- New Zealand

- /

- Health Care REITs

- /

- NZSE:VHP

Global's Top Undervalued Small Caps With Insider Activity In April 2025

Reviewed by Simply Wall St

In April 2025, global markets experienced mixed results, with smaller-cap indexes like the S&P MidCap 400 and Russell 2000 outperforming their larger counterparts amid ongoing trade tensions and economic uncertainties. As investors navigate these volatile conditions, identifying small-cap stocks that exhibit strong fundamentals and insider activity can be a key strategy for uncovering potential opportunities.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Dicker Data | 19.2x | 0.7x | -36.80% | ★★★★☆☆ |

| Atturra | 30.9x | 1.3x | 32.10% | ★★★★☆☆ |

| Sing Investments & Finance | 7.4x | 3.7x | 41.55% | ★★★★☆☆ |

| FRP Advisory Group | 12.6x | 2.2x | 8.69% | ★★★☆☆☆ |

| PWR Holdings | 33.3x | 4.6x | 27.39% | ★★★☆☆☆ |

| Hansen Technologies | 297.0x | 2.9x | 21.86% | ★★★☆☆☆ |

| Integral Diagnostics | 149.3x | 1.7x | 44.27% | ★★★☆☆☆ |

| Westshore Terminals Investment | 13.6x | 3.9x | 36.99% | ★★★☆☆☆ |

| Manawa Energy | NA | 2.7x | 40.62% | ★★★☆☆☆ |

| Charter Hall Long WALE REIT | NA | 11.0x | 25.51% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Safestore Holdings (LSE:SAFE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Safestore Holdings is a company that provides self-storage accommodation and related services, with a market capitalization of approximately £2.93 billion.

Operations: The company's primary revenue stream is derived from self-storage accommodation and related services, with a recent revenue figure of £223.4 million. Over the years, its net income margin has shown significant variability, reaching as high as 2.47% in April 2022 before declining to 0.89% by October 2023. Operating expenses have generally decreased over time, contributing to changes in profitability trends alongside fluctuating non-operating expenses.

PE: 3.6x

Safestore Holdings, a small-cap company, recently approved a final dividend of £0.20 per share on March 19, 2025. Their Q1 2025 revenue increased to £56.7 million from £55.3 million in the previous year, reflecting modest growth despite earnings forecasted to decline by an average of 12.6% annually over the next three years. Insider confidence is evident with recent purchases by executives in early 2025, indicating belief in future prospects amidst current challenges and external borrowing risks.

- Navigate through the intricacies of Safestore Holdings with our comprehensive valuation report here.

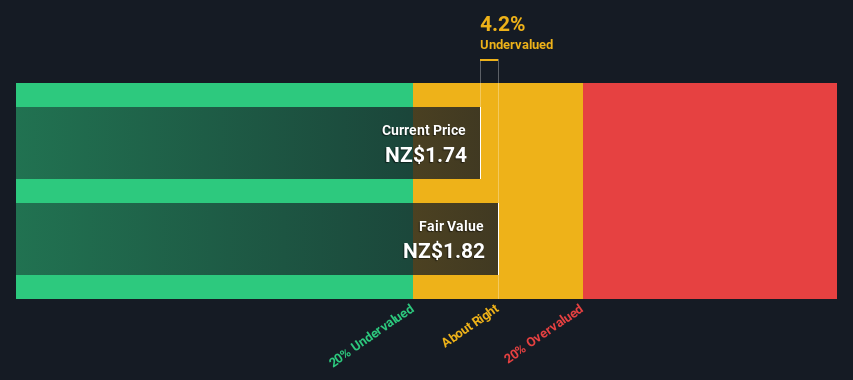

Vital Healthcare Property Trust (NZSE:VHP)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Vital Healthcare Property Trust is a real estate investment trust focused on investing in health sector-related properties, with a market capitalization of approximately NZ$1.34 billion.

Operations: The trust generates revenue primarily through investing in health sector-related properties, with a recent revenue figure of NZ$172.60 million. Its cost structure includes costs of goods sold at NZ$26.15 million and operating expenses at NZ$27.01 million, impacting its net income margin which was recorded at -0.20%. The gross profit margin stood at 84.85%, reflecting the efficiency in managing production costs relative to sales revenue during the latest period analyzed.

PE: -34.7x

Vital Healthcare Property Trust, a small player in healthcare real estate, has seen insider confidence with share purchases over the past year. Despite its external borrowing reliance, the company reported improved financials for H1 2025, reducing net losses from NZ$113.13 million to NZ$39.29 million compared to last year. Sales increased slightly to NZ$77.14 million from NZ$75.16 million a year ago. With earnings forecasted to grow significantly at 46% annually, potential growth remains promising despite current challenges in covering interest payments through earnings alone.

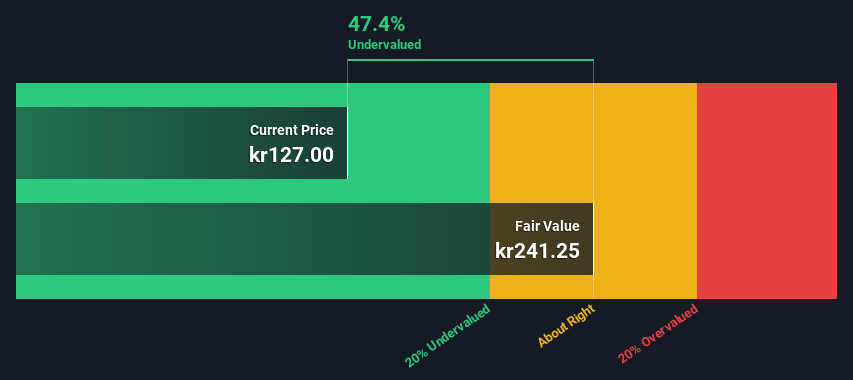

Arendals Fossekompani (OB:AFK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Arendals Fossekompani is a diversified industrial investment company involved in sectors such as renewable energy, technology, and real estate, with a market capitalization of approximately NOK 5.66 billion.

Operations: The company's revenue streams are primarily driven by ENRX and NSSL Global, contributing significantly to its overall revenue. The gross profit margin has shown fluctuations, with the most recent figure at 65.83%. Operating expenses have been a substantial part of the cost structure, particularly general and administrative expenses. Recent data indicates a net income margin of 7.62%, reflecting profitability challenges amidst varying non-operating expenses.

PE: 21.0x

Arendals Fossekompani, a smaller player in the market, recently showcased significant growth with sales reaching NOK 4.3 billion and net income jumping to NOK 2.6 billion for the year ending December 2024. This financial upswing reflects potential value despite its reliance on external borrowing, a higher-risk funding source. Insider confidence is evident as an executive vice president increased their stake by purchasing 9,000 shares worth approximately NOK 1.5 million between January and April 2025, indicating belief in future prospects amidst recent dividend affirmations of NOK 1 per share paid in February.

Turning Ideas Into Actions

- Dive into all 157 of the Undervalued Global Small Caps With Insider Buying we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:VHP

Vital Healthcare Property Trust

An NZX-listed fund that invests in high-quality healthcare properties in New Zealand and Australia including private hospitals (~81% of portfolio value), ambulatory care facilities (~17% of portfolio value) and aged care (~2% of portfolio value).

Established dividend payer and fair value.

Market Insights

Community Narratives