- Saudi Arabia

- /

- Consumer Services

- /

- SASE:4292

3 Growth Companies With High Insider Ownership Expecting 21% Earnings Growth

Reviewed by Simply Wall St

In a week marked by mixed performances across major global indices, growth stocks have continued to capture investor attention, with the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite reaching record highs. As growth shares outperformed value stocks significantly, sectors like consumer discretionary and information technology saw notable gains amid ongoing economic developments such as job growth rebounds and anticipated Federal Reserve rate cuts. In this environment, companies that not only exhibit robust earnings potential but also have high insider ownership can offer unique insights into future performance expectations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.4% | 110.9% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Atea (OB:ATEA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Atea ASA offers IT infrastructure and related solutions to businesses and public sector organizations in the Nordic countries and Baltic regions, with a market cap of NOK15.95 billion.

Operations: The company's revenue segments are comprised of NOK8.28 billion from Norway, NOK12.44 billion from Sweden, NOK7.37 billion from Denmark, NOK3.62 billion from Finland, and NOK1.76 billion from the Baltics, along with Group Shared Services contributing NOK9.20 billion.

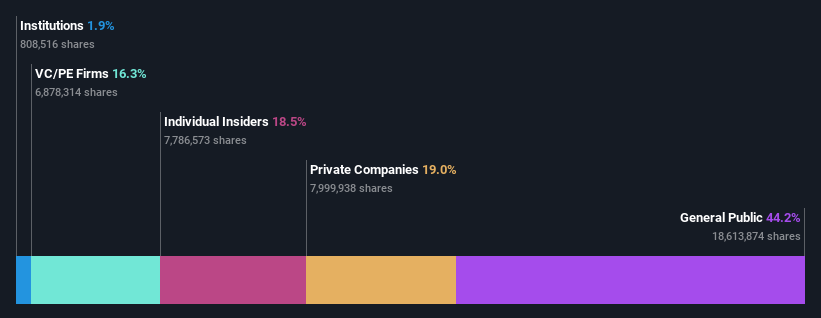

Insider Ownership: 29.0%

Earnings Growth Forecast: 18.9% p.a.

Atea's growth prospects are underscored by its forecasted earnings increase of 18.9% annually, outpacing the Norwegian market. Despite trading at a significant discount to its estimated fair value, Atea's dividend yield of 4.91% is not well covered by earnings, raising sustainability concerns. Recent share repurchase authorization highlights management's confidence in the company's valuation and future potential. Third-quarter results showed modest sales and net income increases year-over-year, reflecting steady operational performance amidst revenue challenges.

- Click here and access our complete growth analysis report to understand the dynamics of Atea.

- Our expertly prepared valuation report Atea implies its share price may be lower than expected.

Ataa Educational (SASE:4292)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ataa Educational Company operates private and international schools for kindergarten through secondary education in Saudi Arabia, with a market cap of SAR3.23 billion.

Operations: The company's revenue is primarily derived from its Education segment, which accounts for SAR645.68 million, supplemented by the Training segment at SAR30.42 million and Recruitment at SAR2.55 million.

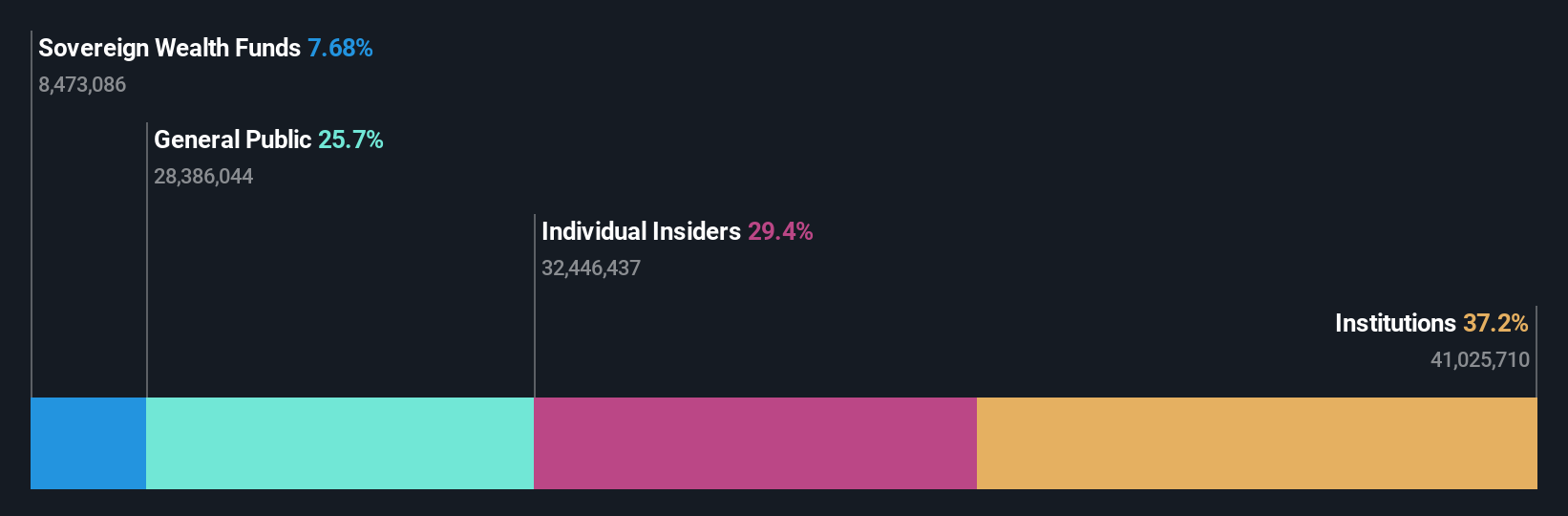

Insider Ownership: 18.5%

Earnings Growth Forecast: 21.8% p.a.

Ataa Educational's growth outlook is supported by a significant forecasted earnings increase of 21.8% annually, surpassing the South African market's average. Despite this, recent earnings results showed a slight decline in net income to SAR 63.37 million from SAR 67.79 million year-over-year, indicating potential profitability challenges. Revenue growth is expected at 4.8% per year, higher than the market average but still modest for aggressive growth investors seeking high insider ownership benefits.

- Delve into the full analysis future growth report here for a deeper understanding of Ataa Educational.

- The valuation report we've compiled suggests that Ataa Educational's current price could be inflated.

Quanta Computer (TWSE:2382)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Quanta Computer Inc. is a global manufacturer and seller of notebook computers, with a market capitalization of NT$1.14 trillion.

Operations: The company's revenue from the Electronics Sector amounts to NT$2.78 billion.

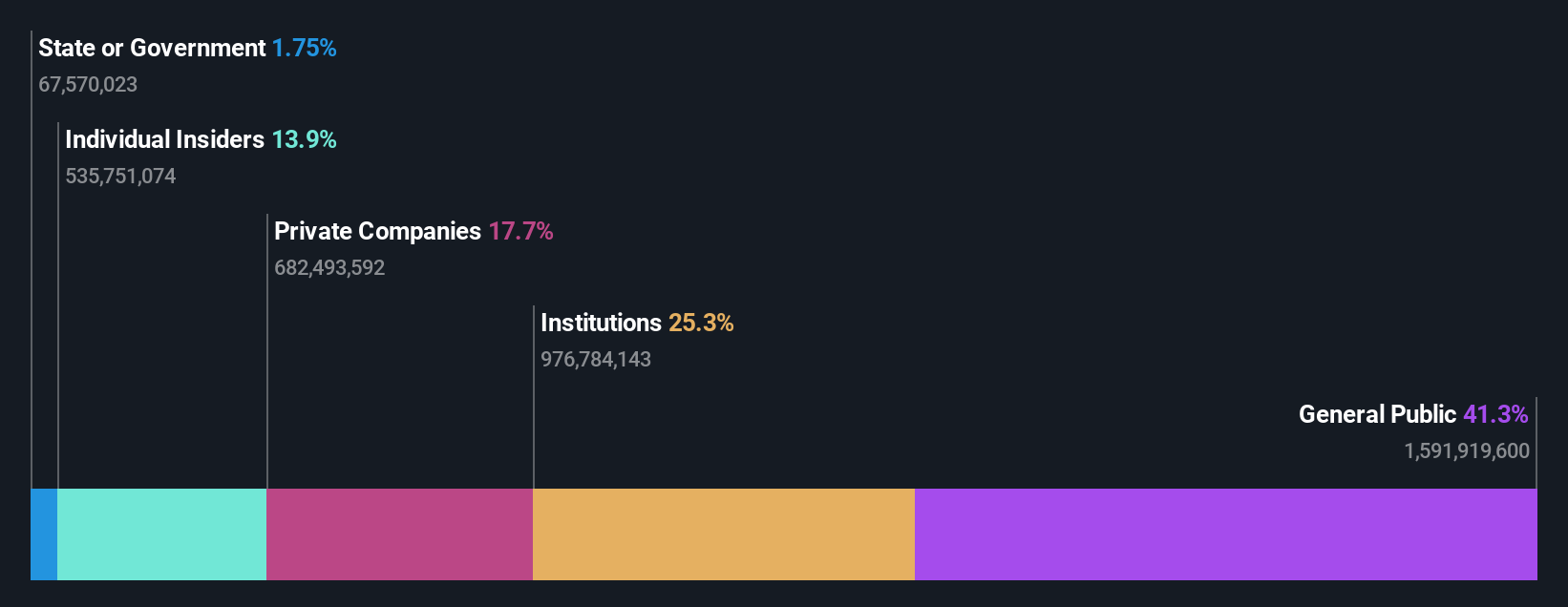

Insider Ownership: 13.7%

Earnings Growth Forecast: 19.7% p.a.

Quanta Computer's robust growth trajectory is underscored by a 41% increase in earnings over the past year, with revenue forecasted to grow at 36.9% annually, outpacing the Taiwan market. Despite trading at a significant discount to its estimated fair value and being valued well against peers, its dividend yield of 3.04% isn't fully supported by free cash flows. Recent quarterly results show sales reaching TWD 424.55 billion, reflecting strong performance momentum amid high insider ownership levels.

- Get an in-depth perspective on Quanta Computer's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Quanta Computer shares in the market.

Next Steps

- Explore the 1509 names from our Fast Growing Companies With High Insider Ownership screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4292

Ataa Educational

Engages in the establishment of private and international, kindergarten, primary, intermediate, and secondary schools for boys and girls in the Kingdom of Saudi Arabia.

Moderate growth potential unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives