As European markets navigate a landscape marked by geopolitical tensions and economic uncertainties, the pan-European STOXX Europe 600 Index recently experienced a decline, reflecting broader concerns. Amidst this backdrop, dividend stocks continue to attract investors seeking stability and income; these stocks can offer potential resilience through regular payouts even when market conditions are volatile.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.57% | ★★★★★★ |

| Teleperformance (ENXTPA:TEP) | 5.57% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.00% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.43% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.50% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 5.01% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.87% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.22% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.91% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.53% | ★★★★★★ |

Click here to see the full list of 242 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

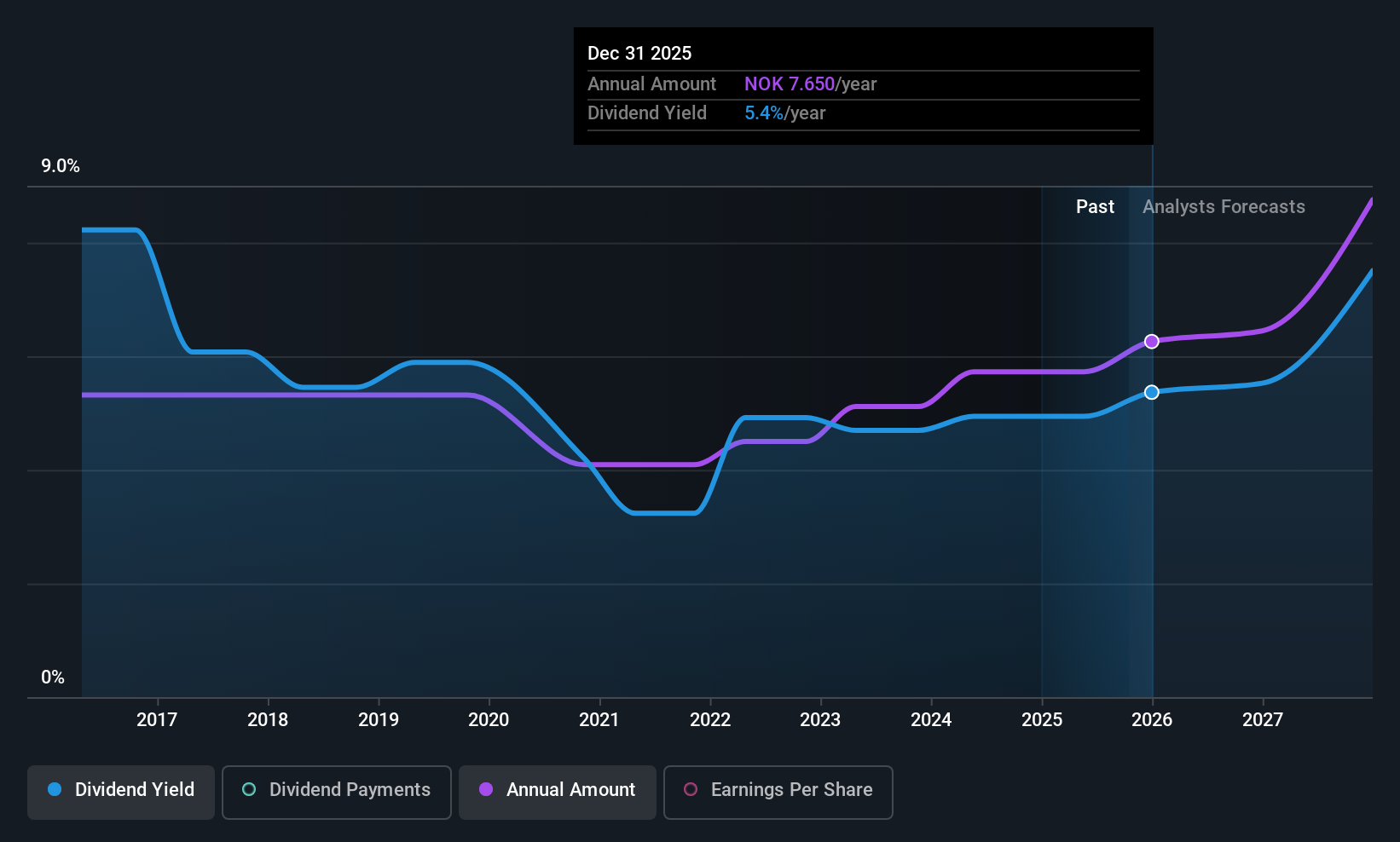

Atea (OB:ATEA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Atea ASA offers IT infrastructure and related solutions to businesses and public sector organizations across the Nordic countries and Baltic regions, with a market cap of NOK17.17 billion.

Operations: Atea ASA generates revenue from several segments in the Nordic and Baltic regions, with Norway contributing NOK9 billion, Sweden NOK13.06 billion, Denmark NOK8.25 billion, Finland NOK3.57 billion, and the Baltics NOK1.80 billion.

Dividend Yield: 4.5%

Atea's dividends have been stable and reliable over the past decade, with recent shareholder approval for a NOK 7.00 dividend per share to be paid in two instalments. However, the dividend yield of 4.55% is not well-covered by earnings due to a high payout ratio of 105.2%, although cash flows adequately support it with a cash payout ratio of 48.7%. The stock trades at a significant discount to its estimated fair value, offering potential value despite these concerns.

- Dive into the specifics of Atea here with our thorough dividend report.

- Our expertly prepared valuation report Atea implies its share price may be lower than expected.

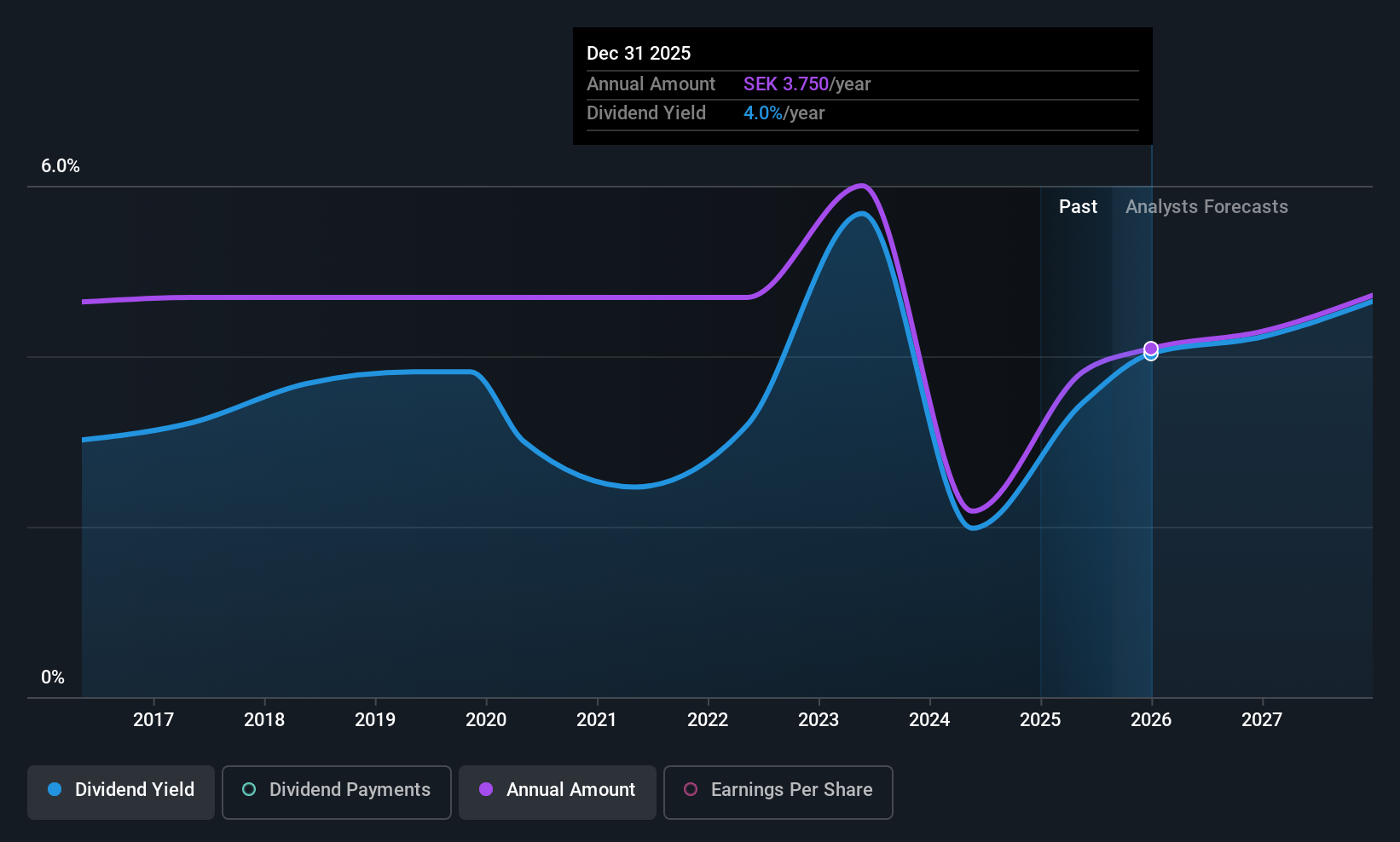

Billerud (OM:BILL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Billerud AB (publ) is a company that provides paper and packaging materials globally, with a market cap of SEK24.87 billion.

Operations: Billerud AB (publ) generates revenue primarily from Region Europe with SEK28.55 billion and Region North America with SEK12.55 billion, alongside currency hedging impacts.

Dividend Yield: 3.5%

Billerud's dividend reliability has been inconsistent over the past decade, with recent volatility in payments. Despite this, the company maintains a sustainable payout ratio of 47.1%, supported by both earnings and cash flows. The dividend yield is modest at 3.5%, below Sweden's top quartile payers. Trading significantly below its fair value estimate, Billerud offers potential value but faces challenges from large one-off items affecting earnings quality and recent board changes following its AGM on May 20, 2025.

- Delve into the full analysis dividend report here for a deeper understanding of Billerud.

- Upon reviewing our latest valuation report, Billerud's share price might be too pessimistic.

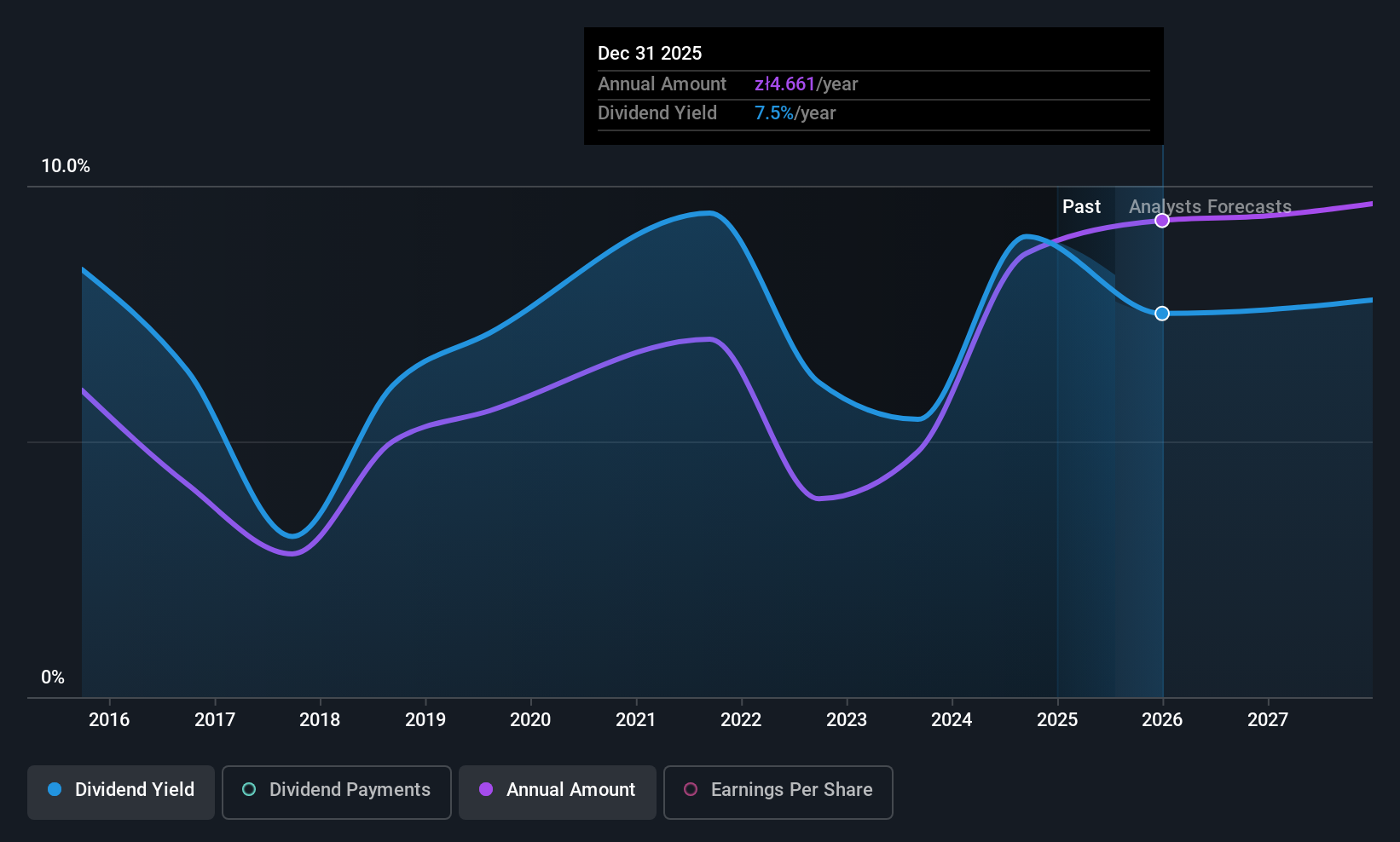

Powszechny Zaklad Ubezpieczen (WSE:PZU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Powszechny Zaklad Ubezpieczen SA offers life and non-life insurance products and services in Poland, the Baltic States, and Ukraine with a market cap of PLN51.90 billion.

Operations: Powszechny Zaklad Ubezpieczen SA's revenue is primarily derived from its Mass Insurance segment at PLN15.90 billion, Banking Activities at PLN41.73 billion, Group and Individually Continued Insurance at PLN11.90 billion, Corporate Insurance at PLN5.35 billion, Investments at PLN841 million, Pensions at PLN370 million, Ukraine operations at PLN279 million, Life Investment Insurance at PLN99 million, and Investment Contracts contributing PLN39 million.

Dividend Yield: 7.4%

Powszechny Zaklad Ubezpieczen's dividend payments have been volatile over the past decade, despite recent increases. The dividends are well-covered by both earnings and cash flows, with a payout ratio of 66% and a low cash payout ratio of 14.2%. Offering a competitive yield in Poland's market, PZU trades significantly below its estimated fair value. However, the company's future is uncertain due to an ongoing merger process with Bank Polska Kasa Opieki S.A., expected to conclude in mid-2026.

- Take a closer look at Powszechny Zaklad Ubezpieczen's potential here in our dividend report.

- According our valuation report, there's an indication that Powszechny Zaklad Ubezpieczen's share price might be on the cheaper side.

Next Steps

- Dive into all 242 of the Top European Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:PZU

Powszechny Zaklad Ubezpieczen

Provides life and non-life insurance products and services in Poland, the Baltic States, and Ukraine.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives