- Sweden

- /

- Trade Distributors

- /

- OM:MMGR B

Margin Compression Pressures Momentum Group (OM:MMGR B) Outlook Despite Strong Growth Forecasts

Reviewed by Simply Wall St

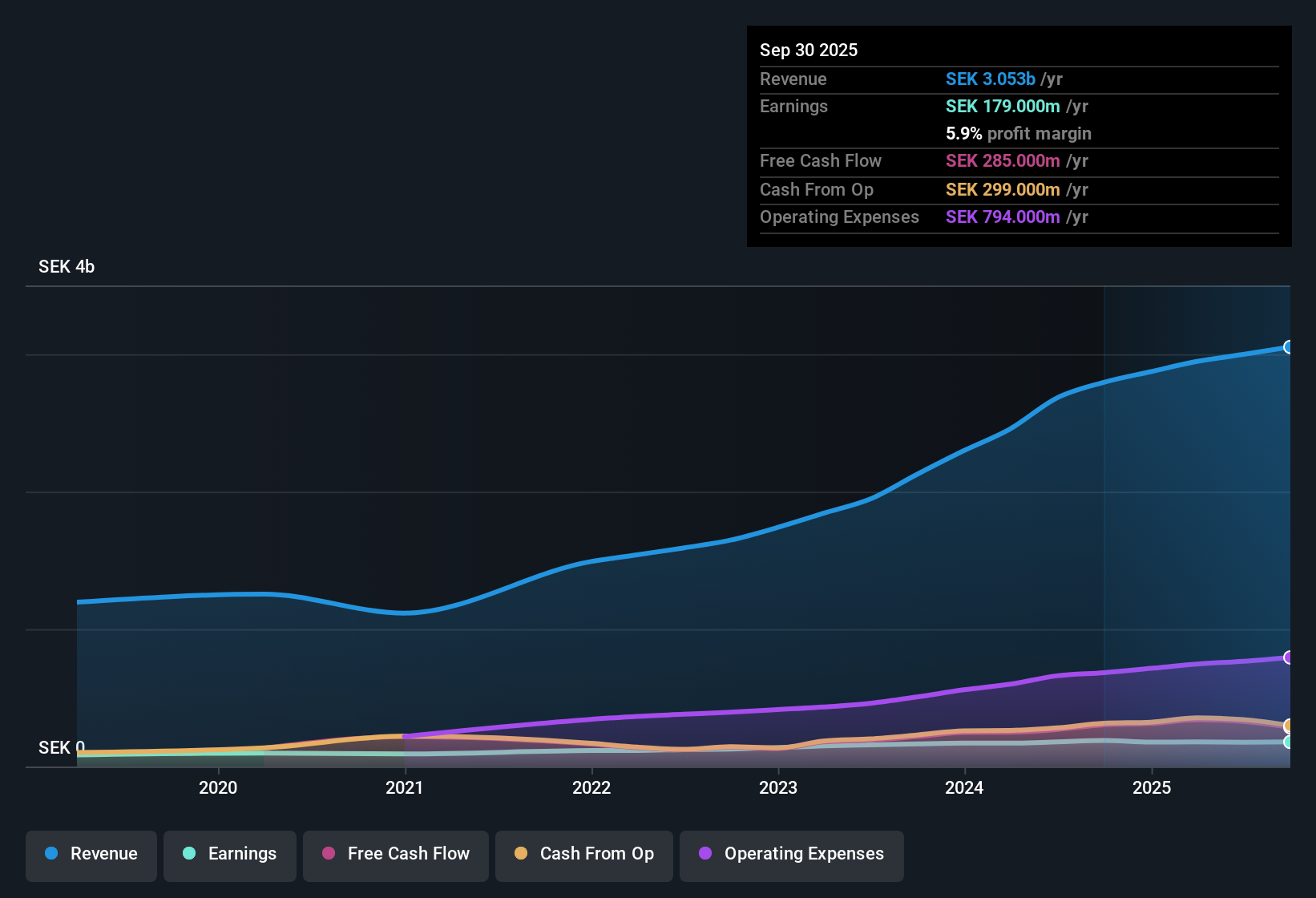

Momentum Group (OM:MMGR B) posted average annual earnings growth of 14.5% over the last five years, but the most recent year saw a decline in earnings. Looking ahead, forecasts suggest annual earnings growth of 13.4%, ahead of the Swedish market’s projected 12.6%. Revenue is expected to rise 8.4% per year, easily outpacing local peers. Margin compression, with net profit margins slipping from 6.7% to 5.9%, remains a watchpoint. Yet the outlook for earnings and revenue expansion gives investors a positive setup for the quarters ahead.

See our full analysis for Momentum Group.Next, we will see how this latest set of numbers matches up with the prevailing narratives about Momentum Group, whether they confirm the bullish case or challenge some expectations.

See what the community is saying about Momentum Group

Margin Expansion on Analysts’ Radar

- Analysts expect profit margins to rise from 5.9% today to 7.4% over the next three years, which would extend beyond the recent compression seen compared to last year’s 6.7% margin.

- Analysts' consensus view highlights that Momentum’s push for operational efficiency, including the relocation to a modern, automated warehouse, could be a key lever for stronger operating margins.

- Ongoing cost pressures such as higher logistics and wage costs could offset some of these anticipated gains if not tightly managed.

Growth Strategy Relies on Acquisitions

- A high portion of recent revenue and EBITA growth comes directly from acquired operations, not just organic improvement in the core business.

- Analysts' consensus view notes that maintaining a steady pace of bolt-on acquisitions is central to Momentum Group’s expansion plans.

- However, heavy reliance on deals introduces risks if acquisition pipelines dwindle or if integration costs escalate, which may put pressure on future earnings and net margins.

Valuation at a Steep Premium

- Shares currently trade at a Price-to-Earnings ratio of 46.4x, significantly higher than the industry average of 17.1x and the peer average of 35.9x. The market price of SEK166.0 also stands above the DCF fair value of SEK161.24.

- Analysts' consensus view flags that for the analyst price target of SEK178.33 to hold, investors must assume strong earnings growth and margin expansion. Any missed targets or margin slippage could prompt a sharp reassessment of this premium.

- The current premium to industry and fair value highlights investors’ high expectations for future performance, along with the risk of disappointment if momentum falters.

Consensus results like these always fuel debate. See how the broader market is weighing Momentum Group’s prospects in the full consensus narrative. 📊 Read the full Momentum Group Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Momentum Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on these results? Use your insights to craft a narrative of your own in just a few minutes, and Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Momentum Group.

See What Else Is Out There

Momentum Group’s steep valuation, margin pressures, and reliance on acquisitions mean future growth expectations carry plenty of risk for investors.

For a shot at better value and less downside, check out these 872 undervalued stocks based on cash flows that offer more reasonable prices based on future cash flows and earnings quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MMGR B

Momentum Group

Supplies industrial components, industrial services, and related services to the industrial sector in Sweden, Norway, Denmark, Finland, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)