- Sweden

- /

- Industrials

- /

- OM:STOR B

Storskogen Group AB (publ) (STO:STOR B) Surges 27% Yet Its Low P/S Is No Reason For Excitement

Storskogen Group AB (publ) (STO:STOR B) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 48% in the last year.

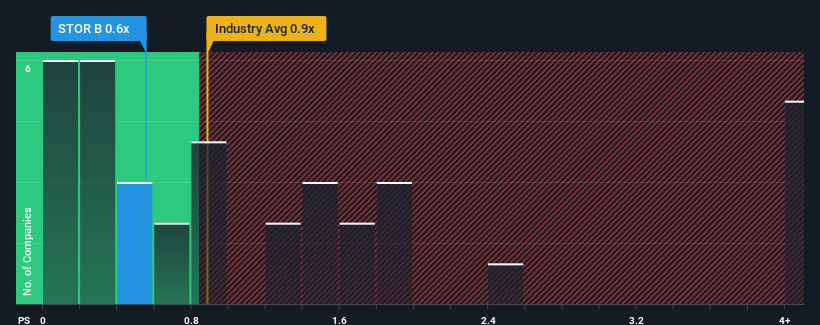

Although its price has surged higher, when close to half the companies operating in Sweden's Industrials industry have price-to-sales ratios (or "P/S") above 1.5x, you may still consider Storskogen Group as an enticing stock to check out with its 0.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Storskogen Group

What Does Storskogen Group's P/S Mean For Shareholders?

Storskogen Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Storskogen Group will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Storskogen Group would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.1%. Even so, admirably revenue has lifted 146% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 0.1% during the coming year according to the five analysts following the company. Meanwhile, the broader industry is forecast to expand by 8.3%, which paints a poor picture.

In light of this, it's understandable that Storskogen Group's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Despite Storskogen Group's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's clear to see that Storskogen Group maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Storskogen Group's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Storskogen Group, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Storskogen Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:STOR B

Storskogen Group

Owns and develops small and medium-sized businesses operating in services, trade, and industrial sectors.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives