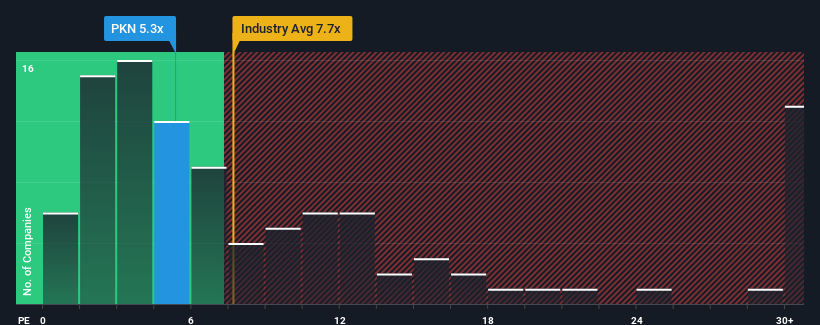

When close to half the companies in Poland have price-to-earnings ratios (or "P/E's") above 13x, you may consider Orlen S.A. (WSE:PKN) as a highly attractive investment with its 5.3x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Orlen hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Orlen

How Is Orlen's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Orlen's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 65%. As a result, earnings from three years ago have also fallen 24% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 11% each year as estimated by the eight analysts watching the company. Meanwhile, the broader market is forecast to expand by 10% each year, which paints a poor picture.

With this information, we are not surprised that Orlen is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Orlen's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Orlen's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Orlen (of which 1 is a bit concerning!) you should know about.

You might be able to find a better investment than Orlen. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:PKN

Orlen

Operates in refining, petrochemical, energy, retail, gas, and upstream business.

Flawless balance sheet and fair value.