- Netherlands

- /

- Food

- /

- ENXTAM:FFARM

European Market Insights: TTS (Transport Trade Services) And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

Amid escalating trade tensions and fluctuating consumer sentiment, the European markets have experienced a turbulent period, with major indices like the STOXX Europe 600 Index posting losses. Despite these challenges, opportunities can still be found in lesser-known areas of the market, such as penny stocks. While often associated with smaller or newer companies, these stocks can offer significant value and growth potential when backed by strong financials. In this article, we explore three promising penny stocks that stand out for their financial resilience and potential upside in today's complex market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK1.998 | SEK1.91B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.47 | SEK230.27M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.58 | SEK268.45M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.92 | SEK238.49M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.38 | PLN114.56M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.51 | €52.94M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.96 | €32.15M | ✅ 3 ⚠️ 3 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €4.10 | €23.74M | ✅ 3 ⚠️ 3 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.83 | €18.05M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.095 | €289.24M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 427 stocks from our European Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

TTS (Transport Trade Services) (BVB:TTS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TTS (Transport Trade Services) S.A. is a Romanian company specializing in freight forwarding services, with a market capitalization of RON718.67 million.

Operations: TTS (Transport Trade Services) S.A. does not report specific revenue segments.

Market Cap: RON718.67M

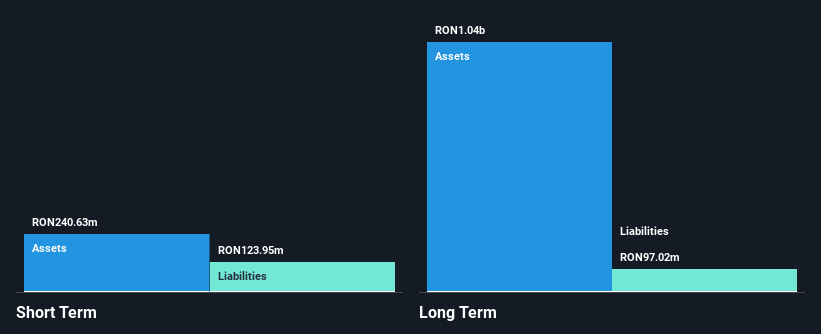

TTS (Transport Trade Services) S.A., with a market cap of RON718.67 million, exhibits both strengths and challenges typical of penny stocks. While its short-term assets exceed liabilities, providing some financial stability, the company's recent performance has been mixed. Earnings have declined significantly over the past year despite strong growth over the previous five years. The dividend yield is high at 9.5% but not well covered by free cash flows, reflecting potential sustainability concerns. Recent earnings reports show a notable drop in net income and sales compared to last year, highlighting volatility in financial performance that investors should consider carefully.

- Take a closer look at TTS (Transport Trade Services)'s potential here in our financial health report.

- Assess TTS (Transport Trade Services)'s future earnings estimates with our detailed growth reports.

ForFarmers (ENXTAM:FFARM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ForFarmers N.V. operates as a provider of feed solutions for both conventional and organic livestock farming across several European countries, including the Netherlands, the United Kingdom, Germany, Poland, and Belgium, with a market cap of €358.69 million.

Operations: The company generates €2.75 billion in revenue through its Food Processing segment.

Market Cap: €358.69M

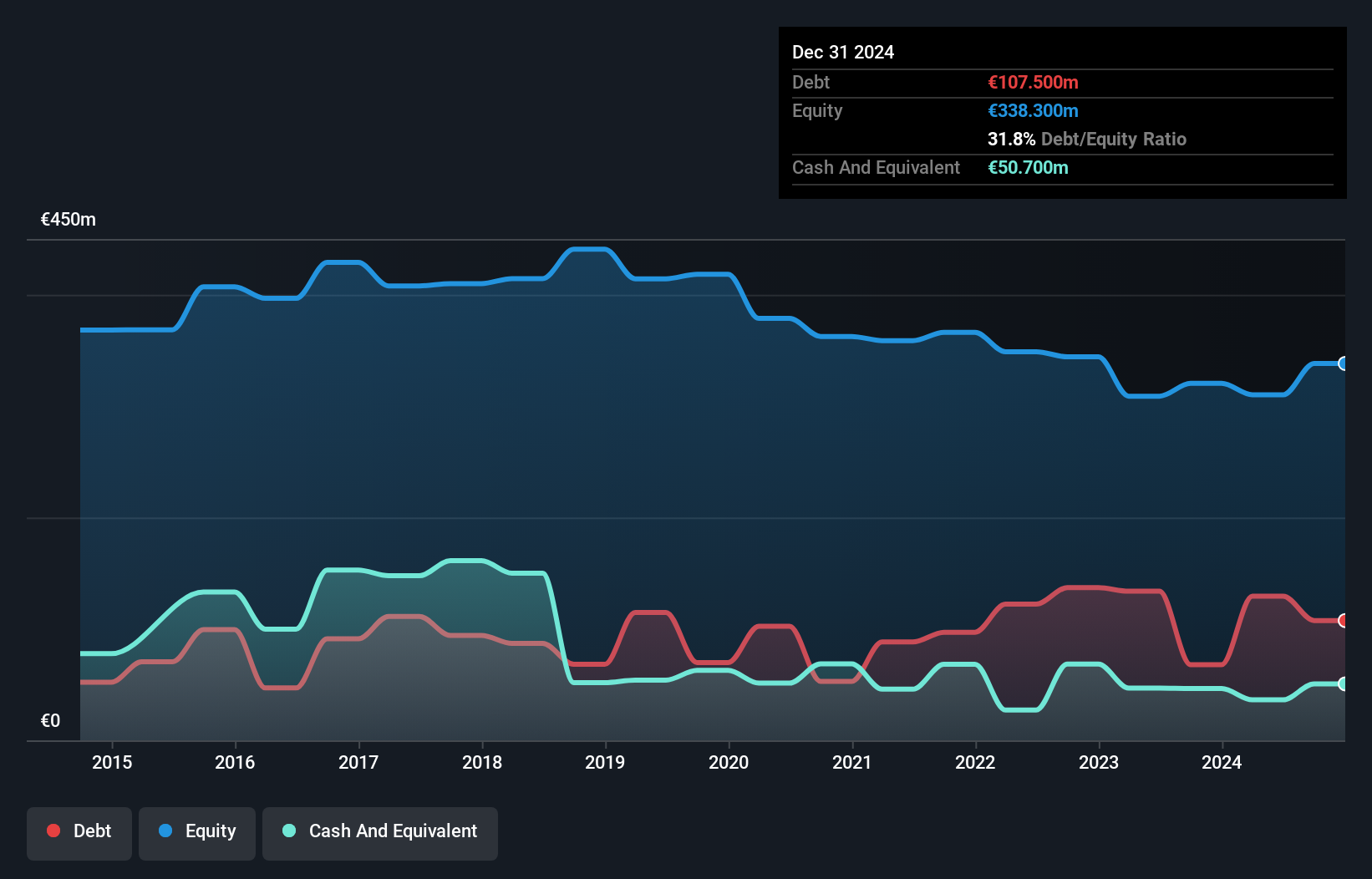

ForFarmers N.V., with a market cap of €358.69 million, offers a mixed financial outlook typical of penny stocks. The company recently returned to profitability, reporting net income of €31.4 million for 2024 compared to a loss the previous year, and announced an annual dividend of €0.20 per share. Despite this positive shift, earnings have been impacted by one-off items and declined over the past five years at an average rate of 8.5% annually. While short-term assets cover both short- and long-term liabilities, its management team is relatively inexperienced with an average tenure of 1.5 years.

- Unlock comprehensive insights into our analysis of ForFarmers stock in this financial health report.

- Examine ForFarmers' earnings growth report to understand how analysts expect it to perform.

Deceuninck (ENXTBR:DECB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Deceuninck NV is involved in the design, manufacture, recycling, and distribution of multi-material window, door, and building solutions across Europe, North America, Turkey, and other international markets with a market capitalization of €289.24 million.

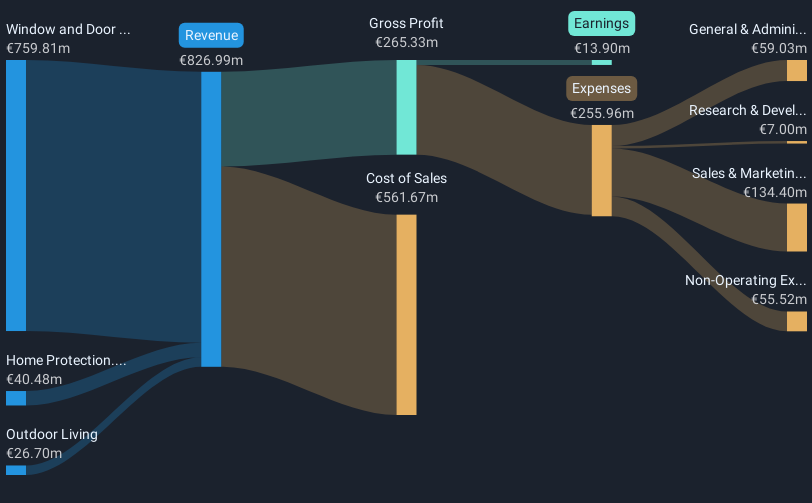

Operations: The company's revenue is primarily generated from Window and Door Systems (€759.81 million), followed by Home Protection (€40.48 million) and Outdoor Living (€26.70 million).

Market Cap: €289.24M

Deceuninck NV, with a market cap of €289.24 million, presents a mixed picture typical of penny stocks. The company reported 2024 sales of €827 million and net income of €15.9 million, reflecting growth from the previous year. Earnings per share increased to €0.1 from €0.07, indicating improved profitability despite revenue decline. The debt-to-equity ratio has significantly decreased over five years to 26.3%, and short-term assets comfortably cover liabilities, suggesting financial stability. However, challenges include low return on equity at 4.5% and an inexperienced management team with an average tenure of 1.3 years.

- Click to explore a detailed breakdown of our findings in Deceuninck's financial health report.

- Understand Deceuninck's earnings outlook by examining our growth report.

Taking Advantage

- Reveal the 427 hidden gems among our European Penny Stocks screener with a single click here.

- Curious About Other Options? AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:FFARM

ForFarmers

Provides feed solutions for conventional and organic livestock farming under the ForFarmers brand in the Netherlands, the United Kingdom, Germany, Poland, Belgium, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives