- Russia

- /

- Electric Utilities

- /

- MISX:MRKS

Shareholders of Interregional Distribution Grid Company of Siberia (MCX:MRKS) Must Be Delighted With Their 640% Total Return

We think all investors should try to buy and hold high quality multi-year winners. And we've seen some truly amazing gains over the years. For example, the Public Joint Stock Company Interregional Distribution Grid Company of Siberia (MCX:MRKS) share price is up a whopping 605% in the last half decade, a handsome return for long term holders. And this is just one example of the epic gains achieved by some long term investors. Also pleasing for shareholders was the 49% gain in the last three months. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for Interregional Distribution Grid Company of Siberia

Interregional Distribution Grid Company of Siberia isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

For the last half decade, Interregional Distribution Grid Company of Siberia can boast revenue growth at a rate of 5.9% per year. Put simply, that growth rate fails to impress. Therefore, we're a little surprised to see the share price gain has been so strong, at 48% per year, compound, over the period. We'll tip our hats to that, any day, but the top-line growth isn't particularly impressive when you compare it to other pre-profit companies. Having said that, a closer look at the numbers might surface good reasons to believe that profits will gush in the future.

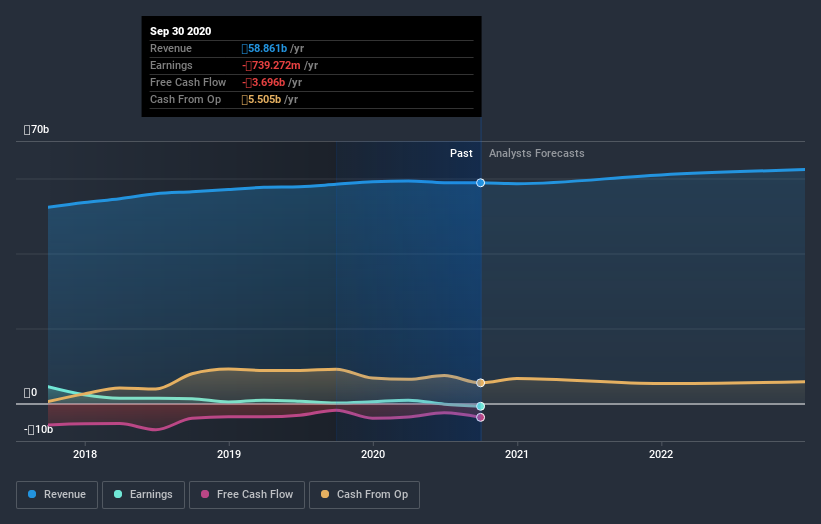

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Interregional Distribution Grid Company of Siberia's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Interregional Distribution Grid Company of Siberia's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Interregional Distribution Grid Company of Siberia's TSR of 640% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

We're pleased to report that Interregional Distribution Grid Company of Siberia shareholders have received a total shareholder return of 28% over one year. However, the TSR over five years, coming in at 49% per year, is even more impressive. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for Interregional Distribution Grid Company of Siberia that you should be aware of before investing here.

Of course Interregional Distribution Grid Company of Siberia may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on RU exchanges.

If you’re looking to trade Interregional Distribution Grid Company of Siberia, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About MISX:MRKS

Interregional Distribution Grid Company of Siberia

Public Joint-Stock Company Interregional Distribution Grid Company of Siberia, together with its subsidiaries, transmits and distributes electricity for power grids in Russia.

Weak fundamentals or lack of information.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026