- Switzerland

- /

- Commercial Services

- /

- SWX:OFN

European Dividend Stocks To Consider

Reviewed by Simply Wall St

The European stock market has shown tentative optimism recently, buoyed by potential trade deals with the U.S. and a stable interest rate environment as maintained by the European Central Bank. In this context, dividend stocks can be appealing to investors seeking steady income streams, especially when markets are navigating through uncertain economic landscapes.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.42% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.20% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.63% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.73% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.76% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.83% | ★★★★★★ |

| ERG (BIT:ERG) | 5.15% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.00% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.56% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.51% | ★★★★★★ |

Click here to see the full list of 229 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

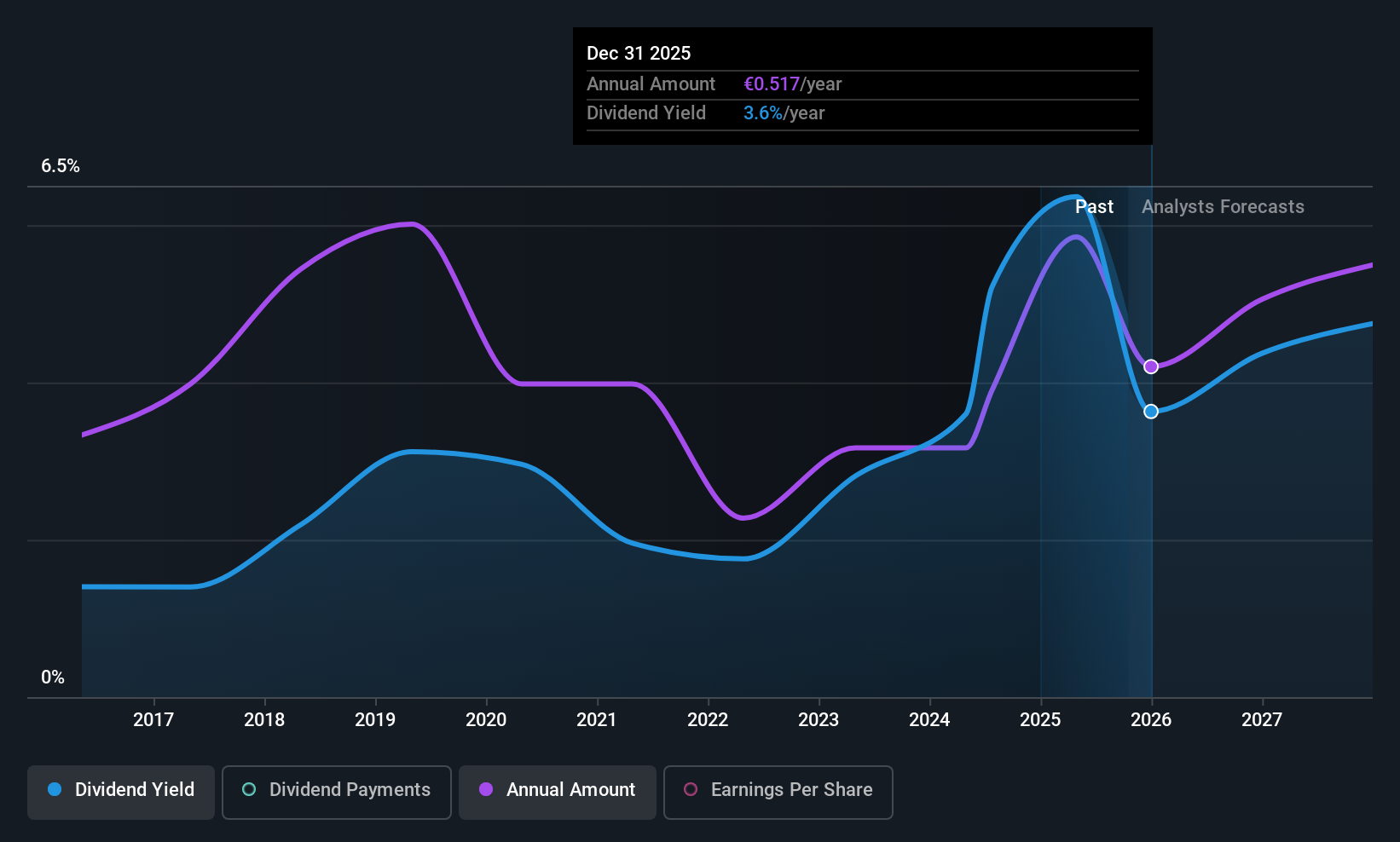

OPmobility (ENXTPA:OPM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: OPmobility SE specializes in designing and producing intelligent exterior systems, customized complex modules, lighting systems, energy storage systems, and electrification solutions for global mobility players, with a market cap of €1.91 billion.

Operations: OPmobility SE's revenue is primarily derived from its Exterior Systems segment (€4.70 billion), followed by Modules (€3.15 billion) and Powertrain (€2.62 billion).

Dividend Yield: 5.4%

OPmobility's dividend yield is among the top 25% in the French market, with a payout ratio of 32.2%, indicating dividends are well covered by earnings. Despite this, its dividend history has been volatile and unreliable over the past decade. Recent earnings showed a decline in net income to €90 million from €100 million year-on-year, reflecting potential challenges. The stock trades at a significant discount to estimated fair value but carries high debt levels and large one-off items affecting results.

- Get an in-depth perspective on OPmobility's performance by reading our dividend report here.

- According our valuation report, there's an indication that OPmobility's share price might be on the cheaper side.

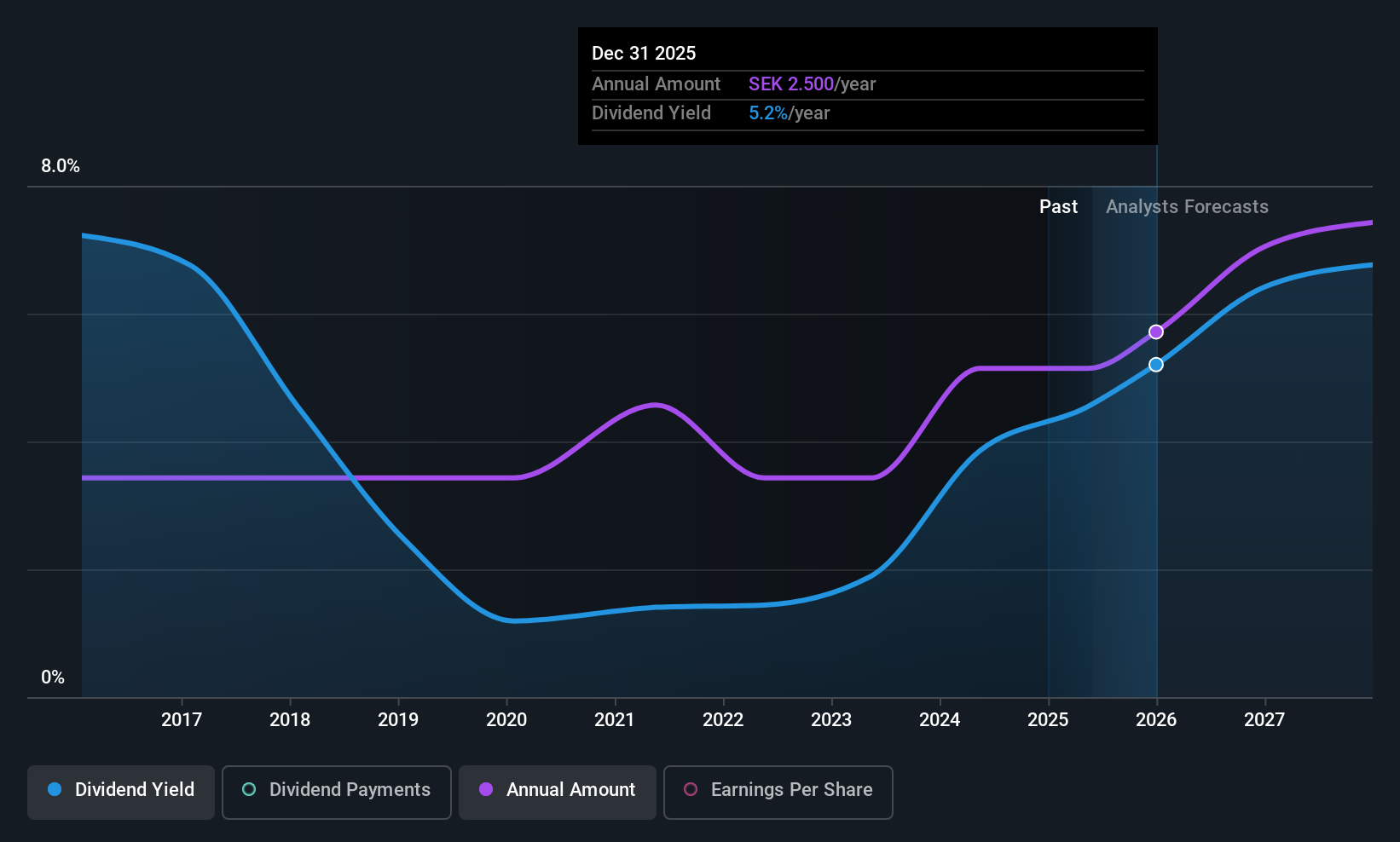

Eolus Aktiebolag (OM:EOLU B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eolus Aktiebolag (publ) focuses on the development, construction, and operation of renewable energy assets across several countries including Sweden, Finland, and the United States, with a market cap of SEK1.45 billion.

Operations: Eolus Aktiebolag (publ) generates revenue through its activities in the renewable energy sector, which include developing, constructing, and managing energy assets in regions such as Poland, Spain, and the Baltic states.

Dividend Yield: 3.9%

Eolus Aktiebolag's dividend yield ranks in the top 25% of Swedish dividend payers, yet its history shows volatility and unreliability over the past decade. Despite a low payout ratio of 20.2%, dividends aren't supported by free cash flow or earnings, raising sustainability concerns. Recent financials reveal a significant revenue increase to SEK 2 billion but lower profit margins compared to last year. The stock trades at a notable discount to estimated fair value.

- Unlock comprehensive insights into our analysis of Eolus Aktiebolag stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Eolus Aktiebolag is priced lower than what may be justified by its financials.

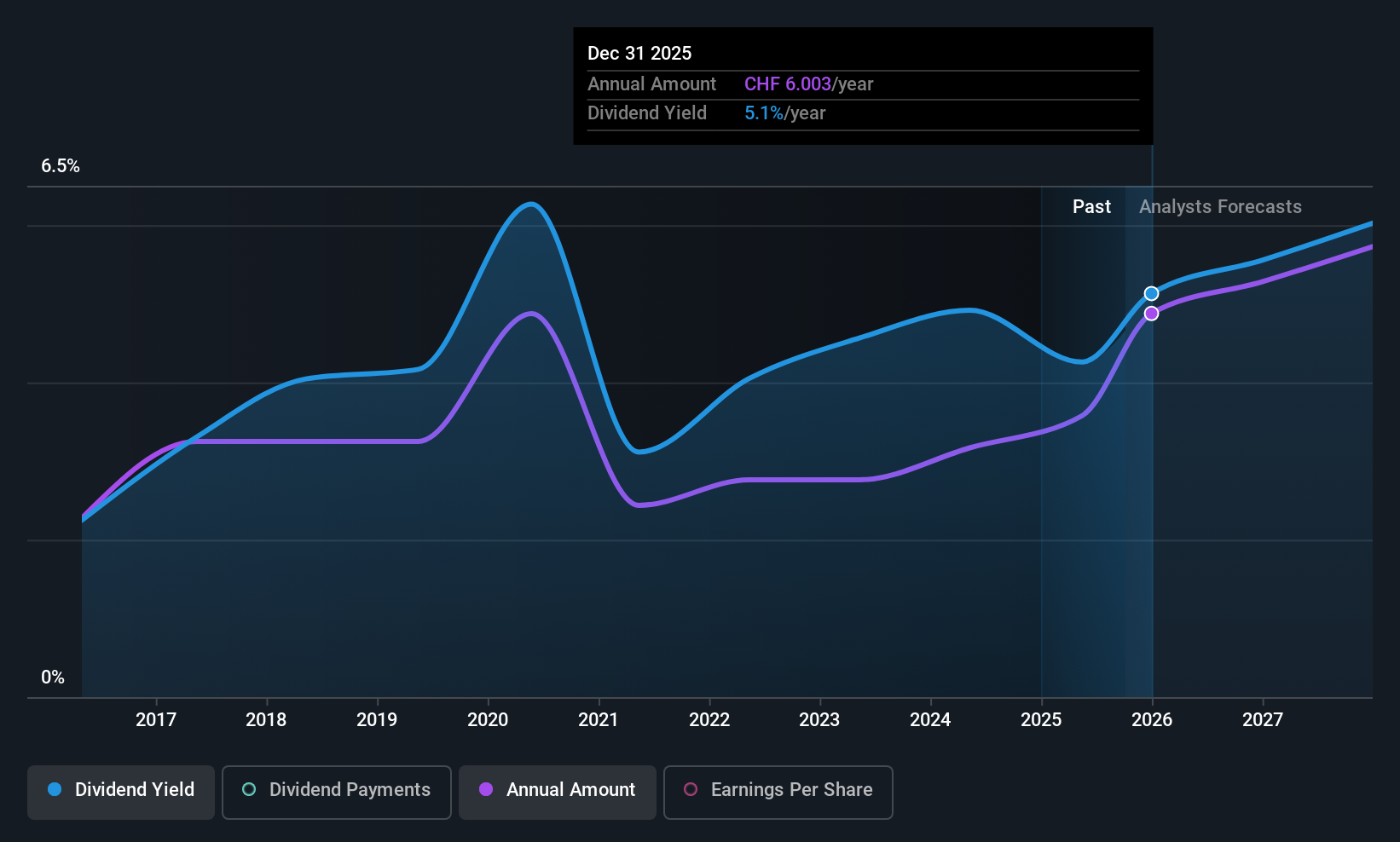

Orell Füssli (SWX:OFN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orell Füssli AG operates in security printing and technology, book retailing, and publishing across multiple regions including Switzerland, Germany, Europe, Africa, the Americas, Asia, and Oceania with a market cap of CHF205.80 million.

Operations: Orell Füssli AG generates revenue through its operations in security printing and technology, book retailing, and publishing.

Dividend Yield: 4.2%

Orell Füssli's dividend yield is among the top 25% in Switzerland, supported by a payout ratio of 44.9%, indicating coverage by earnings and cash flows. Despite recent dividend increases, its short nine-year history reveals volatility and unreliability. Recent financials show strong growth with revenue reaching CHF 124.98 million and net income at CHF 6.69 million for H1 2025, suggesting improved profitability but future earnings are expected to decline slightly over the next three years.

- Delve into the full analysis dividend report here for a deeper understanding of Orell Füssli.

- In light of our recent valuation report, it seems possible that Orell Füssli is trading behind its estimated value.

Seize The Opportunity

- Click through to start exploring the rest of the 226 Top European Dividend Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:OFN

Orell Füssli

Engages in security printing and technology, book retailing, and publishing business in Switzerland Germany, rest of Europe and Africa, North and South America, Asia, and Oceania.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)