XBS PRO-LOG S.A. (WSE:XBS) Soars 35% But It's A Story Of Risk Vs Reward

Despite an already strong run, XBS PRO-LOG S.A. (WSE:XBS) shares have been powering on, with a gain of 35% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 83% in the last year.

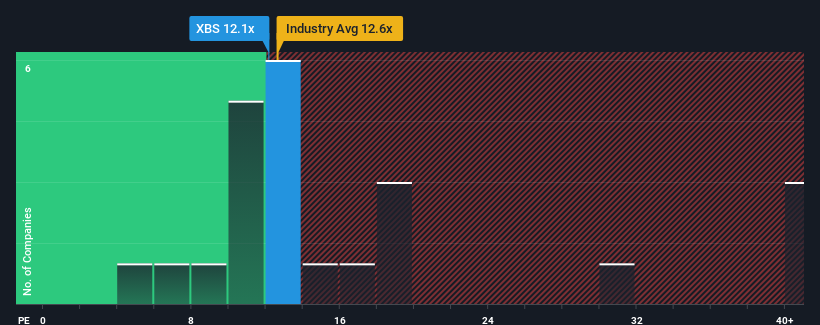

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about XBS PRO-LOG's P/E ratio of 12.1x, since the median price-to-earnings (or "P/E") ratio in Poland is also close to 12x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

XBS PRO-LOG has been doing a good job lately as it's been growing earnings at a solid pace. It might be that many expect the respectable earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Check out our latest analysis for XBS PRO-LOG

How Is XBS PRO-LOG's Growth Trending?

The only time you'd be comfortable seeing a P/E like XBS PRO-LOG's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 24%. The latest three year period has also seen an excellent 188% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is only predicted to deliver 10% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it interesting that XBS PRO-LOG is trading at a fairly similar P/E to the market. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From XBS PRO-LOG's P/E?

Its shares have lifted substantially and now XBS PRO-LOG's P/E is also back up to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of XBS PRO-LOG revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

There are also other vital risk factors to consider and we've discovered 2 warning signs for XBS PRO-LOG (1 is a bit unpleasant!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:XBS

Flawless balance sheet and good value.

Market Insights

Community Narratives