- Poland

- /

- Capital Markets

- /

- WSE:LUD

FinTech Ventures (WSE:FIV) May Not Be Profitable But It Seems To Be Managing Its Debt Just Fine, Anyway

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that FinTech Ventures S.A. (WSE:FIV) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for FinTech Ventures

What Is FinTech Ventures's Net Debt?

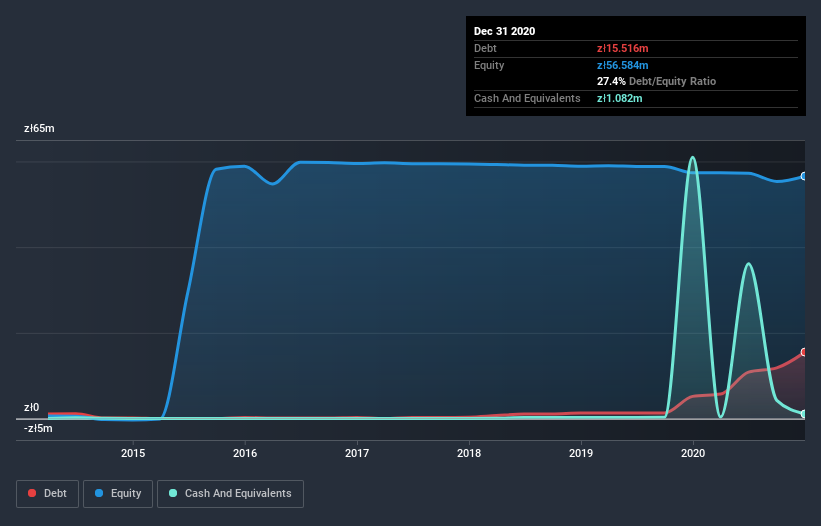

The image below, which you can click on for greater detail, shows that at December 2020 FinTech Ventures had debt of zł15.5m, up from zł5.18m in one year. However, because it has a cash reserve of zł1.08m, its net debt is less, at about zł14.4m.

How Strong Is FinTech Ventures' Balance Sheet?

According to the last reported balance sheet, FinTech Ventures had liabilities of zł16.1m due within 12 months, and liabilities of zł2.40m due beyond 12 months. On the other hand, it had cash of zł1.08m and zł35.3m worth of receivables due within a year. So it can boast zł17.8m more liquid assets than total liabilities.

This excess liquidity suggests that FinTech Ventures is taking a careful approach to debt. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders. The balance sheet is clearly the area to focus on when you are analysing debt. But it is FinTech Ventures's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Given it has no significant operating revenue at the moment, shareholders will be hoping FinTech Ventures can make progress and gain better traction for the business, before it runs low on cash.

Caveat Emptor

Importantly, FinTech Ventures had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost zł2.7m at the EBIT level. Looking on the brighter side, the business has adequate liquid assets, which give it time to grow and develop before its debt becomes a near-term issue. But we'd want to see some positive free cashflow before spending much time on trying to understand the stock. Nonetheless, the revenue growth is clearly impressive and that would make it easier to raise capital if need be. So it's risky, but with some potential. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 5 warning signs for FinTech Ventures (3 shouldn't be ignored) you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade FinTech Ventures, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Ludus, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:LUD

Ludus

Operates an esports platform. The company provides services, such as e-wallet; courses, masterclasses, and private coaching; deals solutions; cashback; FIFA; fitness tracker; marketplace for NFTs; greets that allows communication; and banking solutions.

Adequate balance sheet low.

Market Insights

Community Narratives