- Poland

- /

- Metals and Mining

- /

- WSE:COG

If You Had Bought Cognor Holding (WSE:COG) Shares A Year Ago You'd Have Earned 302% Returns

While stock picking isn't easy, for those willing to persist and learn, it is possible to buy shares in great companies, and generate wonderful returns. When an investor finds a multi-bagger (a stock that goes up over 200%), it makes a big difference to their portfolio. For example, the Cognor Holding S.A. (WSE:COG) share price is up a whopping 302% in the last year, a handsome return in a single year. It's also good to see the share price up 88% over the last quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report. Looking back further, the stock price is 59% higher than it was three years ago.

See our latest analysis for Cognor Holding

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

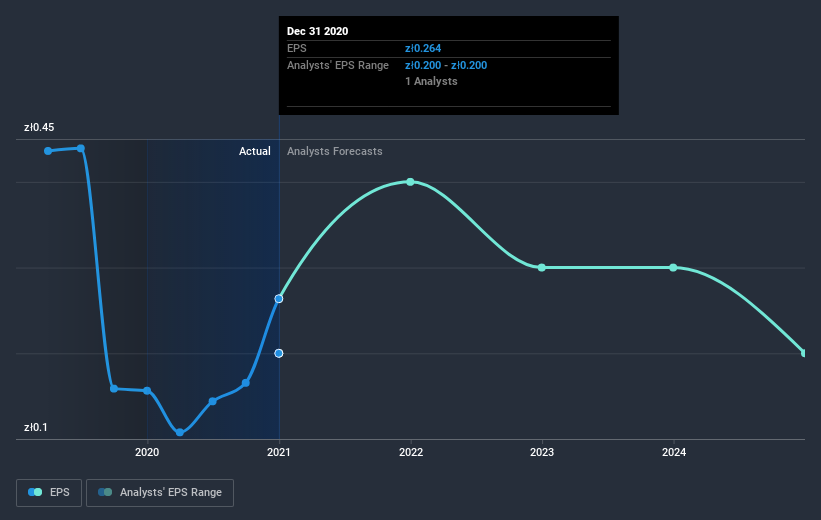

During the last year Cognor Holding grew its earnings per share (EPS) by 69%. This EPS growth is significantly lower than the 302% increase in the share price. So it's fair to assume the market has a higher opinion of the business than it a year ago.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Cognor Holding has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

It's good to see that Cognor Holding has rewarded shareholders with a total shareholder return of 302% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 28% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Cognor Holding better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for Cognor Holding (of which 2 shouldn't be ignored!) you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

If you’re looking to trade Cognor Holding, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:COG

Cognor Holding

Engages in the production and distribution of steel products in Poland, the Czech Republic, Germany, and internationally.

Good value with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026