Systemair (OM:SYSR) Valuation After Better‑Than‑Expected Q2 and Signs of European Demand Recovery

Reviewed by Simply Wall St

Systemair (OM:SYSR) just released a Q2 update that quietly shifts the narrative, reporting roughly 8% organic growth and EBIT margins near 12%, supported by firmer demand in Continental Europe and several other regions.

See our latest analysis for Systemair.

The market has started to notice this shift, with an 11.2% 1 month share price return lifting Systemair to SEK 86.6 even though the 1 year total shareholder return is still negative. This suggests early but improving momentum after a strong three year run.

If Systemair’s steady recovery has you thinking about where else momentum and quality might be lining up, now could be a good time to explore fast growing stocks with high insider ownership.

With earnings surprising to the upside and the share price still below both its one year level and analyst targets, the key question now is whether Systemair remains undervalued or if the market is already pricing in a full recovery.

Most Popular Narrative Narrative: 9.2% Undervalued

With Systemair last closing at SEK 86.6 versus a narrative fair value near SEK 95, the story currently points to upside if execution holds.

Product innovation continues to be a focus with new advanced solutions (e.g., energy-efficient Menerga units, fire dampers, heat pump-based energy recovery) being launched and tailored for major infrastructure and sustainability-focused projects (e.g., metro expansion, public pool retrofits), enabling Systemair to capture structurally higher-margin, specialized market segments and benefit from increasing global demand for energy-efficient, sustainable building systems.

Want to see the math behind that upside signal and 6.2% discount rate, plus how future margins and earnings power reshape fair value? The full narrative connects every dot.

Result: Fair Value of $95.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative could unravel if project driven sales stay volatile or if slow recoveries in key European markets continue to limit growth.

Find out about the key risks to this Systemair narrative.

Another Angle on Valuation

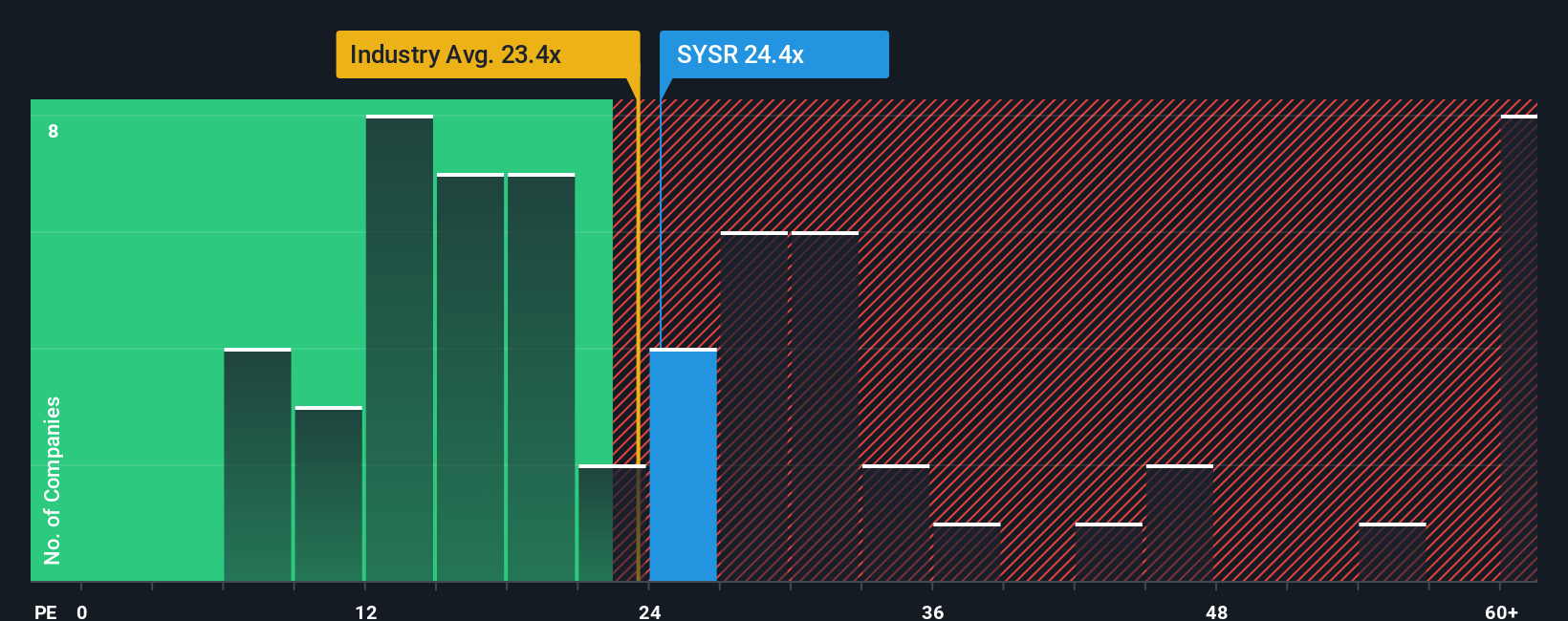

On earnings, Systemair looks less forgiving. The shares trade on a 26.1x price to earnings ratio versus 22.4x for the European Building sector and a fair ratio of 24.2x, implying less margin for error if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Systemair Narrative

If you interpret the numbers differently or want to explore the underlying drivers yourself, you can create a new Systemair story in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Systemair.

Looking for more investment ideas?

Shift your focus beyond a single stock and put the Simply Wall Street Screener to work so you do not miss compelling opportunities lining up right now.

- Capture potential cash flow opportunities by scanning these 908 undervalued stocks based on cash flows that the market may be mispricing today.

- Explore structural trends by targeting these 30 healthcare AI stocks transforming patient outcomes and medical workflows.

- Consider positioning yourself in the evolving landscape of digital finance with these 80 cryptocurrency and blockchain stocks at the forefront of blockchain-related innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SYSR

Systemair

Manufactures and sells of ventilation, heating and cooling products, and systems in Europe, North America, the Middle East, Asia, Australia, and Africa.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026