- Philippines

- /

- Food and Staples Retail

- /

- PSE:SEVN

Undiscovered Gems Three Promising Stocks To Explore This December 2024

Reviewed by Simply Wall St

As global markets navigate a period of monetary policy shifts, with the ECB and SNB cutting rates and anticipation building for a potential Fed rate cut, small-cap stocks have experienced underperformance compared to their larger counterparts. In this environment, discerning investors may find opportunities in lesser-known stocks that demonstrate resilience and potential for growth despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| African Rainbow Capital Investments | NA | 37.52% | 38.29% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Philippine Seven (PSE:SEVN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Philippine Seven Corporation operates convenience stores in the Philippines with a market capitalization of ₱102.87 billion.

Operations: Philippine Seven Corporation generates revenue primarily from its store operations, totaling ₱88.61 billion.

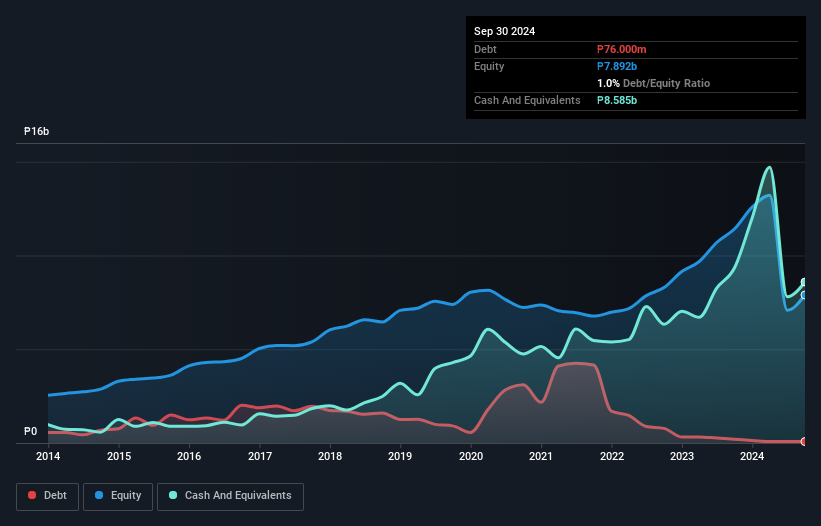

Philippine Seven, a notable player in the retail sector, has demonstrated strong financial health over recent years. The company has impressively reduced its debt to equity ratio from 12.4% to 1% in five years and maintains a robust interest coverage of 6.3x by EBIT. Last year’s earnings growth of 26.1% outpaced the industry average of 8.8%, showcasing its competitive edge. Recent quarterly results highlight revenue reaching ₱22 billion from ₱19.54 billion previously, with net income climbing to ₱813 million from ₱719 million last year, indicating solid operational performance amidst challenging market conditions.

- Delve into the full analysis health report here for a deeper understanding of Philippine Seven.

Understand Philippine Seven's track record by examining our Past report.

Jiangsu Jinling Sports EquipmentLtd (SZSE:300651)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Jinling Sports Equipment Co., Ltd. specializes in the production and sale of sporting goods, with a market capitalization of CN¥2.03 billion.

Operations: Jinling Sports Equipment generates revenue primarily from the sale of sporting goods, amounting to CN¥450.20 million.

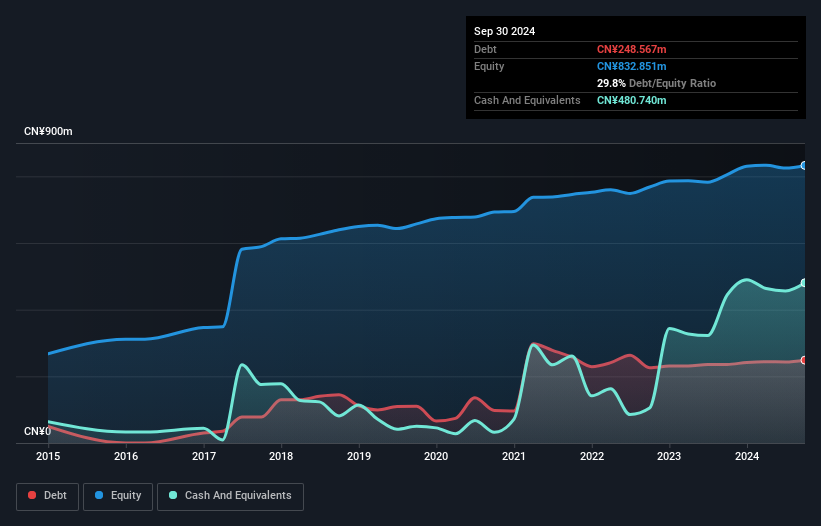

Jiangsu Jinling Sports Equipment, a small player in the sports gear market, reported CNY 256.46 million in sales for the first nine months of 2024, down from CNY 320.14 million last year. Net income also decreased to CNY 21.78 million from CNY 37.53 million previously, with basic earnings per share dropping to CNY 0.1692 from CNY 0.2915 a year ago. Despite this dip in performance and an increased debt-to-equity ratio over five years (16.7% to 29.8%), the company remains profitable with high-quality earnings and more cash than total debt, suggesting solid financial footing amidst industry challenges.

Zilltek Technology (TPEX:6679)

Simply Wall St Value Rating: ★★★★★★

Overview: Zilltek Technology Corp. is an IC design company with operations in Taiwan, China, and internationally, and it has a market capitalization of NT$17.56 billion.

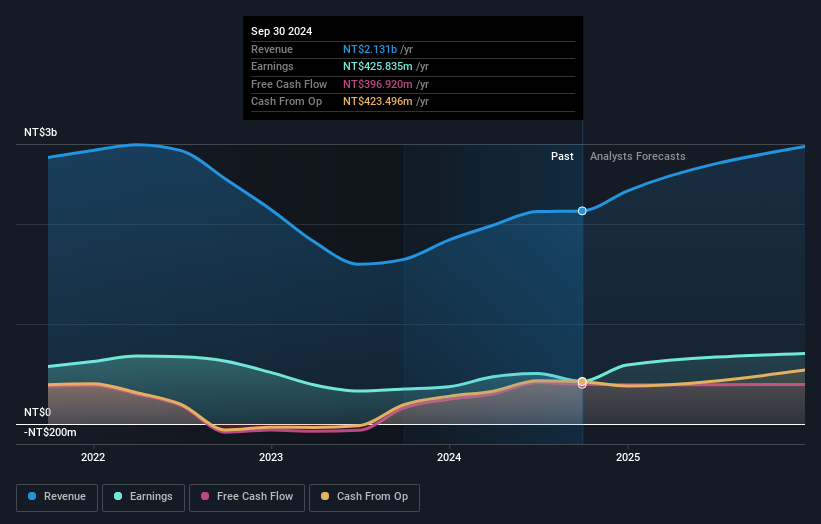

Operations: The primary revenue stream for Zilltek Technology comes from electronic components and parts, generating NT$2.13 billion.

Zilltek Technology, a nimble player in the tech space, recently showcased its financial agility with earnings results for Q3 2024. Sales reached TWD 517.91 million, slightly up from TWD 511.79 million the previous year. However, net income dipped to TWD 81.12 million from last year's TWD 159.21 million, reflecting some challenges in profitability despite higher revenues over nine months at TWD 1,598.1 million compared to TWD 1,306.54 million previously. Earnings per share also saw a reduction to TWD 1.51 from last year's TWD 2.97 for the quarter but improved overall for nine months at TWD 6.79 against prior figures of TWD 5.81.

- Get an in-depth perspective on Zilltek Technology's performance by reading our health report here.

Evaluate Zilltek Technology's historical performance by accessing our past performance report.

Make It Happen

- Get an in-depth perspective on all 4492 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:SEVN

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives