- Philippines

- /

- Real Estate

- /

- PSE:SHNG

3 Dividend Stocks To Consider With Up To 7.3% Yield

Reviewed by Simply Wall St

In the midst of global market fluctuations, investors are closely monitoring potential policy changes and their implications on various sectors, with financials and energy seeing gains while healthcare faces challenges. As interest rates remain a central focus, dividend stocks offer an appealing option for those seeking steady income amidst economic uncertainty. A good dividend stock typically combines a reliable payout history with the potential for growth, making it a valuable consideration in today's dynamic market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.61% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.57% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.16% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.74% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.76% | ★★★★★★ |

| Petrol d.d (LJSE:PETG) | 5.84% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.85% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.57% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.46% | ★★★★★★ |

Click here to see the full list of 1956 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Shang Properties (PSE:SHNG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shang Properties, Inc. operates in the property investment and development sector in the Philippines with a market cap of ₱18.81 billion.

Operations: Shang Properties, Inc.'s revenue segments primarily derive from its activities in property investment and development within the Philippines.

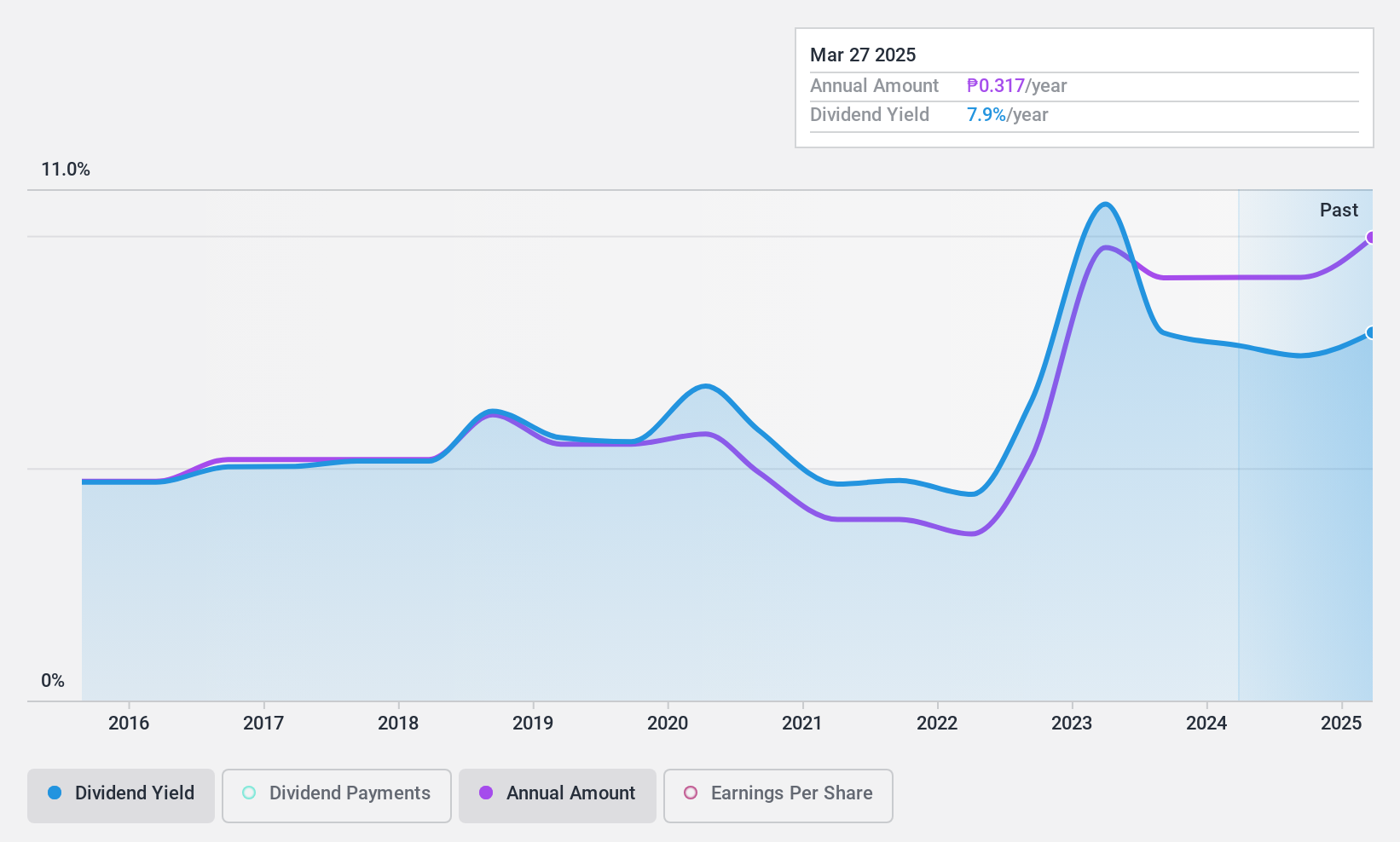

Dividend Yield: 7.3%

Shang Properties offers a dividend yield of 7.33%, positioning it in the top quartile of Philippine dividend payers. However, its dividends are not well covered by cash flows, with a high cash payout ratio of 1990.2%. Despite having a low earnings payout ratio of 2%, indicating coverage by earnings, dividends have been unreliable and volatile over the past decade. Recent earnings showed improvement with net income rising to PHP 1.58 billion for Q3 2024 from PHP 1.35 billion year-on-year.

- Get an in-depth perspective on Shang Properties' performance by reading our dividend report here.

- The analysis detailed in our Shang Properties valuation report hints at an inflated share price compared to its estimated value.

First Tractor (SEHK:38)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Tractor Company Limited is involved in the research, development, manufacture, and sale of agricultural and power machinery globally, with a market cap of HK$14.66 billion.

Operations: First Tractor Company Limited generates revenue primarily from its agricultural and power machinery segments, with total revenue in these areas amounting to CN¥9.58 billion.

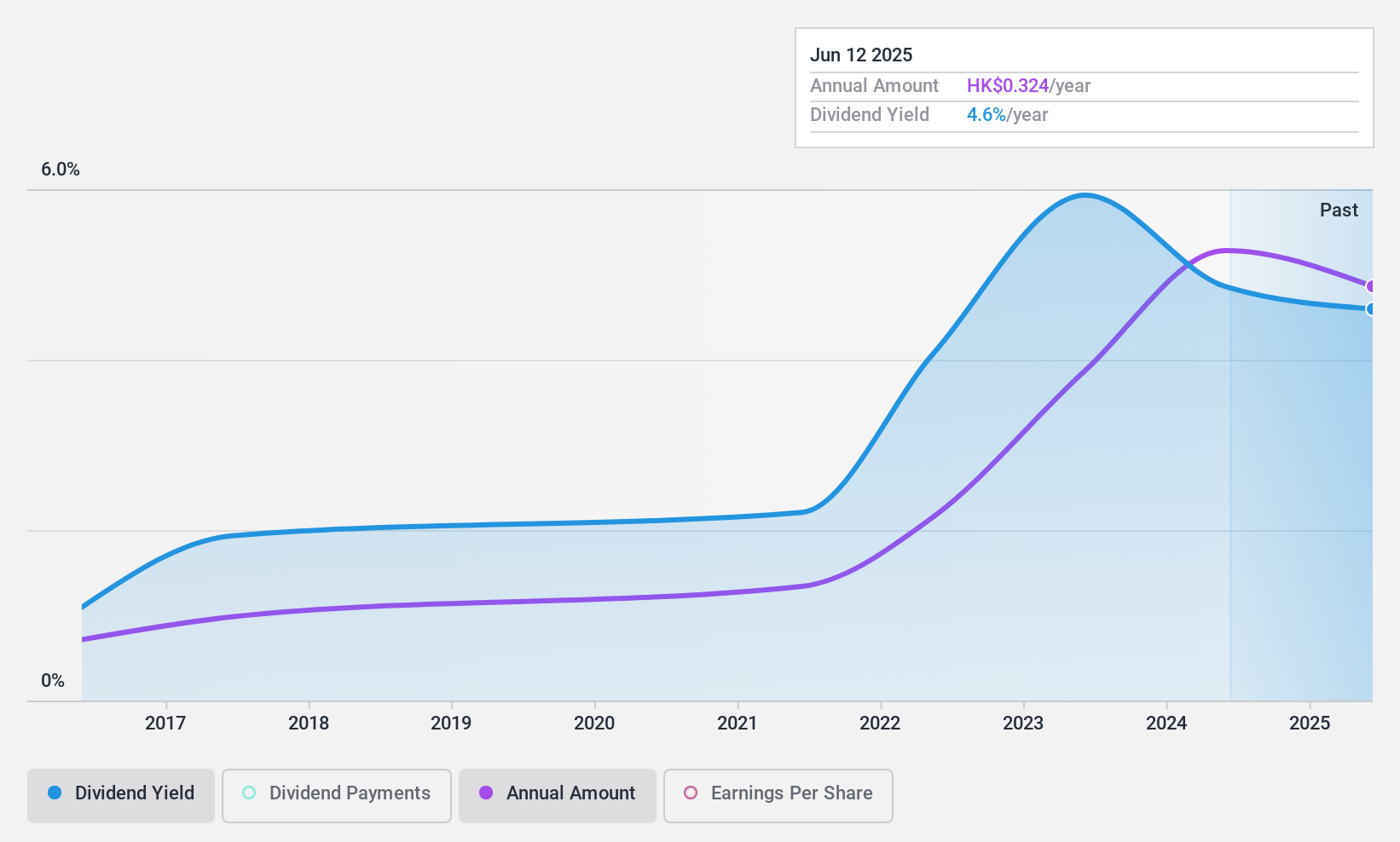

Dividend Yield: 5.1%

First Tractor's dividend yield of 5.06% is below the top tier in Hong Kong, with dividends well-covered by earnings and cash flows, reflected in payout ratios of 35.4% and 30.3%, respectively. However, its dividend track record has been unstable over the past decade due to volatility. Recent earnings show growth, with net income reaching CNY 1.10 billion for the nine months ending September 2024, up from CNY 1.09 billion year-on-year.

- Click here to discover the nuances of First Tractor with our detailed analytical dividend report.

- Our valuation report here indicates First Tractor may be undervalued.

Bangkok Airways (SET:BA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bangkok Airways Public Company Limited, along with its subsidiaries, offers air transportation and airport services with a market cap of THB50.40 billion.

Operations: Bangkok Airways Public Company Limited generates revenue from its airlines segment (THB17.87 billion), supporting airlines business (THB5.07 billion), and airport services (THB513 million).

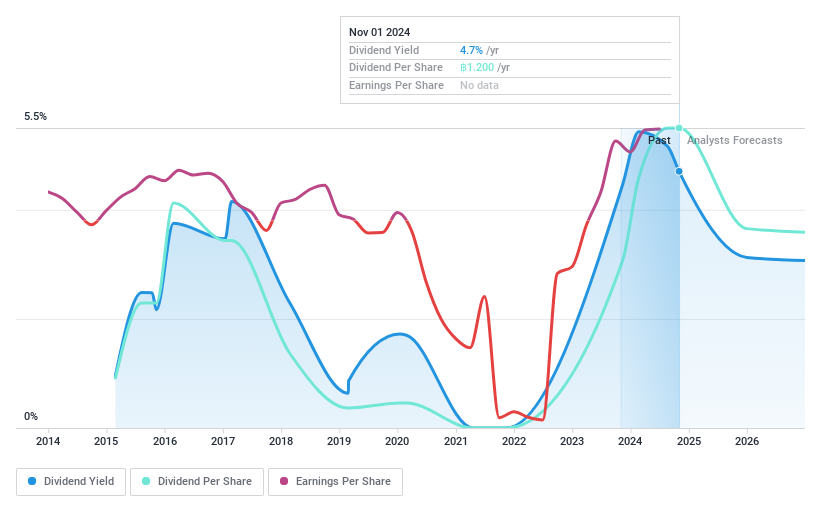

Dividend Yield: 4.9%

Bangkok Airways' dividend yield of 4.92% is below the top tier in Thailand, with dividends covered by earnings and cash flows, indicated by payout ratios of 79.4% and 50%, respectively. Despite a history of volatility and unreliability over the past decade, recent interim dividends were declared at THB 0.60 for early 2024 operations. Earnings have declined year-on-year, with net income for Q3 at THB 671.22 million compared to THB 1,910.99 million previously.

- Dive into the specifics of Bangkok Airways here with our thorough dividend report.

- Our expertly prepared valuation report Bangkok Airways implies its share price may be lower than expected.

Next Steps

- Discover the full array of 1956 Top Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:SHNG

Shang Properties

Engages in property investment and development business primarily in the Philippines.

Solid track record with adequate balance sheet and pays a dividend.