- Sweden

- /

- Trade Distributors

- /

- OM:FNM

Ferronordic AB (publ) (STO:FNM) Soars 33% But It's A Story Of Risk Vs Reward

Despite an already strong run, Ferronordic AB (publ) (STO:FNM) shares have been powering on, with a gain of 33% in the last thirty days. Notwithstanding the latest gain, the annual share price return of 8.3% isn't as impressive.

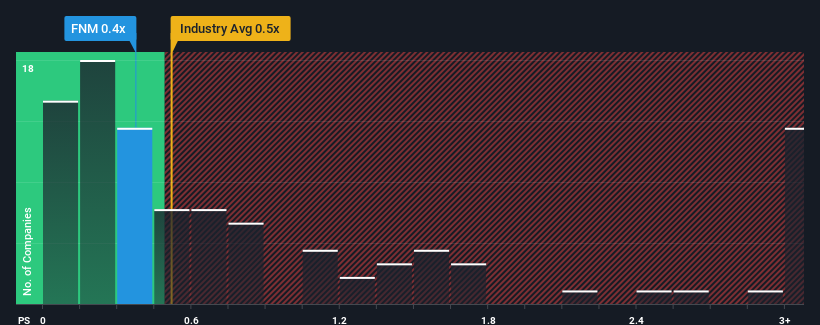

In spite of the firm bounce in price, considering around half the companies operating in Sweden's Trade Distributors industry have price-to-sales ratios (or "P/S") above 1.6x, you may still consider Ferronordic as an solid investment opportunity with its 0.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Ferronordic

What Does Ferronordic's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Ferronordic has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ferronordic.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Ferronordic's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 58% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 29% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 51% over the next year. With the industry only predicted to deliver 8.0%, the company is positioned for a stronger revenue result.

With this information, we find it odd that Ferronordic is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Ferronordic's P/S Mean For Investors?

The latest share price surge wasn't enough to lift Ferronordic's P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Ferronordic's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It is also worth noting that we have found 1 warning sign for Ferronordic that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:FNM

Ferronordic

Sells, rents, and services construction equipment, trucks, and other machines in Kazakhstan, Germany, and the United States.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives