- New Zealand

- /

- Industrial REITs

- /

- NZSE:PFI

Undervalued Small Caps In Global With Insider Action December 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by dovish Federal Reserve comments and mixed economic signals, small-cap stocks have shown resilience, with the Russell 2000 Index advancing significantly. In this environment, identifying promising small-cap opportunities often involves looking at companies with strong fundamentals that may benefit from broader market optimism and potential insider action.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Speedy Hire | NA | 0.3x | 36.14% | ★★★★★☆ |

| Senior | 24.2x | 0.8x | 25.49% | ★★★★★☆ |

| Eurocell | 16.6x | 0.3x | 39.40% | ★★★★☆☆ |

| Centurion | 3.7x | 3.1x | -55.62% | ★★★★☆☆ |

| Chinasoft International | 21.4x | 0.7x | -1186.22% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 45.18% | ★★★★☆☆ |

| Nickel Asia | 12.2x | 1.9x | 13.58% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.5x | 0.4x | -425.08% | ★★★☆☆☆ |

| PSC | 10.1x | 0.4x | 18.37% | ★★★☆☆☆ |

| CVS Group | 45.3x | 1.3x | 27.52% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Property For Industry (NZSE:PFI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Property For Industry is a company that focuses on property investment and management, with operations generating NZ$127.46 million in revenue.

Operations: PFI's revenue primarily comes from its property investment and management activities, totaling NZ$127.46 million. The company's gross profit margin was 82.82% as of the latest period, reflecting its ability to manage costs effectively against revenue generated. Operating expenses are recorded at NZ$11.16 million, with non-operating expenses showing a negative balance of NZ$11.63 million, indicating gains in this area. Net income stands at NZ$106.02 million, resulting in a net income margin of 83.18%.

PE: 11.7x

Property For Industry, a smaller company in its sector, has recently seen insider confidence with Jeremy Simpson purchasing 40,000 shares valued at NZ$99,400. This reflects potential optimism despite the company's reliance on higher-risk external borrowing for funding. PFI's board welcomed Angela Bull following Mr. Beverley's retirement. With earnings projected to grow by 4.51% annually and recent cash dividends declared in November 2025, the company presents an interesting case for those exploring underappreciated opportunities in this segment.

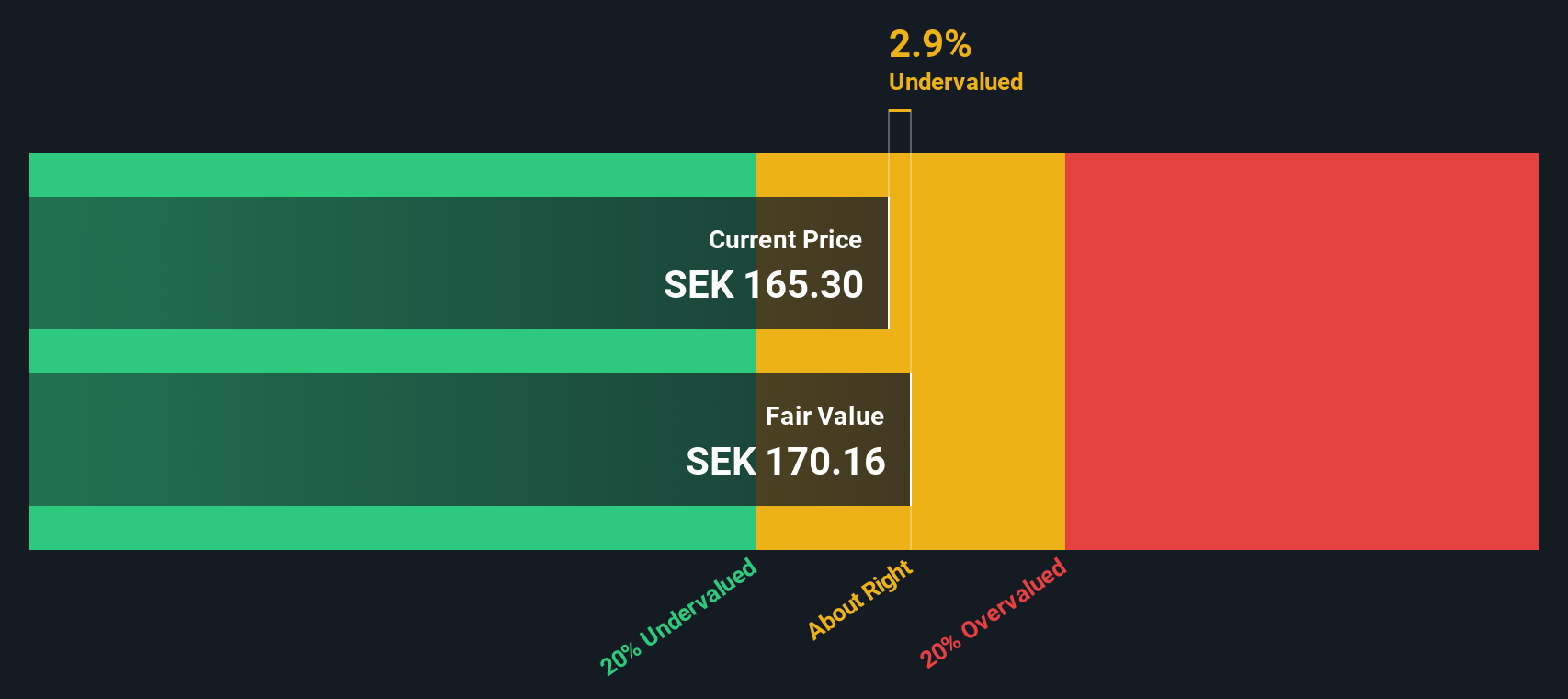

Paradox Interactive (OM:PDX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Paradox Interactive is a Swedish video game publisher and developer known for its strategy and management simulation games, with a market cap of approximately SEK 25.11 billion.

Operations: Paradox Interactive's revenue primarily stems from its computer graphics segment, with recent figures showing SEK 2.03 billion. The company's cost of goods sold (COGS) was SEK 710.97 million, contributing to a gross profit margin of 64.91%. Operating expenses include significant allocations to sales and marketing, which were SEK 210.12 million in the latest period analyzed.

PE: 27.9x

Paradox Interactive, a dynamic player in the gaming industry, recently launched several expansions for its popular titles like Age of Wonders 4 and Crusader Kings III. Despite a dip in Q3 sales to SEK 394.96 million from SEK 433.99 million last year, net income rose over nine months to SEK 326.85 million from SEK 273.81 million previously, showing resilience amidst challenges. Insider confidence is evident with recent share purchases in October and November 2025, suggesting belief in future growth potential as they expand their gaming portfolio with innovative releases across multiple platforms.

- Click here to discover the nuances of Paradox Interactive with our detailed analytical valuation report.

Gain insights into Paradox Interactive's past trends and performance with our Past report.

Lassonde Industries (TSX:LAS.A)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Lassonde Industries is a company primarily engaged in the production and marketing of non-alcoholic beverages, with a market capitalization of CA$1.35 billion.

Operations: The company generates revenue primarily from non-alcoholic beverages, with recent figures showing CA$2.90 billion in this segment. The cost of goods sold (COGS) for the latest period was CA$2.13 billion, leading to a gross profit of CA$769.46 million and a gross profit margin of 26.50%. Operating expenses were reported at CA$569.65 million, impacting net income which stood at CA$122.81 million with a net income margin of 4.23%.

PE: 12.0x

Lassonde Industries, a small cap company, recently reported third-quarter sales of C$723.85 million, up from C$668.27 million the previous year, with net income rising to C$36.84 million from C$29.65 million. Their earnings per share increased to C$5.4 from C$4.35 a year ago, indicating solid growth potential despite higher-risk external borrowing as their sole funding source. Insider confidence is evident with recent stock purchases by key figures in the company during this period of financial improvement and strategic expansion efforts in the U.S., positioning them for continued growth driven by "Buy Canadian" sentiment and pricing strategies.

- Click to explore a detailed breakdown of our findings in Lassonde Industries' valuation report.

Explore historical data to track Lassonde Industries' performance over time in our Past section.

Turning Ideas Into Actions

- Gain an insight into the universe of 149 Undervalued Global Small Caps With Insider Buying by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:PFI

Property For Industry

Engages in the property investment and management business in New Zealand.

Established dividend payer and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026