- Hong Kong

- /

- Communications

- /

- SEHK:1523

Three Stocks That May Be Priced Below Their Estimated Value In January 2025

Reviewed by Simply Wall St

As global markets navigate the evolving landscape of U.S. policy changes under President Trump, major indices like the S&P 500 and Dow Jones Industrial Average have been reaching new heights, buoyed by optimism surrounding potential trade deals and AI investments. Amidst this environment of fluctuating consumer sentiment and manufacturing rebounds, identifying stocks that may be priced below their estimated value becomes crucial for investors seeking opportunities in a market characterized by both growth potential and economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.50 | NT$526.72 | 49.8% |

| Berkshire Hills Bancorp (NYSE:BHLB) | US$28.32 | US$56.60 | 50% |

| Shenzhen Yinghe Technology (SZSE:300457) | CN¥18.80 | CN¥37.54 | 49.9% |

| World Fitness Services (TWSE:2762) | NT$92.70 | NT$184.63 | 49.8% |

| Vertiseit (OM:VERT B) | SEK50.20 | SEK99.93 | 49.8% |

| Fudo Tetra (TSE:1813) | ¥2153.00 | ¥4301.30 | 49.9% |

| Greenworks (Jiangsu) (SZSE:301260) | CN¥13.95 | CN¥27.81 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5854.00 | ¥11678.68 | 49.9% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥9.10 | CN¥18.19 | 50% |

| Tenable Holdings (NasdaqGS:TENB) | US$43.39 | US$86.65 | 49.9% |

Let's uncover some gems from our specialized screener.

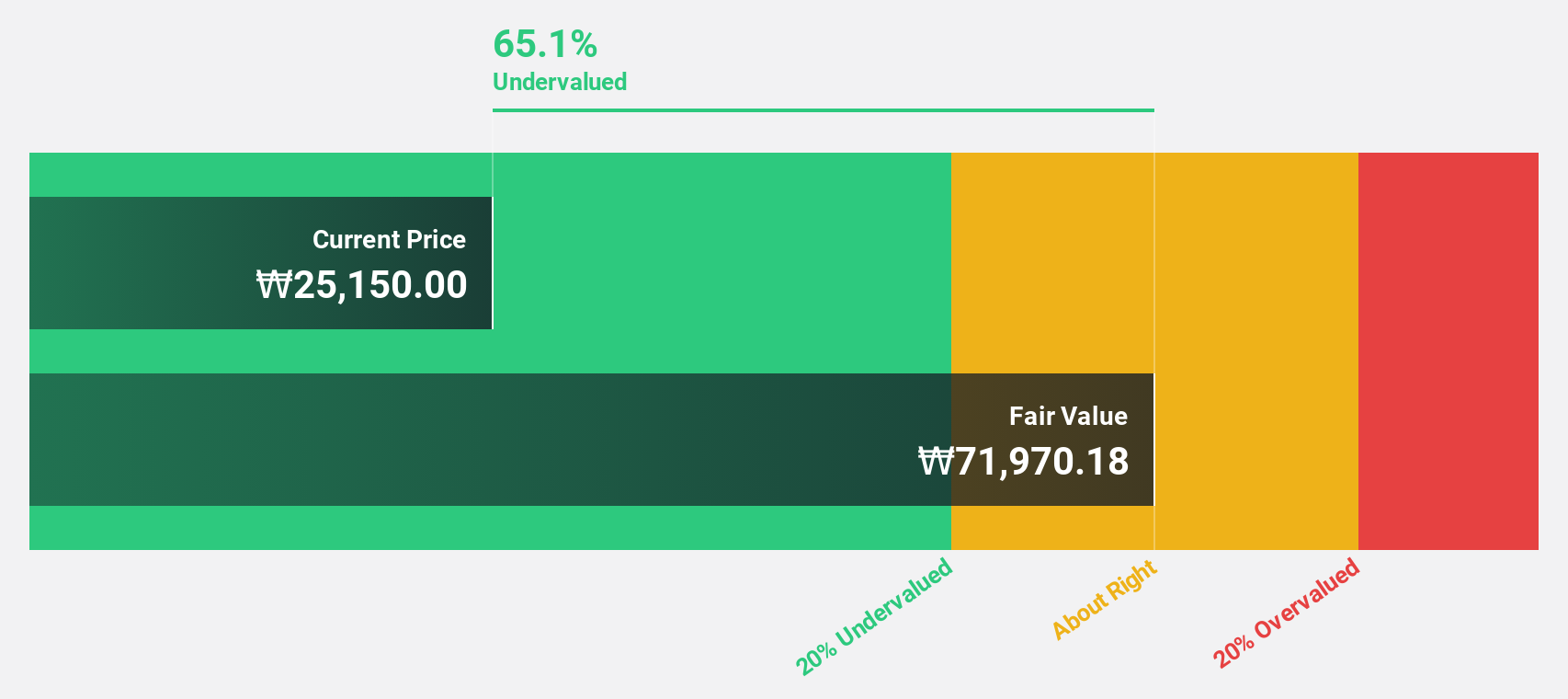

Hanall Biopharma (KOSE:A009420)

Overview: Hanall Biopharma Co., Ltd. is a pharmaceutical company that manufactures and sells pharmaceutical products both in South Korea and internationally, with a market cap of ₩2.09 trillion.

Operations: The company's revenue from the manufacture and sale of pharmaceuticals is ₩134.24 billion.

Estimated Discount To Fair Value: 21.8%

Hanall Biopharma is trading at ₩41,150, significantly below its estimated fair value of ₩52,646.98. The company is expected to become profitable within three years and has a forecasted revenue growth rate of 18.9% annually, outpacing the Korean market average. Despite recent earnings declines and net losses for nine months ending September 2024, successful Phase 1 trials for Parkinson's therapy HL192 highlight potential future growth avenues alongside ongoing clinical developments in other treatments.

- Our comprehensive growth report raises the possibility that Hanall Biopharma is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Hanall Biopharma.

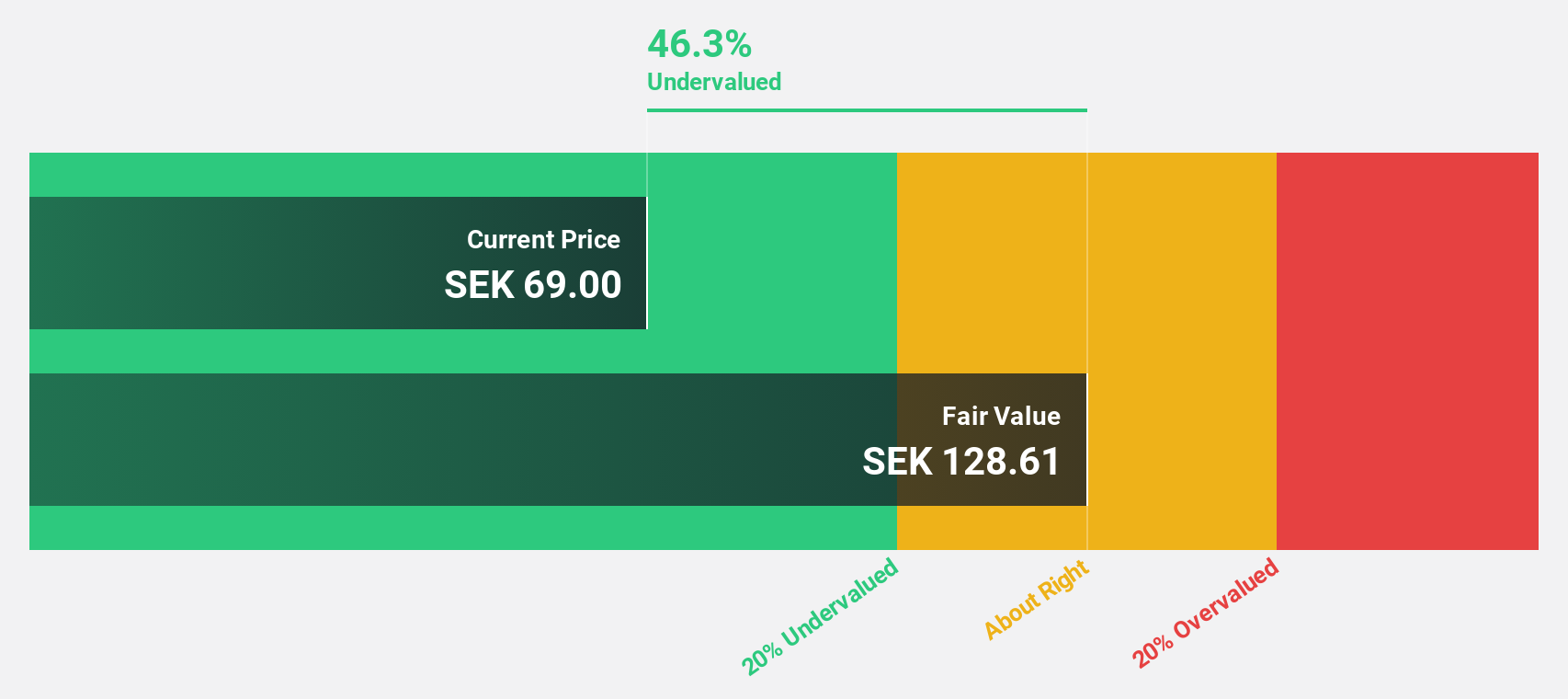

Electrolux Professional (OM:EPRO B)

Overview: Electrolux Professional AB (publ) offers food service, beverage, and laundry products and solutions to various service facilities such as restaurants and hotels, with a market cap of approximately SEK21.64 billion.

Operations: The company generates revenue from its Laundry segment, amounting to SEK4.70 billion, and Food & Beverage segment, totaling SEK7.53 billion.

Estimated Discount To Fair Value: 38.6%

Electrolux Professional is trading at SEK75.3, significantly below its estimated fair value of SEK122.73, reflecting a potential undervaluation based on cash flows. Despite a high debt level, the company's earnings are projected to grow significantly over the next three years at 20.44% annually, outpacing the Swedish market's average growth rate of 14%. Recent leadership changes with Bo Erickson joining as President Food Americas may enhance strategic direction and operational efficiency in key markets.

- Our growth report here indicates Electrolux Professional may be poised for an improving outlook.

- Take a closer look at Electrolux Professional's balance sheet health here in our report.

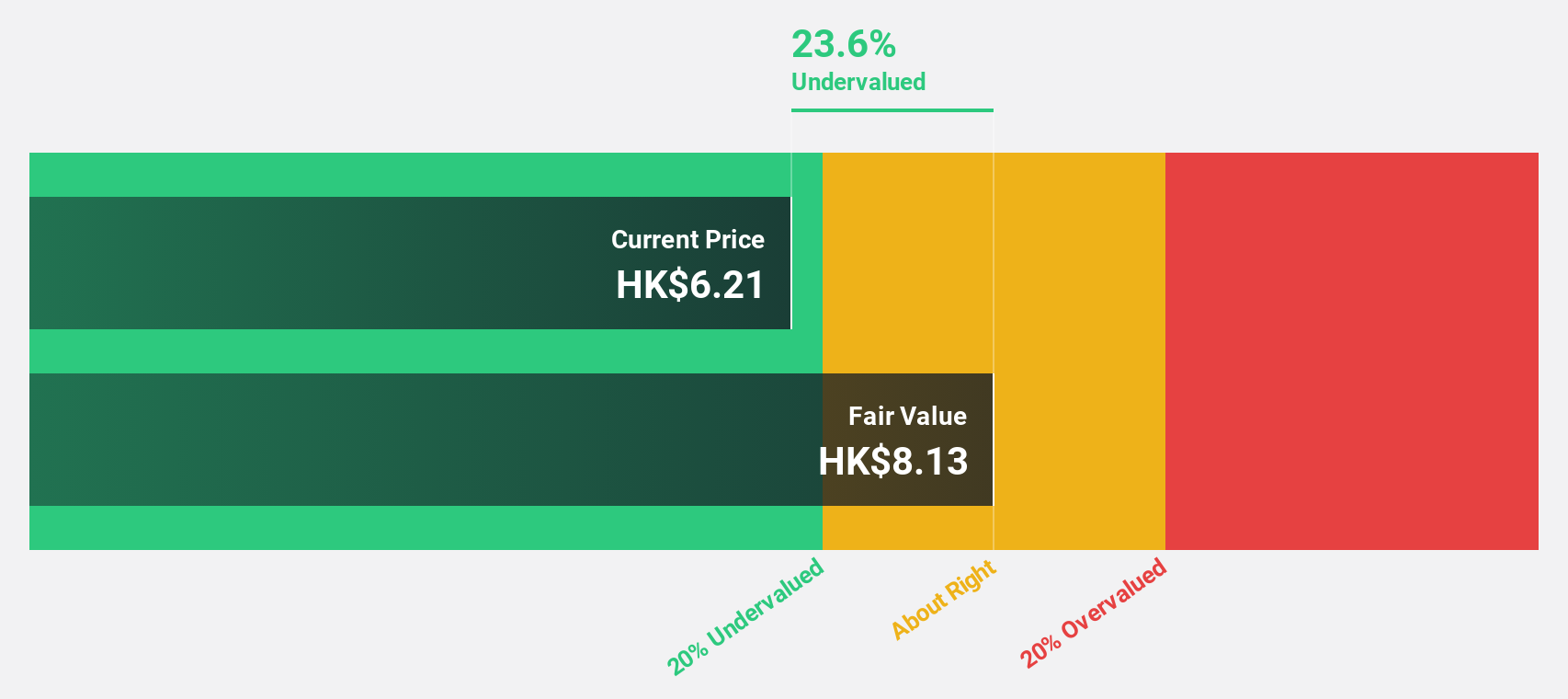

Plover Bay Technologies (SEHK:1523)

Overview: Plover Bay Technologies Limited is an investment holding company that designs, develops, and markets software-defined wide area network routers, with a market cap of HK$5.58 billion.

Operations: The company's revenue segments include $15.19 million from sales of SD-WAN routers with fixed first connectivity, $59.87 million from sales of SD-WAN routers with mobile first connectivity, and $31.86 million from software licenses and warranty and support services.

Estimated Discount To Fair Value: 14.8%

Plover Bay Technologies is trading at HK$5.06, approximately 14.8% below its fair value estimate of HK$5.94, suggesting potential undervaluation based on cash flows. The company forecasts earnings growth of 17.3% annually, surpassing the Hong Kong market average of 11.3%. Recent guidance indicates a profit increase exceeding 10% compared to last year's US$28.1 million due to higher sales volumes and improved net profit margins from SD-WAN router products and new connectivity offerings.

- According our earnings growth report, there's an indication that Plover Bay Technologies might be ready to expand.

- Navigate through the intricacies of Plover Bay Technologies with our comprehensive financial health report here.

Summing It All Up

- Discover the full array of 887 Undervalued Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1523

Plover Bay Technologies

An investment holding company, designs, develops, and markets software defined wide area network routers.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives