- Hong Kong

- /

- Consumer Finance

- /

- SEHK:8030

Undiscovered Gems in Asia to Watch This December 2025

Reviewed by Simply Wall St

As global markets adjust to the Federal Reserve's recent interest rate cuts and mixed economic signals, small-cap stocks have shown resilience, with indices like the Russell 2000 outperforming their larger counterparts. In Asia, where market dynamics are similarly influenced by central bank policies and economic indicators, investors might find intriguing opportunities in lesser-known stocks that demonstrate strong fundamentals and potential for growth.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oriental Precision & EngineeringLtd | 32.67% | 9.30% | 4.58% | ★★★★★★ |

| Thai Steel Cable | NA | 3.35% | 17.89% | ★★★★★★ |

| Camelot Electronics TechnologyLtd | 10.07% | 11.02% | -5.75% | ★★★★★★ |

| Nextronics Engineering | 20.23% | 11.39% | 24.54% | ★★★★★★ |

| Shangri-La Hotel | NA | 33.29% | 66.13% | ★★★★★★ |

| Guangdong Green Precision Components | NA | -8.91% | -38.16% | ★★★★★★ |

| Jiangsu Rainbow Heavy Industries | 25.93% | 19.62% | 2.58% | ★★★★★☆ |

| CTCI Advanced Systems | 28.70% | 17.79% | 19.38% | ★★★★★☆ |

| Shandong Sacred Sun Power SourcesLtd | 19.20% | 12.37% | 36.24% | ★★★★★☆ |

| Zhejiang Risun Intelligent TechnologyLtd | 51.85% | 20.80% | -5.94% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Daehan Shipbuilding (KOSE:A439260)

Simply Wall St Value Rating: ★★★★★☆

Overview: Daehan Shipbuilding Co., Ltd. specializes in ship construction and repair services, with a market cap of ₩2.92 billion.

Operations: Daehan Shipbuilding generates revenue primarily through its ship construction and repair services. The company has a market capitalization of ₩2.92 billion.

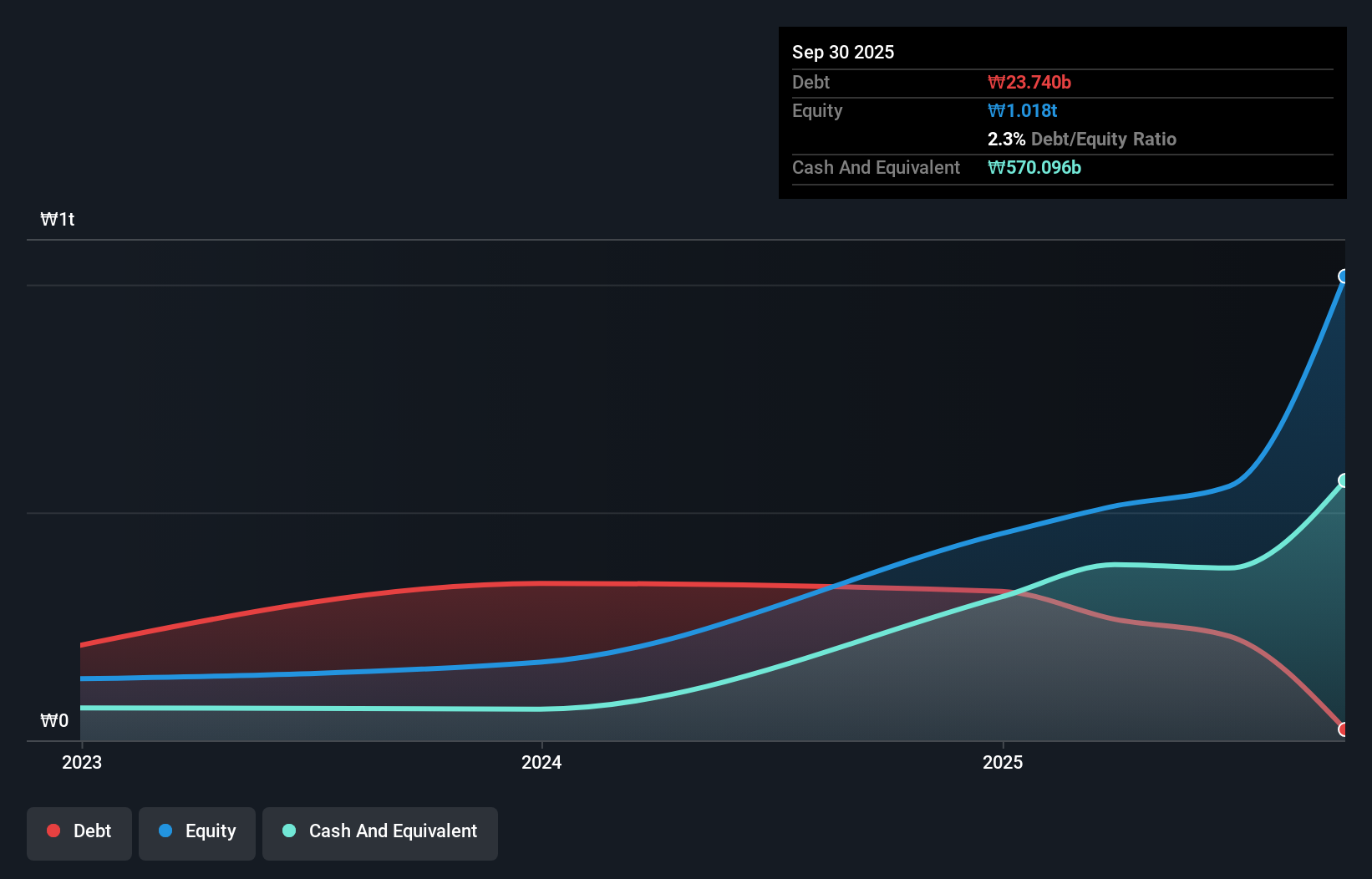

Daehan Shipbuilding, a small player in the shipbuilding industry, is trading at 43.1% below its estimated fair value, making it an intriguing prospect for investors. With earnings growth of 92.8% over the past year, it has outpaced the broader machinery industry's growth rate of 31.2%. The company boasts more cash than total debt and its interest payments are well covered by EBIT with a coverage ratio of 93.1x. Free cash flow remains positive, suggesting operational efficiency and financial stability despite challenges in capital expenditure management which reached US$18 million recently. Earnings are projected to grow by 3.87% annually, indicating potential for steady future performance.

- Click here and access our complete health analysis report to understand the dynamics of Daehan Shipbuilding.

Understand Daehan Shipbuilding's track record by examining our Past report.

Asian Terminals (PSE:ATI)

Simply Wall St Value Rating: ★★★★★★

Overview: Asian Terminals, Inc., along with its subsidiaries, operates and manages the South Harbor Port of Manila and the Port of Batangas in Batangas City in the Philippines, with a market capitalization of ₱68.10 billion.

Operations: ATI generates revenue primarily from its Ports Business, which reported ₱18.60 billion.

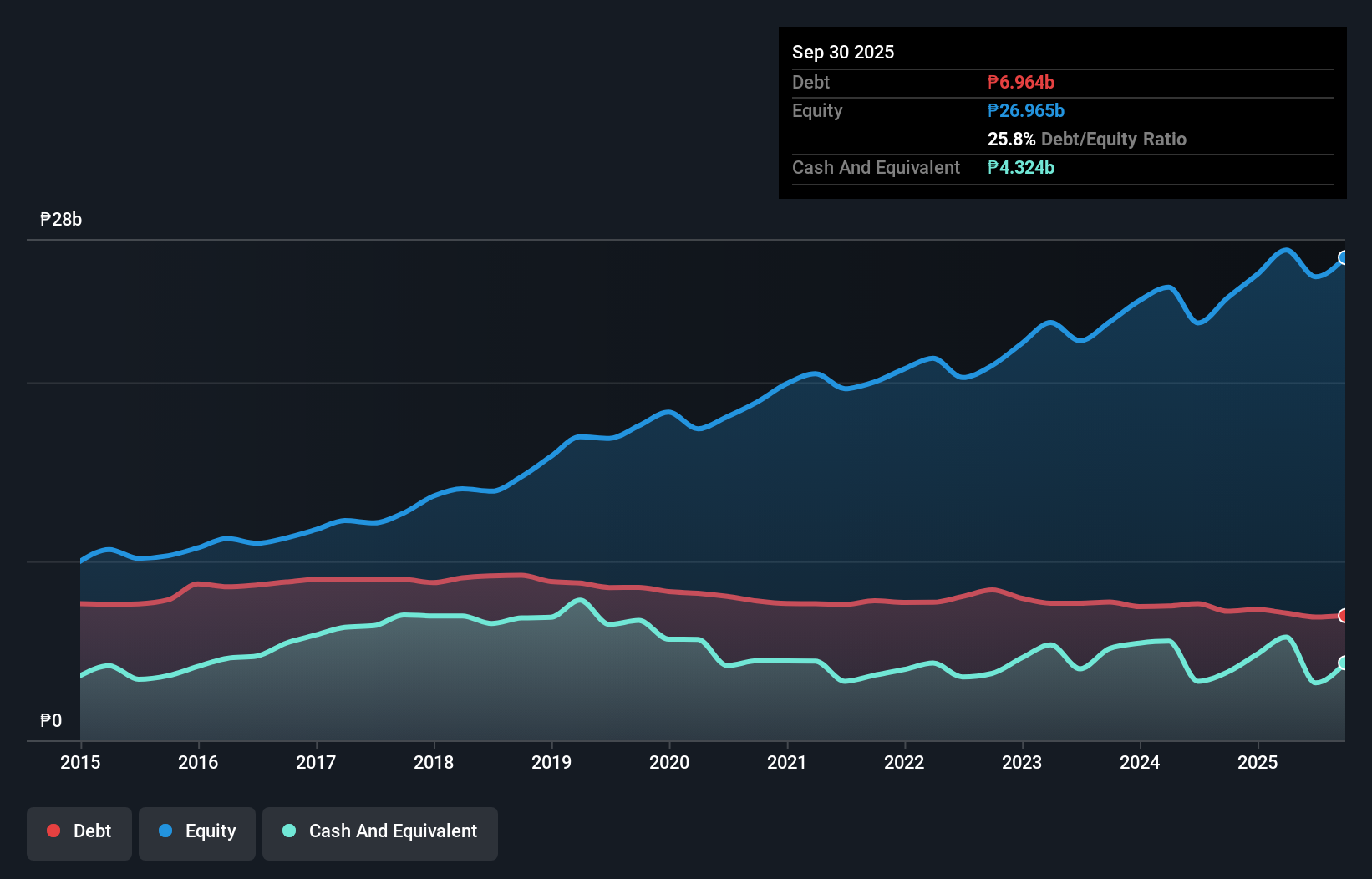

Asian Terminals, Inc. (ATI) is making waves with a notable earnings growth of 27.8% over the past year, outpacing the infrastructure industry’s 8.4%. Its debt to equity ratio has impressively reduced from 41.2% to 25.8% in five years, and its net debt to equity ratio stands at a satisfactory 9.8%. Recent developments include Maharlika Investment Corporation's proposal to acquire a 5.10% stake for PHP 3.6 billion, highlighting investor confidence in ATI's potential value trading at nearly 30% below its estimated fair value and strong EBIT coverage of interest payments at over twenty-nine times.

- Take a closer look at Asian Terminals' potential here in our health report.

Gain insights into Asian Terminals' past trends and performance with our Past report.

Fengyinhe Holdings (SEHK:8030)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Fengyinhe Holdings Limited is an investment holding company that offers a range of financial services to the real estate market in the People’s Republic of China, with a market capitalization of HK$4.42 billion.

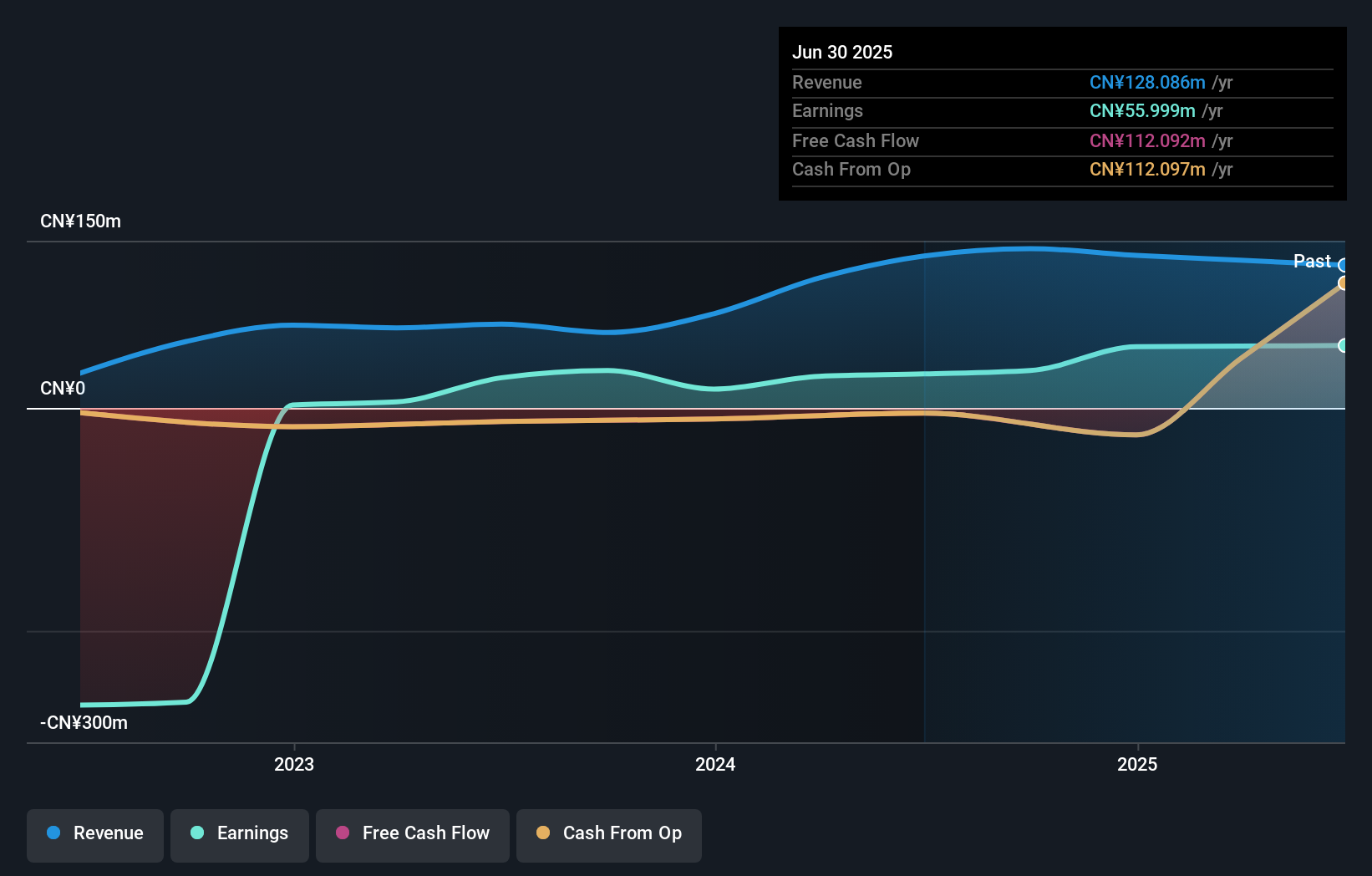

Operations: Fengyinhe Holdings generates its revenue primarily from financial service platforms, contributing CN¥100.37 million, and from entrusted loan, pawn loan, other loan services, and financial consultation services amounting to CN¥7.70 million.

Fengyinhe Holdings, a promising player in the Asian market, has seen its earnings grow by 84% over the past year, significantly outpacing the Consumer Finance industry average of 17%. Despite a debt to equity ratio increase from 4.1 to 9.4 over five years, it boasts more cash than total debt. Recent board changes include Ms. Fok Ka Man as an independent director and Mr. Yu Xiuliang as an executive director, both bringing extensive legal and technical expertise respectively. These strategic appointments align with Fengyinhe's focus on expanding business opportunities and enhancing corporate governance.

- Unlock comprehensive insights into our analysis of Fengyinhe Holdings stock in this health report.

Evaluate Fengyinhe Holdings' historical performance by accessing our past performance report.

Taking Advantage

- Click here to access our complete index of 2499 Asian Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:8030

Fengyinhe Holdings

An investment holding company, provides various financial services to real estate market in the People’s Republic of China.

Outstanding track record with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)