As global markets navigate a period of economic uncertainty, with major indices experiencing mixed performances and central banks adjusting monetary policies, small-cap stocks have faced particular challenges. The Russell 2000 Index's recent underperformance relative to large-cap counterparts highlights the volatility within this segment, yet it also presents potential opportunities for investors seeking value. In such an environment, identifying small-cap stocks that demonstrate strong fundamentals and insider confidence can be crucial for discerning investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Maharashtra Seamless | 11.9x | 2.1x | 24.78% | ★★★★★☆ |

| ABG Sundal Collier Holding | 12.4x | 2.1x | 40.71% | ★★★★☆☆ |

| JiaXing Gas Group | 5.8x | 0.3x | 28.42% | ★★★★☆☆ |

| Optima Health | NA | 1.3x | 47.31% | ★★★★☆☆ |

| Gooch & Housego | 41.7x | 1.0x | 31.25% | ★★★☆☆☆ |

| L.G. Balakrishnan & Bros | 14.9x | 1.7x | -48.82% | ★★★☆☆☆ |

| Kambi Group | 16.1x | 1.5x | 41.13% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| THG | NA | 0.4x | -1213.47% | ★★★☆☆☆ |

| Digital Mediatama Maxima | NA | 1.3x | 14.04% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

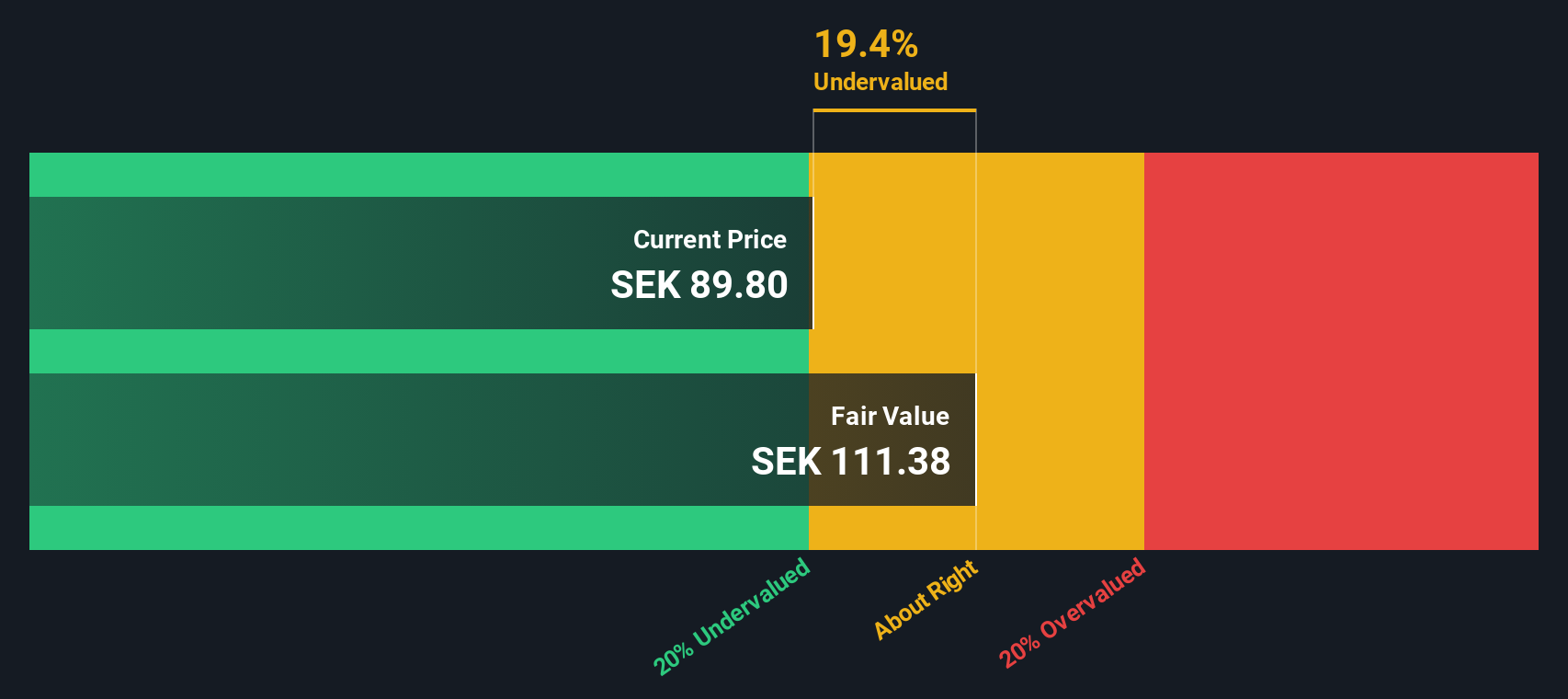

Hanza (OM:HANZA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hanza is a manufacturing solutions provider that offers comprehensive services across main and other markets, with a market cap of approximately SEK 3.42 billion.

Operations: Hanza generates revenue primarily from Main Markets and Other Markets, with a gross profit margin that fluctuated between 38.78% and 44.46% over the observed periods. The company's cost structure includes significant operating expenses, which impact its overall profitability.

PE: 26.5x

Hanza, a smaller company in the manufacturing sector, is experiencing mixed financial performance. Although earnings are forecast to grow by 34% annually, profit margins have decreased from 5.1% to 2.7%. The company's recent partnership with a German firm for EUR 1.4 million annually signifies growth potential despite economic challenges. However, reliance on external borrowing poses higher risks due to insufficient earnings coverage for interest payments. Insider confidence is evident as executives strengthen management for strategic expansion starting January 2025.

- Click here to discover the nuances of Hanza with our detailed analytical valuation report.

Examine Hanza's past performance report to understand how it has performed in the past.

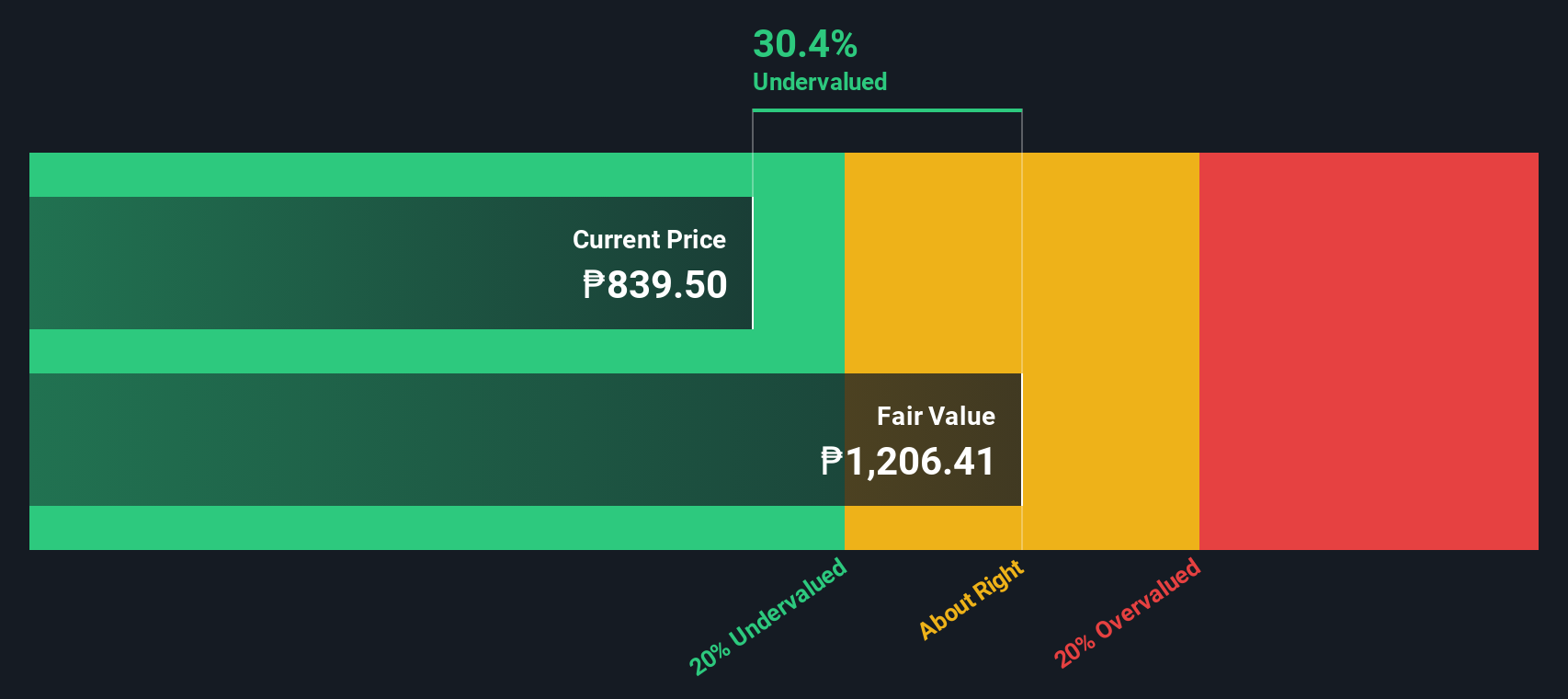

Far Eastern University (PSE:FEU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Far Eastern University operates as an educational institution with various revenue segments including its main campus, other schools, and trimestral schools, and has a market capitalization of ₱9.58 billion.

Operations: The company's revenue primarily comes from its main campus, other schools, and trimestral schools. Cost of goods sold (COGS) and operating expenses are significant components of its cost structure. The net profit margin has shown fluctuations, with recent figures around 37.18%.

PE: 8.8x

Far Eastern University, a smaller company with potential, has shown insider confidence as Anthony Raymond Goquingco increased their stake by 340 shares in October 2024, valued at PHP 236,300. Despite recent volatility and a net loss of PHP 99.76 million for Q1 ending August 2024, revenue rose to PHP 608.39 million from the previous year. The company's reliance on external borrowing highlights risk but also opportunity if managed well. Recent changes include appointing SGV & Co as auditors and declaring a cash dividend of PHP 16 per share.

- Unlock comprehensive insights into our analysis of Far Eastern University stock in this valuation report.

Explore historical data to track Far Eastern University's performance over time in our Past section.

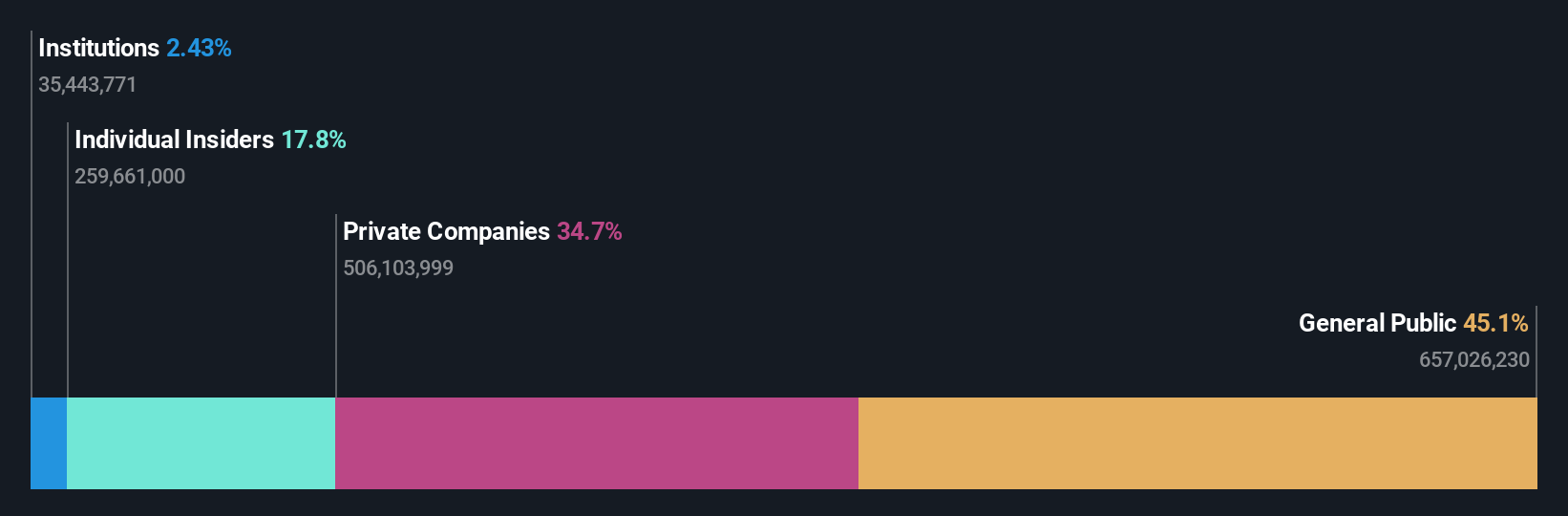

China XLX Fertiliser (SEHK:1866)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: China XLX Fertiliser is a company engaged in the production and sale of various chemical products, including urea, compound fertilisers, methanol, and melamine, with a market capitalisation of approximately CN¥6.77 billion.

Operations: China XLX Fertiliser's primary revenue streams include urea and compound fertiliser, with significant contributions from methanol. The company's cost of goods sold (COGS) has been a major expense, impacting its gross profit margins, which recently were 18.83%. Operating expenses are another substantial cost factor, including general and administrative expenses.

PE: 4.2x

China XLX Fertiliser, a smaller company in the market, has recently seen insider confidence with Qingjin Zhang acquiring 270,000 shares valued at approximately US$1.09 million. This purchase increased their shareholding by 169%, suggesting a positive outlook from within. Despite facing high debt levels and relying solely on external borrowing for funding, the company's earnings are projected to grow by 11.59% annually. Recent board meetings have focused on strategic resolutions and financial results announcements, indicating active management engagement in growth strategies.

- Click here and access our complete valuation analysis report to understand the dynamics of China XLX Fertiliser.

Evaluate China XLX Fertiliser's historical performance by accessing our past performance report.

Next Steps

- Delve into our full catalog of 181 Undervalued Small Caps With Insider Buying here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Hanza, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hanza might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HANZA

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives