Shareholders in Develia S.A. (WSE:DVL) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. The consensus statutory numbers for both revenue and earnings per share (EPS) increased, with their view clearly much more bullish on the company's business prospects.

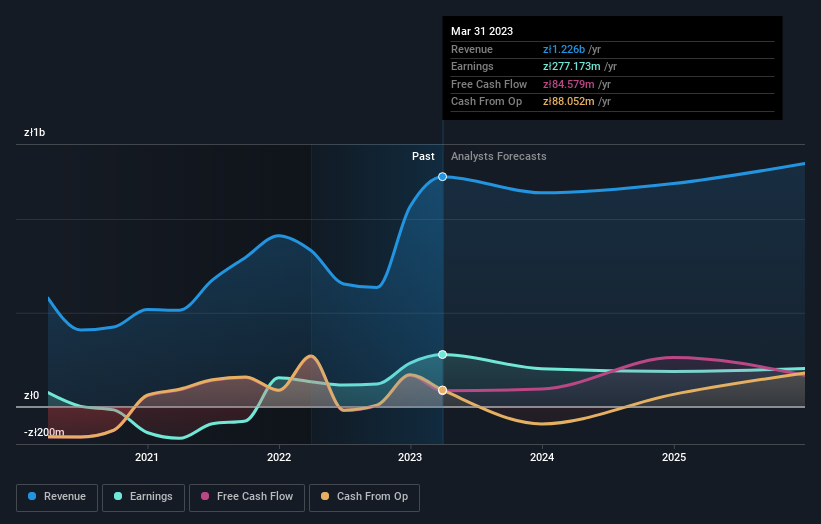

Following the upgrade, the consensus from two analysts covering Develia is for revenues of zł1.1b in 2023, implying a perceptible 7.0% decline in sales compared to the last 12 months. Statutory earnings per share are anticipated to nosedive 24% to zł0.47 in the same period. Prior to this update, the analysts had been forecasting revenues of zł1.0b and earnings per share (EPS) of zł0.40 in 2023. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

See our latest analysis for Develia

With these upgrades, we're not surprised to see that the analysts have lifted their price target 12% to zł3.95 per share. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values Develia at zł4.90 per share, while the most bearish prices it at zł2.65. This shows there is still some diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 9.3% by the end of 2023. This indicates a significant reduction from annual growth of 2.0% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 6.0% per year. It's pretty clear that Develia's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. Fortunately, they also upgraded their revenue estimates, and are forecasting revenues to grow slower than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, Develia could be worth investigating further.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for Develia going out as far as 2025, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:DVL

Develia

Through its subsidiaries, engages in real estate business in Poland.

Undervalued with solid track record and pays a dividend.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026