Investors Aren't Entirely Convinced By Talex S.A.'s (WSE:TLX) Revenues

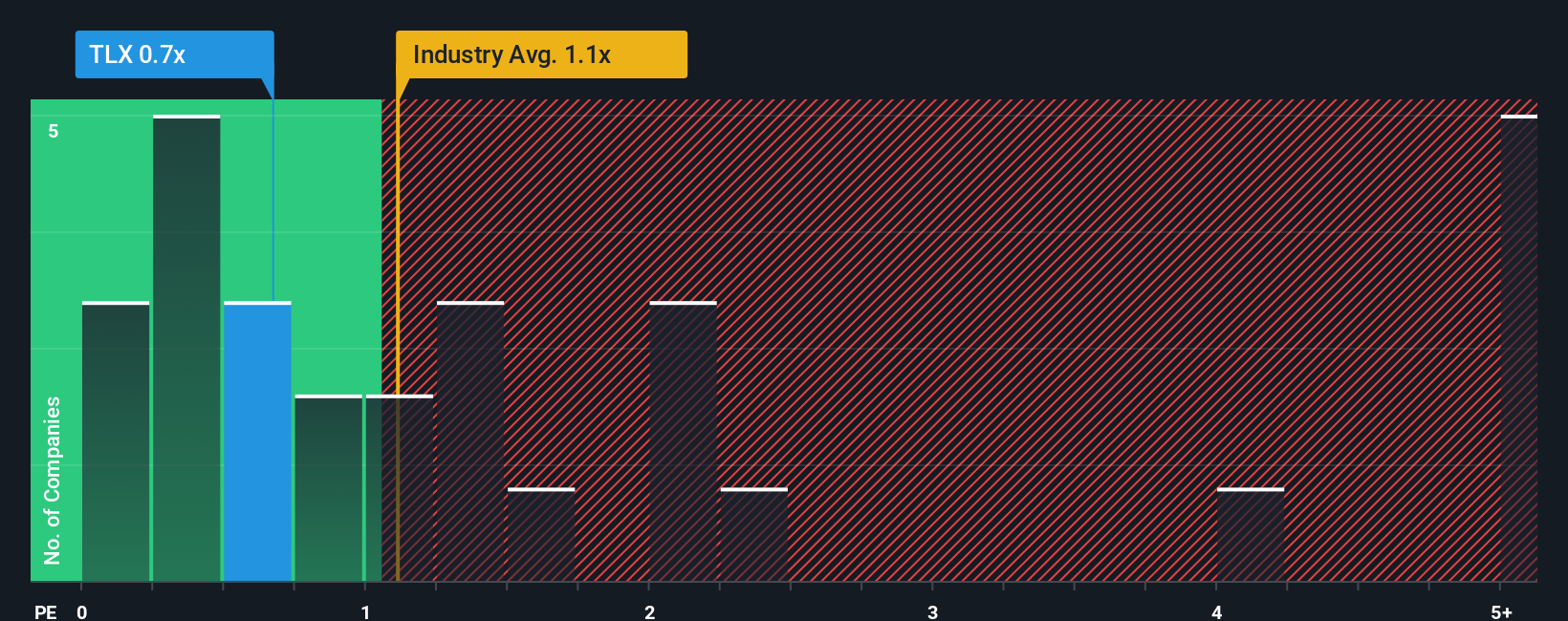

It's not a stretch to say that Talex S.A.'s (WSE:TLX) price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" for companies in the IT industry in Poland, where the median P/S ratio is around 1.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Talex

How Has Talex Performed Recently?

Talex has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Talex's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

Talex's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. The solid recent performance means it was also able to grow revenue by 18% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 3.5% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's curious that Talex's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Talex's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To our surprise, Talex revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Before you settle on your opinion, we've discovered 3 warning signs for Talex that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Talex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:TLX

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026