- Saudi Arabia

- /

- Chemicals

- /

- SASE:2223

3 Stocks Estimated To Be Undervalued By Up To 30.5% Offering Potential Value

Reviewed by Simply Wall St

In recent weeks, global markets have experienced mixed performances, with major U.S. stock indexes like the S&P 500 and Nasdaq Composite reaching record highs while others such as the Russell 2000 saw declines. Amidst these fluctuations and diverse sector performances, investors are increasingly focused on identifying stocks that may be undervalued by market standards, offering potential value opportunities in a complex economic environment. Recognizing undervalued stocks involves assessing their intrinsic value relative to current market prices, particularly in sectors where growth has lagged behind broader indices or where economic indicators suggest potential for recovery or expansion.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Round One (TSE:4680) | ¥1264.00 | ¥2527.25 | 50% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.26 | US$99.93 | 49.7% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.7% |

| West Bancorporation (NasdaqGS:WTBA) | US$23.32 | US$46.38 | 49.7% |

| EnomotoLtd (TSE:6928) | ¥1441.00 | ¥2877.97 | 49.9% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP289.40 | CLP576.08 | 49.8% |

| Nidaros Sparebank (OB:NISB) | NOK99.60 | NOK198.62 | 49.9% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$27.10 | HK$54.00 | 49.8% |

| Zalando (XTRA:ZAL) | €34.70 | €69.28 | 49.9% |

| Akeso (SEHK:9926) | HK$66.35 | HK$131.88 | 49.7% |

Let's explore several standout options from the results in the screener.

Saudi Aramco Base Oil Company - Luberef (SASE:2223)

Overview: Saudi Aramco Base Oil Company - Luberef is engaged in the production and sale of base oils and various by-products both within Saudi Arabia and internationally, with a market cap of SAR19.61 billion.

Operations: The company generates revenue primarily from its Oil & Gas - Refining & Marketing segment, amounting to SAR9.94 billion.

Estimated Discount To Fair Value: 30.2%

Saudi Aramco Base Oil Company - Luberef is trading at SAR 116.2, significantly undervalued compared to its estimated fair value of SAR 166.52, offering a good relative value against peers. Despite declining revenue projections of -6% annually over three years, earnings are expected to grow at 20.4% per year, outpacing the Saudi market's growth rate. However, recent earnings have declined with profit margins dropping from 22.9% to 10.4%, and dividends remain unsustainably high at 6.2%.

- Our earnings growth report unveils the potential for significant increases in Saudi Aramco Base Oil Company - Luberef's future results.

- Unlock comprehensive insights into our analysis of Saudi Aramco Base Oil Company - Luberef stock in this financial health report.

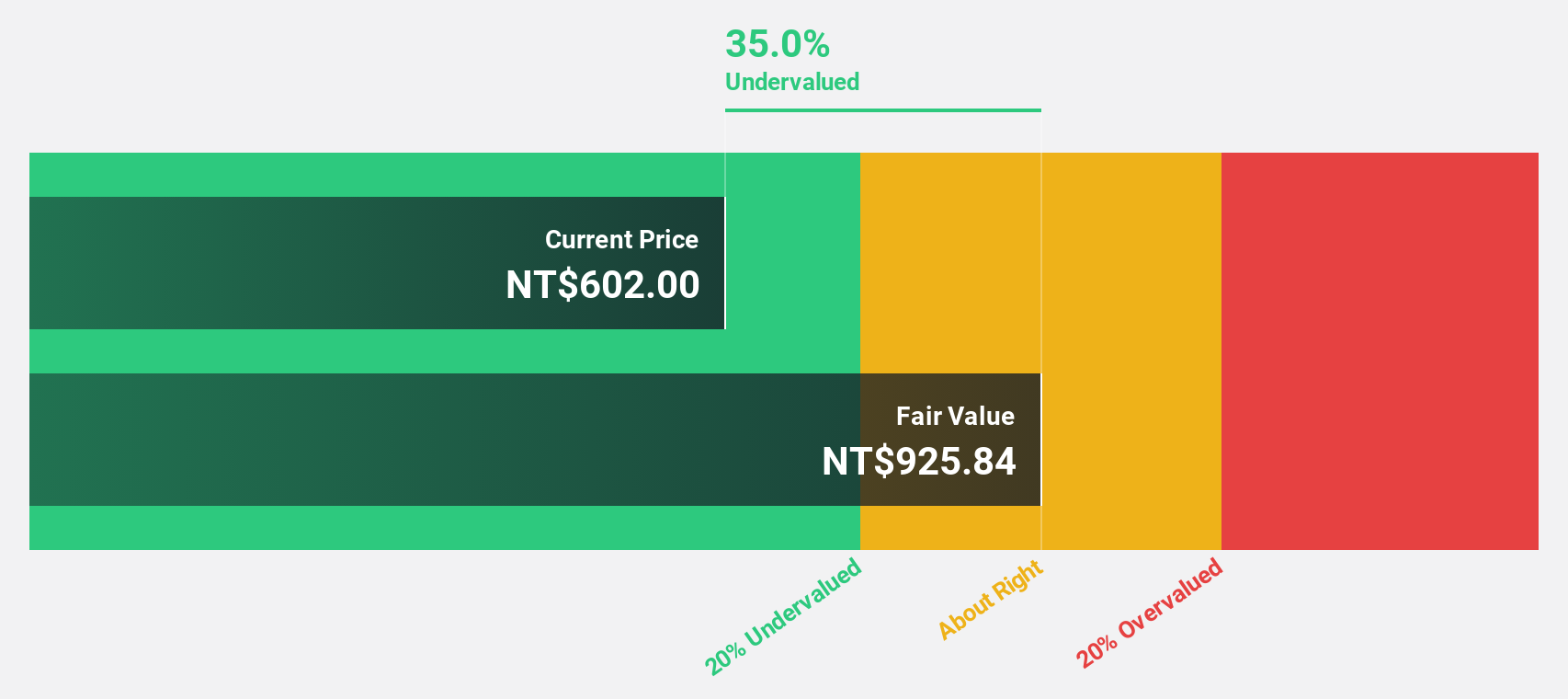

Parade Technologies (TPEX:4966)

Overview: Parade Technologies, Ltd. is a fabless semiconductor company operating in South Korea, China, Taiwan, Japan, and internationally with a market cap of NT$59.88 billion.

Operations: The company's revenue primarily comes from its Electronic Components & Parts segment, generating NT$15.95 billion.

Estimated Discount To Fair Value: 30.5%

Parade Technologies is trading at NT$755, substantially below its fair value estimate of NT$1086.36, presenting a potential opportunity based on cash flows. The company reported strong earnings growth with net income rising to TWD 761.7 million for Q3 2024 from TWD 611.93 million the previous year, despite an unstable dividend history. Earnings are projected to grow significantly at over 22% annually, surpassing the Taiwan market's average growth rate.

- The growth report we've compiled suggests that Parade Technologies' future prospects could be on the up.

- Get an in-depth perspective on Parade Technologies' balance sheet by reading our health report here.

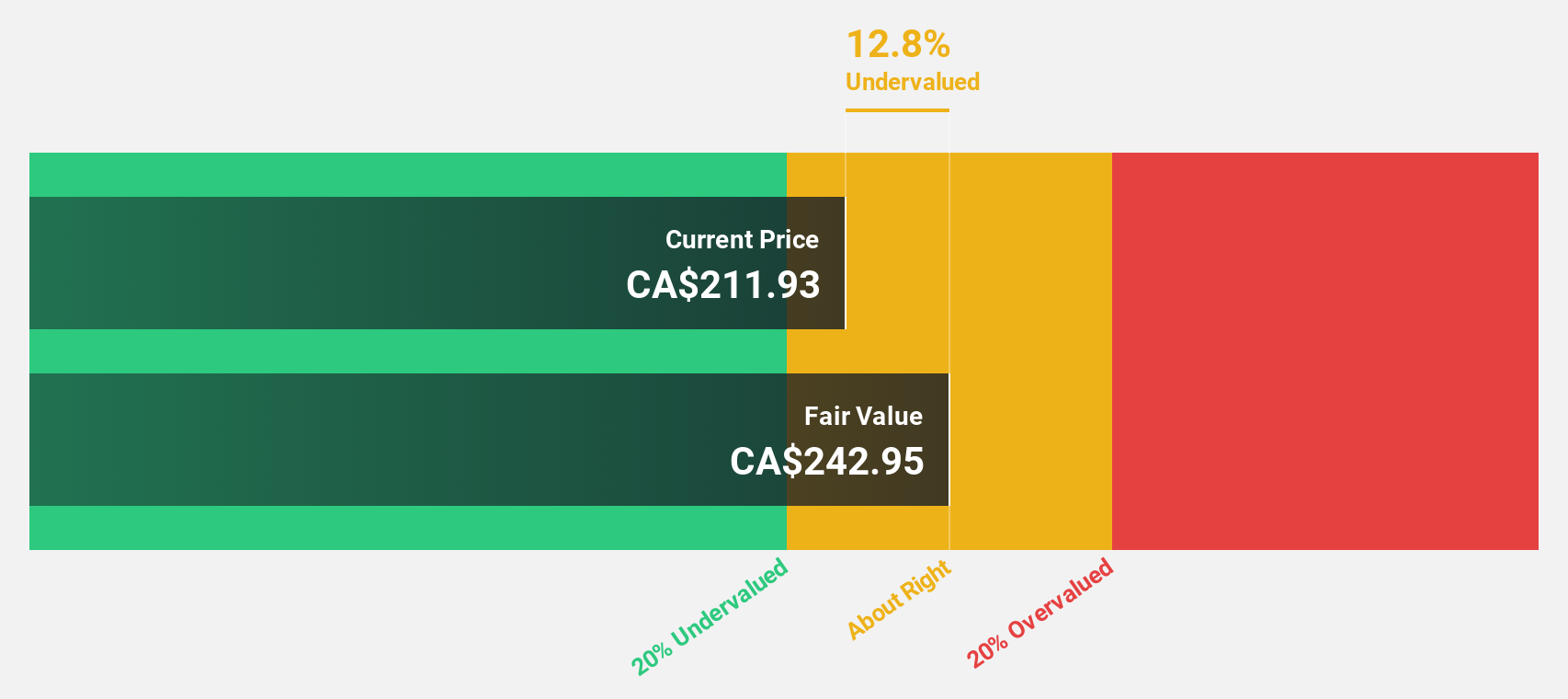

Franco-Nevada (TSX:FNV)

Overview: Franco-Nevada Corporation is a gold-focused royalty and streaming company with operations in South America, Central America, Mexico, the United States, Canada, and internationally; it has a market cap of CA$32.85 billion.

Operations: The company's revenue is primarily derived from its mining segment, which accounts for $904.30 million, and its energy segment, contributing $191.60 million.

Estimated Discount To Fair Value: 21.3%

Franco-Nevada is trading at CA$173.1, below its estimated fair value of CA$220.01, suggesting undervaluation based on cash flows. Despite a challenging year with reduced GEO sales guidance and lower-than-expected gold production, revenue for 2024 is projected between $1.05 billion and $1.15 billion. Earnings are forecast to grow significantly at 58.27% annually, outpacing the Canadian market's average growth rate of 7.6%, highlighting potential value despite current headwinds in production output.

- According our earnings growth report, there's an indication that Franco-Nevada might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Franco-Nevada.

Next Steps

- Click through to start exploring the rest of the 887 Undervalued Stocks Based On Cash Flows now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2223

Saudi Aramco Base Oil Company - Luberef

Produces and sells base oils and various by-products in the Kingdom of Saudi Arabia, the United Arab Emirates, India, Egypt, Singapore, the United States, and internationally.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives