3 Undervalued Small Caps In Global With Insider Action To Consider

Reviewed by Simply Wall St

In recent weeks, global markets have shown signs of resilience amid easing trade tensions and positive corporate earnings reports, contributing to a rebound in small- and mid-cap equities. However, challenges such as slowing business activity growth and fluctuating consumer sentiment continue to create a complex environment for investors. In this context, identifying promising small-cap stocks involves looking for companies with strong fundamentals that can navigate economic uncertainties while potentially benefiting from insider actions that may signal confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 11.0x | 0.5x | 41.32% | ★★★★★★ |

| Nexus Industrial REIT | 5.2x | 2.7x | 25.18% | ★★★★★★ |

| Tristel | 27.8x | 3.9x | 26.24% | ★★★★★☆ |

| Eastnine | 17.2x | 8.3x | 42.14% | ★★★★★☆ |

| Savills | 23.5x | 0.5x | 43.93% | ★★★★☆☆ |

| Speedy Hire | NA | 0.2x | 0.22% | ★★★★☆☆ |

| Sing Investments & Finance | 7.0x | 3.5x | 44.47% | ★★★★☆☆ |

| Norcros | 24.4x | 0.6x | 27.68% | ★★★☆☆☆ |

| Westshore Terminals Investment | 13.7x | 3.9x | 36.72% | ★★★☆☆☆ |

| Saturn Oil & Gas | 5.6x | 0.4x | -20.80% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

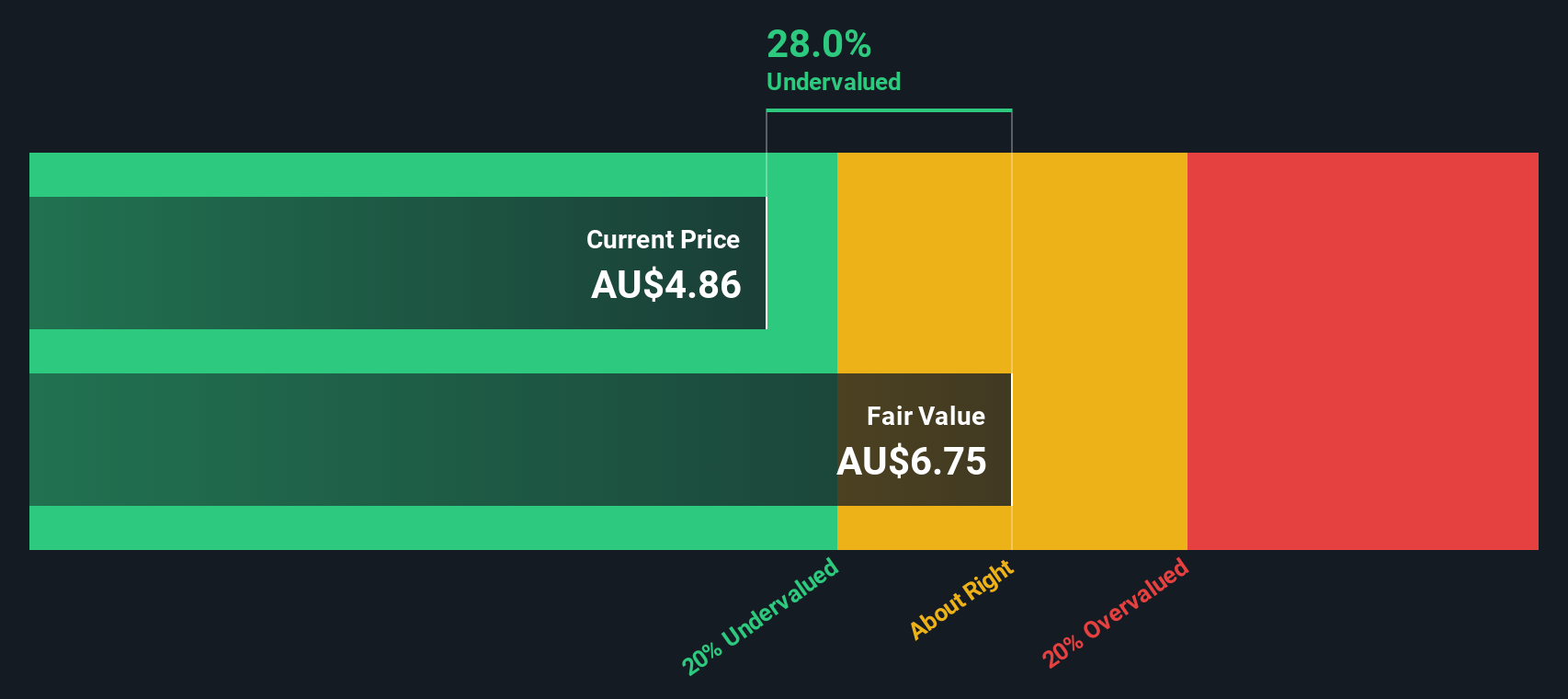

Hansen Technologies (ASX:HSN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hansen Technologies is a global provider of software and services to the energy, water, and communications industries with a market cap of approximately A$1.5 billion.

Operations: Hansen Technologies derives its revenue primarily from its operations, with a recent quarterly revenue of A$363.50 million. The company experienced a gross profit margin of 27.73%, reflecting the cost dynamics and efficiency in managing production expenses relative to sales. Operating expenses, including general and administrative costs, significantly impact net income, which stood at A$3.51 million for the latest period reported.

PE: 310.9x

Hansen Technologies, a small company in the tech sector, is gaining attention for its potential value. Recent insider confidence is evident with share purchases over the past few months. The company secured multi-year agreements with DIRECTV Latin America and RiksTV, highlighting its strong client relationships and product adaptability. Despite recent financial challenges, including a dip in net income to A$0.07 million for H1 2024 from A$17.62 million the previous year, Hansen's revenue grew to A$178.94 million from A$168.45 million year-over-year. This growth trajectory is supported by innovative offerings like their AI Virtual Agent and Hansen Trade solutions for energy markets. Looking ahead, Hansen reaffirms its revenue guidance of A$398-405 million for 2025, suggesting continued expansion opportunities amidst evolving market demands.

- Dive into the specifics of Hansen Technologies here with our thorough valuation report.

Evaluate Hansen Technologies' historical performance by accessing our past performance report.

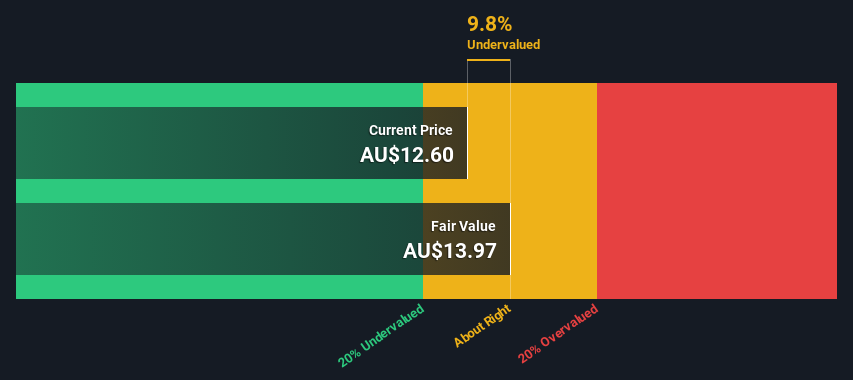

Super Retail Group (ASX:SUL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Super Retail Group is an Australian-based company operating a diverse portfolio of retail brands including Rebel, Macpac, Super Cheap Auto, and Boating, Camping and Fishing (BCF), with a market capitalization of A$2.78 billion.

Operations: Revenue streams are primarily driven by SCA, Rebel, and BCF segments. The gross profit margin reached 47.96% in June 2021 before gradually decreasing to 45.93% by December 2024. Operating expenses consistently account for a significant portion of revenue, with sales and marketing being a notable component.

PE: 13.5x

Super Retail Group, a smaller player in the retail sector, has seen insider confidence with share purchases over recent months. Despite a slight dip in net income to A$129.8 million for the half-year ending December 2024, sales grew to A$2.11 billion from A$2.03 billion year-on-year, indicating potential growth prospects. The company maintains higher-risk external borrowing as its sole funding source but forecasts earnings growth of 4.71% annually, suggesting optimism for future performance amidst industry challenges.

- Click here and access our complete valuation analysis report to understand the dynamics of Super Retail Group.

Gain insights into Super Retail Group's past trends and performance with our Past report.

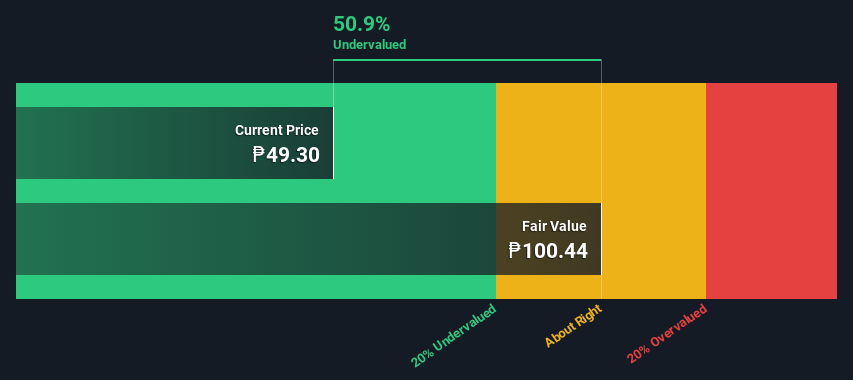

Philippine National Bank (PSE:PNB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Philippine National Bank is a financial institution engaged in various banking services, including retail and corporate banking, treasury operations, and other financial activities, with a market capitalization of ₱58.68 billion.

Operations: The primary revenue streams are retail banking and corporate banking, contributing significantly to overall earnings. The company's gross profit margin has consistently remained high, reaching 99.92% in recent periods. Operating expenses are primarily driven by general and administrative costs, which have been substantial across the reported periods.

PE: 3.5x

Philippine National Bank, a smaller player in the banking sector, has seen significant insider confidence with Roberto Baltazar purchasing 119,600 shares valued at approximately PHP 5 million. This activity suggests potential optimism about the bank's future. Despite a high level of bad loans at 6.9% and low allowance for these loans at 85%, earnings are projected to grow by 7.6% annually. Recent executive changes include Edwin R. Bautista taking over as CEO on April 29, bringing extensive experience from Union Bank of the Philippines, potentially steering PNB towards digitalization and retail lending growth.

Make It Happen

- Dive into all 162 of the Undervalued Global Small Caps With Insider Buying we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Hansen Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hansen Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HSN

Hansen Technologies

Engages in the development, integration, and support of billing systems software for the energy, utilities, communications, and media sectors.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives