Highlighting Banca Popolare di Sondrio Among 3 Top Dividend Stocks

Reviewed by Simply Wall St

As global markets grapple with inflation concerns and political uncertainties, investors are witnessing a mixed performance across major indices, with U.S. equities experiencing notable declines and European stocks showing resilience. Amid this backdrop of fluctuating market conditions, dividend stocks continue to attract attention for their potential to provide steady income streams; Banca Popolare di Sondrio stands out as one of the top picks in this category due to its consistent dividend payouts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.31% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.36% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.80% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.66% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.21% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.17% | ★★★★★★ |

Click here to see the full list of 2007 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

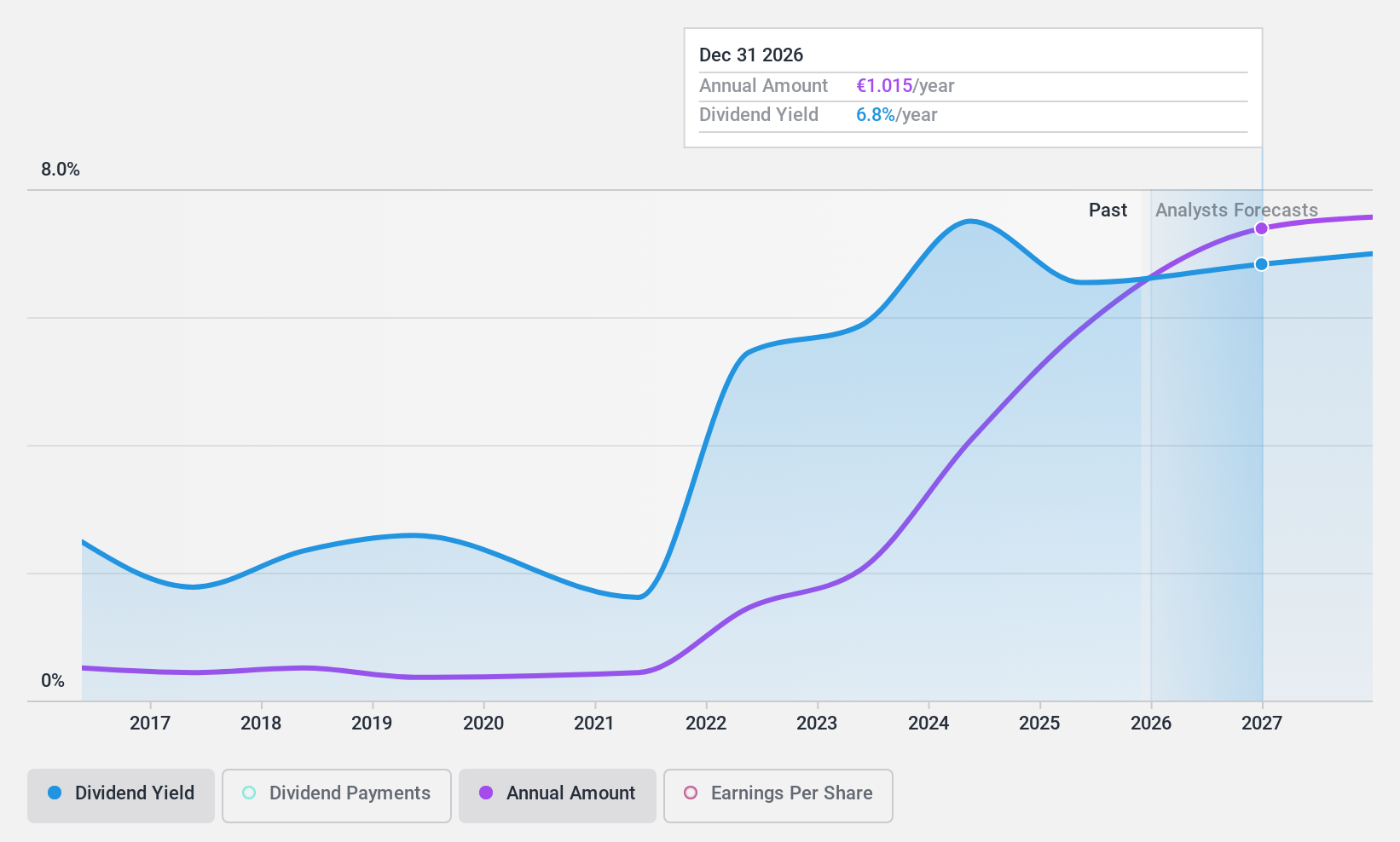

Banca Popolare di Sondrio (BIT:BPSO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banca Popolare di Sondrio S.p.A., along with its subsidiaries, offers a range of banking products and services in Italy and has a market capitalization of approximately €3.73 billion.

Operations: Revenue Segments (in millions of €):

Dividend Yield: 6.7%

Banca Popolare di Sondrio offers a dividend yield of 6.75%, placing it in the top 25% of Italian dividend payers, though its dividends have been volatile over the past decade. The bank's payout ratio is low at 46.3%, indicating dividends are well covered by earnings, with future coverage expected to remain sustainable. However, a high bad loans ratio (3.2%) and forecasted earnings decline pose potential risks to its dividend stability despite recent strong earnings growth and increased net interest income.

- Take a closer look at Banca Popolare di Sondrio's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Banca Popolare di Sondrio is trading beyond its estimated value.

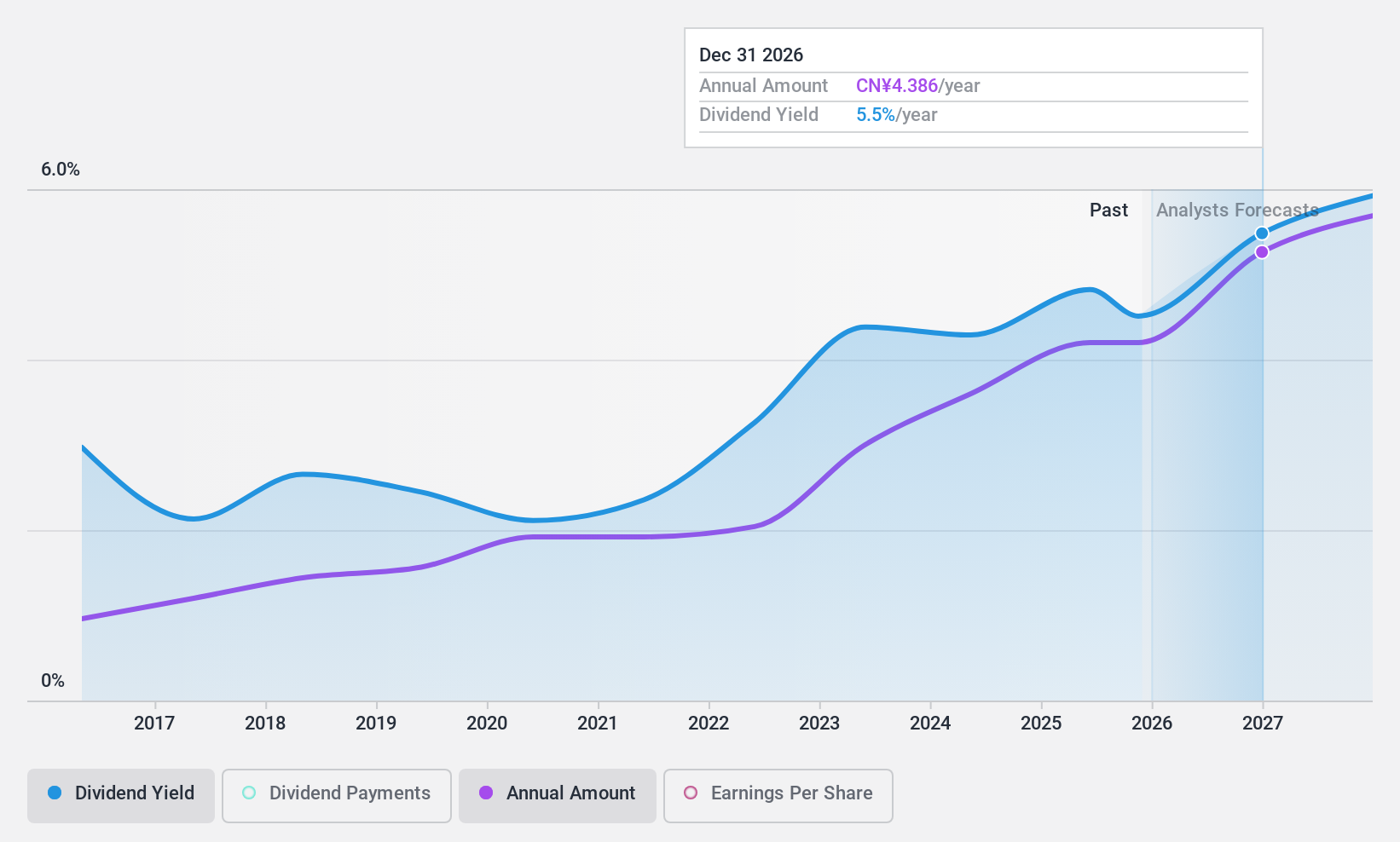

Midea Group (SZSE:000333)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Midea Group Co., Ltd., along with its subsidiaries, manufactures and sells home appliances and robotic and automation systems both in China and internationally, with a market cap of CN¥573.81 billion.

Operations: Midea Group Co., Ltd. generates revenue from its core segments of home appliances and robotic and automation systems, serving both domestic and international markets.

Dividend Yield: 3.9%

Midea Group offers a dividend yield of 3.93%, ranking it among the top 25% in the Chinese market. Its dividends have been stable and growing over the past decade, supported by a payout ratio of 55% and a cash payout ratio of 34.2%, ensuring coverage by earnings and cash flows. Recent earnings growth of 15% enhances its financial stability, though shareholder dilution occurred last year. The recent launch of an energy-efficient Heat Pump Water Heater may bolster future revenue streams.

- Click here and access our complete dividend analysis report to understand the dynamics of Midea Group.

- Insights from our recent valuation report point to the potential overvaluation of Midea Group shares in the market.

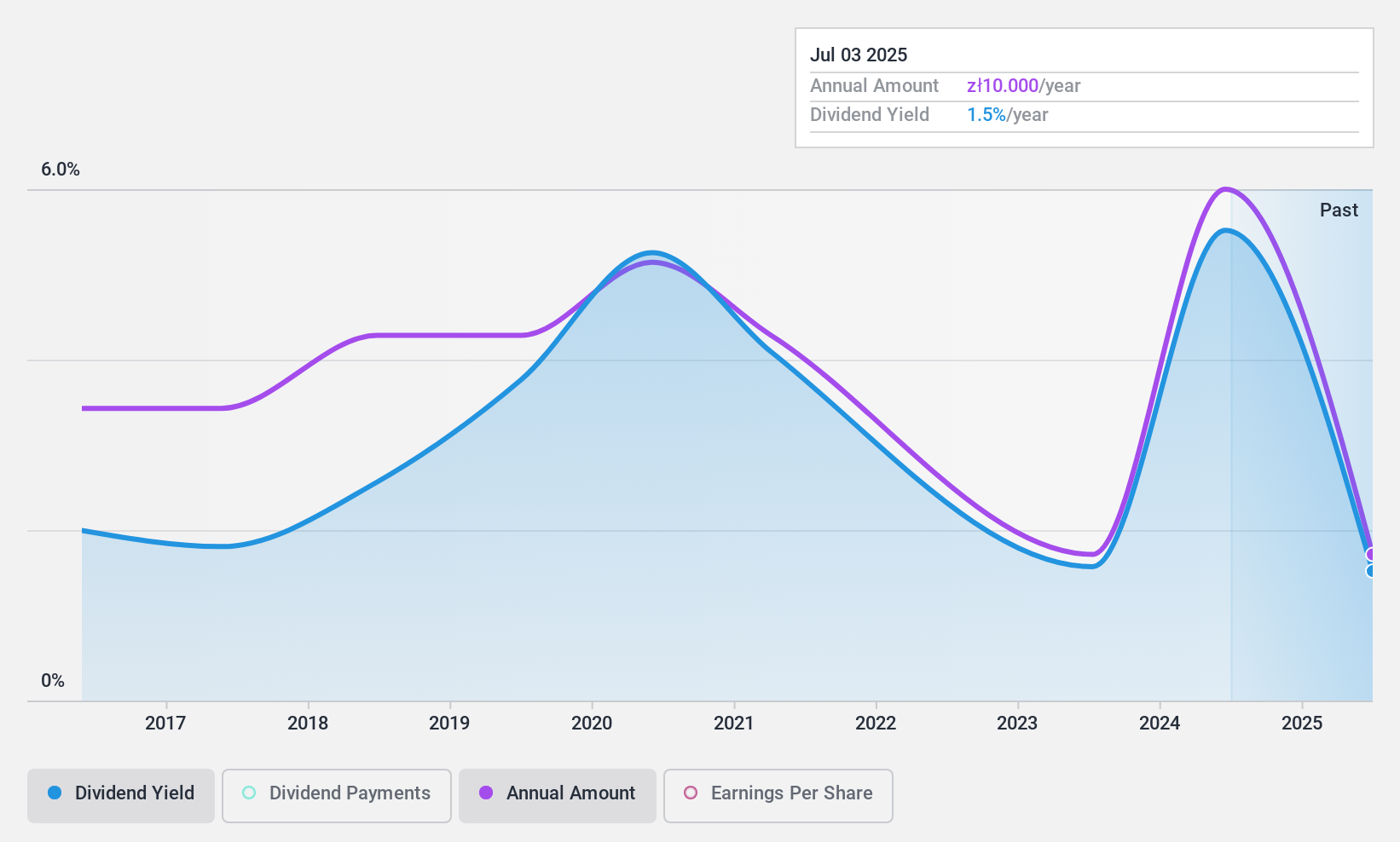

Wawel (WSE:WWL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wawel S.A. is a Polish company that produces and sells cocoa, chocolate, and confectionery products with a market cap of PLN780.27 million.

Operations: The company's revenue primarily comes from the production and sale of confectionery products, amounting to PLN672.94 million.

Dividend Yield: 5.8%

Wawel's dividend payments are covered by earnings and cash flows, with payout ratios of 63.9% and 58.4%, respectively. However, its dividends have been unreliable and volatile over the past decade, experiencing significant fluctuations. Despite a modest annual earnings growth of 4% over five years, recent net income declined to PLN 13.78 million in Q3 2024 from PLN 17.85 million a year prior, reflecting potential challenges in sustaining consistent dividend payouts.

- Unlock comprehensive insights into our analysis of Wawel stock in this dividend report.

- Our expertly prepared valuation report Wawel implies its share price may be lower than expected.

Make It Happen

- Discover the full array of 2007 Top Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wawel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:WWL

Wawel

Produces and sells cocoa, chocolate, and confectionary products in Poland.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026