Middle East Undiscovered Gems Highlighted By Odine Solutions Teknoloji Ticaret ve Sanayi

Reviewed by Simply Wall St

As Middle Eastern markets navigate a pivotal week marked by key corporate earnings and the U.S. Federal Reserve's policy meeting, regional equities have shown resilience despite pressures from recent oil price fluctuations. With Gulf stocks firming up and indices like Qatar's reaching new peaks, investors are keenly observing opportunities in this dynamic landscape. In such an environment, identifying promising stocks often involves looking for companies that demonstrate strong fundamentals and potential for growth amidst broader economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Rimoni Industries | NA | 2.82% | 0.61% | ★★★★★★ |

| Amir Marketing and Investments in Agriculture | 17.44% | 5.21% | 5.41% | ★★★★★★ |

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| Vakif Gayrimenkul Yatirim Ortakligi | 0.00% | 50.97% | 56.63% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 1.05% | 36.24% | 62.23% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| C. Mer Industries | 109.27% | 13.77% | 72.47% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Odine Solutions Teknoloji Ticaret ve Sanayi (IBSE:ODINE)

Simply Wall St Value Rating: ★★★★★☆

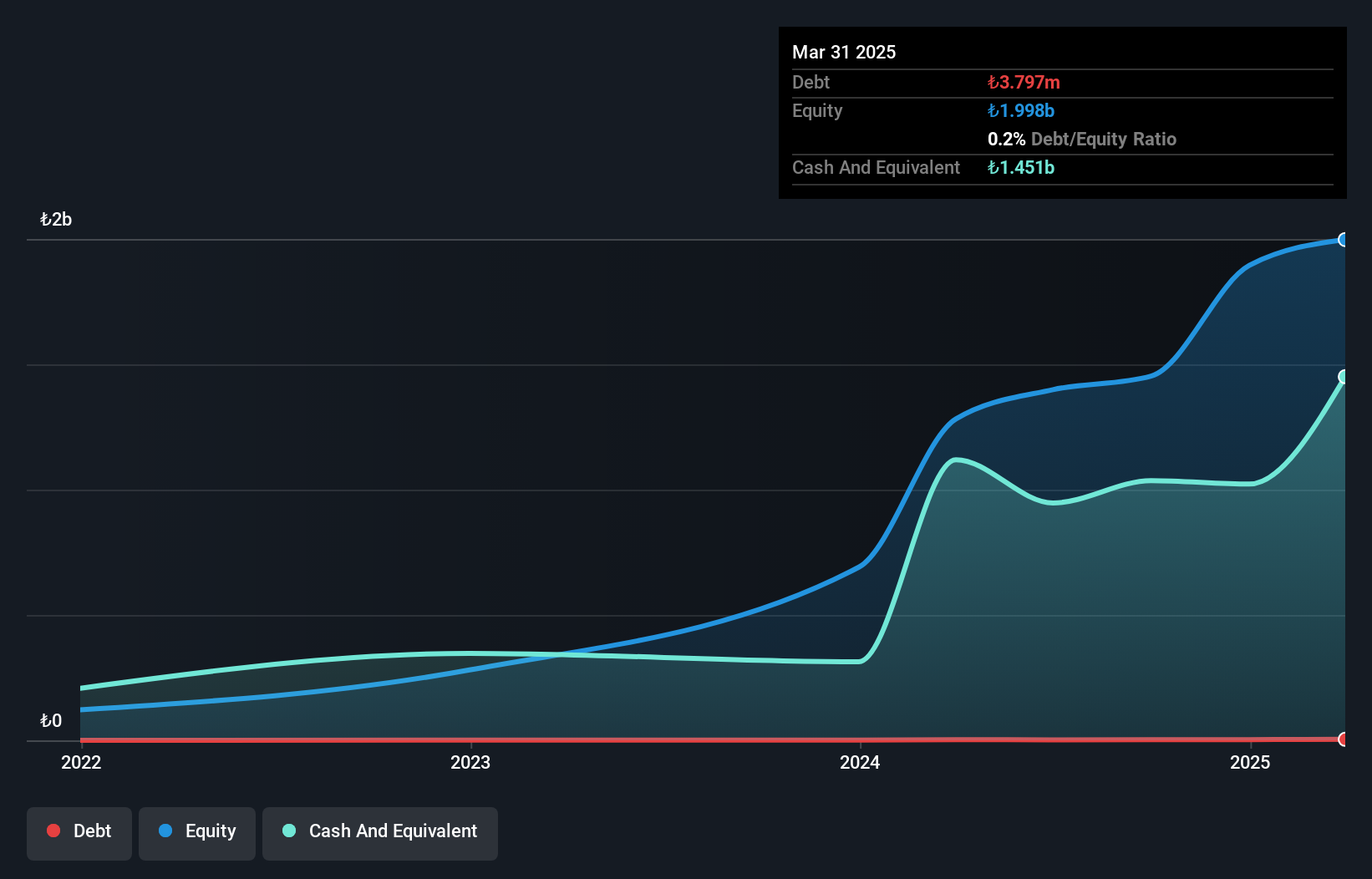

Overview: Odine Solutions Teknoloji Ticaret ve Sanayi A.S. operates in the technology sector, focusing on internet software and services, with a market capitalization of TRY12.72 billion.

Operations: Odine generates revenue of TRY1.31 billion from its internet software and services segment. The company's financial performance is characterized by a focus on this single revenue stream, reflecting its specialization within the technology sector.

Odine Solutions, with its recent earnings growth of 238%, is outpacing the IT industry average of 11%. The company reported TRY 237.88 million in sales for Q1 2025, a significant jump from TRY 123.05 million the previous year. Net income turned positive at TRY 12.5 million compared to a net loss of TRY 101.65 million last year, reflecting improved profitability and basic earnings per share rising to TRY 0.1172 from a loss per share of TRY 1.1266 previously. Despite high volatility in its share price recently, Odine remains free cash flow positive and has more cash than total debt, indicating financial stability amidst rapid growth.

Nayifat Finance (SASE:4081)

Simply Wall St Value Rating: ★★★★★☆

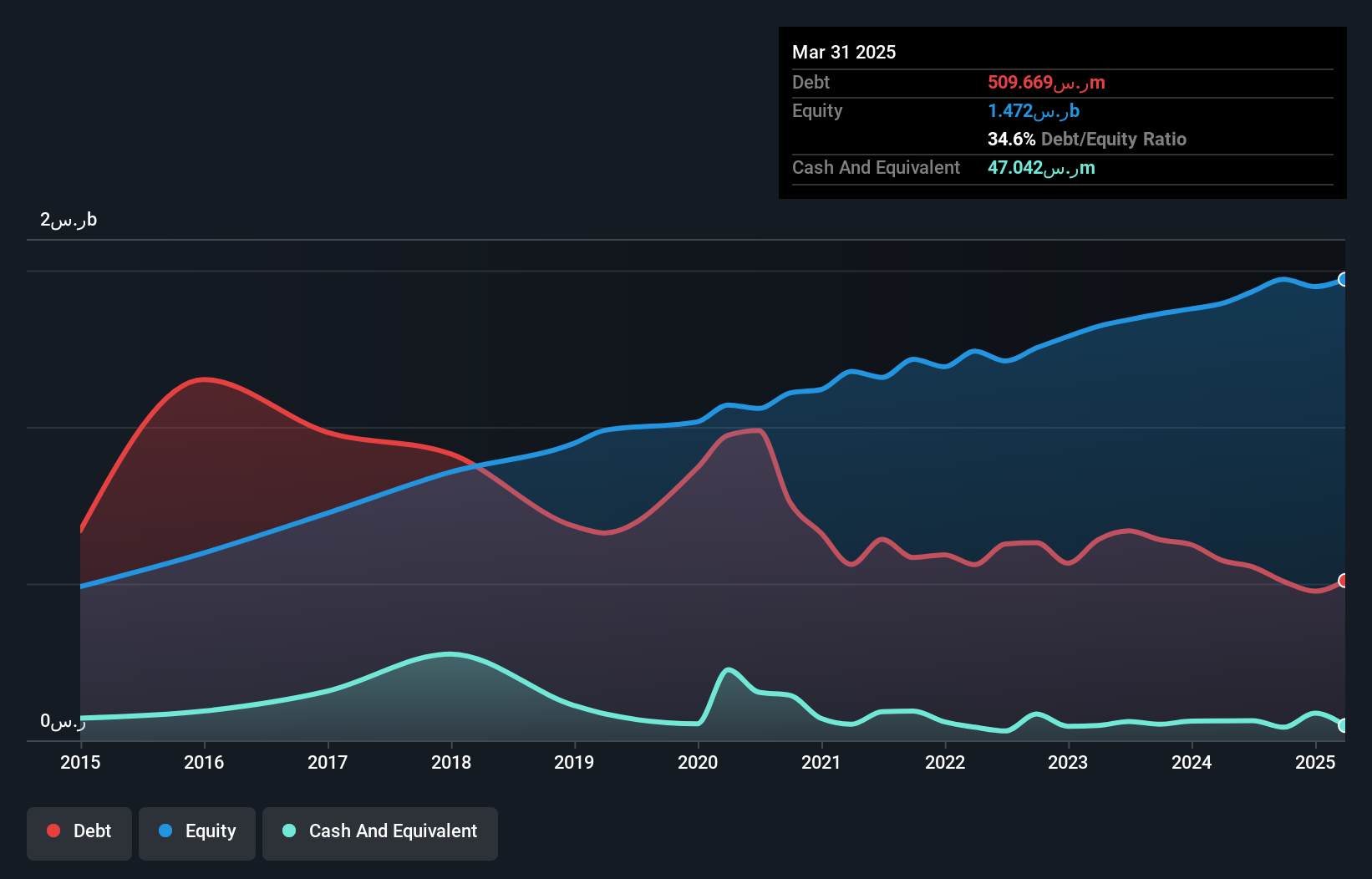

Overview: Nayifat Finance Company offers personal financing solutions in the Kingdom of Saudi Arabia and has a market capitalization of SAR1.55 billion.

Operations: The company's primary revenue stream comes from personal financing, generating SAR258.30 million, while SME financing contributes SAR43.05 million and Islamic credit cards add SAR1.73 million.

Nayifat Finance offers a compelling mix of financial stability and growth potential. With a net debt to equity ratio at 31.4%, it demonstrates prudent financial management, especially considering the reduction from 91% over five years. The company's earnings soared by 87% last year, outpacing the Consumer Finance industry significantly, despite a historical decline of 17% annually over five years. Priced attractively with a P/E ratio of 11.3x against the Saudi market's 20.6x, Nayifat also boasts high-quality earnings and positive free cash flow, suggesting robust operational efficiency amidst recent leadership changes and dividend affirmations totaling SAR 39 million for eligible shareholders.

- Dive into the specifics of Nayifat Finance here with our thorough health report.

Examine Nayifat Finance's past performance report to understand how it has performed in the past.

Rasan Information Technology (SASE:8313)

Simply Wall St Value Rating: ★★★★★★

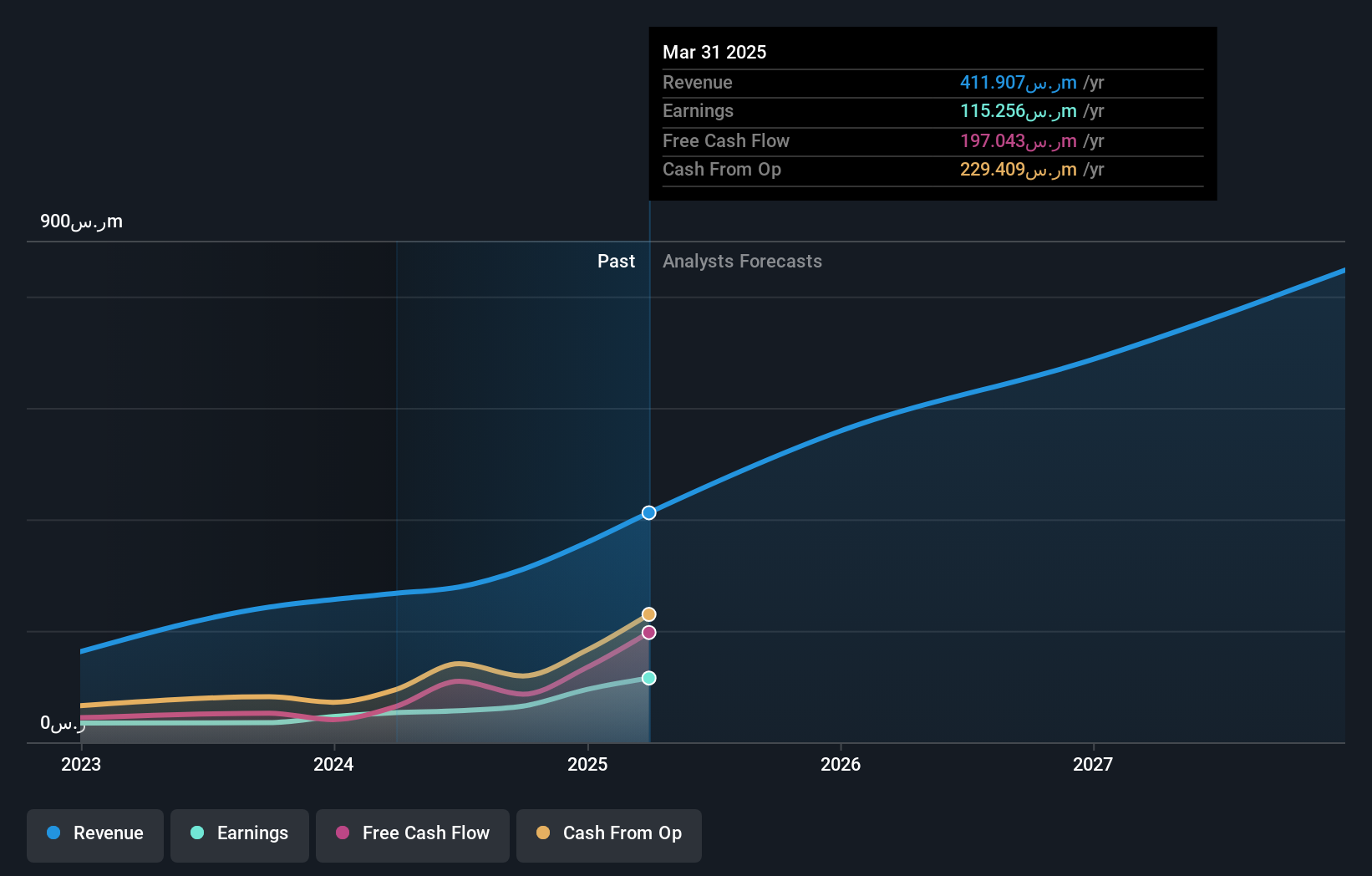

Overview: Rasan Information Technology Company is a financial technology firm offering insurance and financial services in Saudi Arabia, with a market capitalization of SAR6.61 billion.

Operations: Rasan generates revenue primarily through its Tameeni - Motors segment, contributing SAR217.33 million, followed by Leasing at SAR133.96 million and Tameeni - Health at SAR54.74 million.

Rasan Information Technology, a nimble player in the Middle East's tech scene, has shown impressive financial health with no debt over the past five years and high-quality earnings. Its earnings growth of 116% last year outpaced the insurance industry's -18%, highlighting its robust performance. The company is also free cash flow positive, with levered free cash flow reaching US$197 million as of July 2025. Recent board changes include appointing Mr. Turki Salman Al-Sudairy as an independent member and Mr. Abdullah bin Abdulaziz Al-Oudah to the Nomination Committee, reflecting strategic leadership adjustments amid its ongoing growth trajectory.

- Take a closer look at Rasan Information Technology's potential here in our health report.

Learn about Rasan Information Technology's historical performance.

Key Takeaways

- Unlock more gems! Our Middle Eastern Undiscovered Gems With Strong Fundamentals screener has unearthed 221 more companies for you to explore.Click here to unveil our expertly curated list of 224 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ODINE

Odine Solutions Teknoloji Ticaret ve Sanayi

Odine Solutions Teknoloji Ticaret ve Sanayi A.S.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives