European Penny Stocks Under €60M Market Cap: 3 Hidden Opportunities

Reviewed by Simply Wall St

As European markets continue to navigate a mixed economic landscape, with the STOXX Europe 600 Index posting its longest streak of weekly gains since 2012, investors are exploring diverse opportunities. Penny stocks, often associated with smaller or newer companies, remain an intriguing area for those seeking growth potential at a lower cost. Despite being considered a niche market today, these stocks can still offer significant value when backed by strong financials and clear growth prospects.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Financial Health Rating |

| Angler Gaming (NGM:ANGL) | SEK3.82 | SEK286.44M | ★★★★★★ |

| Deceuninck (ENXTBR:DECB) | €2.135 | €295.47M | ★★★★★★ |

| Hifab Group (OM:HIFA B) | SEK3.98 | SEK242.14M | ★★★★★★ |

| Transferator (NGM:TRAN A) | SEK2.19 | SEK207.01M | ★★★★★★ |

| High (ENXTPA:HCO) | €2.72 | €53.43M | ★★★★★★ |

| Netgem (ENXTPA:ALNTG) | €0.996 | €33.35M | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.02 | SEK1.93B | ★★★★☆☆ |

| I.M.D. International Medical Devices (BIT:IMD) | €1.40 | €24.25M | ★★★★★☆ |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €1.03 | €82.97M | ★★★★★☆ |

| Arcure (ENXTPA:ALCUR) | €4.82 | €27.87M | ★★★★☆☆ |

Click here to see the full list of 435 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Patria Bank (BVB:PBK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Patria Bank SA offers banking and financial services to small and medium enterprises, micro enterprises, agribusinesses, and retail clients in Romania, with a market cap of RON277.06 million.

Operations: Patria Bank SA does not report specific revenue segments.

Market Cap: RON277.06M

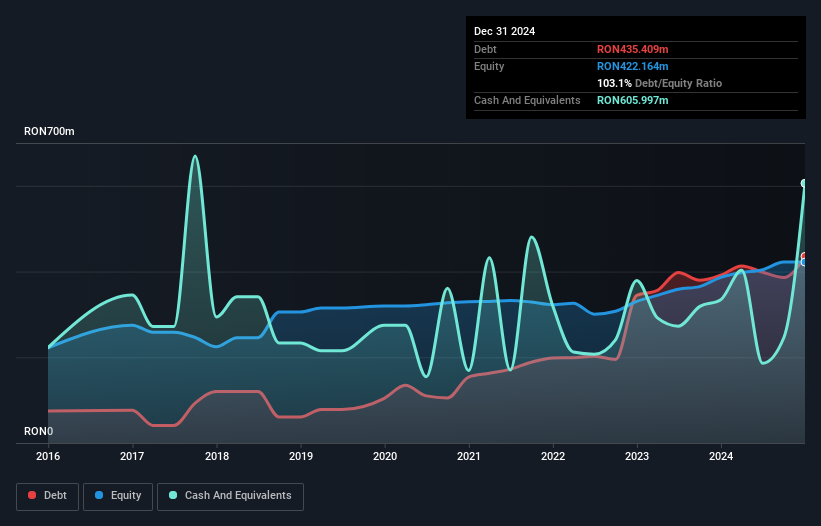

Patria Bank SA has demonstrated robust earnings growth, with a 59.4% increase over the past year, surpassing its 5-year average of 48% annually. The bank's net profit margins improved to 17.9%, and it maintains a strong capital structure with primarily low-risk funding from customer deposits (87%). Its price-to-earnings ratio of 6.8x suggests good value compared to the broader Romanian market. Despite high levels of non-performing loans (5.4%), the bank's Loans to Deposits ratio is appropriate at 69%. However, its Return on Equity remains low at 9.6%, indicating room for improvement in profitability measures.

- Jump into the full analysis health report here for a deeper understanding of Patria Bank.

- Review our growth performance report to gain insights into Patria Bank's future.

Hifab Group (OM:HIFA B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hifab Group AB (publ) offers project management and consulting services across Sweden, Europe, Asia, and Africa with a market cap of SEK 242.14 million.

Operations: The company generates revenue of SEK 328.3 million from its project management segment.

Market Cap: SEK242.14M

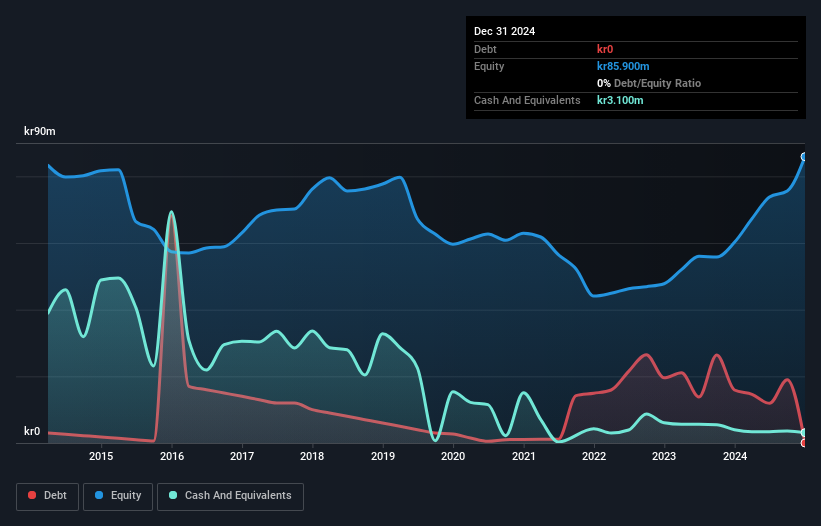

Hifab Group AB has shown impressive financial performance, with earnings growing by 101.6% over the past year, significantly outpacing the Professional Services industry. The company is debt-free, with short-term assets of SEK 111.4 million comfortably covering both short and long-term liabilities. Its return on equity stands at a high 29.9%, reflecting strong profitability metrics. Despite an unstable dividend track record, Hifab's net profit margins improved to 7.8% from last year's 4.1%. The stock trades at a substantial discount to its estimated fair value, suggesting potential upside for investors seeking value in penny stocks.

- Take a closer look at Hifab Group's potential here in our financial health report.

- Evaluate Hifab Group's historical performance by accessing our past performance report.

Polska Grupa Militarna Spólka Akcyjna (WSE:PMG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Polska Grupa Militarna Spólka Akcyjna develops video games for digital distribution platforms both in Poland and internationally, with a market cap of PLN31.31 million.

Operations: No revenue segments have been reported.

Market Cap: PLN31.31M

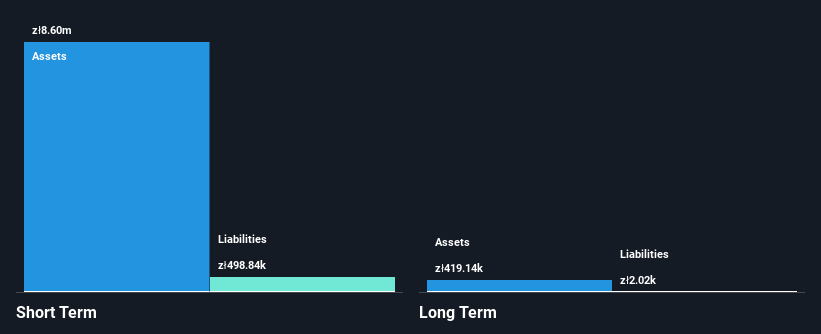

Polska Grupa Militarna Spólka Akcyjna, a video game developer with a market cap of PLN31.31 million, is pre-revenue with sales under US$1 million. Despite past financial challenges, the company has improved its balance sheet by turning negative equity positive and maintaining more cash than debt. However, it faces high volatility and less than a year of cash runway based on current free cash flow trends. Recent earnings showed revenue growth to PLN0.87 million for Q4 2024 from PLN0.27 million the previous year, but profitability remains elusive as historical losses have increased significantly over five years.

- Click here to discover the nuances of Polska Grupa Militarna Spólka Akcyjna with our detailed analytical financial health report.

- Learn about Polska Grupa Militarna Spólka Akcyjna's historical performance here.

Turning Ideas Into Actions

- Take a closer look at our European Penny Stocks list of 435 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Patria Bank, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:PBK

Patria Bank

Provides banking and other financial services to small and medium enterprises, micro enterprises, agribusinesses, and retail clients in Romania.

Solid track record with adequate balance sheet.