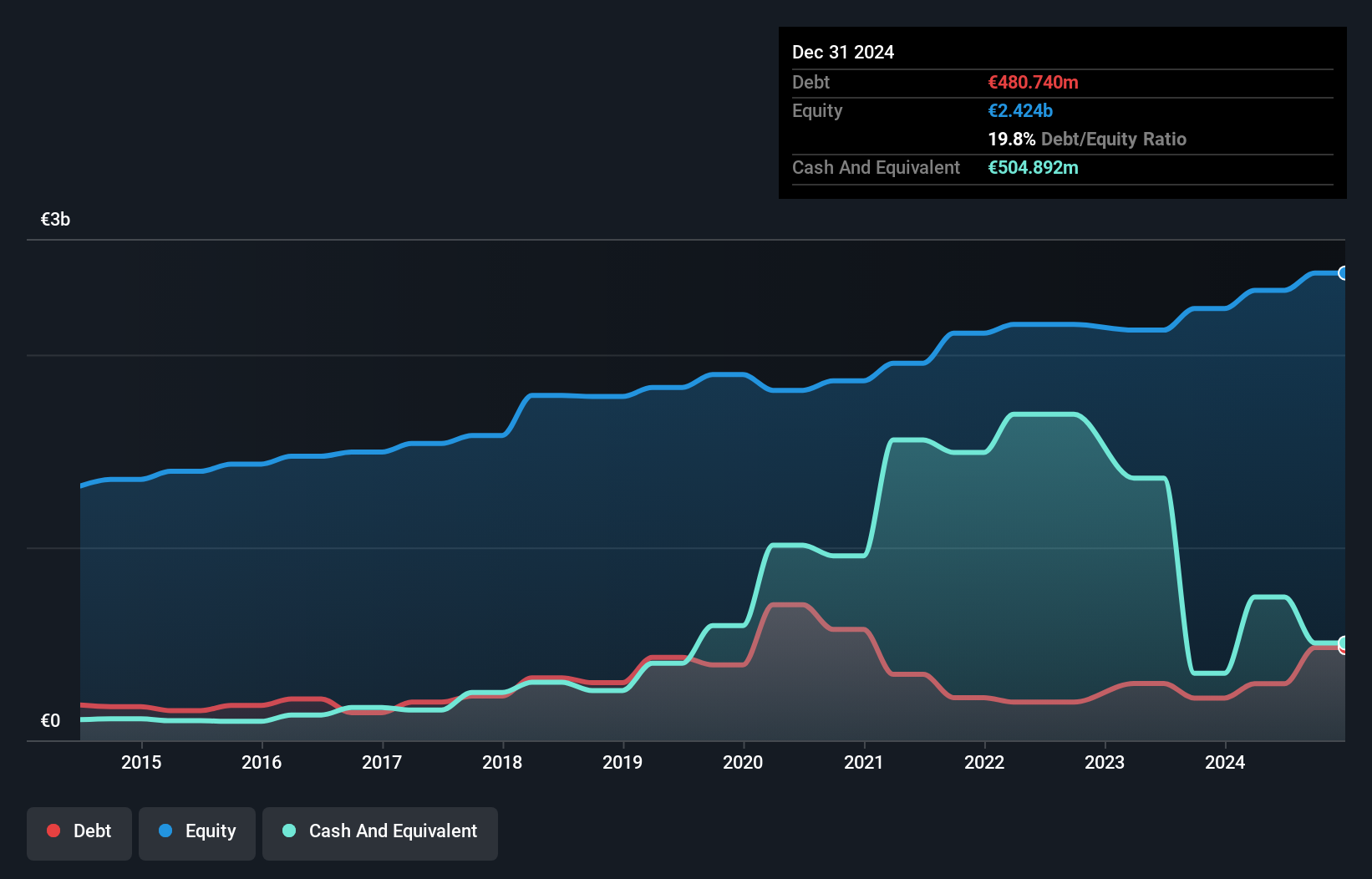

Crédit Agricole Mutuel d'Ille-et-Vilaine, with total assets of €20.9 billion and equity of €2.4 billion, stands out for its robust financial health. The cooperative's earnings growth at 6.2% surpasses the industry average of 3.2%, indicating strong performance relative to peers. A sufficient allowance for bad loans at 122% and a low non-performing loan ratio of 1.4% reflect prudent risk management practices. With customer deposits comprising 95% of its liabilities, it enjoys a stable funding base that's less risky than external borrowing sources, trading at an attractive discount to fair value by about 5%.

Systemair (OM:SYSR)

Simply Wall St Value Rating: ★★★★★★

Overview: Systemair AB (publ) is a company that manufactures and sells ventilation products across Europe, the Americas, the Middle East, Asia, Australia, and Africa with a market capitalization of SEK18.97 billion.

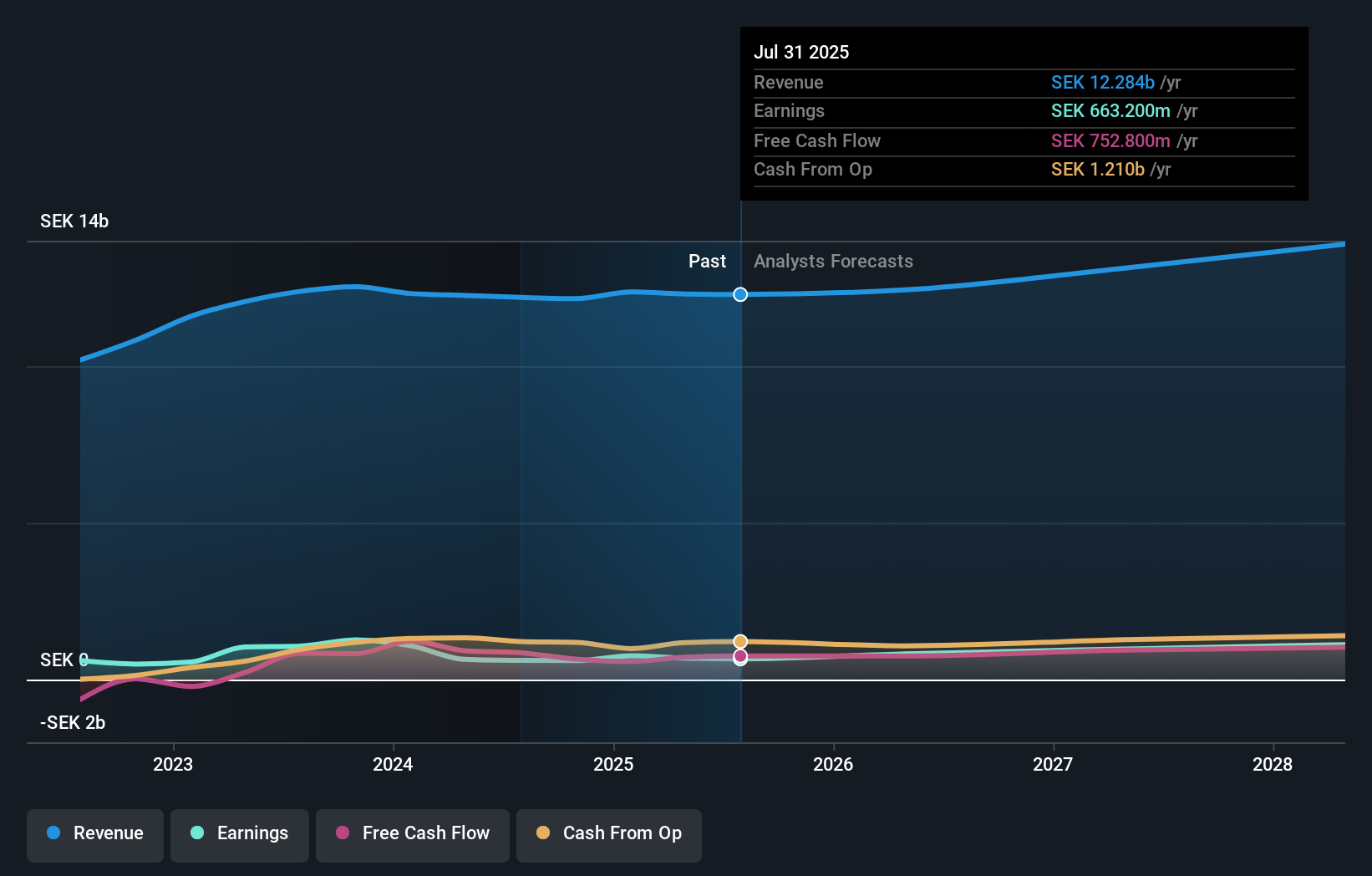

Operations: The company generates revenue primarily from the manufacture and sale of ventilation products, totaling SEK12.30 billion.

Systemair, a promising player in the European market, is making strategic moves with facility expansions in India and Italy to boost operational efficiency. The company's debt to equity ratio has impressively dropped from 64.7% to 22.4% over five years, signaling prudent financial management. Recent earnings growth of 5.4% outpaced the building industry's -5.8%, showcasing resilience amid challenging conditions in Germany and Eastern Europe. With a net profit margin increase from 6.1% to an anticipated 8.1%, Systemair's focus on sustainability initiatives positions it well for future competitiveness despite current soft market conditions in key regions like Germany and Eastern Europe.

Seize The Opportunity

- Embark on your investment journey to our 319 European Undiscovered Gems With Strong Fundamentals selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ITM

Italmobiliare

An investment holding company, owns and manages a portfolio of equity and other investments in the financial and industrial sectors in Italy and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives