As we navigate the European markets this March 2025, investor sentiment is being shaped by uncertainties around U.S. trade policies and a recent rate cut by the European Central Bank, which has tempered inflation concerns but also highlighted economic challenges. Amid these conditions, identifying promising stocks often involves looking for companies with strong fundamentals and the potential to benefit from increased infrastructure spending or other regional economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| ABG Sundal Collier Holding | 0.61% | -1.57% | -8.96% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

cBrain (CPSE:CBRAIN)

Simply Wall St Value Rating: ★★★★★☆

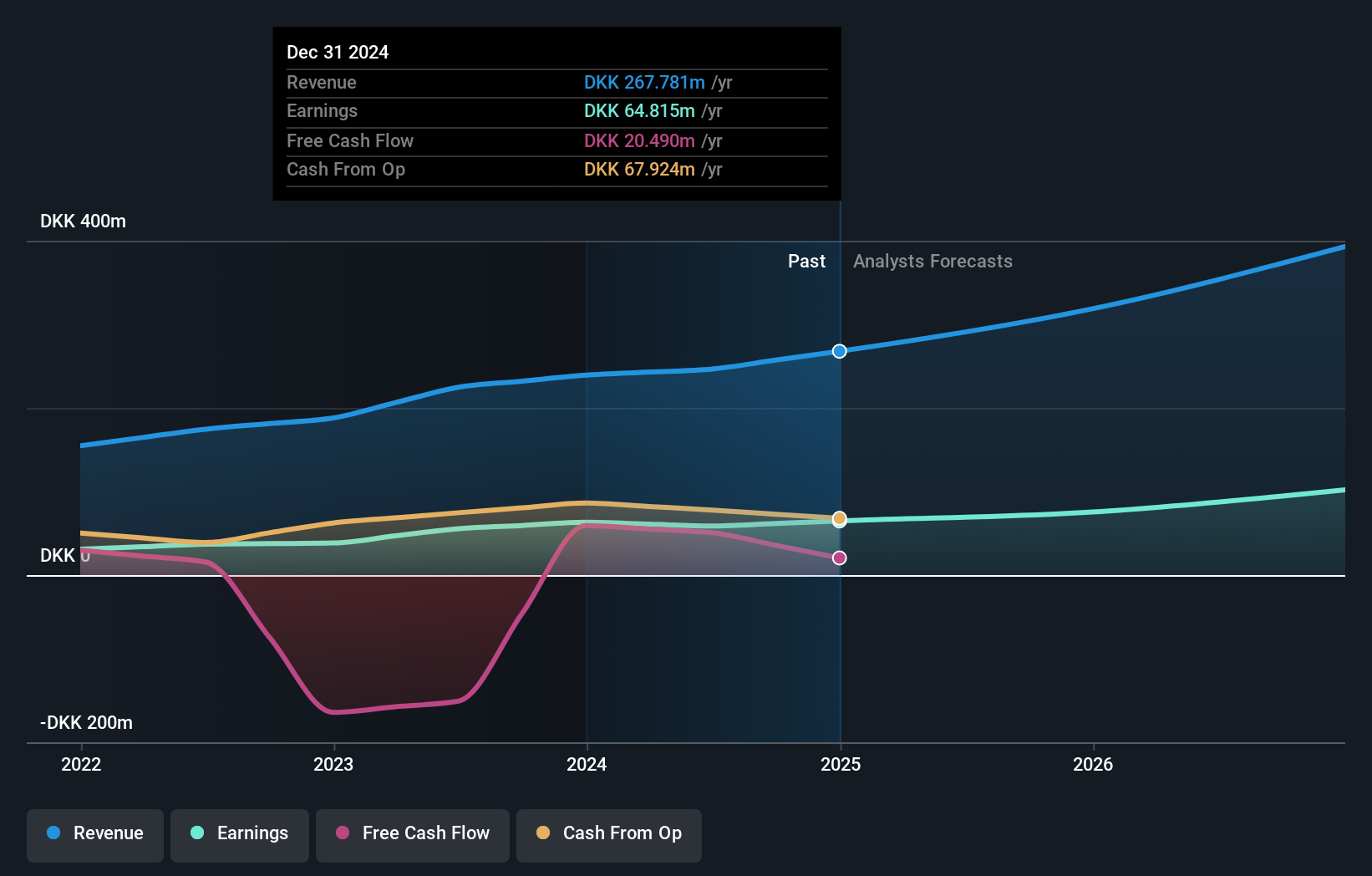

Overview: cBrain A/S is a software company that offers solutions for government, private, education, and non-profit sectors both in Denmark and internationally, with a market capitalization of DKK2.75 billion.

Operations: With a revenue of DKK267.78 million from its Software & Programming segment, cBrain A/S focuses on providing software solutions across various sectors.

cBrain, a nimble player in the tech space, has seen its earnings grow 34% annually over the past five years. Despite a volatile share price recently, it maintains high-quality earnings and satisfactory debt levels with a net debt to equity ratio of 9%. The company reported sales of DKK 267.78 million for 2024, up from DKK 239.18 million the previous year, alongside net income rising slightly to DKK 64.82 million. With an expected revenue growth forecast of 10-15% for this year and robust coverage on interest payments at 37 times EBIT, cBrain seems poised for continued stability.

- Click here and access our complete health analysis report to understand the dynamics of cBrain.

Understand cBrain's track record by examining our Past report.

Caisse régionale de Crédit Agricole Mutuel d'Ille-et-Vilaine Société coopérative (ENXTPA:CIV)

Simply Wall St Value Rating: ★★★★★★

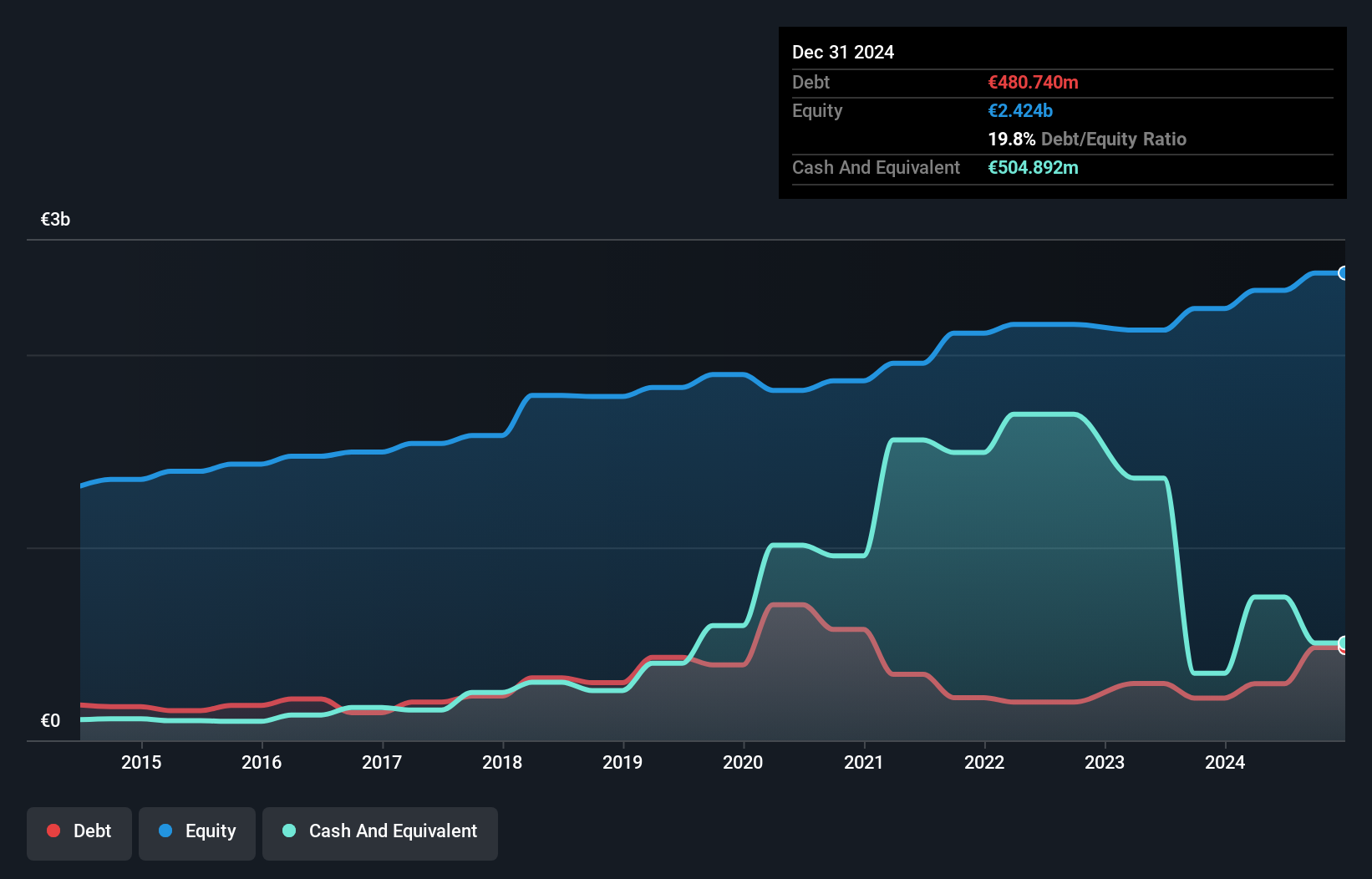

Overview: Caisse régionale de Crédit Agricole Mutuel d'Ille-et-Vilaine Société coopérative offers banking services in France and has a market capitalization of €482.10 million.

Operations: CIV generates its revenue primarily through retail banking, amounting to €299.55 million.

With total assets of €20.2B and equity of €2.3B, Caisse régionale de Crédit Agricole Mutuel d'Ille-et-Vilaine showcases a robust financial foundation. The bank's deposits and loans both stand at €16.7B, reflecting a balanced approach to its operations. Its earnings growth of 17.9% over the past year notably outpaces the industry average of 5.3%, suggesting strong performance momentum in its sector. Additionally, with 93% of liabilities funded through low-risk customer deposits, it maintains a stable funding structure while trading at 21% below estimated fair value indicates potential undervaluation for investors seeking opportunities in this space.

Trakcja (WSE:TRK)

Simply Wall St Value Rating: ★★★★☆☆

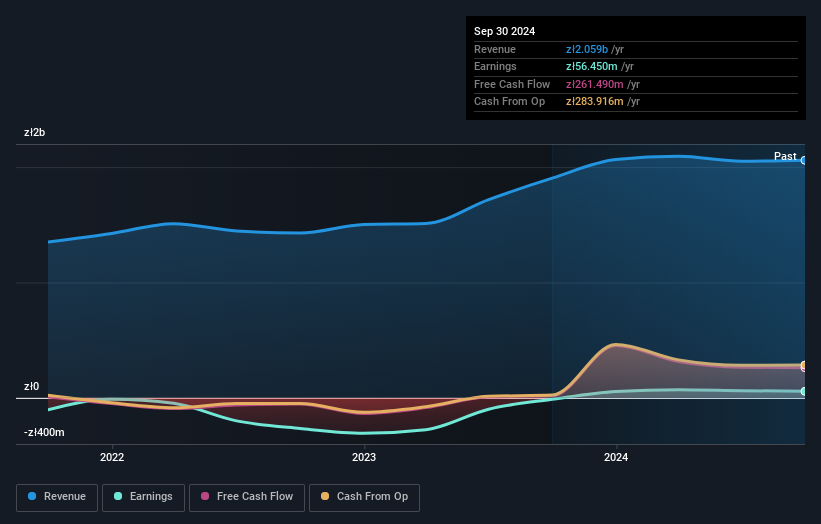

Overview: Trakcja S.A. operates in the infrastructure and energy construction sector in Poland and internationally, with a market capitalization of PLN1.08 billion.

Operations: Revenue primarily comes from Civil Construction Works in Poland (PLN1.12 billion) and Construction, Engineering, and Concession Agreements in the Baltic countries (PLN845.39 million).

Trakcja, a notable player in the European construction sector, has recently turned profitable, marking a significant milestone. The company's earnings have been bolstered by a one-off gain of PLN12.5M, which has influenced its financial results over the past year. Trading at 97.6% below its estimated fair value suggests potential for value investors seeking opportunities in underappreciated stocks. While Trakcja's debt to equity ratio rose from 54.6% to 74.3% over five years, its net debt to equity remains satisfactory at 11.7%. Despite recent shareholder dilution and share price volatility, interest payments are well covered with an EBIT coverage of 3.6 times.

- Navigate through the intricacies of Trakcja with our comprehensive health report here.

Evaluate Trakcja's historical performance by accessing our past performance report.

Next Steps

- Take a closer look at our European Undiscovered Gems With Strong Fundamentals list of 372 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CIV

Caisse régionale de Crédit Agricole Mutuel d'Ille-et-Vilaine Société coopérative

Provides banking services in France.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives