Vista Group International And Two Other Stocks Estimated To Be Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a mix of inflation concerns and political uncertainties, investors are seeing value stocks outperform their growth counterparts amidst choppy conditions. In this climate, identifying undervalued stocks can be a strategic approach, as these investments may offer potential for appreciation when market sentiments stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥17.19 | CN¥34.17 | 49.7% |

| Clear Secure (NYSE:YOU) | US$26.72 | US$53.44 | 50% |

| Sichuan Injet Electric (SZSE:300820) | CN¥50.39 | CN¥100.73 | 50% |

| NBTM New Materials Group (SHSE:600114) | CN¥15.60 | CN¥31.06 | 49.8% |

| Ningbo Haitian Precision MachineryLtd (SHSE:601882) | CN¥20.26 | CN¥40.47 | 49.9% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP290.99 | CLP580.39 | 49.9% |

| Constellium (NYSE:CSTM) | US$10.35 | US$20.64 | 49.8% |

| Andrada Mining (AIM:ATM) | £0.0235 | £0.047 | 49.9% |

| Vogo (ENXTPA:ALVGO) | €2.95 | €5.88 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5874.00 | ¥11677.29 | 49.7% |

We're going to check out a few of the best picks from our screener tool.

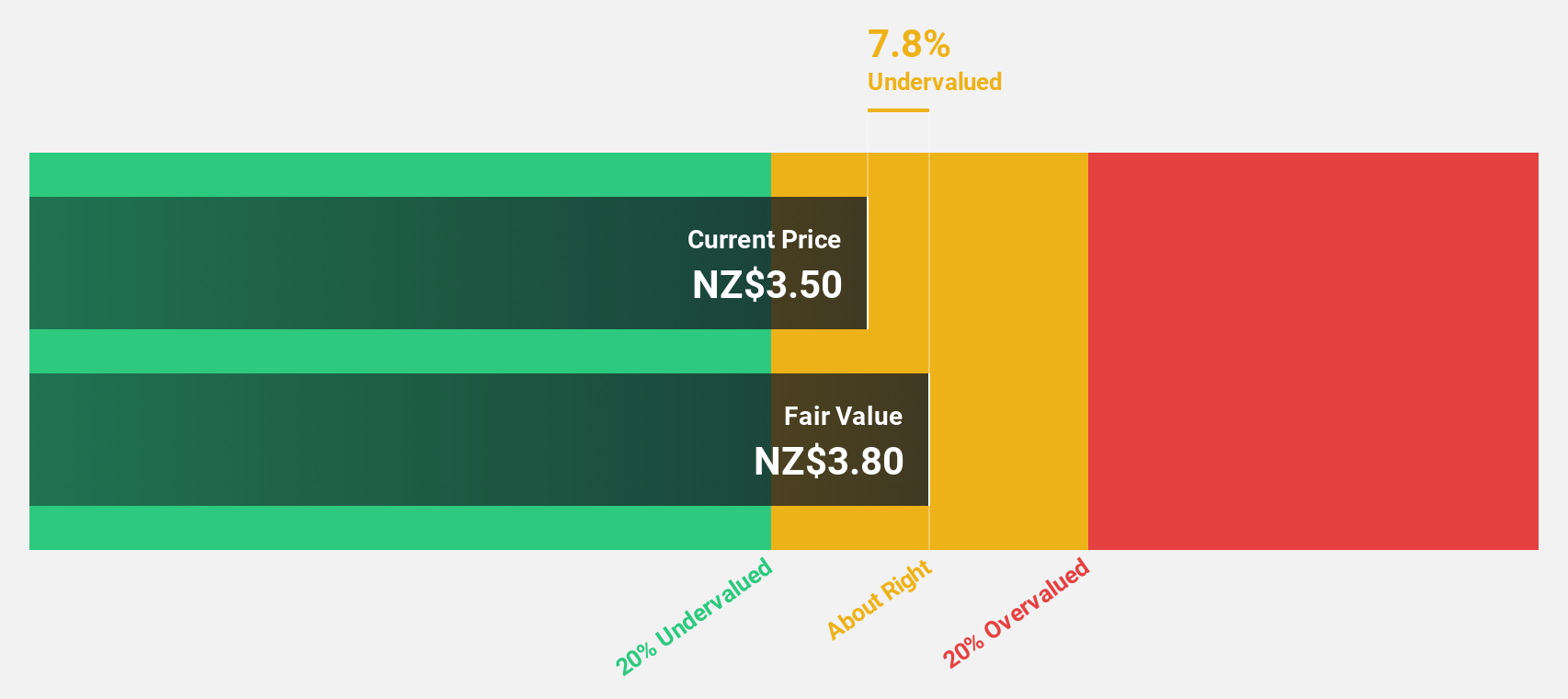

Vista Group International (NZSE:VGL)

Overview: Vista Group International Limited offers software and data analytics solutions for the global film industry, with a market capitalization of NZ$755.81 million.

Operations: Vista Group International Limited generates its revenue from providing software and data analytics solutions to the film industry worldwide.

Estimated Discount To Fair Value: 49.2%

Vista Group International is trading at NZ$3.16, significantly below its estimated fair value of NZ$6.22, suggesting it may be undervalued based on cash flows. The company is expected to achieve profitability within three years, with earnings projected to grow at 47.8% annually. Despite a forecasted slower revenue growth rate of 12.9% compared to the ideal 20%, this still surpasses the broader New Zealand market's growth rate of 4.4%. Recent investor activism has been resolved without major disruptions.

- Our earnings growth report unveils the potential for significant increases in Vista Group International's future results.

- Dive into the specifics of Vista Group International here with our thorough financial health report.

Saudi Aramco Base Oil Company - Luberef (SASE:2223)

Overview: Saudi Aramco Base Oil Company - Luberef specializes in the production and sale of base oils and various by-products both within Saudi Arabia and internationally, with a market cap of SAR18.70 billion.

Operations: The company's revenue is primarily derived from its Oil & Gas - Refining & Marketing segment, totaling SAR9.94 billion.

Estimated Discount To Fair Value: 33.6%

Saudi Aramco Base Oil Company - Luberef is trading at SAR 110.8, well below its estimated fair value of SAR 166.84, highlighting potential undervaluation based on cash flows. Despite a decline in profit margins from 22.9% to 10.4%, earnings are forecast to grow significantly at over 20% annually, outpacing the Saudi Arabian market's growth rate of 6%. However, revenue is expected to decline by 6% annually over the next three years.

- Insights from our recent growth report point to a promising forecast for Saudi Aramco Base Oil Company - Luberef's business outlook.

- Get an in-depth perspective on Saudi Aramco Base Oil Company - Luberef's balance sheet by reading our health report here.

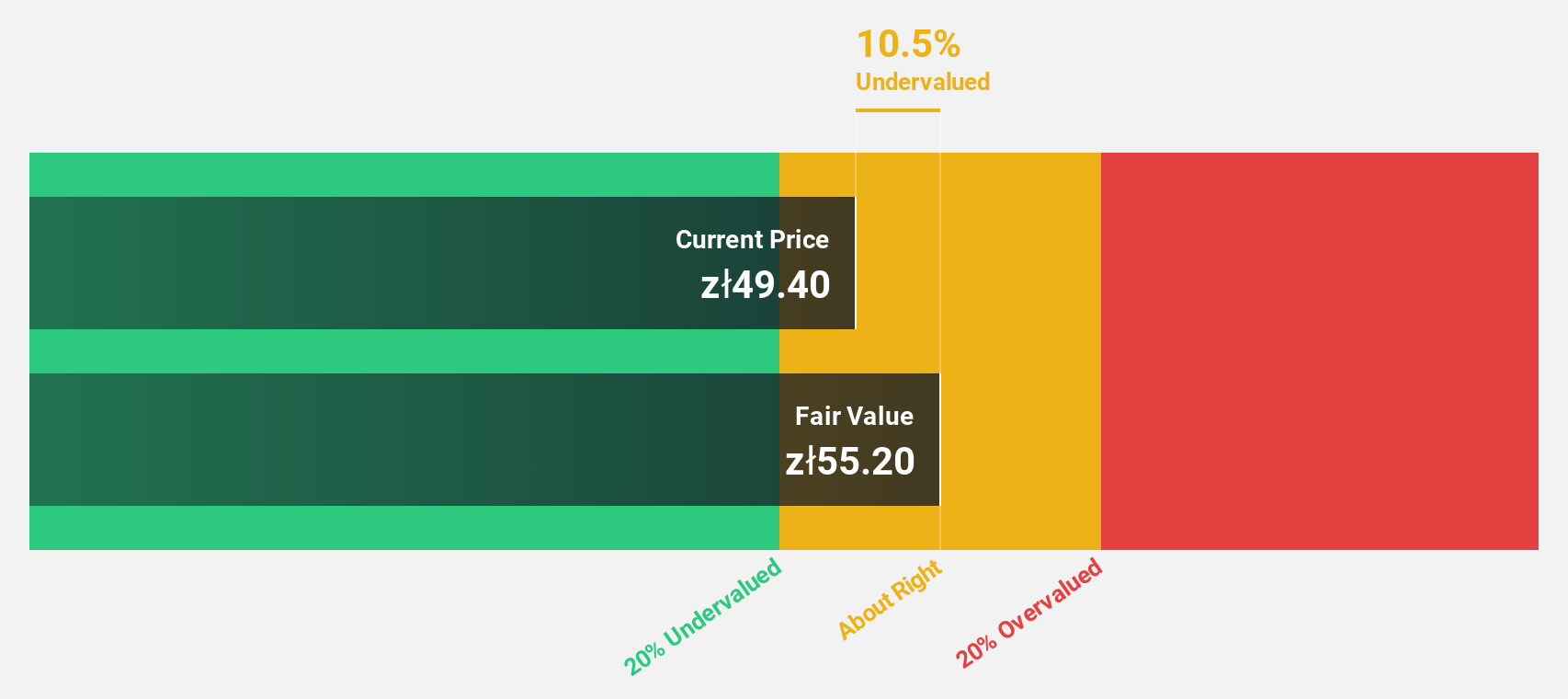

Shoper (WSE:SHO)

Overview: Shoper SA offers Software as a Service solutions for e-commerce in Poland and has a market cap of PLN1.14 billion.

Operations: The company's revenue segments include PLN141.44 million from Solutions and PLN39.87 million from Subscriptions.

Estimated Discount To Fair Value: 30.8%

Shoper S.A. is trading at PLN 40.5, below its estimated fair value of PLN 58.51, suggesting undervaluation based on discounted cash flow analysis. Recent earnings growth of 39.2% and a forecasted annual profit increase of 26.6% indicate strong financial health, with revenue expected to grow faster than the Polish market rate at 15%. A recent acquisition agreement by Cyber_Folks S.A., valued at PLN 547.5 million, underscores strategic interest in Shoper's potential.

- In light of our recent growth report, it seems possible that Shoper's financial performance will exceed current levels.

- Take a closer look at Shoper's balance sheet health here in our report.

Key Takeaways

- Click this link to deep-dive into the 875 companies within our Undervalued Stocks Based On Cash Flows screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:SHO

Shoper

Shoper SA provides Software as a Service solutions for e-commerce in Poland.

Outstanding track record with high growth potential.