- Poland

- /

- Consumer Finance

- /

- WSE:KRU

With EPS Growth And More, KRUK Spólka Akcyjna (WSE:KRU) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like KRUK Spólka Akcyjna (WSE:KRU). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide KRUK Spólka Akcyjna with the means to add long-term value to shareholders.

See our latest analysis for KRUK Spólka Akcyjna

How Fast Is KRUK Spólka Akcyjna Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. To the delight of shareholders, KRUK Spólka Akcyjna has achieved impressive annual EPS growth of 39%, compound, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

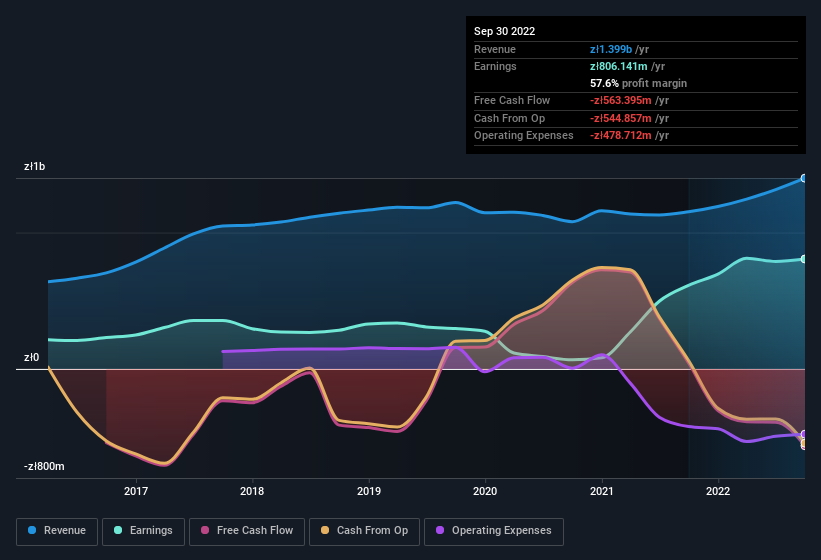

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of KRUK Spólka Akcyjna's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. While KRUK Spólka Akcyjna did well to grow revenue over the last year, EBIT margins were dampened at the same time. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for KRUK Spólka Akcyjna's future profits.

Are KRUK Spólka Akcyjna Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. KRUK Spólka Akcyjna followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. Indeed, they have a considerable amount of wealth invested in it, currently valued at zł656m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. Our analysis has discovered that the median total compensation for the CEOs of companies like KRUK Spólka Akcyjna with market caps between zł4.4b and zł14b is about zł3.1m.

KRUK Spólka Akcyjna's CEO took home a total compensation package worth zł2.7m in the year leading up to December 2021. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is KRUK Spólka Akcyjna Worth Keeping An Eye On?

KRUK Spólka Akcyjna's earnings per share have been soaring, with growth rates sky high. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The sharp increase in earnings could signal good business momentum. Big growth can make big winners, so the writing on the wall tells us that KRUK Spólka Akcyjna is worth considering carefully. Before you take the next step you should know about the 4 warning signs for KRUK Spólka Akcyjna (3 are a bit unpleasant!) that we have uncovered.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if KRUK Spólka Akcyjna might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:KRU

KRUK Spólka Akcyjna

Engages in the management of debt in Poland, Romania, Italy, the Czech Republic, Slovakia, Germany, Spain, and internationally.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives