- Philippines

- /

- Food and Staples Retail

- /

- PSE:SEVN

3 Top Dividend Stocks Offering Yields Up To 6.9%

Reviewed by Simply Wall St

As global markets navigate a landscape of fluctuating interest rates and shifting economic indicators, investors are increasingly seeking stability amid uncertainty. With major indices showing mixed performance and expectations rising for further rate cuts, dividend stocks have become an attractive option for those looking to secure steady income streams. In light of these conditions, selecting dividend stocks with reliable yields can offer a measure of resilience in an unpredictable market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.03% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.22% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.93% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.24% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

Click here to see the full list of 1831 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Philippine Seven (PSE:SEVN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Philippine Seven Corporation operates convenience stores in the Philippines with a market cap of ₱102.87 billion.

Operations: Philippine Seven Corporation generates revenue from its store operations, amounting to ₱88.61 billion.

Dividend Yield: 7.0%

Philippine Seven's dividend yield of 6.96% ranks it among the top 25% of PH market dividend payers, though its payouts have been unreliable and volatile over the past decade. Despite a reasonable cash payout ratio of 71%, dividends are not well-covered by earnings, with a high payout ratio of 191.4%. Recent earnings growth, with Q3 revenue rising to ₱22 billion and net income to ₱813.87 million, highlights strong financial performance but doesn't assure dividend stability.

- Dive into the specifics of Philippine Seven here with our thorough dividend report.

- Our expertly prepared valuation report Philippine Seven implies its share price may be too high.

Yutong BusLtd (SHSE:600066)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yutong Bus Co., Ltd. is involved in the manufacture and sale of buses and related products both in China and internationally, with a market cap of CN¥52.91 billion.

Operations: Yutong Bus Co., Ltd. generates revenue through its core activities of manufacturing and selling buses and related products across domestic and international markets.

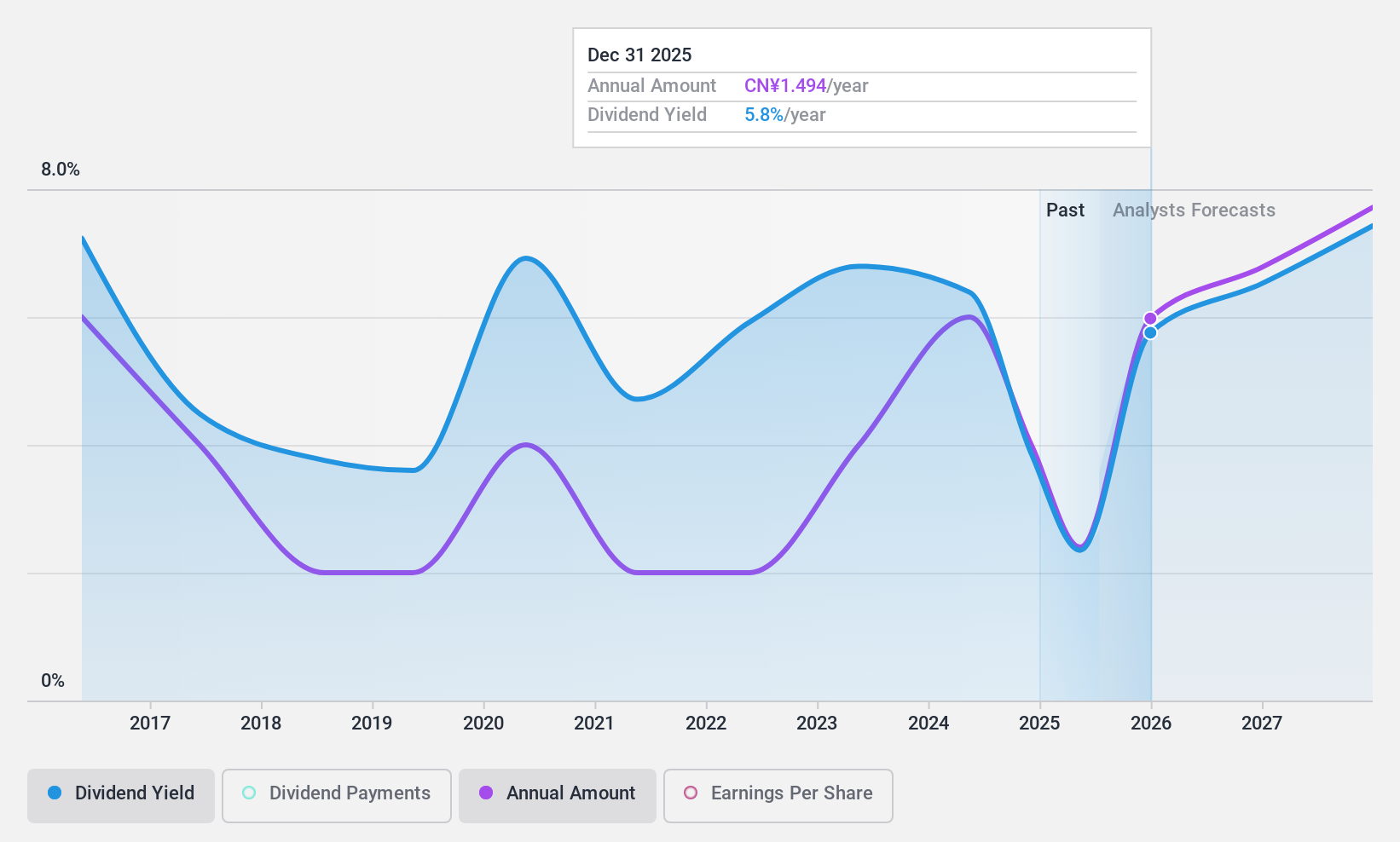

Dividend Yield: 4%

Yutong Bus Co., Ltd. offers a dividend yield of 4.02%, placing it in the top 25% of CN market payers, yet its dividends have been volatile over the past decade and are not well-covered by earnings, evidenced by a high payout ratio of 137.4%. Despite this, dividends are supported by cash flows with a reasonable cash payout ratio of 61.8%. Recent financial performance shows significant growth, with net income rising to CNY 2.43 billion for the first nine months of 2024.

- Navigate through the intricacies of Yutong BusLtd with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Yutong BusLtd is priced lower than what may be justified by its financials.

Aoyama Trading (TSE:8219)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aoyama Trading Co., Ltd. operates in business wear, credit card services, printing and media, sundry sales, repair services, franchisee operations, and other businesses in Japan with a market cap of ¥112.57 billion.

Operations: Aoyama Trading Co., Ltd. generates revenue from its operations in business wear, credit card services, printing and media, sundry sales, repair services, and franchisee activities in Japan.

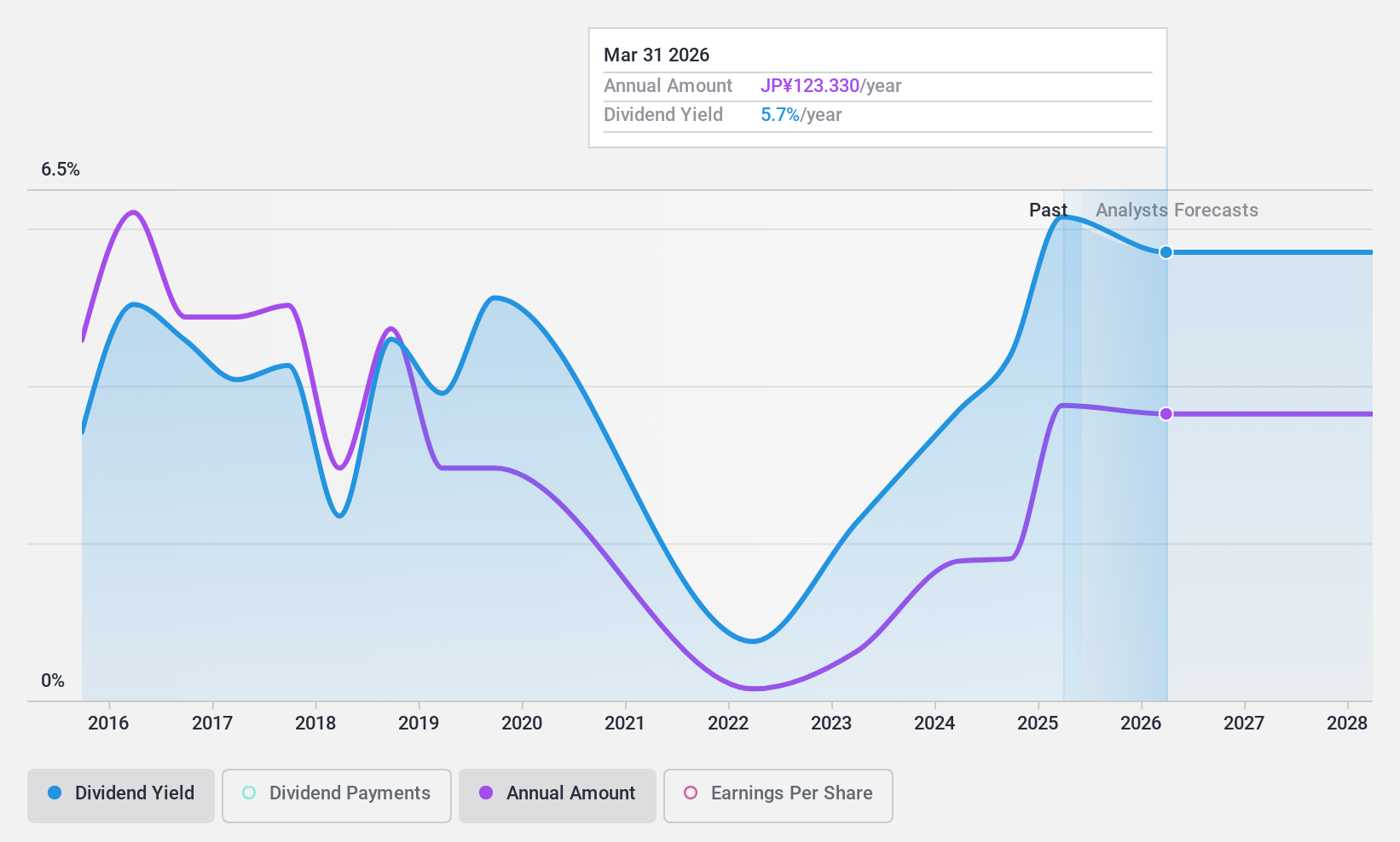

Dividend Yield: 5.4%

Aoyama Trading Co., Ltd. offers a dividend yield of 5.43%, ranking in the top 25% of JP market payers, but its dividends have been volatile and not well-covered by free cash flows, with a high cash payout ratio of 99.8%. Despite this, recent dividend increases to ¥97 per share for fiscal year ending March 2025 highlight commitment to shareholder returns. The company also announced a buyback program for ¥3 billion to enhance capital efficiency.

- Take a closer look at Aoyama Trading's potential here in our dividend report.

- Our valuation report here indicates Aoyama Trading may be undervalued.

Key Takeaways

- Explore the 1831 names from our Top Dividend Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:SEVN

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives