- Switzerland

- /

- Consumer Finance

- /

- SWX:CMBN

European Dividend Stocks To Watch Now

Reviewed by Simply Wall St

As European markets experience a positive upswing, with the STOXX Europe 600 Index rising by 2.35%, investors are keenly observing the region's economic landscape, particularly as inflation appears to align closely with the European Central Bank’s target. In this context, dividend stocks can offer attractive opportunities for income-focused investors seeking stability and potential growth in a market characterized by subdued inflation and strategic fiscal adjustments.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.32% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.54% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 4.18% | ★★★★★☆ |

| Sulzer (SWX:SUN) | 3.01% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.13% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.84% | ★★★★★★ |

| Evolution (OM:EVO) | 4.70% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.16% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.45% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.56% | ★★★★★★ |

Click here to see the full list of 217 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

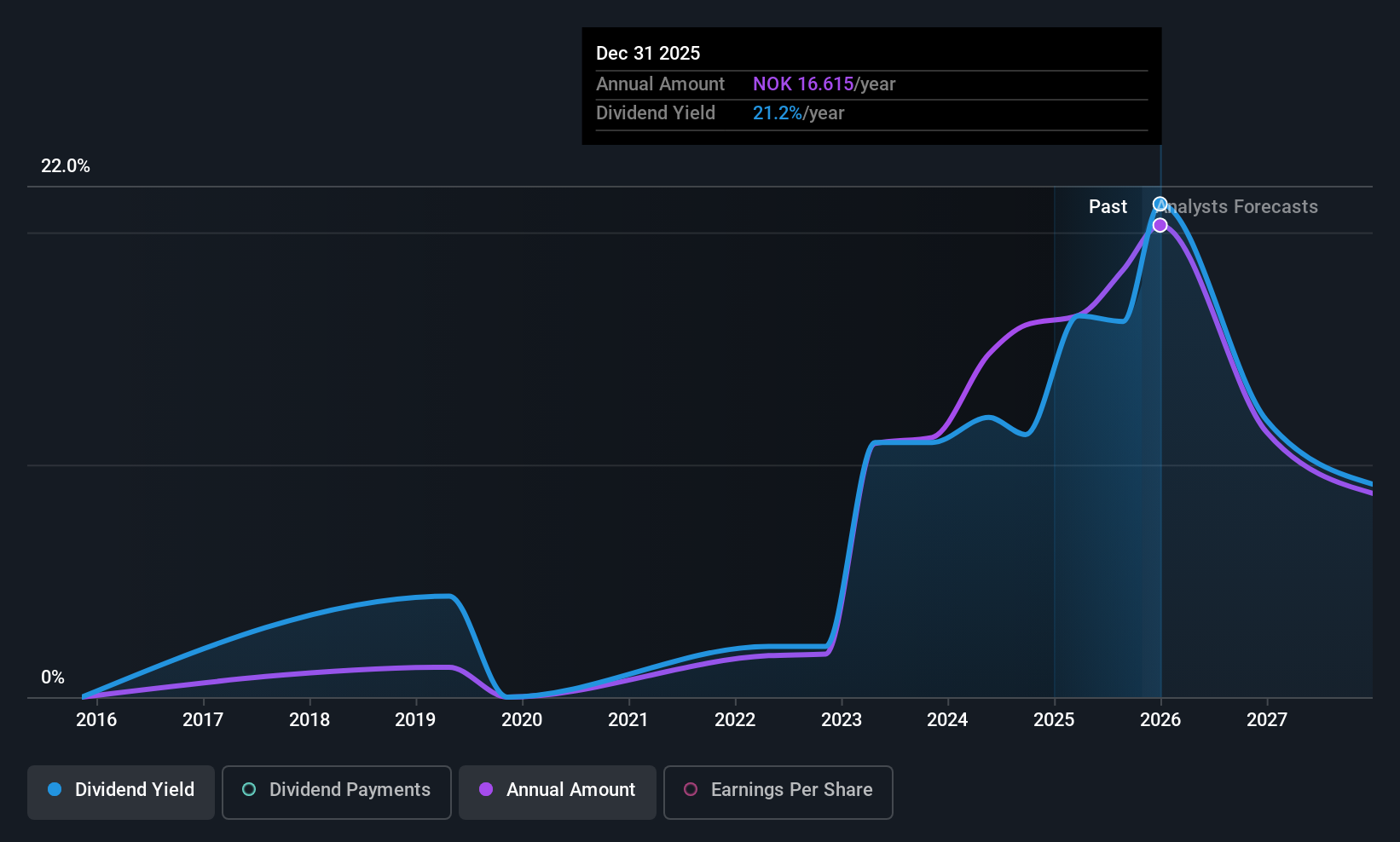

Wallenius Wilhelmsen (OB:WAWI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Wallenius Wilhelmsen ASA, with a market cap of NOK39.19 billion, operates globally in the logistics and transportation sector through its subsidiaries.

Operations: Wallenius Wilhelmsen ASA generates its revenue from three main segments: Shipping Services at $4.01 billion, Logistics Services at $1.12 billion, and Government Services at $437 million.

Dividend Yield: 16.8%

Wallenius Wilhelmsen's dividend payments, though volatile over the past decade, are currently well-covered by earnings and cash flows with payout ratios of 53.6% and 41.2%, respectively. Despite a forecasted decline in earnings by an average of 27.2% annually over the next three years, recent financials show improved net income for Q3 at US$255 million from US$234 million last year, suggesting resilience amidst volatility. The stock trades significantly below its estimated fair value while offering a top-tier dividend yield in Norway's market.

- Delve into the full analysis dividend report here for a deeper understanding of Wallenius Wilhelmsen.

- In light of our recent valuation report, it seems possible that Wallenius Wilhelmsen is trading behind its estimated value.

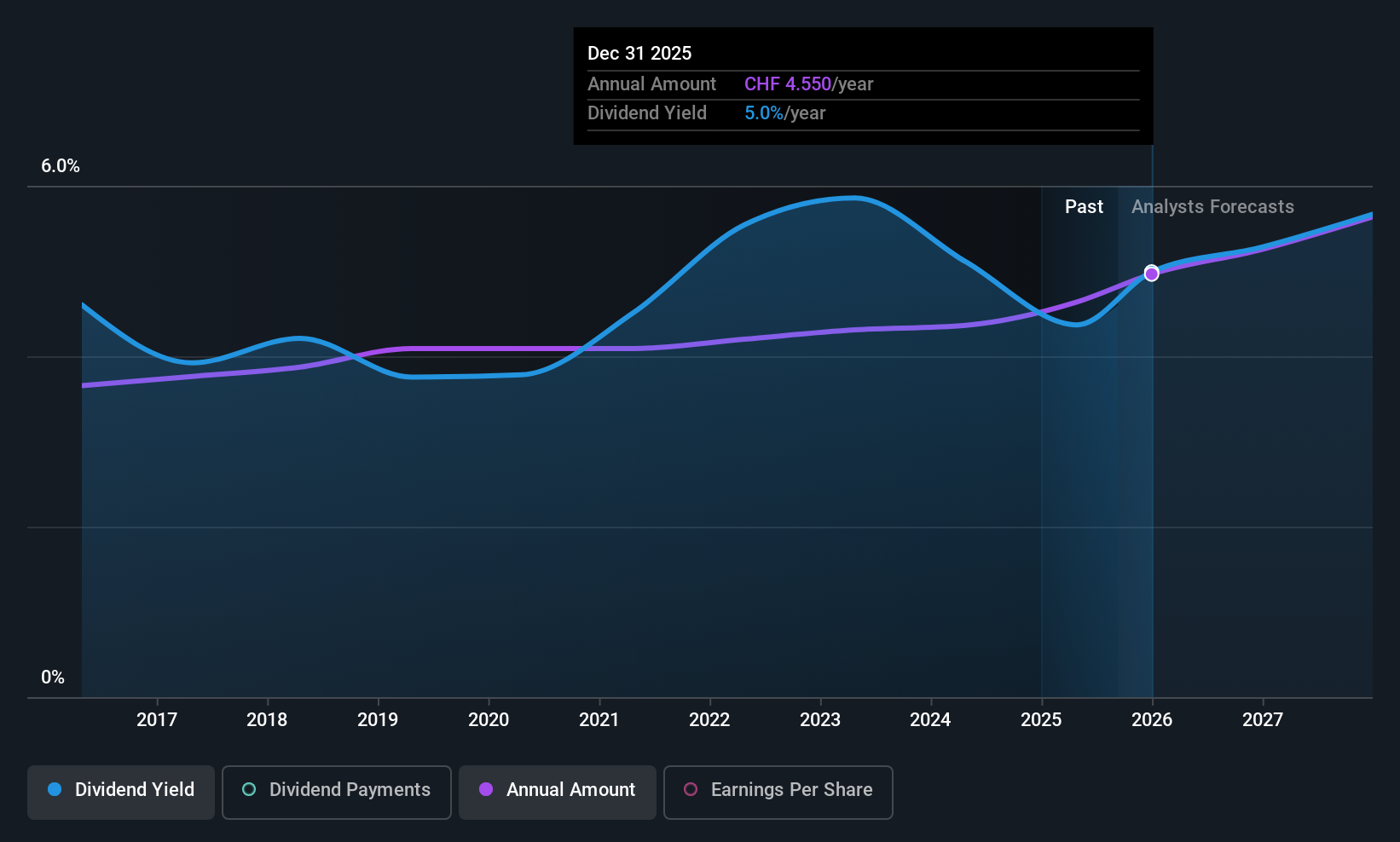

Cembra Money Bank (SWX:CMBN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Cembra Money Bank AG offers consumer finance products and services in Switzerland with a market cap of CHF2.80 billion.

Operations: Cembra Money Bank AG generates revenue from its Lending segment, which contributes CHF279.26 million, and its Payments segment, which accounts for CHF200.17 million.

Dividend Yield: 4.4%

Cembra Money Bank's stable dividend payments over the past decade, coupled with a 4.45% yield, place it among the top 25% of Swiss dividend payers. The dividends are currently sustainable with a payout ratio of 69.5%, forecasted to remain covered at 71.7% in three years. Recent management changes aim to enhance growth and innovation, potentially impacting future earnings positively without immediate effects on its reliable dividend policy.

- Take a closer look at Cembra Money Bank's potential here in our dividend report.

- According our valuation report, there's an indication that Cembra Money Bank's share price might be on the expensive side.

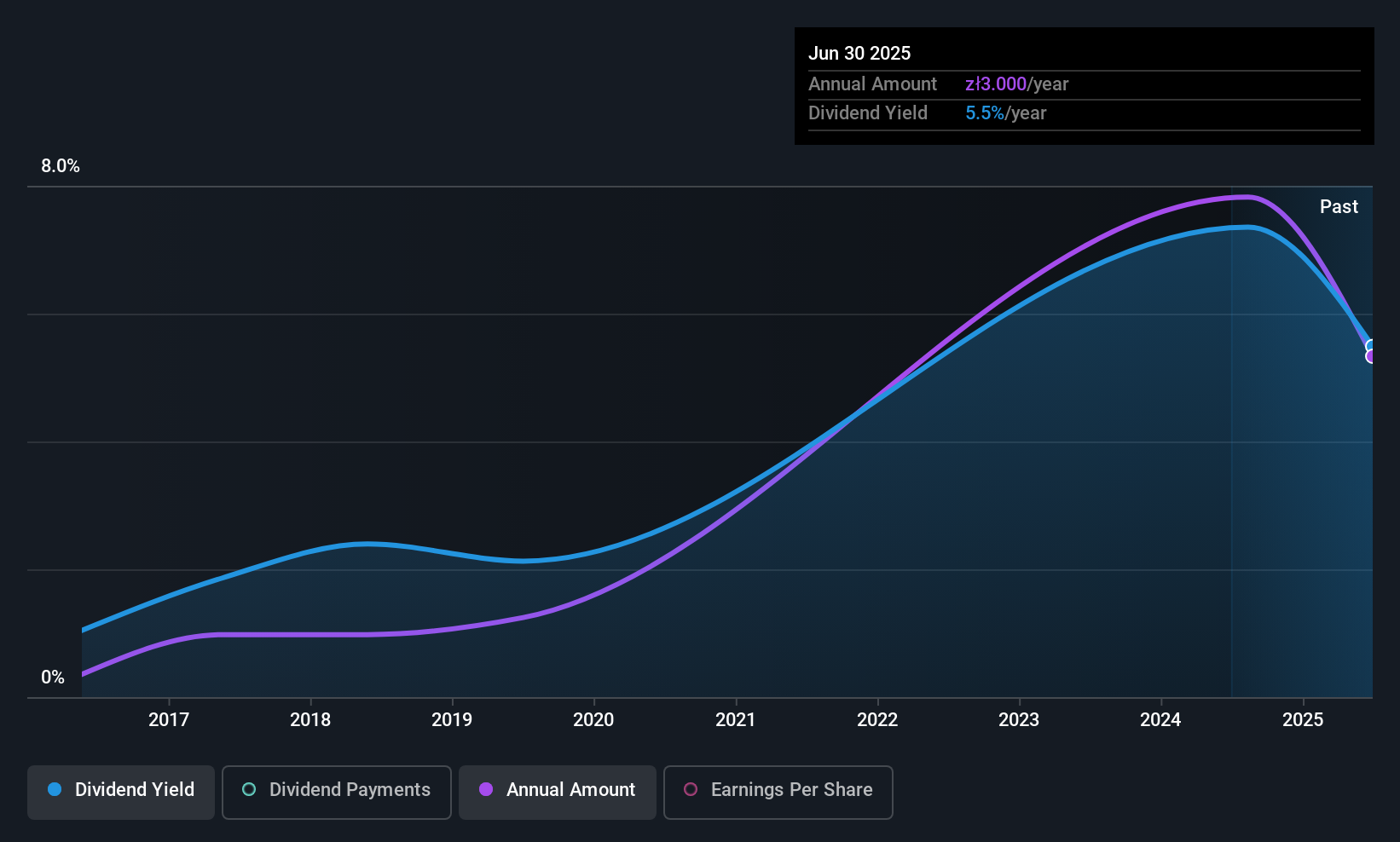

Enter Air (WSE:ENT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Enter Air S.A. is a European charter airline company with a market capitalization of PLN961.40 million.

Operations: Enter Air S.A. operates as a charter airline company in Europe.

Dividend Yield: 5.5%

Enter Air's dividend yield of 5.47% falls short of the top tier in Poland, and its dividends have been volatile over the past decade. Despite this, dividends are well-covered by earnings and cash flows with payout ratios at 26.2% and 10.8%, respectively. Recent earnings showed mixed results; Q3 net income declined to PLN 108.86 million from PLN 185.62 million year-on-year, although nine-month figures improved significantly compared to last year’s performance.

- Get an in-depth perspective on Enter Air's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Enter Air's current price could be quite moderate.

Taking Advantage

- Gain an insight into the universe of 217 Top European Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CMBN

Cembra Money Bank

Provides consumer finance products and services in Switzerland.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026