- Saudi Arabia

- /

- Chemicals

- /

- SASE:2020

Read This Before Considering SABIC Agri-Nutrients Company (TADAWUL:2020) For Its Upcoming ر.س3.50 Dividend

SABIC Agri-Nutrients Company (TADAWUL:2020) is about to trade ex-dividend in the next three days. The ex-dividend date generally occurs two days before the record date, which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. Meaning, you will need to purchase SABIC Agri-Nutrients' shares before the 5th of August to receive the dividend, which will be paid on the 19th of August.

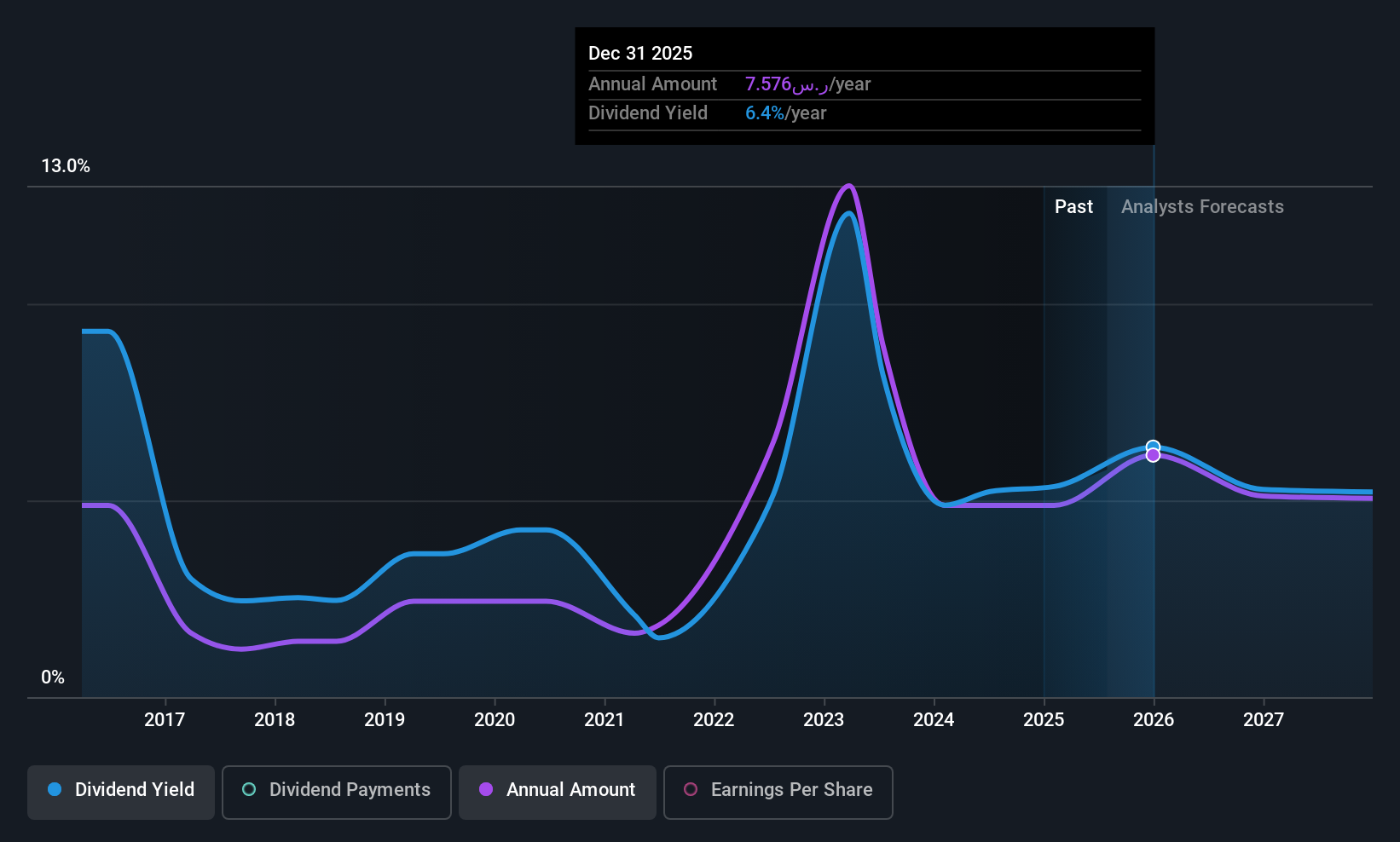

The company's upcoming dividend is ر.س3.50 a share, following on from the last 12 months, when the company distributed a total of ر.س6.00 per share to shareholders. Calculating the last year's worth of payments shows that SABIC Agri-Nutrients has a trailing yield of 5.0% on the current share price of ر.س119.20. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether SABIC Agri-Nutrients can afford its dividend, and if the dividend could grow.

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Its dividend payout ratio is 82% of profit, which means the company is paying out a majority of its earnings. The relatively limited profit reinvestment could slow the rate of future earnings growth. It could become a concern if earnings started to decline. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. The company paid out 98% of its free cash flow over the last year, which we think is outside the ideal range for most businesses. Cash flows are usually much more volatile than earnings, so this could be a temporary effect - but we'd generally want to look more closely here.

SABIC Agri-Nutrients paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Cash is king, as they say, and were SABIC Agri-Nutrients to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

View our latest analysis for SABIC Agri-Nutrients

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings fall far enough, the company could be forced to cut its dividend. Fortunately for readers, SABIC Agri-Nutrients's earnings per share have been growing at 16% a year for the past five years. Earnings have been growing at a decent rate, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. SABIC Agri-Nutrients's dividend payments per share have declined at 0.6% per year on average over the past 10 years, which is uninspiring.

Final Takeaway

Has SABIC Agri-Nutrients got what it takes to maintain its dividend payments? Earnings per share growth is a positive, and the company's payout ratio looks normal. However, we note SABIC Agri-Nutrients paid out a much higher percentage of its free cash flow, which makes us uncomfortable. In summary, it's hard to get excited about SABIC Agri-Nutrients from a dividend perspective.

If you're not too concerned about SABIC Agri-Nutrients's ability to pay dividends, you should still be mindful of some of the other risks that this business faces. For example, we've found 1 warning sign for SABIC Agri-Nutrients that we recommend you consider before investing in the business.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2020

SABIC Agri-Nutrients

Engages in the production, conversion, manufacturing, marketing, and trade of agri-nutrients and chemical products in Singapore, the United States, India, the Kingdom of Saudi Arabia, the United Arab Emirates, Bangladesh, Pakistan, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)