- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:4240

Top Growth Companies With High Insider Ownership In September 2024

Reviewed by Simply Wall St

As global markets grapple with economic slowdown concerns and the S&P 500 experiences its sharpest decline in 18 months, investors are increasingly seeking stable opportunities amidst volatility. One key indicator of a potentially resilient stock is high insider ownership, which often signals strong confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 20.6% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Hartshead Resources (ASX:HHR) | 13.9% | 102.6% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 27.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95.9% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

Let's explore several standout options from the results in the screener.

MBC Group (SASE:4072)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MBC Group is a media company operating in the United Arab Emirates, Saudi Arabia, Egypt, Iraq, North Africa, and internationally with a market cap of SAR14.96 billion.

Operations: MBC Group generates revenue from various segments including advertising, content production and distribution, subscription services, and digital platforms.

Insider Ownership: 36%

MBC Group, recently added to the S&P Pan Arab Composite and S&P Global BMI Index, is forecasted to grow earnings by 33.85% per year, significantly outpacing the SA market's 7% growth rate. Despite a low projected Return on Equity of 10.2%, its revenue is expected to grow by 14.5% annually. The company has no recent insider trading activity but has shown strong past performance with a 76.5% earnings growth over the last year.

- Click here and access our complete growth analysis report to understand the dynamics of MBC Group.

- Our comprehensive valuation report raises the possibility that MBC Group is priced higher than what may be justified by its financials.

Fawaz Abdulaziz Al Hokair (SASE:4240)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fawaz Abdulaziz Al Hokair & Company, with a market cap of SAR1.28 billion, operates as a franchise retailer of fashion products across several countries including Saudi Arabia, Jordan, Egypt, Kazakhstan, the United States, Azerbaijan, Georgia, Armenia and Morocco.

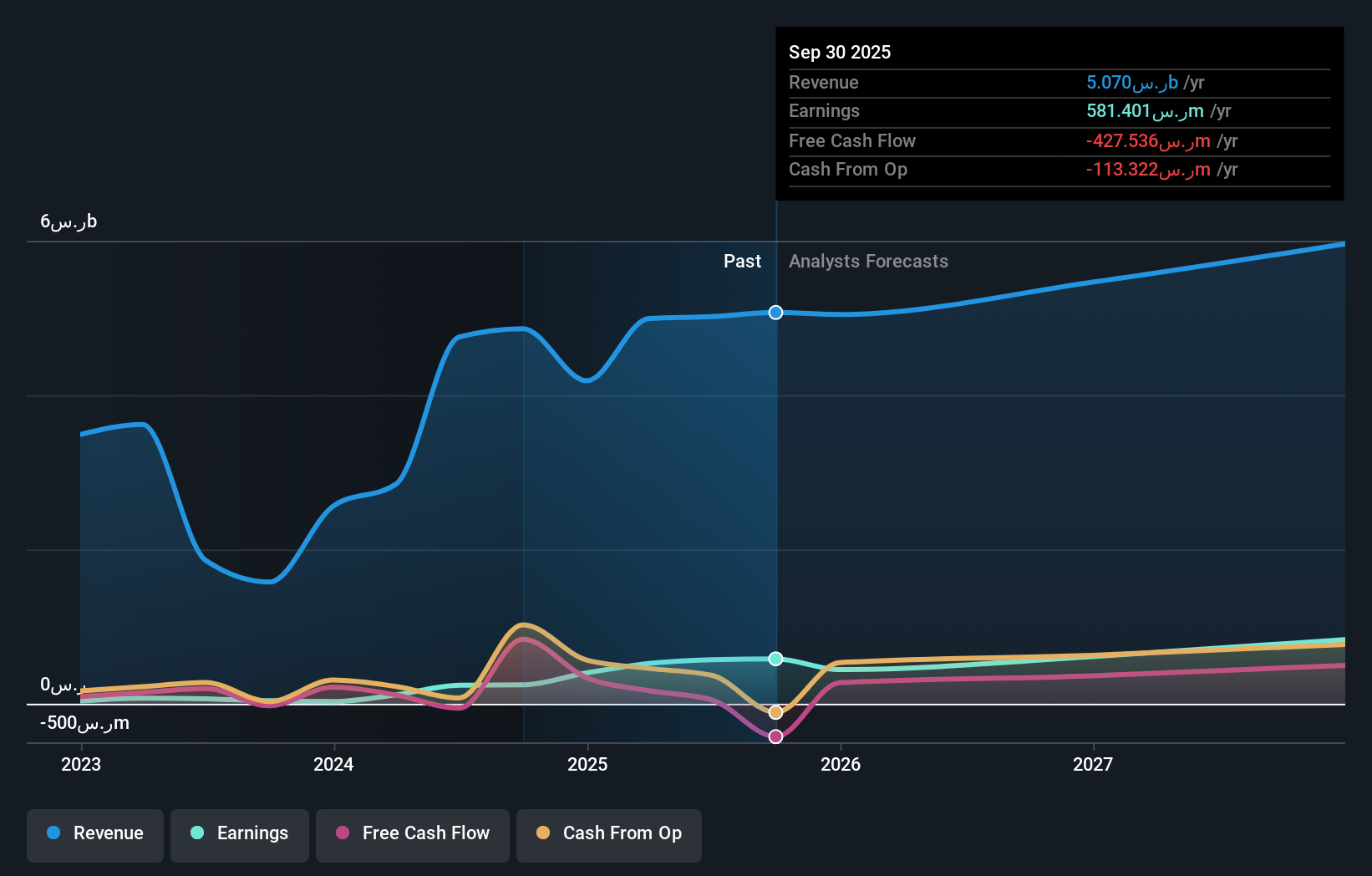

Operations: The company's revenue segments include Fashion Retail (SAR4.64 billion), F&B (SAR359.85 million), and Indoor Entertainment (SAR69.75 million).

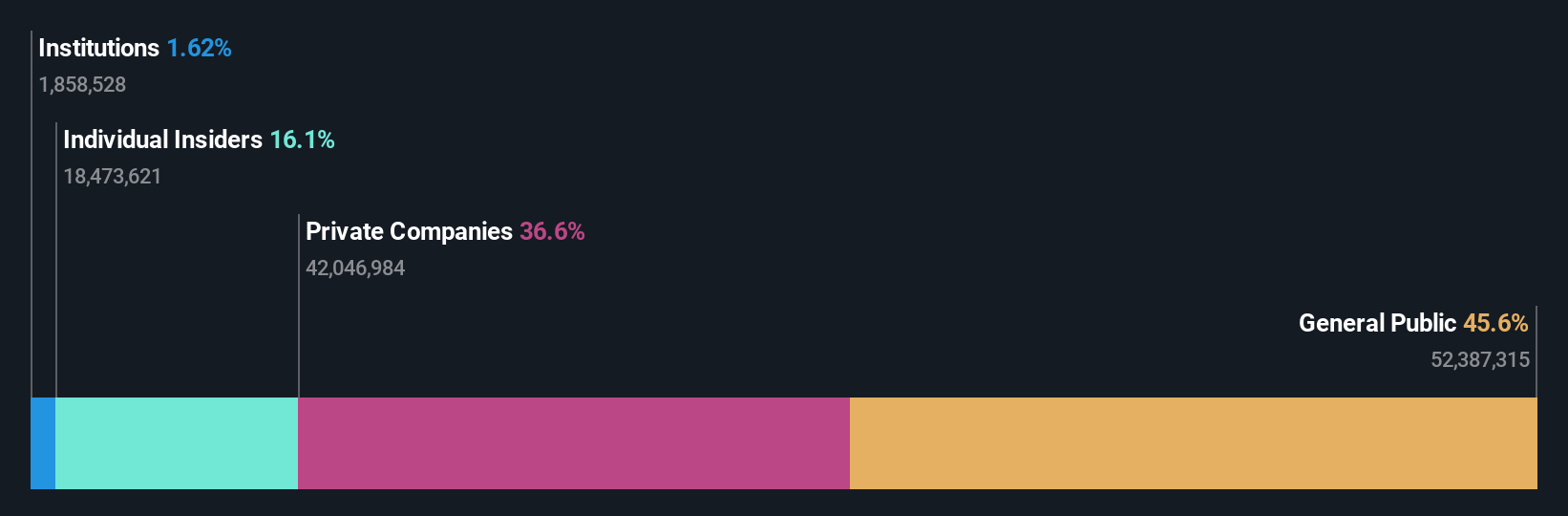

Insider Ownership: 15.2%

Fawaz Abdulaziz Al Hokair & Company, despite recent executive changes with Salim Fakhouri as the new CEO, faces challenges with declining sales and net income. For the second quarter of 2024, sales were SAR 1.26 billion compared to SAR 1.43 billion a year ago, and net income dropped from SAR 166 million to SAR 81 million. However, it trades at a significant discount to its estimated fair value and is forecasted to achieve profitability within three years.

- Click here to discover the nuances of Fawaz Abdulaziz Al Hokair with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Fawaz Abdulaziz Al Hokair is trading behind its estimated value.

Visco Vision (TWSE:6782)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Visco Vision Inc. manufactures and sells silicone hydrogel contact lenses across Asia, Europe, and the Americas, with a market cap of NT$15.12 billion.

Operations: Revenue from the manufacturing and trading of disposable contact lenses totals NT$3.06 billion.

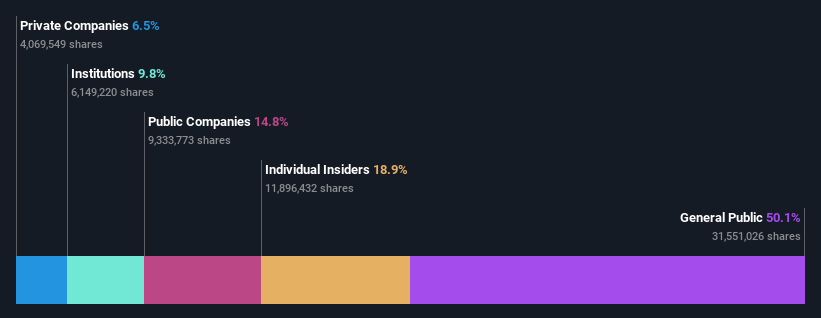

Insider Ownership: 18.9%

Visco Vision Inc. demonstrates strong growth potential with high insider ownership, evidenced by a significant increase in earnings and revenue. For the second quarter of 2024, sales rose to TWD 905.07 million from TWD 535.63 million a year ago, while net income surged to TWD 143.83 million from TWD 56.89 million. Analysts project earnings to grow at an annual rate of 35%, significantly outpacing the market average, and forecast a stock price increase of nearly 29%.

- Take a closer look at Visco Vision's potential here in our earnings growth report.

- Our expertly prepared valuation report Visco Vision implies its share price may be lower than expected.

Turning Ideas Into Actions

- Access the full spectrum of 1510 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Fawaz Abdulaziz Al Hokair, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4240

Fawaz Abdulaziz Al Hokair

Operates as a franchise retailer of fashion products in the Kingdom of Saudi Arabia, Jordan, Egypt, the Republic of Kazakhstan, the United States, the Republic of Azerbaijan, Georgia, Armenia, and Morocco.

Fair value with moderate growth potential.