Global markets have experienced a mixed performance recently, with the Nasdaq Composite reaching a new milestone while other major indexes faced declines. Amidst these fluctuations, investors are increasingly seeking opportunities in various sectors, including smaller-cap stocks that may offer unique growth potential. Penny stocks, though often seen as speculative investments from the past, continue to capture attention due to their affordability and potential for significant returns when backed by strong financials. In this article, we explore several promising penny stocks that stand out for their robust fundamentals and potential for future success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$139.45M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.42 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR295.43M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.09 | HK$43.72B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.49 | £66.56M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.16 | £99.11M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.885 | £185.28M | ★★★★★★ |

Click here to see the full list of 5,762 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Vantage Equities (PSE:V)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vantage Equities, Inc. is an investment and financial holding company based in the Philippines with a market cap of ₱2.90 billion.

Operations: The company's revenue segment is primarily from the Philippines, totaling ₱1.53 billion.

Market Cap: ₱2.9B

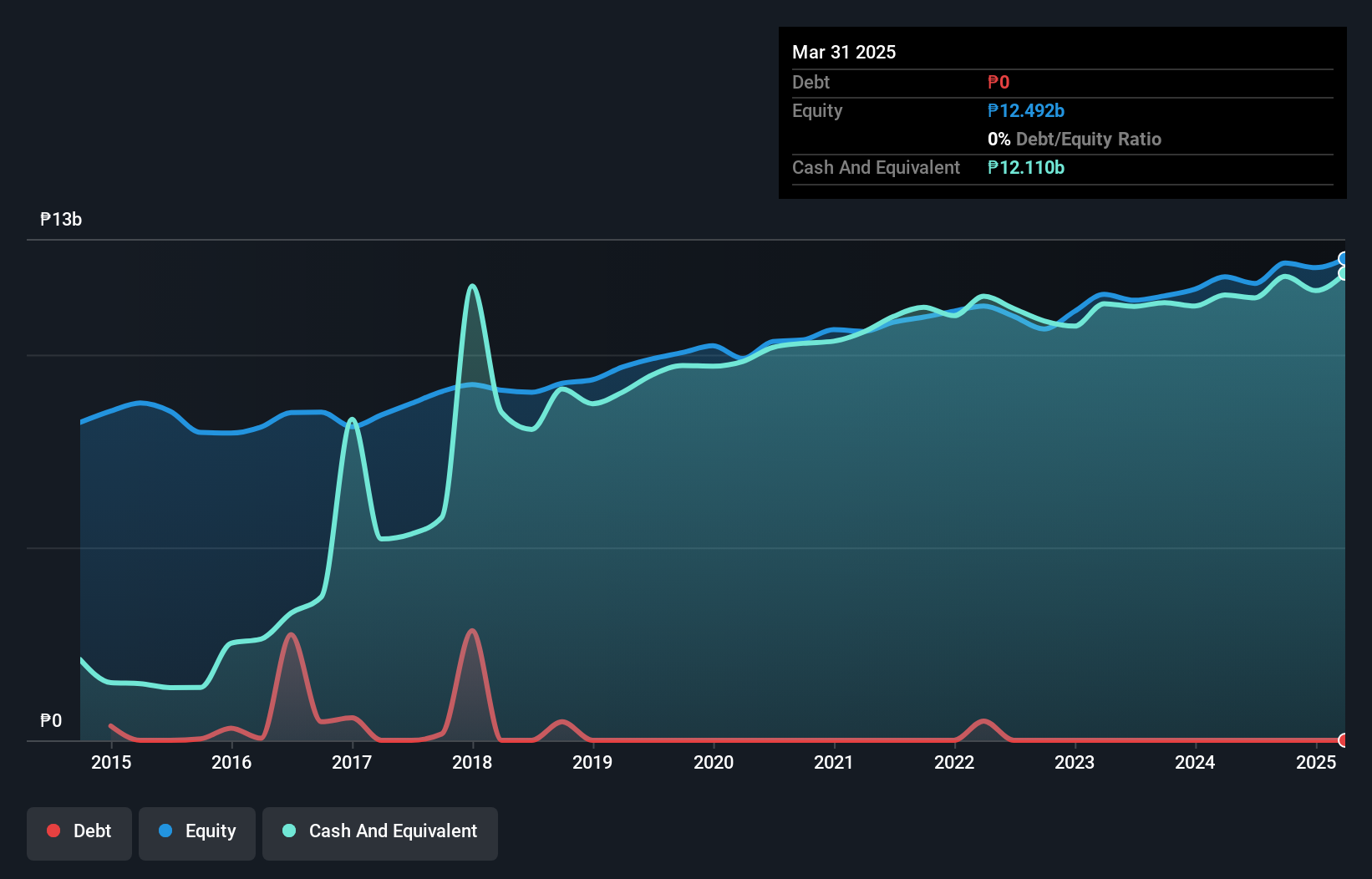

Vantage Equities, Inc., with a market cap of ₱2.90 billion, has demonstrated significant earnings growth recently, reporting a net income of ₱458.35 million for Q3 2024 compared to ₱93.48 million the previous year. The company benefits from strong financial health with no debt and short-term assets of ₱12.5 billion far exceeding its liabilities, providing stability in uncertain markets. Despite this growth, its earnings over the past five years have been relatively stagnant at -0.2% per year on average, and its return on equity remains low at 7.5%. Recent corporate governance changes aim to enhance board efficiency by reducing board members from thirteen to nine in compliance with best practices and regulatory requirements.

- Navigate through the intricacies of Vantage Equities with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Vantage Equities' track record.

Midland Holdings (SEHK:1200)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Midland Holdings Limited is an investment holding company that offers property agency services across Hong Kong, Macau, and Mainland China with a market cap of HK$0.52 billion.

Operations: The company's revenue primarily stems from its property agency services, with HK$4.99 billion generated from residential properties and HK$37.48 million from commercial, industrial properties, and shops.

Market Cap: HK$523.47M

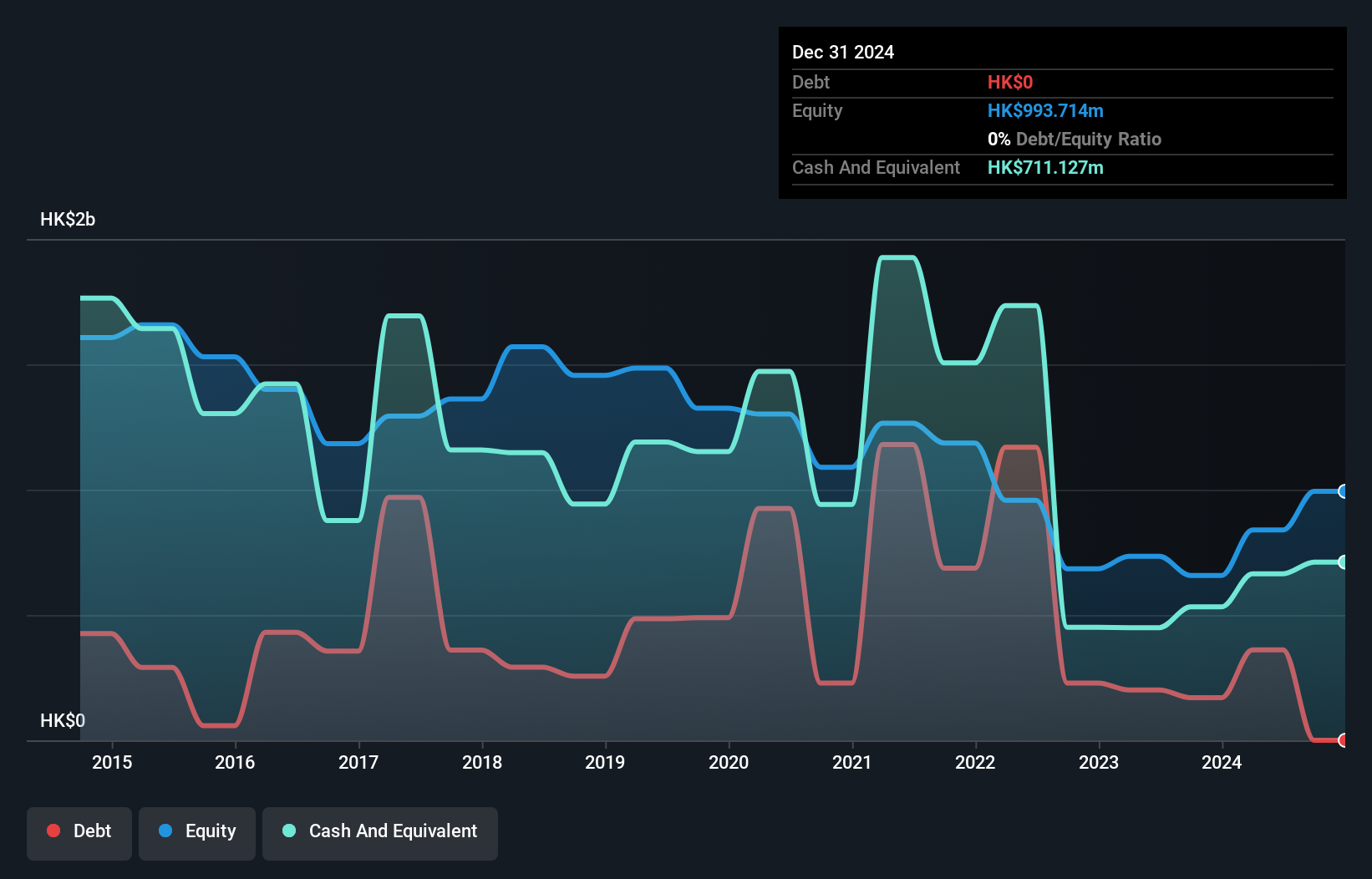

Midland Holdings, with a market cap of HK$0.52 billion, has recently transitioned to profitability, making it challenging to compare its earnings growth against the real estate industry's decline. The company shows strong financial stability with short-term assets of HK$4.6 billion exceeding liabilities and more cash than total debt. Its debt is well-covered by operating cash flow and interest payments are comfortably managed by EBIT at 6.2 times coverage. Despite trading significantly below estimated fair value, Midland's return on equity is low at 11.1%. The seasoned management team and board bring extensive experience to support future growth prospects in the property sector across Hong Kong, Macau, and Mainland China.

- Click here to discover the nuances of Midland Holdings with our detailed analytical financial health report.

- Gain insights into Midland Holdings' outlook and expected performance with our report on the company's earnings estimates.

Geo Energy Resources (SGX:RE4)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Geo Energy Resources Limited is an investment holding company involved in the mining, production, and trading of coal with a market capitalization of SGD371.48 million.

Operations: Geo Energy Resources Limited has not reported any specific revenue segments.

Market Cap: SGD371.48M

Geo Energy Resources, with a market cap of S$371.48 million, has demonstrated financial resilience through reduced debt levels and positive net profit margins, despite recent earnings declines. The company reported Q3 sales of US$84.32 million and net income of US$7.05 million, reflecting a year-over-year decrease but maintaining profitability. While its return on equity is low at 10.8%, Geo Energy's strategic infrastructure development in Indonesia aims to enhance logistical efficiency and revenue diversification. However, interest coverage remains weak at 2.3 times EBIT, highlighting potential challenges in managing debt obligations amidst growth ambitions towards becoming a billion-dollar energy group.

- Unlock comprehensive insights into our analysis of Geo Energy Resources stock in this financial health report.

- Assess Geo Energy Resources' future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Click this link to deep-dive into the 5,762 companies within our Penny Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:V

Vantage Equities

Operates as an investment and financial holding company in the Philippines.

Flawless balance sheet low.