- Poland

- /

- Telecom Services and Carriers

- /

- WSE:OPL

Orange Polska S.A.'s (WSE:OPL) P/E Still Appears To Be Reasonable

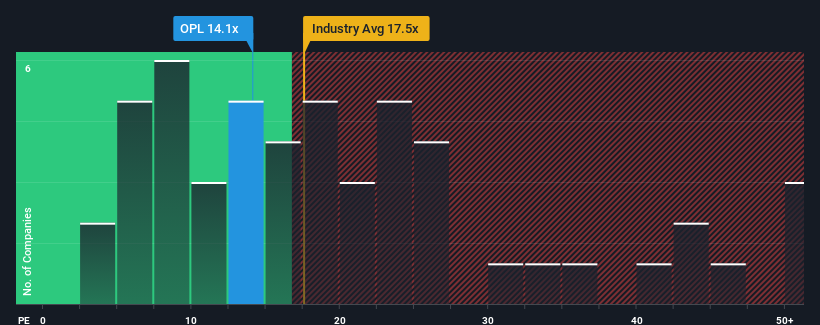

It's not a stretch to say that Orange Polska S.A.'s (WSE:OPL) price-to-earnings (or "P/E") ratio of 14.1x right now seems quite "middle-of-the-road" compared to the market in Poland, where the median P/E ratio is around 12x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Orange Polska hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Check out our latest analysis for Orange Polska

What Are Growth Metrics Telling Us About The P/E?

Orange Polska's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 530% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 12% per annum over the next three years. With the market predicted to deliver 10% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's understandable that Orange Polska's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Orange Polska's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Orange Polska maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Having said that, be aware Orange Polska is showing 1 warning sign in our investment analysis, you should know about.

If you're unsure about the strength of Orange Polska's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:OPL

Orange Polska

Provides telecommunications services for individuals, businesses, and wholesale customers in Poland.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives