- Philippines

- /

- Banks

- /

- PSE:EW

Undervalued Small Caps With Insider Action To Watch In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by central bank rate cuts and mixed performances across major indices, small-cap stocks have faced particular challenges, with the Russell 2000 Index underperforming against its larger counterparts. This environment highlights the importance of identifying promising opportunities within the small-cap sector, where insider activity can serve as a valuable indicator of potential value amidst broader market fluctuations.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paradeep Phosphates | 25.4x | 0.8x | 26.07% | ★★★★★☆ |

| Maharashtra Seamless | 11.4x | 2.0x | 27.81% | ★★★★★☆ |

| Avia Avian | 13.9x | 3.2x | 24.64% | ★★★★★☆ |

| Logistri Fastighets | 12.7x | 9.0x | 40.92% | ★★★★☆☆ |

| JiaXing Gas Group | 5.8x | 0.3x | 28.37% | ★★★★☆☆ |

| Gooch & Housego | 42.6x | 1.0x | 29.84% | ★★★☆☆☆ |

| L.G. Balakrishnan & Bros | 14.8x | 1.7x | -47.77% | ★★★☆☆☆ |

| Kambi Group | 16.1x | 1.5x | 41.10% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| THG | NA | 0.4x | -1214.95% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

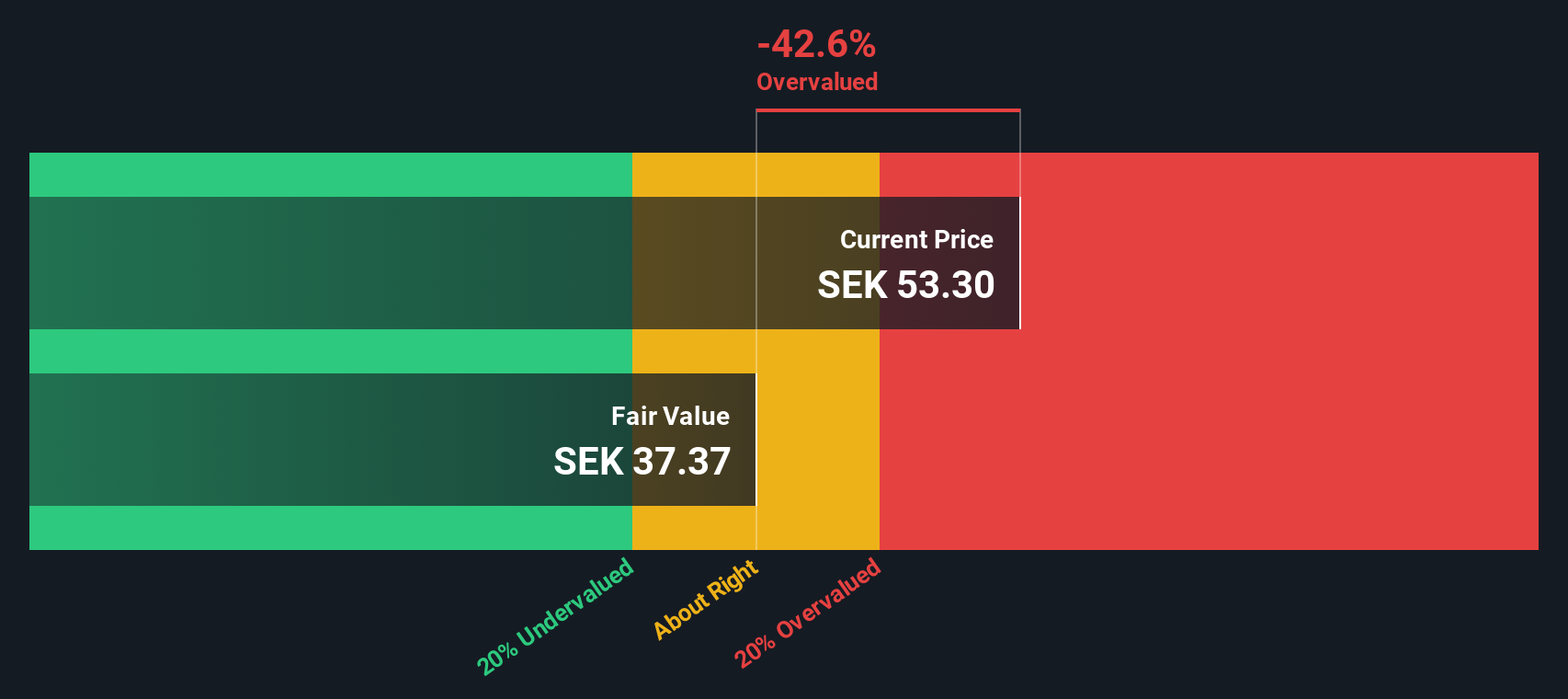

FastPartner (OM:FPAR A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: FastPartner is a real estate company focused on property management across multiple regions, with a market cap of SEK 11.45 billion.

Operations: FastPartner generates revenue primarily from property management across three regions, with a total revenue of SEK 2.28 billion in the latest period. The company's gross profit margin has shown an upward trend, reaching 71.45% recently, while net income has experienced fluctuations, currently at a negative SEK -279.7 million due to significant non-operating expenses.

PE: -45.9x

FastPartner, a company in the smaller stock category, recently reported third-quarter sales of SEK 574 million, up from SEK 544.6 million the previous year, though net income declined to SEK 116 million from SEK 145.2 million. Over nine months, sales reached SEK 1.73 billion with a net income rebound to SEK 488.8 million from a prior loss of SEK 759.4 million. Insider confidence is reflected by Sven-Olof Johansson's purchase of 50,000 shares for approximately US$3.55 million in September this year, indicating potential value recognition despite its reliance on external borrowing for funding and interest payments not being well covered by earnings presently.

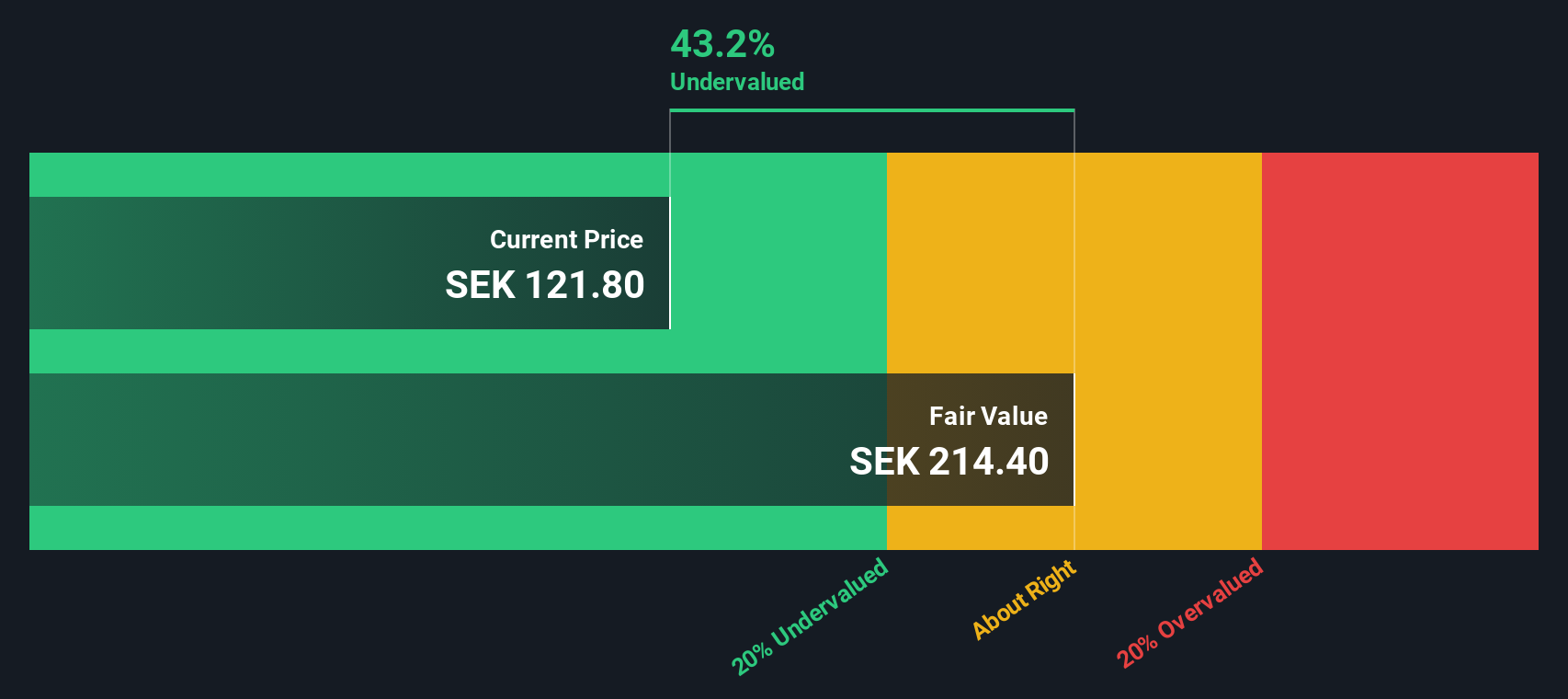

New Wave Group (OM:NEWA B)

Simply Wall St Value Rating: ★★★★★☆

Overview: New Wave Group is a Swedish company engaged in designing, acquiring, and developing branded consumer goods within the corporate, sports & leisure, and gifts & home furnishings sectors with a market cap of SEK 8.41 billion.

Operations: The company generates revenue primarily from its Corporate, Sports & Leisure, and Gifts & Home Furnishings segments. Key financial data shows a gross profit margin of 50.14% as of the latest period ending September 2024. Operating expenses are significant, with general and administrative costs being the largest component.

PE: 13.9x

New Wave Group, a company characterized by its external borrowing strategy, is witnessing insider confidence with Ralph Mühlrad purchasing 3,000 shares in November 2024 for SEK 296,400. Despite a decline in third-quarter net income to SEK 204.2 million from SEK 270.9 million the previous year, earnings are projected to grow annually by nearly 19%. The recent appointment of Anna Gullmarstrand as CFO could signal strategic shifts aimed at enhancing financial performance and addressing funding risks.

- Take a closer look at New Wave Group's potential here in our valuation report.

Review our historical performance report to gain insights into New Wave Group's's past performance.

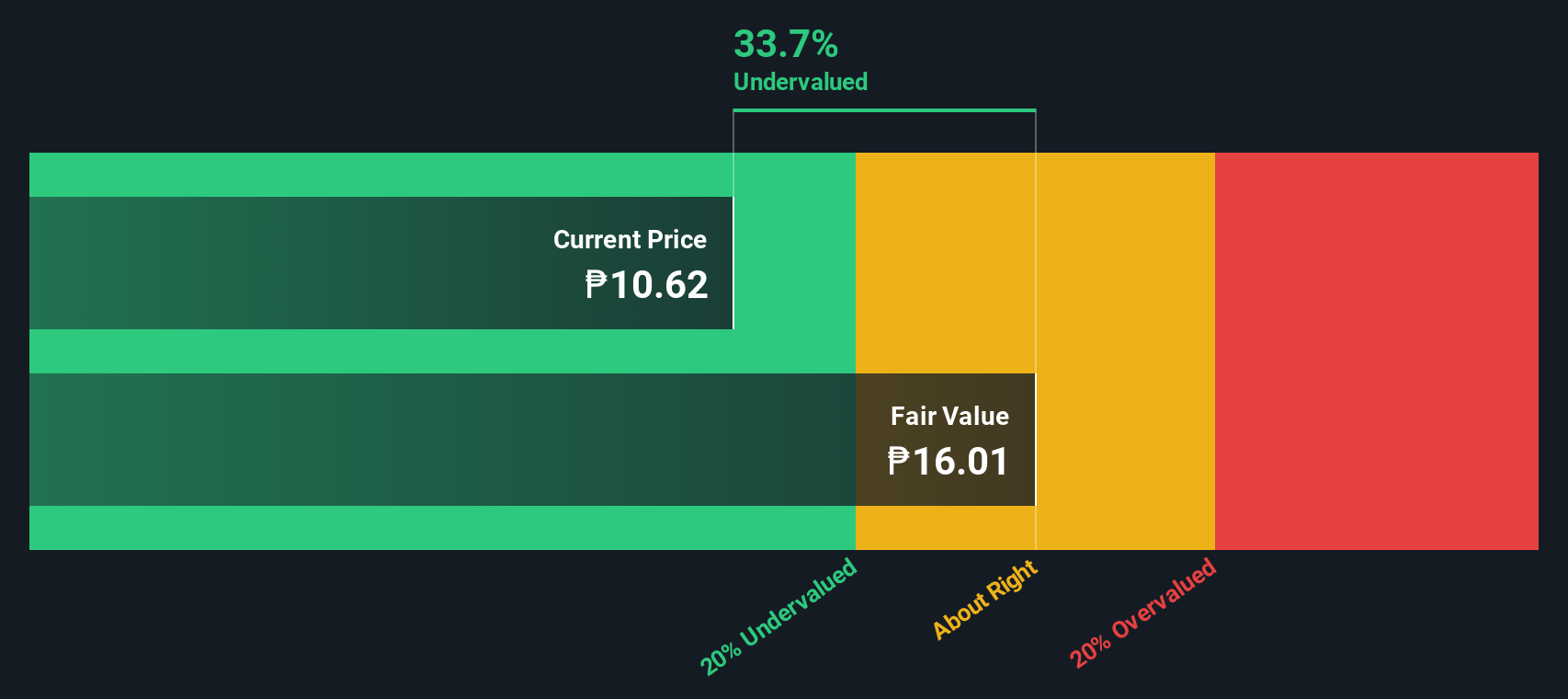

East West Banking (PSE:EW)

Simply Wall St Value Rating: ★★★★★☆

Overview: East West Banking is a financial institution offering services in retail, consumer, and corporate banking, as well as treasury and trust operations, with a market capitalization of ₱31.24 billion.

Operations: The company generates revenue primarily from consumer banking and retail banking, with significant contributions also coming from corporate banking and treasury and trust services. Operating expenses are a major cost component, with general and administrative expenses being substantial. The net income margin has shown variability, reaching as high as 30.79% in June 2020 before declining to 21.08% by March 2024.

PE: 3.1x

East West Banking, a smaller financial institution, is drawing attention with its recent performance and insider confidence. The CEO's purchase of 903,900 shares for approximately ₱8.73 million in December 2024 signals strong faith in the company’s potential. Despite challenges like a high bad loans ratio of 5.4%, the bank reported a notable increase in net income for Q3 2024 to ₱2.32 billion from ₱1.56 billion last year, reflecting improved operational efficiency and potential growth opportunities ahead.

- Delve into the full analysis valuation report here for a deeper understanding of East West Banking.

Evaluate East West Banking's historical performance by accessing our past performance report.

Seize The Opportunity

- Investigate our full lineup of 181 Undervalued Small Caps With Insider Buying right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if East West Banking might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:EW

East West Banking

Operates as a commercial bank that provides a range of financial products and services to individual and corporate clients in the Philippines and internationally.

Undervalued with solid track record.

Market Insights

Community Narratives