SinterCast AB (publ)'s (STO:SINT) investors are due to receive a payment of SEK3.50 per share on 12th of November. This takes the dividend yield to 6.3%, which shareholders will be pleased with.

Estimates Indicate SinterCast's Could Struggle to Maintain Dividend Payments In The Future

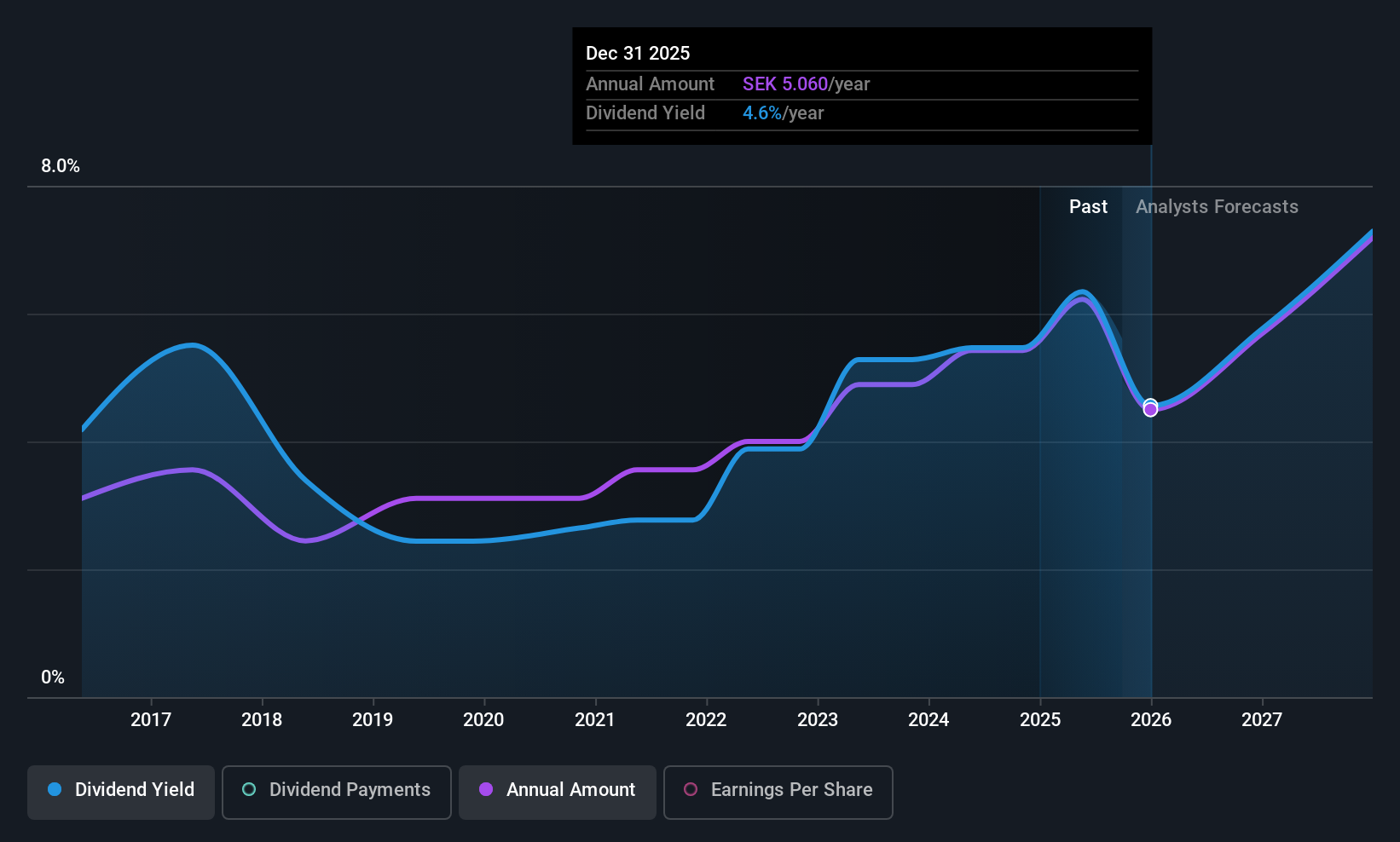

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Prior to this announcement, the company was paying out 124% of what it was earning. This situation certainly isn't ideal, and could place significant strain on the balance sheet if it continues.

The next 12 months is set to see EPS grow by 52.0%. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio reaching 107% over the next year.

See our latest analysis for SinterCast

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2015, the annual payment back then was SEK1.50, compared to the most recent full-year payment of SEK7.00. This works out to be a compound annual growth rate (CAGR) of approximately 17% a year over that time. Despite the rapid growth in the dividend over the past number of years, we have seen the payments go down the past as well, so that makes us cautious.

The Dividend's Growth Prospects Are Limited

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. SinterCast hasn't seen much change in its earnings per share over the last five years.

We're Not Big Fans Of SinterCast's Dividend

In summary, investors will like to be receiving a higher dividend, but we have some questions about whether it can be sustained over the long term. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. Overall, the dividend is not reliable enough to make this a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. To that end, SinterCast has 2 warning signs (and 1 which is significant) we think you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SINT

SinterCast

Provides process control technology to produce compacted graphite iron (CGI) for the foundry and automotive industries in Brazil, Mexico, Sweden, the United States of America, Korea, China, Spain, Japan, the United Kingdom, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026