- Poland

- /

- Specialty Stores

- /

- WSE:OPN

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious Federal Reserve commentary, rate adjustments, and political uncertainties, investors are increasingly seeking stability through dividend stocks. In such an environment, a good dividend stock is often characterized by its ability to provide consistent income streams and maintain resilience amid market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.09% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.76% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.62% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

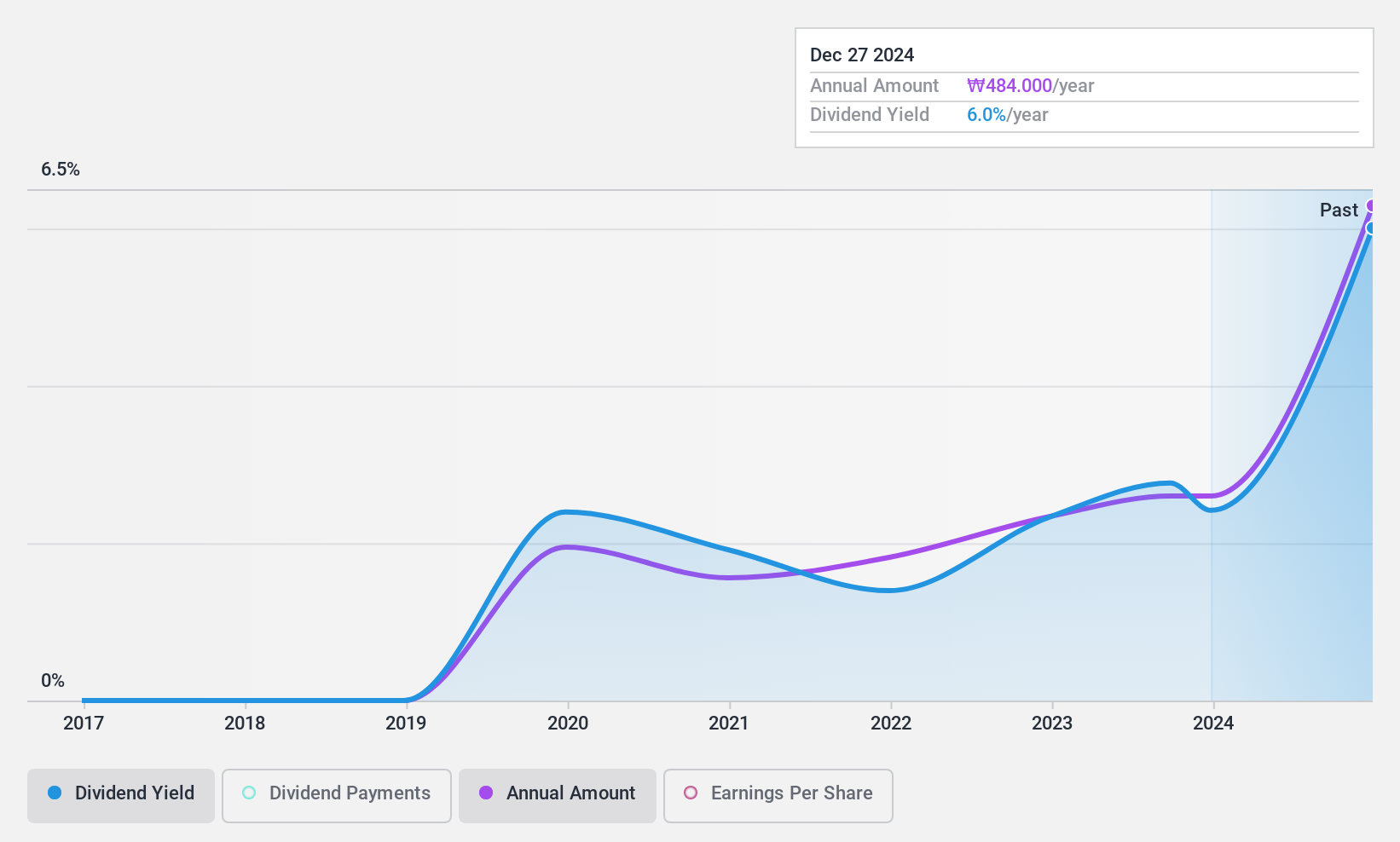

Asia Paper Manufacturing (KOSE:A002310)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Asia Paper Manufacturing Co., Ltd operates in South Korea, focusing on the production and sale of specialized industrial paper, with a market cap of ₩301.28 billion.

Operations: Asia Paper Manufacturing Co., Ltd generates revenue from the production and sale of specialized industrial paper in South Korea.

Dividend Yield: 6.4%

Asia Paper Manufacturing's dividend yield of 6.42% ranks in the top 25% of the Korean market, indicating a competitive return for investors. However, its dividend history is unreliable and volatile over the past five years, with payments only established for five years. Despite this instability, dividends are well-covered by earnings and cash flows with payout ratios at 43.3% and 59.2%, respectively. Recent earnings show decreased net income despite increased sales year-over-year.

- Delve into the full analysis dividend report here for a deeper understanding of Asia Paper Manufacturing.

- Our expertly prepared valuation report Asia Paper Manufacturing implies its share price may be lower than expected.

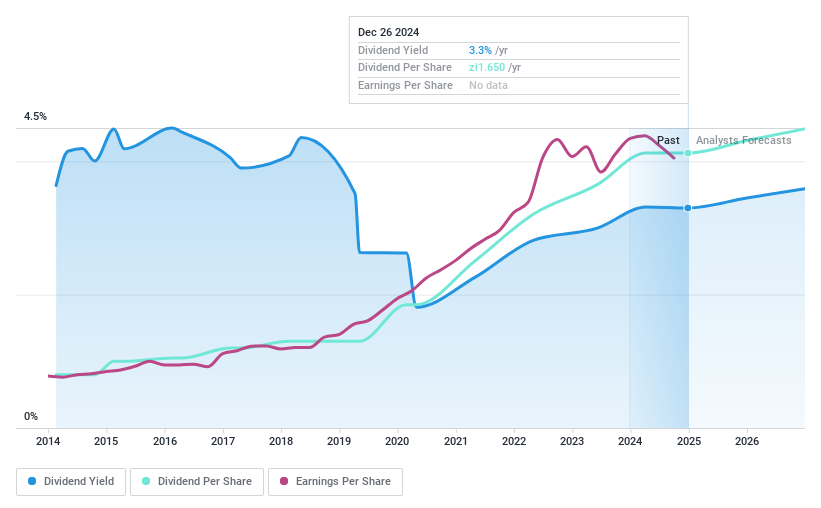

Asseco South Eastern Europe (WSE:ASE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asseco South Eastern Europe S.A., along with its subsidiaries, is involved in selling both proprietary and third-party software, with a market capitalization of PLN2.59 billion.

Operations: Asseco South Eastern Europe S.A.'s revenue is primarily derived from three segments: Banking Solutions (PLN311.90 million), Payment Solutions (PLN854.27 million), and Dedicated Solutions (PLN580.41 million).

Dividend Yield: 3.3%

Asseco South Eastern Europe's dividend payments have been stable and growing over the past decade, supported by a reasonable payout ratio of 45.8% and a cash payout ratio of 58.1%, indicating sustainability from both earnings and cash flows. However, its dividend yield of 3.3% is lower than the top tier in Poland's market. Recent earnings showed increased sales but decreased net income, with Q3 sales at PLN 444.8 million and net income at PLN 54 million.

- Take a closer look at Asseco South Eastern Europe's potential here in our dividend report.

- The analysis detailed in our Asseco South Eastern Europe valuation report hints at an inflated share price compared to its estimated value.

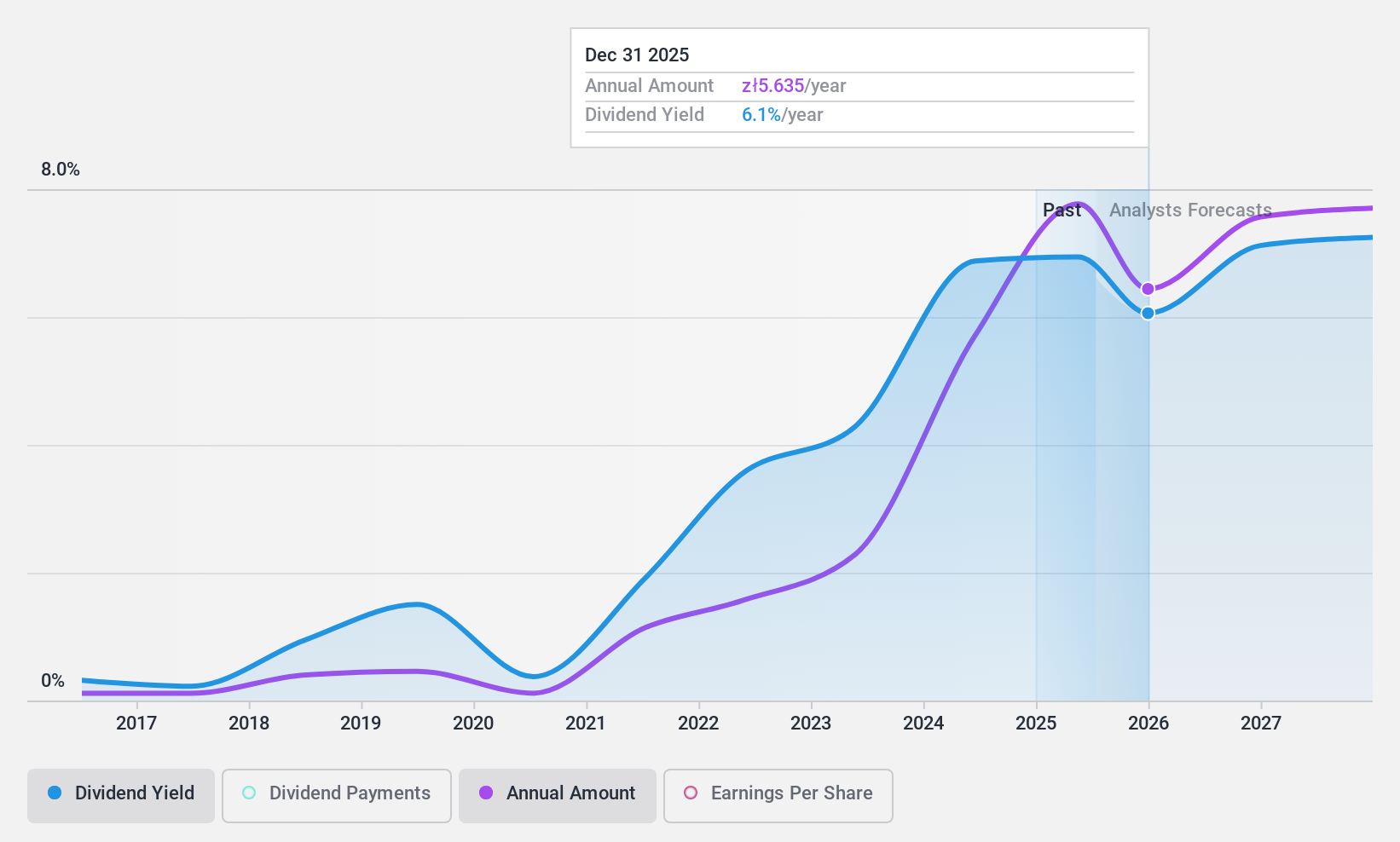

Oponeo.pl (WSE:OPN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oponeo.pl S.A. operates as an online retailer of tires and wheels for motor vehicles both in Poland and internationally, with a market capitalization of PLN865.16 million.

Operations: Oponeo.pl S.A. generates revenue through its Tools Segment (PLN91.02 million), Car Accessories (PLN1.69 billion), and Bicycles and Bicycle Accessories (PLN271.55 million).

Dividend Yield: 6.5%

Oponeo.pl's dividends are covered by earnings and cash flows, with payout ratios of 60.6% and 51.4% respectively, suggesting sustainability despite a high debt level. The company's dividend history is marked by volatility and unreliability, though payments have increased over the past decade. Trading at a discount to fair value, Oponeo.pl offers a dividend yield of 6.49%, which is below the top tier in Poland's market. Recent earnings showed improvement with Q3 sales at PLN 381 million and net income recovering to PLN 6.55 million from a loss last year.

- Unlock comprehensive insights into our analysis of Oponeo.pl stock in this dividend report.

- Our valuation report here indicates Oponeo.pl may be undervalued.

Where To Now?

- Click through to start exploring the rest of the 1948 Top Dividend Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:OPN

Oponeo.pl

Engages in the online retail of tires and wheels for motor vehicles in Poland and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives