- Poland

- /

- Telecom Services and Carriers

- /

- WSE:OPL

Orange Polska (WSE:OPL) Shareholders Have Enjoyed A 14% Share Price Gain

By buying an index fund, you can roughly match the market return with ease. But if you choose individual stocks with prowess, you can make superior returns. For example, Orange Polska S.A. (WSE:OPL) shareholders have seen the share price rise 14% over three years, well in excess of the market decline (14%, not including dividends).

View our latest analysis for Orange Polska

Orange Polska wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Orange Polska's revenue trended up 0.5% each year over three years. That's not a very high growth rate considering it doesn't make profits. In that time the share price is up 4% per year, which is not unreasonable given the revenue gorwth. Ultimately, the important thing is whether the company is trending to profitability. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

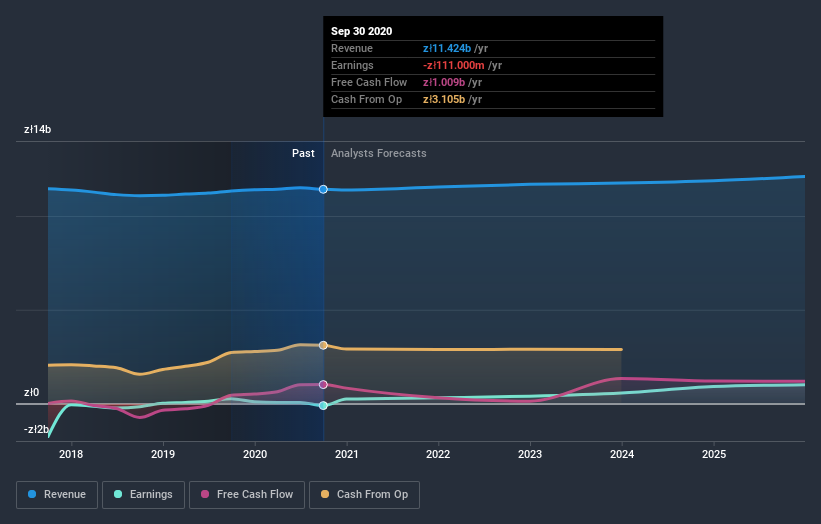

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Orange Polska's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Orange Polska had a tough year, with a total loss of 7.3%, against a market gain of about 2.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 3%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. You could get a better understanding of Orange Polska's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

If you decide to trade Orange Polska, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:OPL

Orange Polska

Provides telecommunications services for individuals, businesses, and wholesale customers in Poland.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives