- Poland

- /

- Telecom Services and Carriers

- /

- WSE:OPL

Top European Dividend Stocks To Consider In July 2025

Reviewed by Simply Wall St

As European markets remain relatively stable with the pan-European STOXX Europe 600 Index ending flat amidst ongoing U.S. and European trade talks, investors are keenly observing economic indicators such as industrial production growth and widening trade surpluses in the Eurozone. In this environment, dividend stocks can offer a compelling option for those seeking steady income streams, especially when market conditions present mixed signals.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.45% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 3.83% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.19% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.76% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.67% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.85% | ★★★★★★ |

| ERG (BIT:ERG) | 5.34% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.01% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.58% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.46% | ★★★★★★ |

Click here to see the full list of 229 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

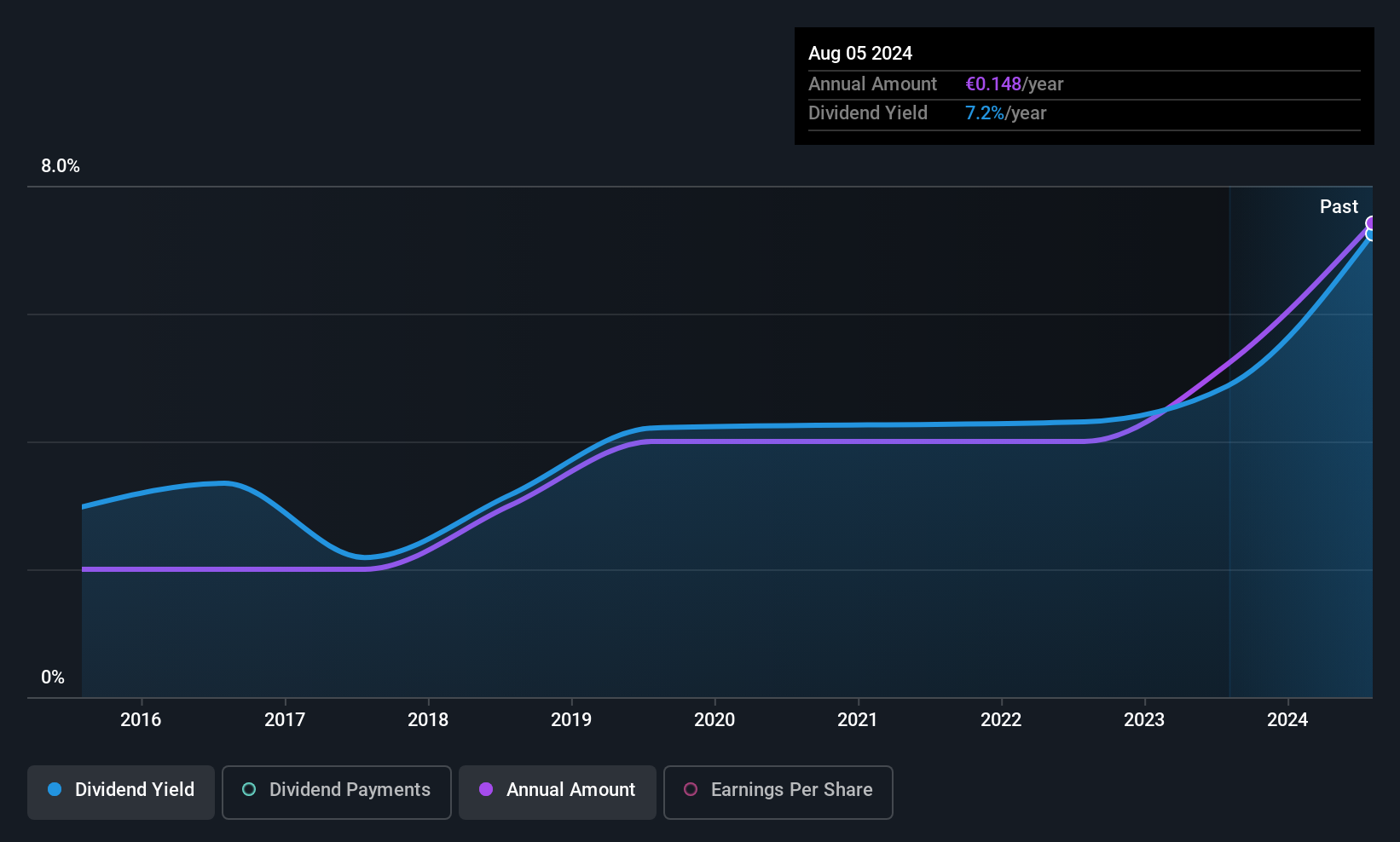

Piquadro (BIT:PQ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Piquadro S.p.A. designs, produces, and markets leather goods and accessories in Italy, the rest of Europe, and internationally with a market cap of €119.02 million.

Operations: Piquadro's revenue is derived from its segments Lancel (€69.18 million), Piquadro (€82.34 million), and The Bridge (€35.84 million).

Dividend Yield: 5.9%

Piquadro offers a competitive dividend yield of 5.89%, placing it in the top quartile among Italian dividend payers. Although its payout ratio of 61.8% suggests dividends are covered by earnings, the lack of recent financial data limits clarity on cash flow coverage. Despite a history of volatility and unreliability in payouts, dividends have grown over the past decade. Its P/E ratio of 10.5x indicates good value compared to the broader Italian market at 17.2x.

- Delve into the full analysis dividend report here for a deeper understanding of Piquadro.

- The valuation report we've compiled suggests that Piquadro's current price could be inflated.

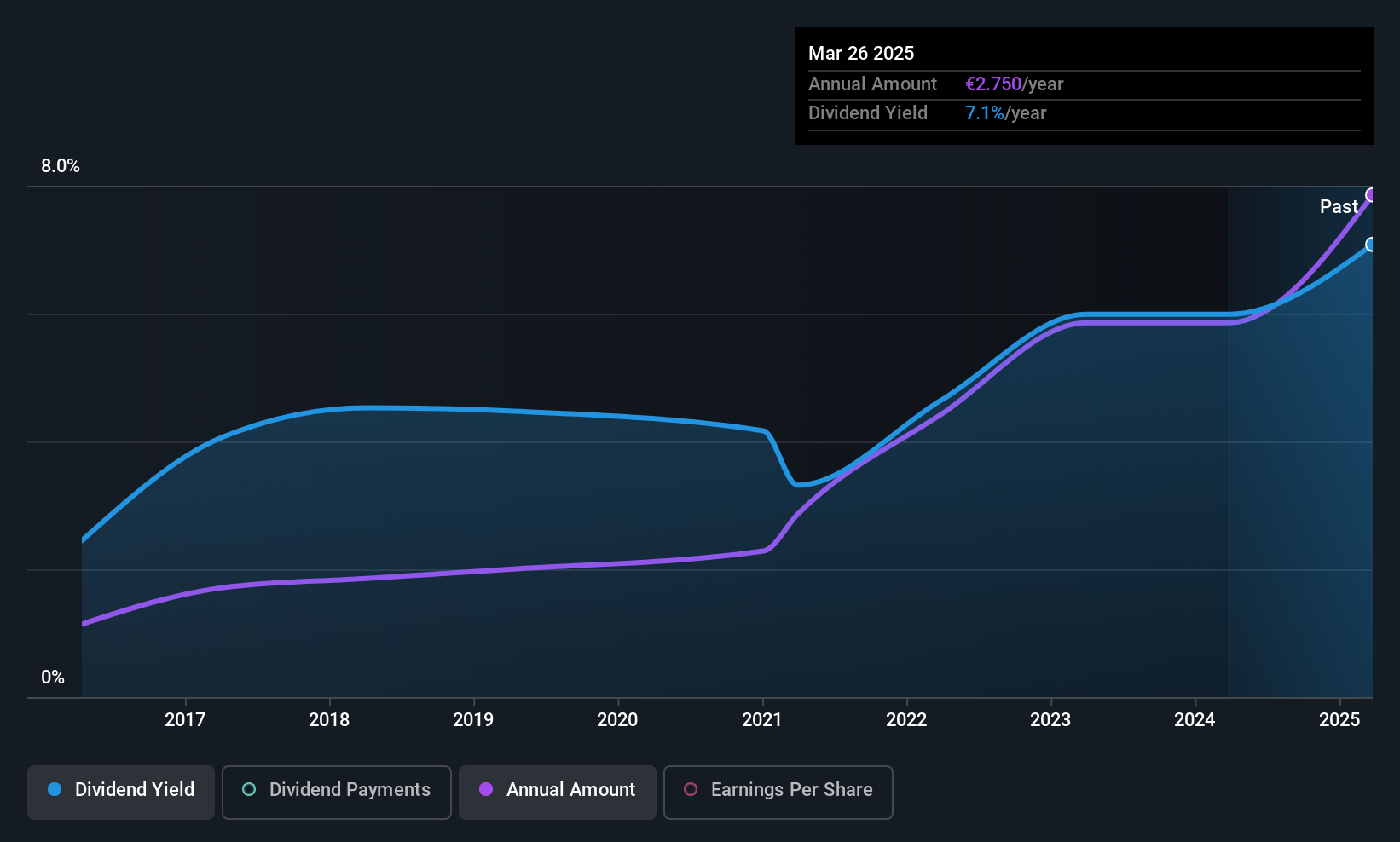

Ålandsbanken Abp (HLSE:ALBAV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ålandsbanken Abp operates as a commercial bank serving private individuals and companies in Finland and Sweden, with a market capitalization of €612.51 million.

Operations: Ålandsbanken Abp generates revenue through its commercial banking services for private individuals and companies across Finland and Sweden.

Dividend Yield: 6.6%

Ålandsbanken Abp offers a high dividend yield of 6.58%, ranking in the top 25% of Finnish dividend payers, with stable and growing dividends over the past decade. The payout ratio of 67.5% suggests dividends are covered by earnings, though data on future coverage is lacking. Trading at a discount to estimated fair value enhances its investment appeal. Recent earnings growth, with net income up to €13.9 million for Q2 2025, supports ongoing dividend reliability.

- Navigate through the intricacies of Ålandsbanken Abp with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Ålandsbanken Abp shares in the market.

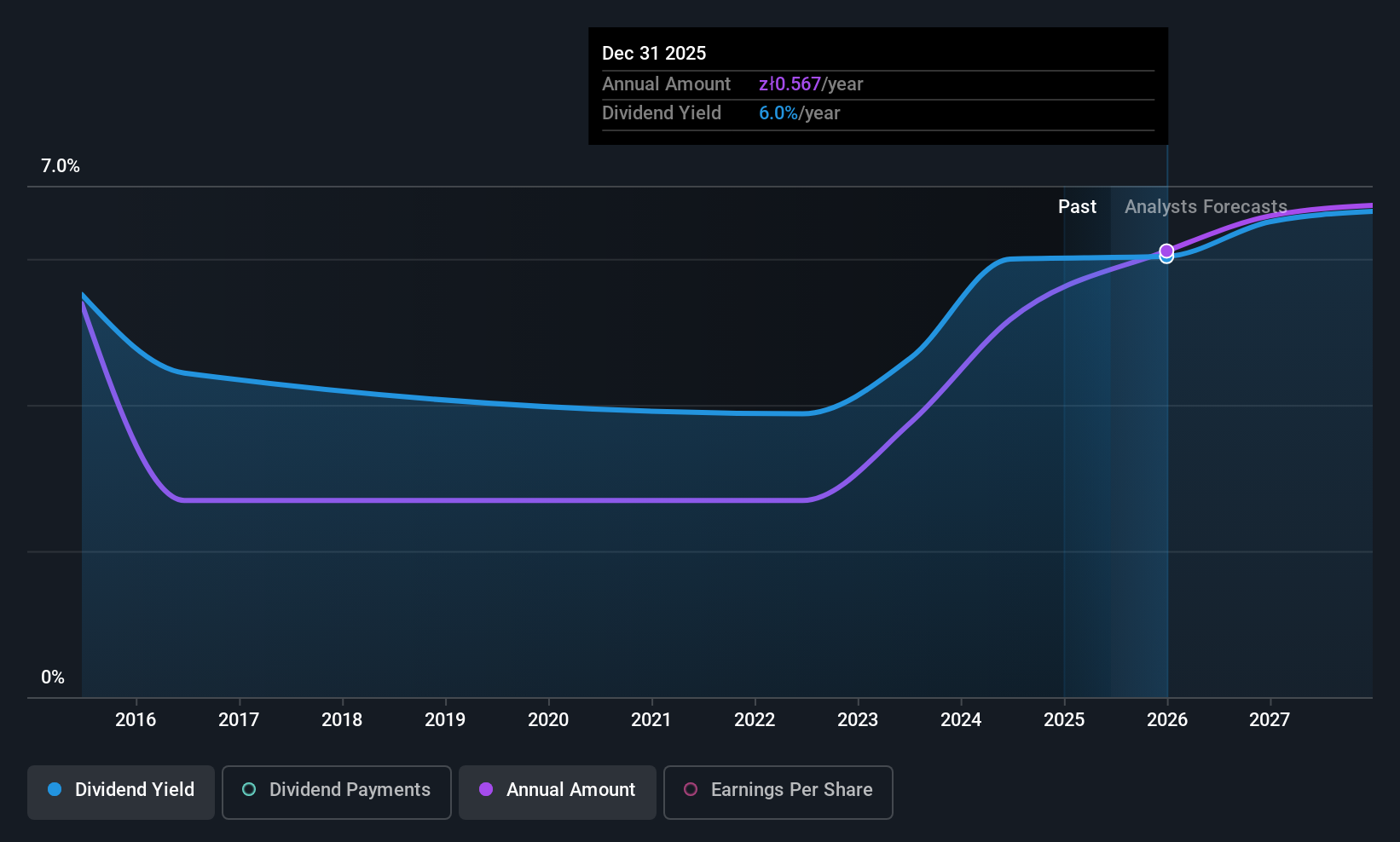

Orange Polska (WSE:OPL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orange Polska S.A., with a market cap of PLN12.09 billion, offers telecommunications services to individual, business, and wholesale customers in Poland through its subsidiaries.

Operations: Orange Polska's revenue primarily comes from its Telecommunications Services segment, amounting to PLN12.80 billion.

Dividend Yield: 5.8%

Orange Polska's dividend payments are covered by earnings and cash flows, with a payout ratio of 79.3% and a cash payout ratio of 53%. Despite this coverage, the dividends have been volatile over the past decade. Currently trading at a significant discount to its estimated fair value, Orange Polska's dividend yield is lower than top Polish payers. Recent earnings showed sales growth but a decline in net income compared to last year, which may impact future payouts.

- Dive into the specifics of Orange Polska here with our thorough dividend report.

- The analysis detailed in our Orange Polska valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Explore the 229 names from our Top European Dividend Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:OPL

Orange Polska

Provides telecommunications services for individuals, businesses, and wholesale customers in Poland.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives