- Philippines

- /

- Metals and Mining

- /

- PSE:NIKL

Undervalued Small Caps With Insider Action In Global For September 2025

Reviewed by Simply Wall St

As global markets experience a surge driven by optimism around artificial intelligence and anticipated rate cuts, small-cap stocks are also seeing positive momentum, with the Russell 2000 Index marking its sixth consecutive week of gains. Amid these dynamic conditions, identifying promising small-cap stocks often involves looking at those with solid fundamentals and potential insider action, which can signal confidence in the company's future prospects.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| GDI Integrated Facility Services | 17.9x | 0.3x | 6.77% | ★★★★★☆ |

| Bytes Technology Group | 18.0x | 4.5x | 8.78% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 43.26% | ★★★★☆☆ |

| Sagicor Financial | 7.6x | 0.4x | -80.09% | ★★★★☆☆ |

| Daiwa House Logistics Trust | 13.5x | 7.0x | 9.94% | ★★★★☆☆ |

| Pizu Group Holdings | 12.1x | 1.2x | 41.26% | ★★★☆☆☆ |

| Chinasoft International | 25.1x | 0.8x | -1225.52% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.8x | 1.8x | 19.14% | ★★★☆☆☆ |

| CVS Group | 46.4x | 1.3x | 36.24% | ★★★☆☆☆ |

| Asante Gold | NA | 1.8x | 0.74% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

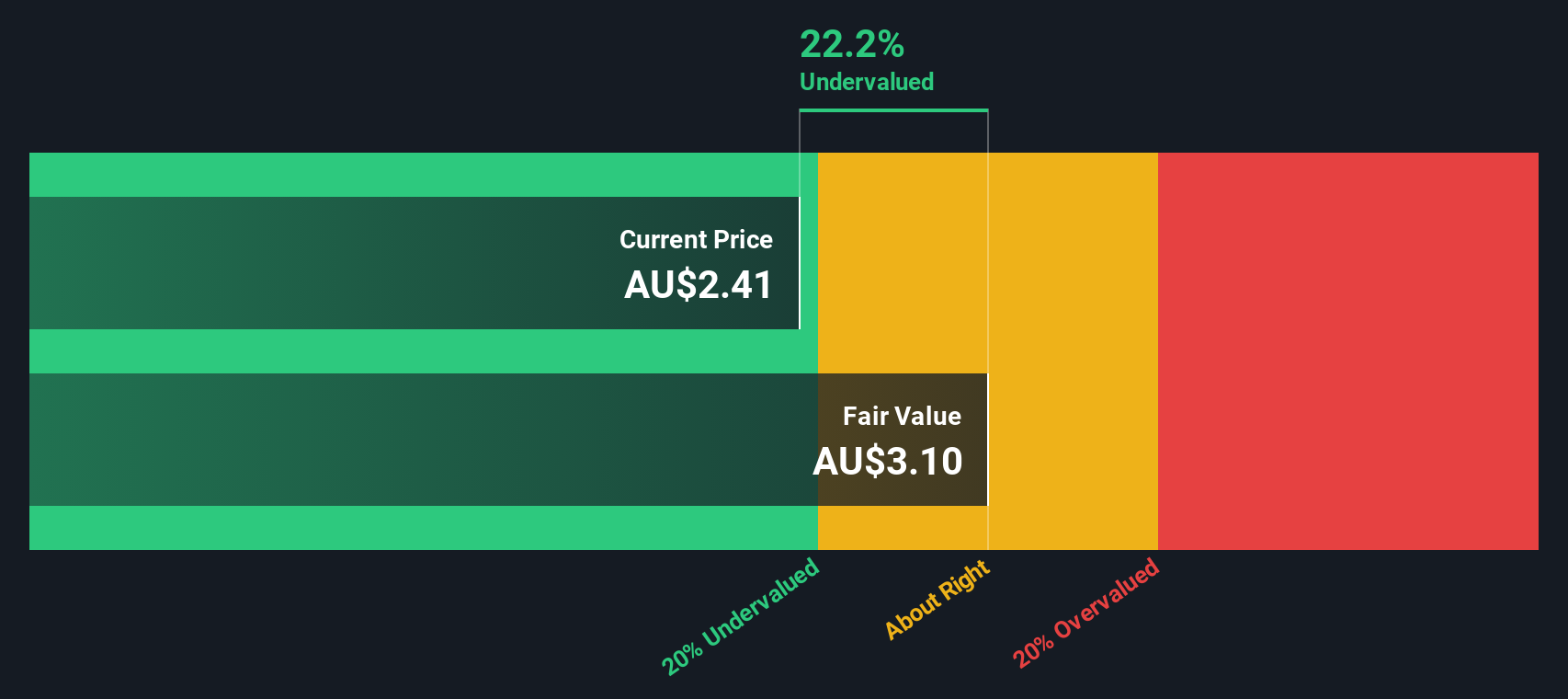

Growthpoint Properties Australia (ASX:GOZ)

Simply Wall St Value Rating: ★★★★★☆

Overview: Growthpoint Properties Australia is a real estate investment trust that focuses on owning and managing a diversified portfolio of office and industrial properties, with a market capitalization of approximately A$3.25 billion.

Operations: Growthpoint Properties Australia generates revenue primarily from its office and industrial segments, contributing A$210 million and A$101 million, respectively. Over recent periods, the company has experienced a decline in net income margin, reaching -38.49% by September 2025. Operating expenses have gradually increased alongside non-operating expenses, impacting overall profitability.

PE: -15.6x

Growthpoint Properties Australia, a smaller player in the real estate sector, recently reported a net loss of A$124.6 million for the year ending June 30, 2025. Despite this, insider confidence is evident with recent purchases made by them. The company faces challenges with interest payments not well covered by earnings and relies solely on external borrowing for funding. However, earnings are projected to grow annually at 39%, suggesting potential future value as they navigate executive transitions and seek growth opportunities under interim CFO Sean Scanlon's guidance.

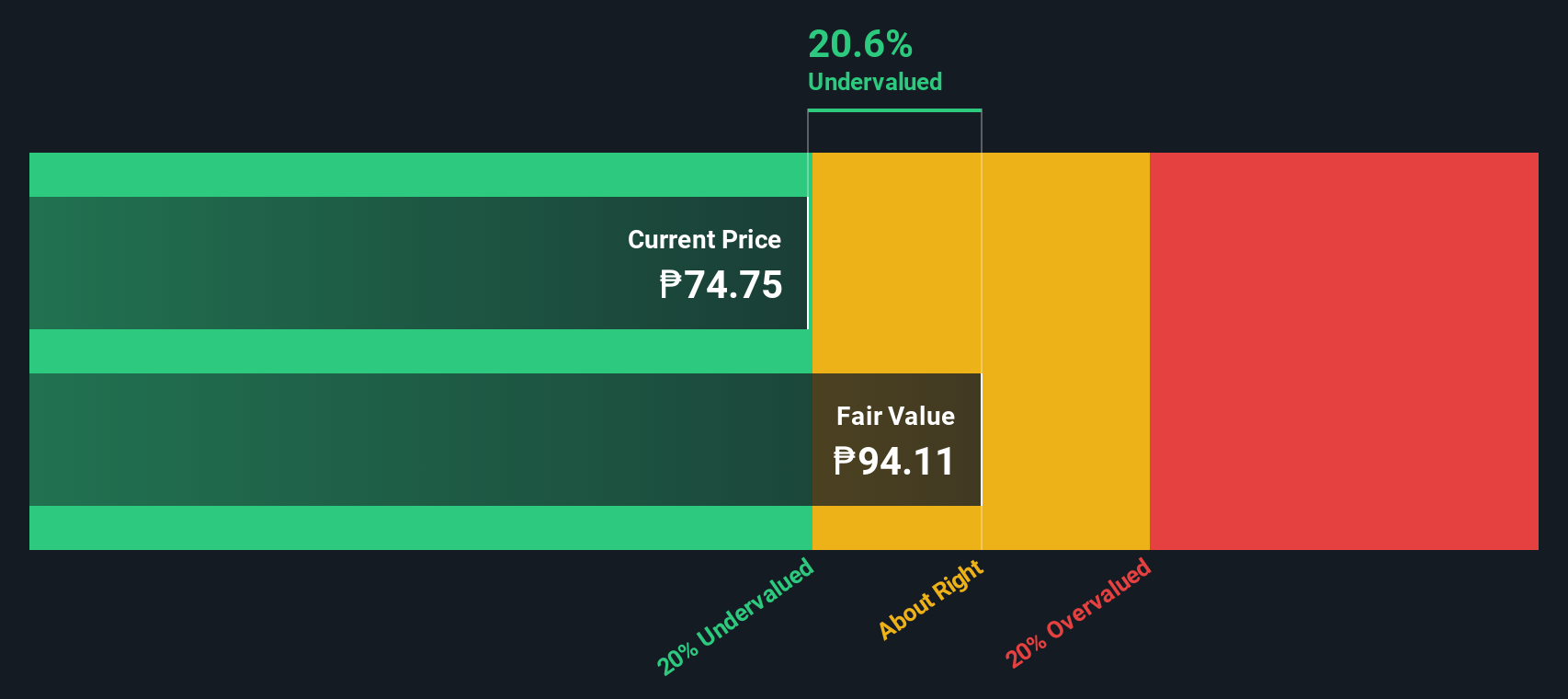

Asia United Bank (PSE:AUB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Asia United Bank is a Philippines-based commercial bank that provides a range of financial services including loans, deposits, and treasury products, with a market capitalization of approximately ₱20.11 billion.

Operations: Asia United Bank's primary revenue stream is its gross profit, which reached ₱19.92 billion as of September 2024. The company faces significant operating expenses, with general and administrative costs consistently being a major component, reaching ₱4.45 billion in the same period. Notably, the net income margin has shown variability, peaking at 53.33% in September 2024.

PE: 6.1x

Asia United Bank's recent earnings report highlights a steady increase in net interest income, reaching PHP 4.48 billion for the second quarter of 2025, up from PHP 4.22 billion the previous year. Net income also rose to PHP 2.99 billion from PHP 2.89 billion, reflecting strong operational performance despite a dividend decrease to PHP 2 per share paid in two tranches starting August and September 2025. Insider confidence is evident with significant stock purchases over recent months, underscoring potential value recognition within this small-cap financial institution amidst strategic leadership changes and experienced new appointments enhancing their treasury capabilities.

- Delve into the full analysis valuation report here for a deeper understanding of Asia United Bank.

Examine Asia United Bank's past performance report to understand how it has performed in the past.

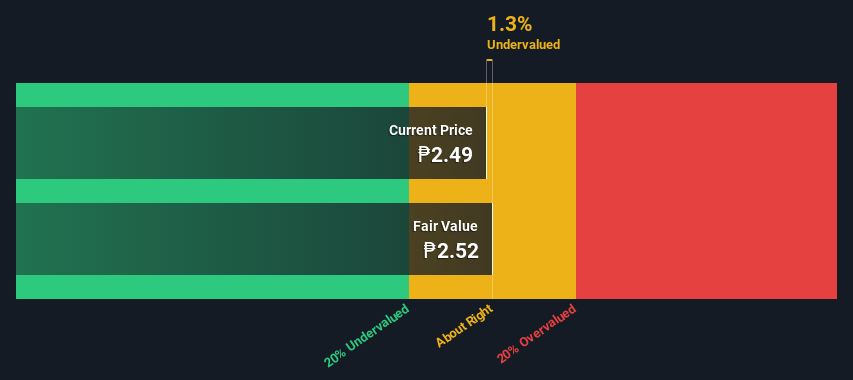

Nickel Asia (PSE:NIKL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nickel Asia is a leading mining company in the Philippines, primarily engaged in nickel ore production and power generation, with a market capitalization of ₱98.76 billion.

Operations: Nickel Asia generates revenue primarily from its mining operations, with significant contributions from TMC and RTN segments. The company's gross profit margin has shown variability, reaching as high as 56.14% in recent periods but also dropping to 38.32%. Operating expenses include general and administrative costs along with sales and marketing expenses, impacting overall profitability.

PE: 19.6x

Nickel Asia's recent performance highlights its potential as an undervalued investment. For Q2 2025, revenue surged to PHP 8.9 billion from PHP 6.6 billion a year earlier, while net income rose to PHP 1.6 billion from PHP 914 million, reflecting strong operational growth despite reliance on external borrowing for funding. Insider confidence is evident with purchases throughout the year, signaling belief in future prospects bolstered by new ventures like their real estate subsidiary and solar power project expansion plans.

- Click here and access our complete valuation analysis report to understand the dynamics of Nickel Asia.

Assess Nickel Asia's past performance with our detailed historical performance reports.

Key Takeaways

- Gain an insight into the universe of 110 Undervalued Global Small Caps With Insider Buying by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nickel Asia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:NIKL

Nickel Asia

Engages in the mining and exploration of nickel saprolite, limonite ore, limestone, and quarry materials in the Philippines.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion