- Saudi Arabia

- /

- Chemicals

- /

- SASE:2290

3 Stocks Estimated To Be Trading Below Fair Value In December 2024

Reviewed by Simply Wall St

As global markets experience a divergence with major U.S. indexes reaching record highs and growth stocks outperforming value shares, investors are closely monitoring economic indicators and central bank policies for future direction. Amidst this complex landscape, identifying stocks trading below their fair value can offer potential opportunities, especially when market volatility presents discrepancies between stock prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Round One (TSE:4680) | ¥1264.00 | ¥2527.25 | 50% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.26 | US$99.93 | 49.7% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.7% |

| West Bancorporation (NasdaqGS:WTBA) | US$23.32 | US$46.38 | 49.7% |

| EnomotoLtd (TSE:6928) | ¥1441.00 | ¥2877.97 | 49.9% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP289.40 | CLP576.08 | 49.8% |

| Nidaros Sparebank (OB:NISB) | NOK99.60 | NOK198.62 | 49.9% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$27.10 | HK$54.00 | 49.8% |

| Zalando (XTRA:ZAL) | €34.70 | €69.28 | 49.9% |

| Akeso (SEHK:9926) | HK$66.35 | HK$131.88 | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

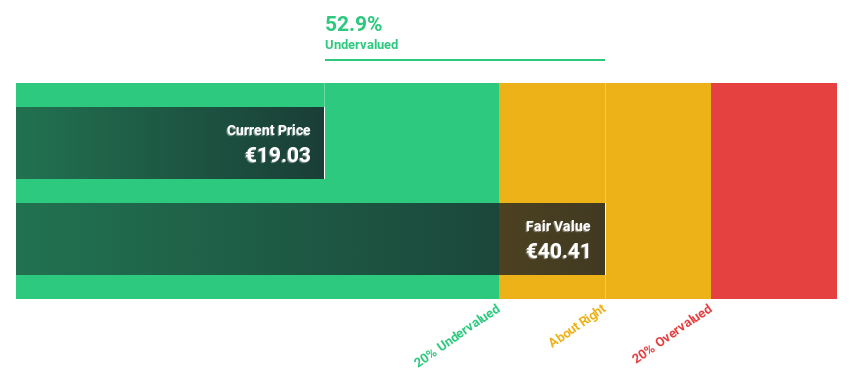

Pluxee (ENXTPA:PLX)

Overview: Pluxee N.V. provides employee benefits and engagement solutions services across France, Latin America, Continental Europe, and internationally with a market cap of €3 billion.

Operations: The company's revenue segments are comprised of €0.46 billion from Latin America, €0.22 billion from the Rest of The World, and €0.53 billion from Continental Europe.

Estimated Discount To Fair Value: 49.5%

Pluxee is trading at €20.58, significantly below its estimated fair value of €40.76, indicating undervaluation based on cash flows. Despite a volatile share price, earnings grew by 64.2% over the past year and are forecast to grow 19.8% annually, outpacing the French market's average growth rate. Recent earnings reports show net income rising to €133 million from €81 million last year, with revenue increasing to €1.21 billion from €1.05 billion.

- Our comprehensive growth report raises the possibility that Pluxee is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Pluxee's balance sheet health report.

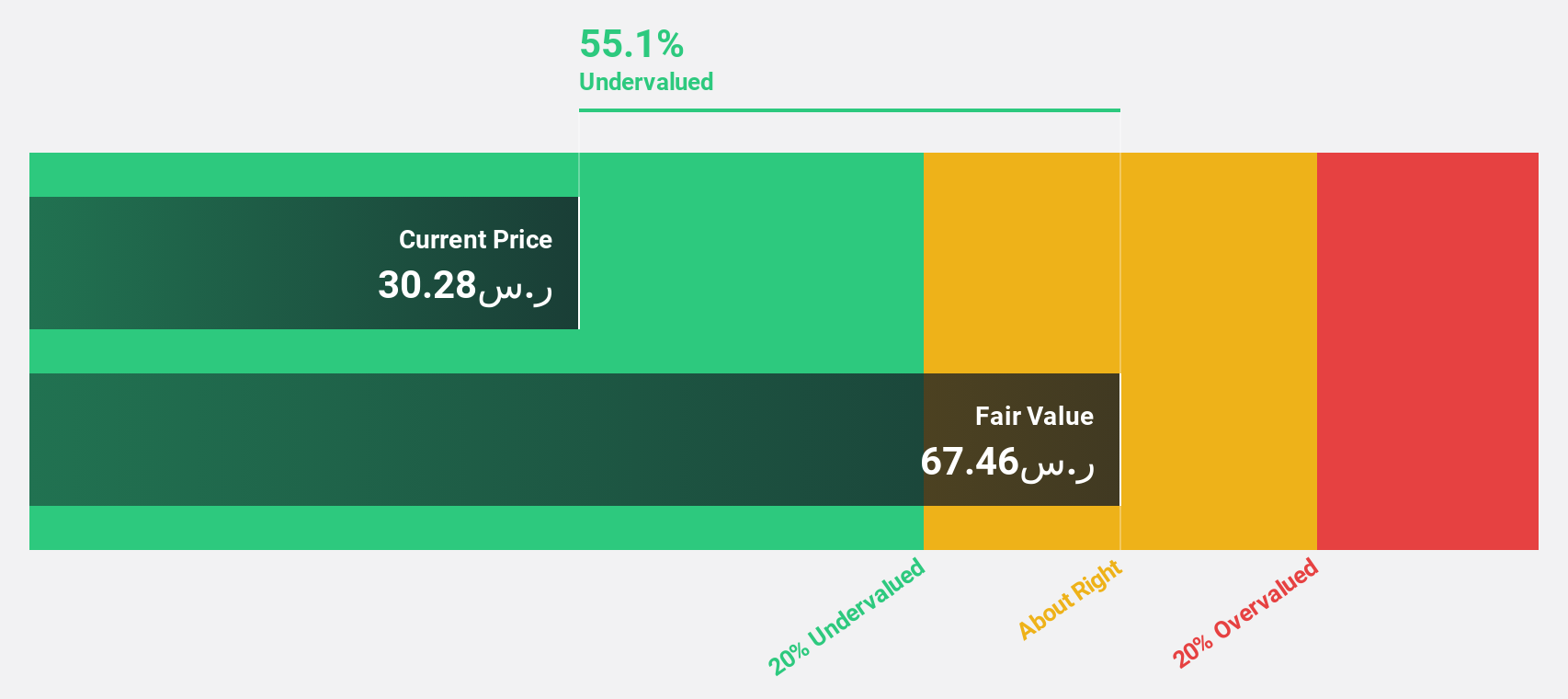

Yanbu National Petrochemical (SASE:2290)

Overview: Yanbu National Petrochemical Company manufactures and sells petrochemical products across various regions including Saudi Arabia, the Americas, Africa, the Middle East, Europe, and Asia with a market cap of SAR21.32 billion.

Operations: The company's revenue primarily comes from its petrochemical segment, which generated SAR6.12 billion.

Estimated Discount To Fair Value: 30.6%

Yanbu National Petrochemical is trading at SAR 37.9, below its estimated fair value of SAR 54.63, highlighting potential undervaluation based on cash flows. The company became profitable this year with a net income of SAR 130.58 million in Q3, reversing a loss from the previous year. Earnings are forecast to grow significantly at 27.8% annually over the next three years, surpassing the South African market's growth rate of 6.3%.

- Our growth report here indicates Yanbu National Petrochemical may be poised for an improving outlook.

- Dive into the specifics of Yanbu National Petrochemical here with our thorough financial health report.

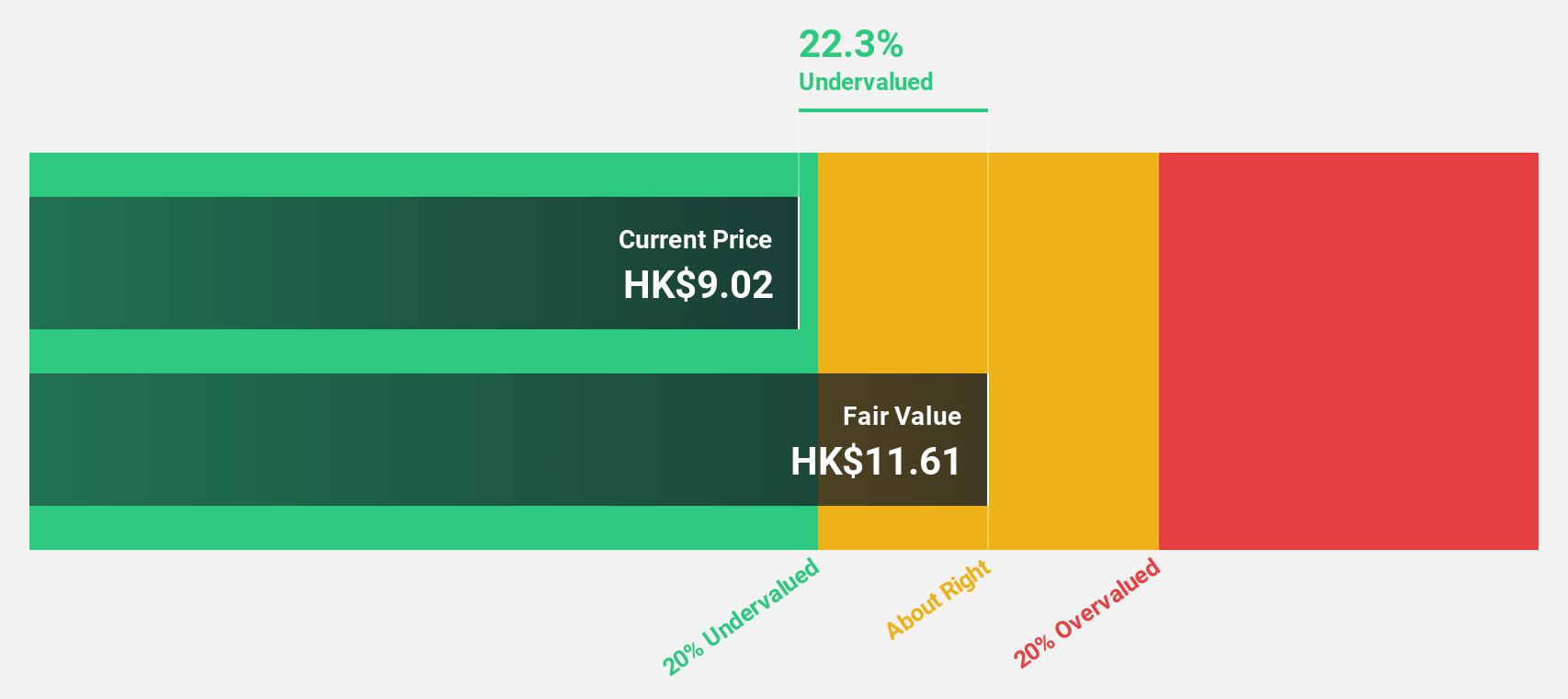

Bairong (SEHK:6608)

Overview: Bairong Inc. is a cloud-based AI turnkey services provider in China with a market capitalization of approximately HK$4.63 billion.

Operations: The company generates revenue from its data processing segment, which amounts to CN¥2.76 billion.

Estimated Discount To Fair Value: 36%

Bairong is trading at HK$10, below its estimated fair value of HK$15.62, indicating potential undervaluation based on cash flows. Despite a decline in net income to CNY 139.96 million for the first half of 2024, revenue increased to CNY 1,321.35 million year-over-year. Earnings are expected to grow significantly at 29.6% annually over the next three years, outpacing the Hong Kong market's growth rate of 11.3%.

- Our expertly prepared growth report on Bairong implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Bairong stock in this financial health report.

Make It Happen

- Get an in-depth perspective on all 890 Undervalued Stocks Based On Cash Flows by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2290

Yanbu National Petrochemical

Engages in the manufacture and sale of petrochemical products in Saudi Arabia, the Americas, Africa, the Middle East, Europe, and Asia.

Flawless balance sheet with reasonable growth potential.